Summary:

- The recent sell-off in Nike stock offers new investors a prime opportunity to purchase a fantastic business with strong growth potential.

- Upcoming catalysts such as the Paris Summer Olympics and Autumn Investor Day should highlight Nike’s return to its innovative roots.

- Despite recent challenges, including supply chain disruptions and macro headwinds, NKE has implemented a successful restructuring plan and is well-positioned for long-term growth.

Thank you for your assistant

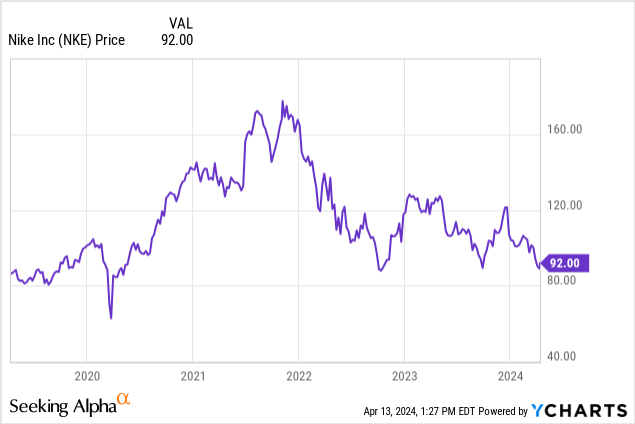

Things have been less than perfect over the recent years at Nike, Inc. (NYSE:NKE). Since hitting all-time highs in 2021, fueled by the surge in consumer spending, shares have fallen by over 40%, translating to the loss of over $130B in shareholder value. Pessimism hasn’t been this extreme for the worldwide leader in footwear and apparel in quite some time. With consumers tightening their spending habits and fears of intensifying industry competition creeping in, many have written NKE off for dead. However, adversity is nothing new for Nike. From the very start, Nike was viewed as an underdog in a fiercely competitive environment. As Phil Knight, founder of Nike, put it, “Like it or not, life is a game,” and I wouldn’t bet against Nike in this game. Although Mr. Market may disagree right now, it’s only halftime for Nike, and they are just getting started.

Company Overview

Nike has become a household name around the globe for good reason. The iconic “swoosh” logo is instantly recognizable and one of the most well-known logos worldwide. How’s that for brand strength? As the world’s largest seller of athletic footwear and apparel, NKE has become the home of top athletes worldwide, such as Michael Jordan, Cristiano Ronaldo, Serena Williams, and LeBron James.

Nike offers an extensive product lineup with familiar names such as Air Jordan, Air Force 1, Converse, and Chuck Taylor. NKE has earned this first-class reputation by developing a long history of innovative marketing campaigns, a winning culture, and a customer-centric approach. Thanks to this pristine brand strength and customer loyalty, NKE has created one of the most large-scale moats in the business world.

Macro Headwinds

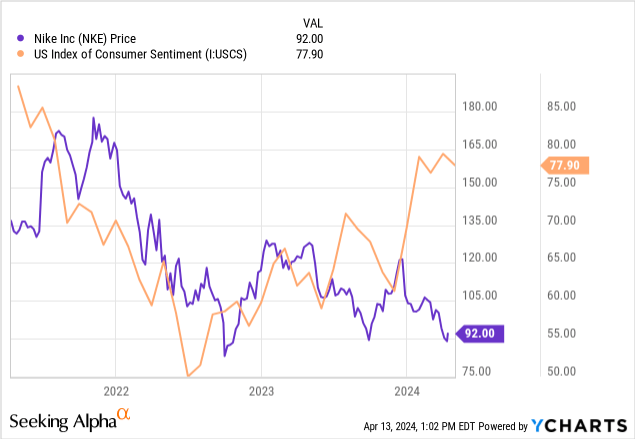

After witnessing a surge in demand throughout 2021 fueled by stimulus checks and consumers returning to everyday life, consumer discretionary spending has since cooled. Nike, heavily reliant on consumer sentiment and spending, naturally finds its business cycle highly cyclical. When consumers have extra money in their wallets and feel confident about the future, they are bound to purchase items such as sneakers and apparel. With that said, when sentiment reverses, Nike immediately feels the consequences. I overlaid the US Index of Consumer Sentiment in the chart below with NKE share price.

As you can see, when sentiment deteriorated from 2021 through 2023, Nike’s share price was a near mirror image. However, what also becomes apparent is that NKE has failed to retrace the recent advancement in consumer sentiment. I will offer an explanation for this divergence later on.

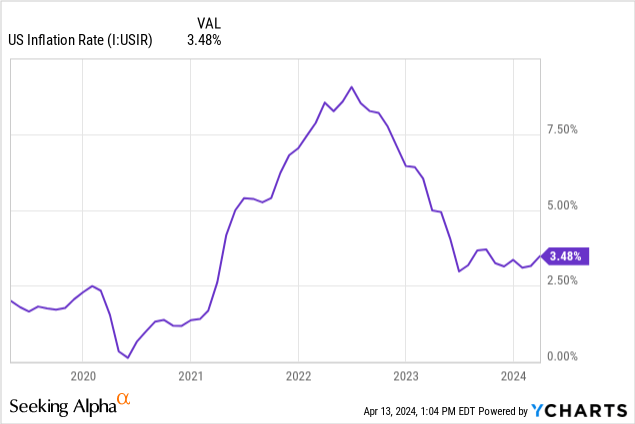

One of the main drivers for this downtrend in US consumer sentiment was one of the most aggressive rises in inflation in distant memory. The US witnessed a near overnight surge in CPI from levels between 1%-2% to 9.1% in June 2022.

Not only did this challenging environment hinder Nike’s top-line sales, but raw material and commodity prices also eroded Nike’s profitability. As a footwear and apparel company, NKE finds itself particularly vulnerable to the costs of raw materials such as cotton, rubber, and polyester. This dramatic rise in input costs heavily weighed on profitability for NKE, with net profit margins falling from 15.30% in Q1 2021 to 10% in Q2 2022.

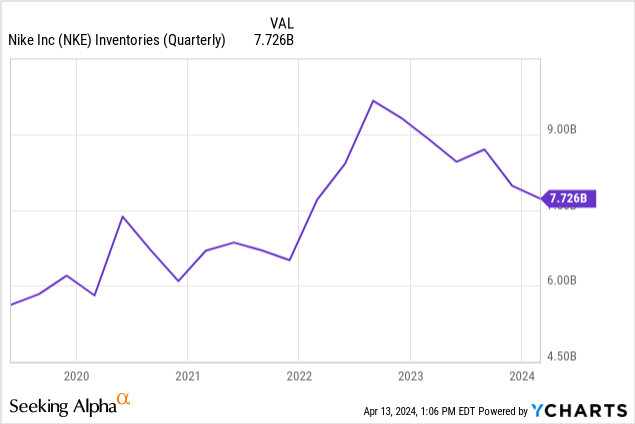

Furthermore, supply chain volatility led to a substantial buildup in Nike’s inventory levels. To meet the surge in demand experienced in 2021, Nike was forced to increase its inventory rapidly.

This led to a staggering 48% increase in inventories, from $6.5B to $ 9.6 B, between Q2 2021 and Q1 2022. However, when consumer sentiment reversed, NKE was left with these excessive inventories and minimal demand, a detrimental combination for any business. While management has made commendable strides in returning to more historically in-line inventory levels, they did so by resorting to increased markdowns and heightened promotional activity, resulting in weaker overall margins.

Competition

While NKE has enjoyed a near stranglehold on athletic footwear and apparel, competition has undoubtedly crept in over the years. NKE faces stiff competition from On Holding AG (ONON), Deckers Outdoor Corporation (DECK) Hoka, Lululemon (LULU), with all three companies outperforming NKE this past year. NKE is well aware of this market share erosion, as CEO John Donahoe has pointed to the “everyday running category” as the segment “where we have the most work.” The growing popularity of brands like ON, Hoka, and New Balance could suggest that consumer taste has shifted from famous court-inspired basketball shoes to athleisure sneakers that can be worn at either home or the office. Jim Tierney, Chief Investment Officer of Concentrated US Growth Equities at AllianceBernstein and long-time NKE shareholder, has said, “If we do a post-mortem, maybe there’s been too much reliance on legacy or historical product.” While NKE has been able to offset some of these competitive headwinds with brand strength and strategic pricing power, the moat is certainly beginning to crack.

Innovation

As Nike founder Phil Knight said, “Life is growth. You grow or die.” There is no denying that NKE has gotten complacent over the years. We have seen an overreliance on legacy products such as Air Force 1, Jordan brand, and Dunks. However, NKE is well aware of the situation and has begun taking steps to return to its innovative roots. One of the first steps of returning to innovation was cutting back on “classic shoes” orders and shifting focus to upcoming launches and developing new products, a pivot management highlighted in the Q3 2024 earnings call.

NKE has already begun releasing new products that have gained significant traction in the early innings, describing the latest Air Max DN sneaker as the “best Air Max product in years.”

NKE has also announced that they are accelerating a multi-year innovation cycle, a perfectly timed pivot emphasizing management’s relentless focus on innovation. One of the most promising key points that management underlined in the Q3 earnings call was the following:

“Since the start of this fiscal year, new and updated footwear models have grown into a majority of our top 20 growing footwear franchises in Q3… And those products are on a trajectory to deliver multi-billions of annual run rate of incremental revenue.”

While all this talk of complacency and need for innovation seems to suggest that current product lines are fracturing, that isn’t entirely the case. NKE has been able to achieve double-digit growth in its basketball segment in Q3, an area that consistently offers strong organic growth. Nike’s unparalleled ability to lean on some of its most prominent athletes and franchises, such as LeBron, Ja, and Kobe, has helped quickly scale products. In addition to the basketball segment, Nike’s women’s segment has shown incredible strength, achieving high single-digit growth over the past three years. Women’s footwear grew double digits, and key apparel franchises, such as $100-plus leggings, had fantastic sell-through. Management plans to lean into this strength in the women’s segment, claiming, “We now have a line of sight into what we believe is the best plan we’ve ever had to accelerate growth in Women’s.” NKE is in a prime position to capitalize on growing consumer trends and industry tailwinds such as athleisure, consumer interest in sports, and healthy lifestyles.

In addition to product innovation, NKE has adopted a heightened focus on sports, athletes, and sponsorships. Having the greatest athletes across the globe embracing the NKE “swoosh” is what has built NKE into the powerhouse they are today. I view this return to focus on sports and athletes as an integral element of achieving the next wave of growth. NKE has already begun getting to work, announcing a new deal with The German Football Association in the Q3 earnings call. This newly awarded deal for NKE marks the end of a 70-year partnership with rival manufacturer Adidas (OTCQX:ADDYY) and a fantastic opportunity for decades of organic growth.

Olympics and Investor Day

NKE has an incredible opportunity to display this ramp-up in innovation on the world’s biggest athletic stage, the summer 2024 Paris Olympics.

In addition to outfitting all US athletes, NKE provides kits for athletics teams in Canada, China, Kenya, Germany, and Uganda at the Olympics and basketball teams of China, France, Japan, and Spain. NKE will also provide kits for the Korean breakdancing athletes, which is a brand new event at the Paris games.

While providing kits for Olympic athletic teams is excellent, what is even better is the ability to showcase new product lines. Olympic athlete endorsements allow NKE to leverage athletes and some of the greatest moments in sports to push new products. While performance products like the Alpha Fly 3 marathon shoe, which retails for $285, will have a solid spotlight, NKE is most excited to showcase more entry-level running shoes, such as the Pegasus shoe, which retails around $130. Lorraine Hutchinson, a securities analyst at Bank of America, highlighted that Olympic quarters have grown about 500 basis points above a regular 1Q because of the increased marketing and product offerings. In the Q3 earnings call, NKE also emphasized the “Air for Athletes” Olympic campaign as the boldest expression of Nike’s brand voice in many years. The way I see it, the Summer Olympics comes at a vital time as NKE leans into a multi-year innovative cycle.

NKE has also scheduled an Autumn Investor Day, the first in over seven years, in which the accelerated innovation cycle will be fully displayed. These innovative events are precisely what NKE needs to show consumers and “the street” that the next wave of growth has begun.

DTC and Wholesale

In recent years, NKE has taken a key pivot towards direct-to-consumer (DTC) sales instead of its historical reliance on wholesale. This push towards DTC was fueled by the hunt for higher margins, with gross margins nearly twice as profitable as typical wholesale routes. Nike established five global store concepts to create a DTC business, including Nike Rise and Nike House of Innovation. NKE began separating from 3rd party retailers such as Foot Locker (FL) and Dillard’s (DDS). These immersive stores featured digital experiences and integrated technology, allowing shoppers to pull up products on their phones, start dressing rooms, and streamline the shopping experience. While growth at NKE-owned channels has been solid, management is now emphasizing the shift in consumer preferences and the strategic ability of consumers to purchase NKE products at multi-brand retailers. When asked about the DTC versus wholesale approach, management had this to say:

“While NIKE Direct will continue to play a critical role, we must lean in with our wholesale partners to elevate our brand and grow the total marketplace”

While NKE has a rewarding DTC strategy, the shift in consumer preferences and desire for choice while shopping diminished its success. Though wholesale margins may not be as strong, I view growing the entire marketplace as a more rewarding approach.

Restructuring

During the Q2 2024 earnings call, NKE management outlined a company-wide $2B cumulative cost savings program over the following three years. The cost savings plan is centered upon several core elements:

-

Simplifying product assortment.

-

Improving supply chain efficiency.

-

Leveraging scale to lower the marginal cost of operations.

-

Increasing automation and speed from data and technology.

-

Streamlining organizational structure.

-

Reducing management layers.

-

Enhancing procurement capabilities.

This cost-cutting program, titled the “Save to Invest” program, will reallocate resources towards consumer-facing activities where the company sees the most potential for robust organic growth. Investors can already see the program in effect, with the announcement of a 2% layoff resulting in more than 1500 job cuts. I view this “Save-to-Invest” strategy as a massive catalyst in sparking the next wave of growth at NKE as management returns to playing offense.

Dividend and Share Repurchases

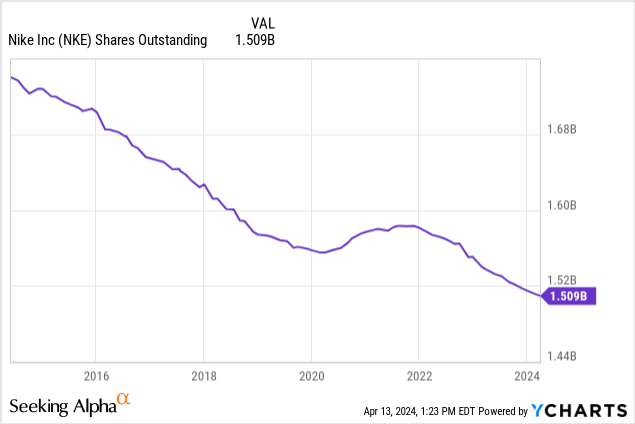

With $10.57B in total cash and short-term investments and only $12.1B in total debt, NKE finds itself in a relatively flexible financial position. With over $6.3B in annualized free cash flow (FCF) this past year, NKE has the flexibility to deliver shareholder value in a variety of ways. NKE repurchased 7.9M shares this past quarter, worth roughly $866M. Over the past ten years, NKE has steadily decreased outstanding shares by over 13%.

NKE still has $10B remaining under the current share repurchase program, highlighting a fantastic opportunity to return value with today’s depressed prices. With operational and liquidity needs met and a stock price trading at a significant discount to its intrinsic value, I believe management will eagerly utilize the repurchase program.

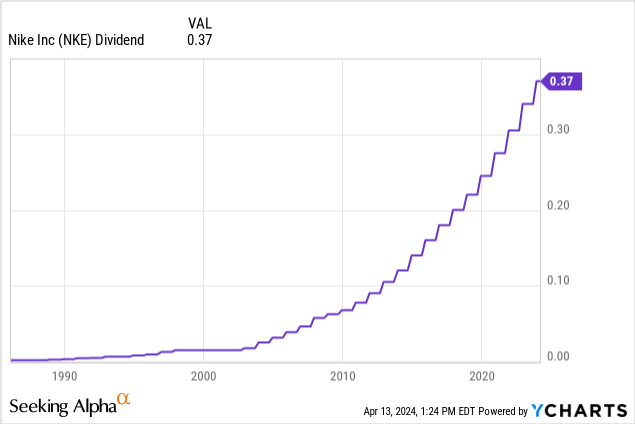

In addition to repurchased shares, NKE returned over $562M in quarterly dividends.

This dividend is going nowhere, as this quarter marks the 22nd year of consecutively increased dividend payouts. The 1.61% dividend yield is an added bonus as shareholders wait for the return to growth.

Margins

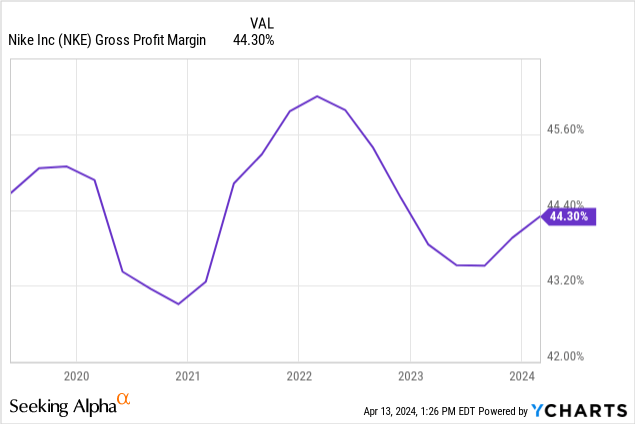

After gross margins fell by nearly 400 basis points from Q3 2022 to Q2 2023, we have seen five sequential gross margin improvement quarters.

While recent Q3 2024 gross margins of 44.75% are roughly 200 basis points below recent highs, management is confident we have seen the inflection point. Although gross margins have undoubtedly been under significant pressure, they are still well above the sector median of 36.14%. Nike is the gold standard for margins in the footwear and apparel sector, as they can consistently utilize brand strength and pricing power to remain on top.

Guidance

Despite the earnings beat, a softer-than-expected sales outlook was one of the biggest drivers behind the recent sell-off in NKE stock. While management reiterated FY 2024 revenue growth of 1%, they guided for a low single-digit decline in revenue in 1H 2025. Management cited a softer consumer and macro environment globally. Although shareholders were disappointed with this weak sales forecast, several positives were also to be mentioned. Management expects revenue and earnings to grow for the year, with gross margins expanding by over 120 basis points. While NKE cannot control the macro environment, I am happy to see a heightened focus on gross margin execution and cost-cutting measures.

Valuation

During 2021, NKE traded between $150-$170, hitting an all-time high of $172. Here is a financial summary of NKE in 2021:

-

Total Revenue: $44.53B

-

Gross Profit: $20B (44.91% Gross Margin)

-

Net Income: $5.72B (12.86% Net Profit Margin)

-

Shares Outstanding: 1.578 Billion

-

Earnings Per Share: $3.63

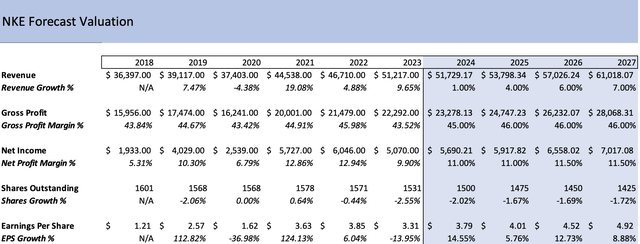

Here is my 3-year forecast valuation for what I believe Nike can achieve given the $2B cost-cutting program, margin expansion, and acceleration of a multi-year innovation cycle.

Using management’s guidance as a benchmark, I forecasted 2024 revenue growth of 1%, followed by a steady return to historically in-line levels. While my 2027 forecasted revenue growth of 7% is a slight tick above the NKE’s 5-year average of 6.91%, I am anticipating the acceleration of a multi-year innovation cycle fueling sizeable organic growth. Next, I used management’s forecasted 120 basis point gross margin expansion as a benchmark, followed by 46% margins through 2027. Given the implementation of a $2B cost-cutting program, I believe these margin targets are easily attainable and likely conservative. I forecasted net profit margins expanding to 11% through FY 2025 and to 11.5% in both FY2026 and FY2027. With over $10B remaining on the current share repurchase program and a long history of substantial repurchases, I forecasted a net reduction of roughly 100 million shares (average. purchase price of $100). Given the depressed share price and softer near-term outlook, management will likely have fantastic opportunities for cheap repurchases in the short term. With that said, this leads us to a FY 2027 EPS of $4.92. By assigning a 30x P/E multiple to these earnings, still below NKE’s 5-year average 33x P/E, we land at a share price of $147.60. This price target implies a 64% upside to NKE from today’s share price. Over three years, this boils down to an 18% compounded annual growth rate (CAGR) before considering any quarterly dividend payments.

Risks

While shares of NKE appear to be trading at a significant discount to intrinsic value, there are always risks to any investment. Some of these risks include the following:

- Persistent macro headwinds: NKE is heavily reliant on consumer sentiment and discretionary spending. Any prolonged macro headwinds and weakened consumer sentiment can negatively impact Nike’s sales and profitability.

- Increased Competition: In a highly competitive industry like footwear and apparel, complacency and failure to adapt/innovate can lead to a loss in market share.

Conclusion

When analyzing NKE stock, I can’t help but think of the late Charlie Munger’s famous quote:

“A great business at a fair price is superior to a fair business at a great price.”

I view NKE as belonging to the “great business” camp. While NKE trades at a premium to industry peers, I believe this premium is warranted. By utilizing brand strength, pricing power, and customer loyalty, NKE can continue gaining market share and creating long-term organic growth. As management returns to the core roots of innovation that built NKE into the powerhouse they are today, Mr. Market will have a change of heart. In the meantime, I view any opportunity to buy NKE below $90 per share as a bargain purchase. Just buy it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.