Johnson & Johnson Q1 Earnings Preview: Shockwave Could Be A Good Fit Despite Headwinds

Summary:

- Pharmaceuticals and medical devices giant Johnson & Johnson will report its first quarter 2024 results on Tuesday, April 16.

- In this earnings preview, I share my thoughts on JNJ’s previous earnings and what can be expected from the upcoming report.

- I also discuss the acquisition of Shockwave Medical, which, at 70 times earnings and 13 times sales, seems very expensive.

- In particular, I examine JNJ’s latest move in light of the company’s acquisition-related track record. After all, Johnson & Johnson has spent more than $72 billion on acquisitions since 2012.

- Finally, I provide a brief valuation update and share whether I think JNJ stock is a good buy ahead of Q1 earnings.

Mohammed Haneefa Nizamudeen/iStock via Getty Images

Introduction

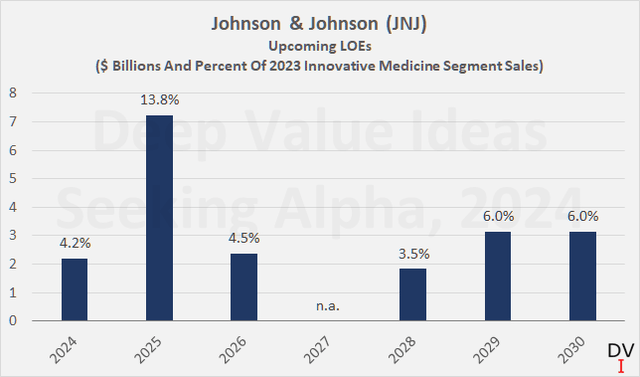

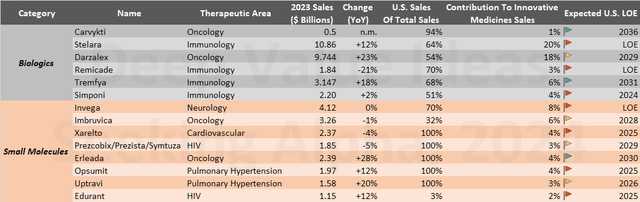

The shares of pharmaceutical and medical technology giant Johnson & Johnson (NYSE:JNJ) have had a rather sobering performance over the last couple of years and lagged the broader market. Of course, it is currently difficult for a “boring” value stock of a blue-chip company to catch much of a bid, as the focus is still on the current growth darlings (artificial intelligence). However, it’s not just the lack of investor interest that is plaguing Johnson & Johnson’s stock. The talk litigation overhang (see my in-depth article) isn’t exactly helping sentiment, and I get the impression that this “healthcare mutual fund” – what some view JNJ as – is losing its appeal with risk-averse investors who appreciated the three-pronged strategy (pharmaceuticals, medical devices, consumer health). Recall that JNJ split off its consumer health business Kenvue, Inc. (KVUE, which I also cover here on Seeking Alpha) last year. Finally, the upcoming loss of exclusivity (LOE) of key pharmaceutical assets somewhat clouds the future of the Innovative Medicine (formerly Pharmaceuticals) segment (Figure 1, Table 1).

Figure 1: Johnson & Johnson (JNJ): Upcoming LOEs in theoretical dollars assuming immediate replacement with generics or biosimilars, as well as in percent of 2023 Innovative Medicine segment sales (own work, based on company filings)

Table 1: Johnson & Johnson (JNJ): Sales, year-over-year sales growth/decline, U.S. sales, and expected U.S. LOE of selected treatments (own work, based on company filings)

With this in mind, it will, of course, be interesting to see what management will report next Tuesday, April 16, when JNJ’s Q1 2024 results are released.

In this update, I share what to expect from Johnson & Johnson’s Q1 earnings report on Tuesday and what to make of the recently announced acquisition of Shockwave Medical, Inc. (SWAV). I explore the question of whether Shockwave is another smart acquisition or a sign of desperation in the face of ongoing drug pipeline challenges, weaker diversification, and the talc litigation overhang. Finally, I’ll provide a brief valuation update and share whether I think JNJ stock is a good buy ahead of Q1 earnings.

How Were Johnson & Johnson’s Previous Earnings And What To Expect From Q1 Earnings?

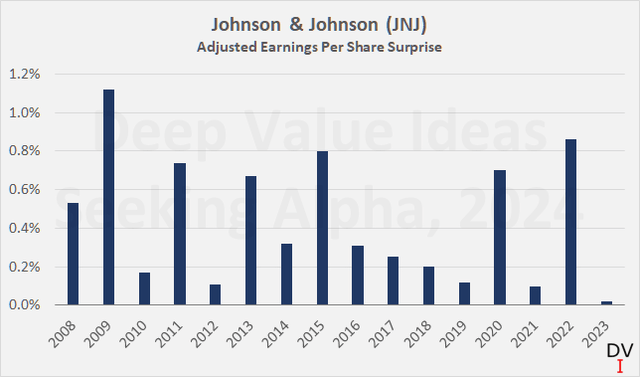

Johnson & Johnson is known for its “clockwork” track record. The company has beaten earnings per share estimates every year since at least 2008, albeit by a rather small percentage (Figure 2). The average EPS surprise was only +0.44%. Sales were mostly in line with estimates, but occasionally missed. On average, they were 0.04% above estimates, with a standard deviation of 0.63% (period 2008-2023).

On a quarterly basis, JNJ beat analysts’ estimates for at least the last sixteen quarters. Particularly during the period of government-mandated lockdowns during the pandemic, it appears that analysts underestimated Johnson & Johnson, as the company beat quarterly earnings estimates by 10% or more in many cases. In recent quarters, EPS surprises have tended to be in the mid-single digits.

Figure 2: Johnson & Johnson (JNJ): Earnings per share surprises on an annual basis for the 2008 to 2023 period (own work, based on data from Seeking Alpha)

In my view, we can therefore expect another beat on EPS estimates on Tuesday, also because estimate revisions over the last six months have been insignificant. The consensus for JNJ’s Q1 EPS is $2.65, which represents a 1.1% year-over-year decline. As JNJ’s Q4 2023 EPS was comparatively low, year-over-year growth will be skewed towards the end of 2024. Overall, analysts currently expect JNJ’s earnings to grow 7.5% this year, but keep in mind that JNJ’s growth is likely to slow to 3% to 5% in the longer term.

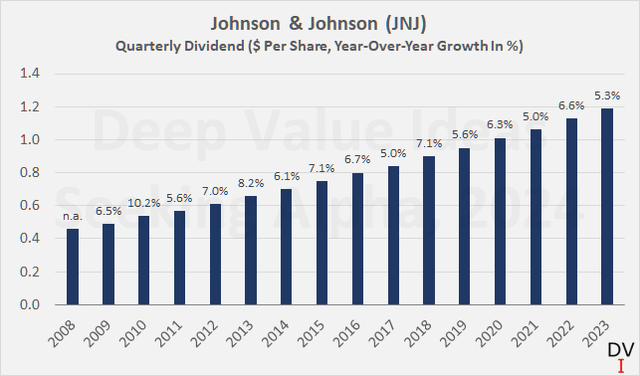

In addition to another earnings beat, investors can expect another dividend increase from Johnson & Johnson on Tuesday. Traditionally, the CFO announces the increase during the earnings call, and the upcoming increase would be the 62nd one without interruption. In my view, it is a strong testament to the quality of management and the company as a whole that JNJ has increased its payout to shareholders for more than six decades while maintaining a robust balance sheet with very little debt – despite making more or less regular and often quite significant acquisitions (more on that later).

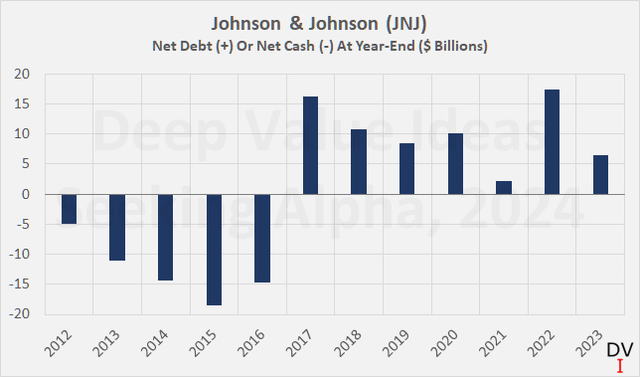

At the end of 2023, JNJ only had $6.4 billion of net debt on its balance sheet – compare that to its current market capitalization of $370 billion. Of course, the more than $10 billion year-over-year decline in net debt is largely due to the proceeds from the Kenvue split off, and it’s important to understand that JNJ’s free cash flow will be significantly lower going forward. In my last article, I estimated Kenvue’s average annual free cash flow to be about $2.7 billion. Now that the first 10-K report is available, the actual average free cash flow for 2022-2023 – treating stock-based compensation as a cash expense – is about $2.3 billion. This means that the parent company’s baseline free cash flow will amount to around $17.5 to $18 billion going forward, excluding net proceeds from investments, which have averaged around $700 million annually over the last twelve years.

This puts JNJ’s current leverage ratio at less than 0.4 times average free cash flow and the dividend payout ratio at 64% – reassuring ratios that make a continuation of average dividend growth of 5 to 6% seem realistic (Figure 3).

Figure 3: Johnson & Johnson (JNJ): Quarterly dividend since 2008 and year-over-year growth in percent (own work, based on company filings)

However, as JNJ’s tendency to under-promise and over-deliver is well known, I don’t expect JNJ’s stock price to jump on Tuesday in response to an earnings beat and the announcement of its 62nd dividend increase.

I think investors are becoming increasingly cautious, largely because of the now missing “third leg” of diversification – the Consumer Health segment. While I certainly appreciated the added diversification, I personally don’t think the impact of the Kenvue split off is overly significant in terms of diversification, as I pointed out in my last article. Other reasons for the rather uninspiring sentiment, which I discussed back in January, are the overhang of talc litigation and LOE-related concerns.

The recent acquisition of Shockwave Medical – at a price-to-earnings (P/E) ratio of lofty 70 and more than 13 times expected 2024 sales – is likely another contributing factor. Let’s now look at the deal and whether it’s a good fit for JNJ – or whether it could be a sign of desperation given the impending LOEs and the somewhat lackluster performance of the MedTech segment.

The Acquisition Of Shockwave – A Solid Fit Or A Sign Of Desperation Amid Growth-Related Uncertainties?

I have already pointed out SWAV’s high valuation multiples. They can be viewed on Seeking Alpha’s valuation dashboard, for example, and do not really require adjustment as SWAV stock is already trading very close to the $335 per share takeover offer (currently a 2% discount).

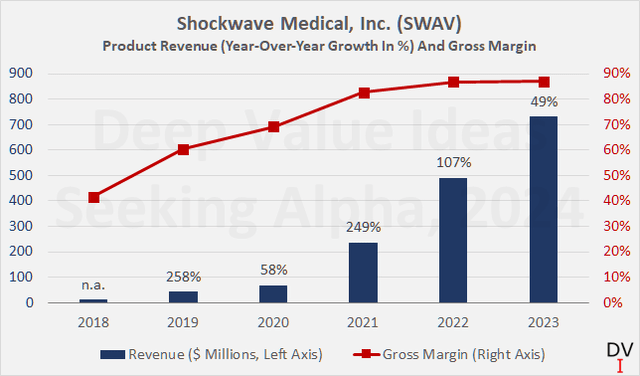

Although a P/E and P/S ratio of 70 and 13.3, respectively, suggest that JNJ has overpaid significantly, it is worth noting that SWAV is growing very fast (hence a price/earnings growth ratio of only 2.3) and its gross margin – which should remain well above 80% going forward – is very promising (Figure 4). I think it’s fair to give JNJ’s management the benefit of the doubt, especially when we take a look at the company’s track record.

Figure 4: Shockwave Medical, Inc. (SWAV): Product revenue and gross margin (own work, based on company filings)

Over the last twelve years, JNJ has spent $72.4 billion on acquisitions, offset by $15.0 billion in proceeds from divestitures. Goodwill impairments are rare, and most of the impairments I noticed relate to acquired in-process research and development. Over the last twelve years, JNJ has generated $200 billion in free cash flow, after stock-based compensation and including $8.3 billion in net proceeds from investments. This means that after acquisitions, $143 billion of free cash flow remained for other discretionary uses such as dividend payments and share repurchases. Since 2012, JNJ paid out $111.8 billion in dividends to shareholders and bought back shares for $74.6 billion. This means that the gap of $43.2 billion was probably funded via debt – something I do not like.

However, net debt at the end of 2023 was only around $6.4 billion, a difference of $11 billion compared to the end of 2012 (Figure 5), when JNJ still had a net cash position of around $4.9 billion. This suggests that other sources of cash (e.g. related to other working capital accounts or reduced income tax payments due to the exercise of stock options) were used to fund cash returns to shareholders.

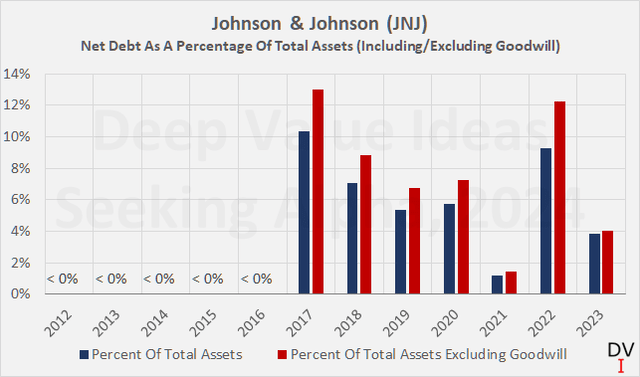

In my view, it would therefore be inappropriate to conclude that JNJ is returning cash to shareholders in an unsustainable manner and/or overpaying for its acquisitions. The far-sighted and conservative balance sheet management – against the backdrop of several significant and fairly regular acquisitions – can also be illustrated by putting net debt in relation to total assets, including and excluding goodwill. At the end of 2023, JNJ’s net debt amounted to only around 4% of total assets, notably excluding goodwill (Figure 6).

Figure 5: Johnson & Johnson (JNJ): Net debt/cash at year-end (own work, based on company filings)

Figure 6: Johnson & Johnson (JNJ): Net debt as a percentage of total assets, including and excluding goodwill (own work, based on company filings)

Returning to Shockwave now and realizing what early stage of growth the company is at, I was pleasantly surprised to see that it is already free cash flow positive. If we treat stock-based compensation as a cash expense, SWAV’s free cash flow in 2023 was $92 million, or $165 million if calculated in the usual way. Of course, this contribution won’t move the needle for JNJ for quite some time, but with the total addressable market for SWAV’s portfolio currently estimated at $14.5 billion (p. 9, SWAV 2023 10-K), I expect a significant contribution to free cash flow in a few years. JNJ CFO Wolk emphasized at the press conference on April 5, 2024 that JNJ expects Shockwave to add approximately 50 basis points to the MedTech segment’s growth profile.

But what makes Shockwave so interesting for JNJ? Those of you who remember the acquisition of Abiomed in late 2022 will know that JNJ is currently focused on bolstering its cardiovascular portfolio. While Abiomed is active in the field of external and implantable circulatory support devices, Shockwave’s focus is on intravascular lithotripsy (IVL) devices. IVL is a minimally invasive technique for e.g. the treatment of peripheral and coronary artery disease. In simple terms, the device (a vascular catheter) emits sonic pressure waves that destabilize atherosclerotic plaques. Vessels treated in this way become more amenable for the actual treatment, such as angioplasty or stenting. At the same time, loose plaque fragments are largely avoided, reducing the risk of downstream embolization and other complications (see e.g. p. 10 ff. SWAV 2023 10-K).

Shockwave’s IVL catheters (six are currently approved in the U.S. and E.U.) are predominantly used by interventional cardiologists and, according to the company, are easily adopted and used on a daily basis. Those interested in the technical details of IVL should check out this review article from 2022, which can be downloaded free of charge from PubMed (note, however, that the publication was directly supported by SWAV and one of the authors also receives speaker honoraria).

All in all, I think Shockwave – with its excellent growth prospects – is a good fit for JNJ, and despite the high static valuation multiples, I give management the benefit of the doubt. Johnson & Johnson’s longer-term acquisition history, conservative balance sheet management, solid free cash flow growth, and excellent working capital management are proof that the pharmaceuticals and medical devices giant has a knack for profitable inorganic growth. In my view, the acquisition of Shockwave was definitely not a sign of desperation in light of the upcoming LOEs and the now missing consumer health diversification.

Conclusion – And Is JNJ Stock A Buy, Sell Or Hold Now At $150?

Johnson & Johnson will announce its first quarter 2024 results on Tuesday, April 16, before the market opens. Analysts expect the pharmaceuticals and medical devices giant to report $2.65, slightly lower than a year ago. For the full year, the consensus is for growth of 7.5% year-over-year, while revenues are expected to increase by 3.8%.

JNJ has routinely beaten analysts’ estimates in the past, albeit only by a small margin. For this reason, and because of the insignificant estimate revisions, it is reasonable to expect (yet) another earnings beat on Tuesday. However, as JNJ’s tendency to under-promise and over-deliver is well known, I do not expect JNJ’s stock price to jump in response to an earnings beat.

Together with the results for the first quarter, the company will most certainly announce its 62nd dividend increase. With leverage remaining very low and free cash flow very strong even after the split off of Kenvue, a continuation of the 5% to 6% increases is a reasonable expectation.

But of course, modest concerns about JNJ’s drug portfolio remain, and the talc litigation overhang is not helping sentiment either. In addition, I think the acquisition of Shockwave – just one year after the acquisition of Abiomed ($16.6 billion enterprise value) – has been interpreted by some as a possible sign of desperation.

However, I don’t think it’s fair to conclude that JNJ is “growing at any cost”. First, it is important to note that Johnson & Johnson typically does a very good job of selecting promising acquisition targets and integrating them properly, as evidenced, for example, by its solid return on invested capital (ROIC), good working capital management, and rare goodwill impairment charges. If Johnson & Johnson routinely overpaid for its acquisitions, why is its balance sheet still the way it is?

In my view, Shockwave’s offerings are excellent in their own right, and the acquisition fits very well into JNJ’s still cardiovascular portfolio. The IVL catheters manufactured by Shockwave have a very high gross margin, and it is only reasonable to expect that growth will remain very strong and will be significantly supported by JNJ’s distribution and marketing capabilities.

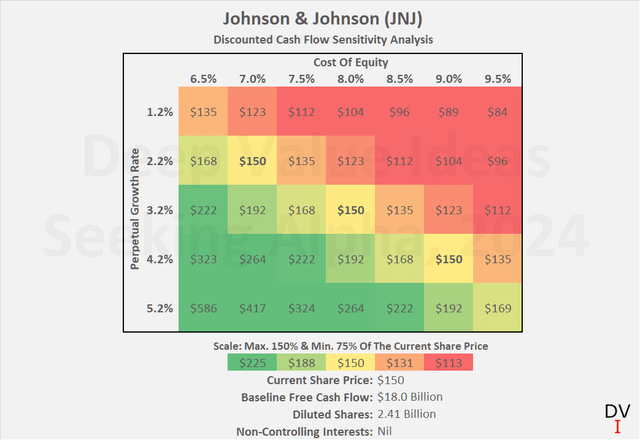

Overall, I remain positive on JNJ stock, and with it now trading near $150 – where I had previously rated it a “buy” – I reiterate this view. Figure 7 shows an updated discounted cash flow sensitivity analysis that takes into account the decline in free cash flow after the Kenvue split off and the lower number of shares outstanding. If an investor is comfortable with 8.0% per annum (cost of equity) and JNJ can continue to grow its free cash flow at just over 3% in perpetuity, the stock would be fairly valued today. This is not a particularly demanding valuation, but of course, I expect a significant recovery only if the talc litigation is resolved once and for all and there is positive pipeline-related news. So even though I maintain that Johnson & Johnson is a buy at current levels, JNJ’s stock price outlook remains elusive over the near term.

Figure 7: Johnson & Johnson (JNJ): Discounted cash flow sensitivity analysis, taking into account the Kenvue split off (own work, based on company filings)

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.