Summary:

- PepsiCo offers a better value than Coca-Cola in terms of product diversity, cash management, dividend growth, and upside potential.

- Pepsi’s global exposure and portfolio of products make it well-suited to navigate rough economic cycles.

- Pepsi’s valuation suggests a potential upside of 12.8%. When combined with the dividend yield of 3%, we are looking at the potential for a large double-digit return.

Rattankun Thongbun

Overview

PepsiCo (NASDAQ:PEP) versus Coca-Cola (KO) is the decade’s old argument. While I’ll start this off by controversially stating that Coke tastes better, I’ll end this by trying to prove that Pepsi is a better company to own at the moment. I previously covered Pepsi with my article titled, ‘PepsiCo: Expensive, But Must Have‘ where I discussed how the price traded at a premium valuation. However, the price has come down since then and now looks to be trading at a more attractive value. In addition, PEP remains more attractive as a business compared to KO.

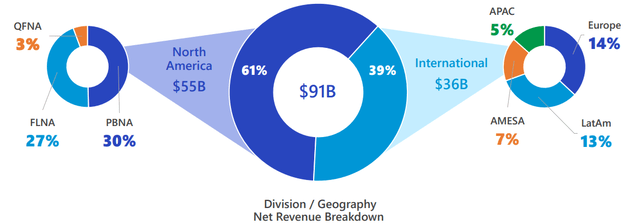

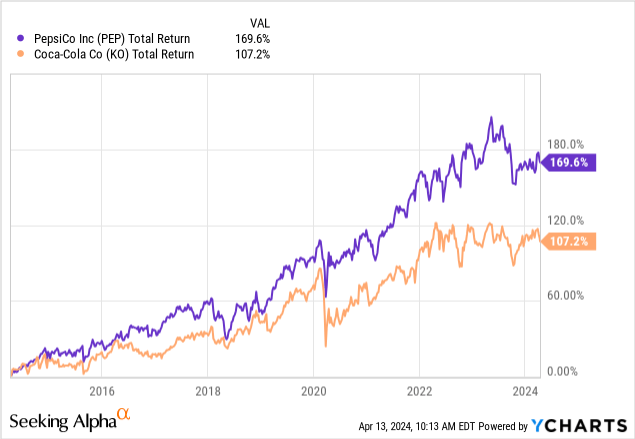

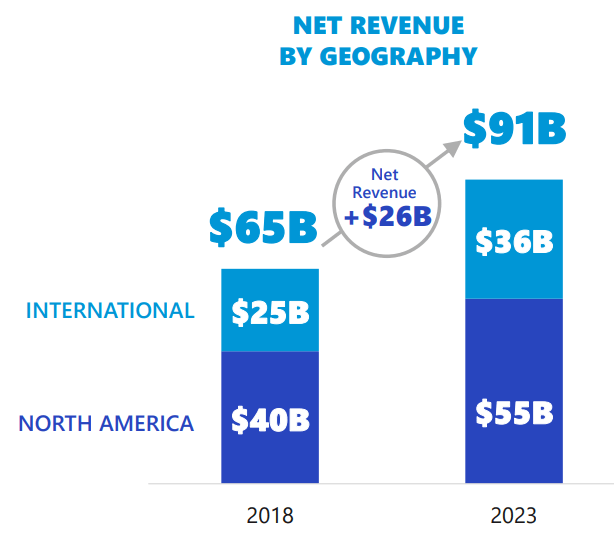

We can see how PEP has a superior level of total return over the last decade. This can likely be attributed to a better product diversity in the snacks category. This better product diversity makes them more appealing than KO, despite KO already having a global recognized soda brand. Pepsi management knows it would be hard to compete with their soda counterpart, and has instead made huge strides in their global presence in the snack category. In fact, the majority of their revenue doesn’t even come from soda. For the full year of 2023, they pulled in $91B in revenue. 59% of this came from the snacks category, with brands like Doritos and Lay’s. The remaining 41% came from the drinks category.

Their global exposure also leaves room for expansion. 61% of their revenue comes from the North American market while only 39% comes from international markets, across Latin American, APAC, Europe, and AMESA. I think that PEP’s portfolio of products are better suited to navigate rough economic cycles are well. This has already been supported by the level of dividend growth that PEP managed to achieve over the pandemic when sales are impacted globally.

Valuation & Dividend

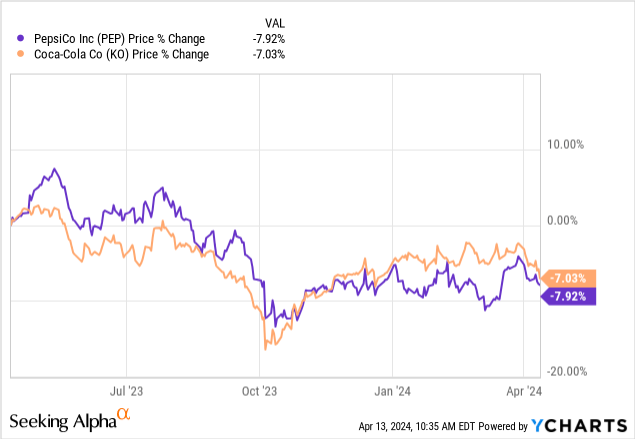

The price over the last year has come down by about -8%. Seeking Alpha’s Quant rating of 4.35 reinforces a Buy at this level. In addition, the average Wall St. price target sits at $187.80 per share. This represents a potential upside of nearly 12%. The highest price target is at $210 per share, and the lowest sits at $151 per share. With the recent price drop, I thought it would be a good time to assess my own valuation with a dividend discount model to see if I can get a rough estimate on fair value.

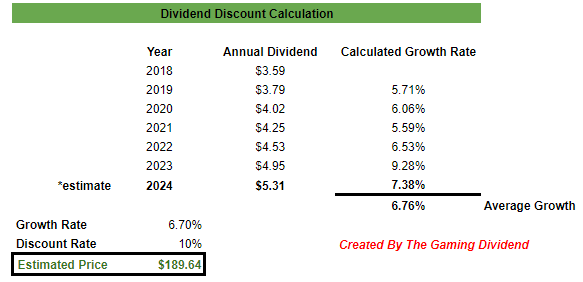

I first compiled all of the dividend data for prior years, starting from 2018. We can see that since then, the dividend has grown at a CAGR (compound annual growth rate) of roughly 6.76%. Next, I used the estimated annual dividend for 2024 of $5.31 per share. This estimates that the anticipated dividend raise will fall within the range of a 7.4% raise. I used 6.7% as the estimated growth rate, since that is the average over the measured time frame. As a result, we get an estimated fair value at $189.64 per share.

Pepsi Fair Estimated Price (Author Created)

My estimated fair price of $189.64 leaves up with a potential upside of 12.8%, which closely aligns with the Wall St. price target. In combination with this upside, take into consideration that the current dividend yield is 3%. This means you have the opportunity to capture a total return of more than 15% if you include the dividend payments received.

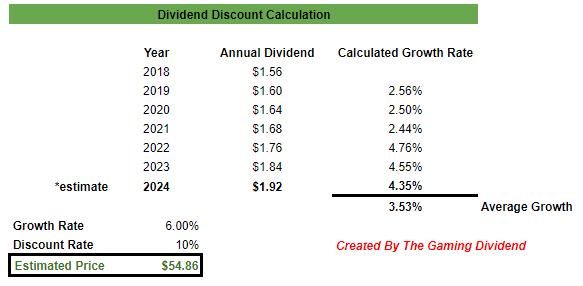

In comparison, if you run this exact same calculation with Coca-Cola, we determine that the price is currently trading above a fair value. In addition, we can see that KO’s dividend was only half as strong as PEP’s during the same time period. Even with a high estimated growth rate of 6% inputted, we can see that a fair estimated price is only $54.86 per share. This would actually present a near 6% downside.

Coca Cola Dividend Discount Calculation (Author Created)

Both PEP and KO are dividend kings, having increased their dividend payouts for over 50 consecutive years. Pepsi increased their dividends for 51 consecutive years, while KO increased theirs for over 61 years. However, KO is losing a bit of steam in terms of the rate they can continue growing the dividend. KO’s current payout ratio is 68.4% while PEP’s is slightly lower at 64.9%.

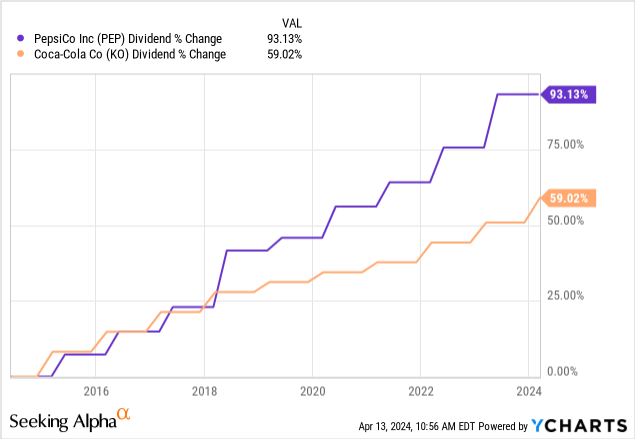

The dividend growth of PEP remains stronger than KO as well. For example, over a ten-year period, KO’s dividend has grown at a CAGR of 5% flat. In comparison, PEP’s dividend has grown at a CAGR of 8.35% over the same period. PEP’s short-term dividend growth has been even strong, and my assumption is because they were able to navigate the pandemic with much more comfortable levels of revenue and cash flow. For example, their five-year dividend CAGR is 6.4% in comparison to KO’s 3.5% over the same period.

We can see that over the last decade, the total dividend growth of PEP far outpaces that of KO. While you are getting a slightly higher yield of 3.3% with KO, PEP offers better growth prospects, even though their dividend yield is only 3%.

With all of this in mind, I stand by the fact that the data reinforces PEP to be of better value at the moment. There is more price upside to gain from PEP, as well as a better dividend growth rate that can be captured.

Financials

In terms of financials, Pepsi’s revenue can be broken down into three main segments. These segments each have their own diverse product offerings, and all of them are exposed throughout international markets.

- PepsiCo beverages: Offer drinks like sodas, teas, sport drinks, energy drinks, and coffees. This segment brings in an estimated $28B in revenue.

- Frito Lay: Lock in on brands across the salty and savory snack categories. This includes brands like Lay’s, Doritos, Ruffles, and Tostitos. This segment brings in an estimated $25B in revenue.

- Quaker Foods: This is where they have a slight breakfast and sides presence with offerings such as oatmeal, pasta-roni, and pancake syrup. This segment brings in an estimated $3B in revenue.

In their latest earnings report, there were some disappointments in sales across some of these segments, but I think that’s expected in this environment. With the latest CPI report in mind, I think we are in for another rocky year with flat or declining sales. For example, their Q4 earnings report cited lots of loss in operating profit. The beverages segment saw a huge -27% decrease in profits. This can be attributed to cost increases and a decrease in organic sales volume. The cost of sweeteners and commodity pricing cut margins too thin and results in management trying to offset this with pricing increases. The pricing increases will be a short-term solution for the decrease in volume.

In addition, the Quaker foods segment saw a decrease in operating profit by a huge -79%. Once again, the impact here was sourced to price increases. They are actively trying to offset the operating costs in this segment by lowering advertising and market spend. Lastly, the Frito-Lay did see a small 2% increase in operating profit. This was due to lower advertising and marketing spend as well as increased volumes.

PEP Annual Report

Despite these Q4 shortfalls, revenue stayed within the same range at $27.85B for the quarter, which was only a -0.5% decreases year over year. In addition, net revenue by geography is still averaging a solid growth over the last 5-year period. The outlook for fiscal year 2024 is an expected organic revenue growth of 4% and an 8% growth in core constant currency EPS.

Thankfully, PEP’s cash management is top tier, and they are able to ride out these sector headwinds. Headwinds are inevitable in business, but thankfully, management has lots of liquidity in preparation. They have $13.44B in cash from operations and an operating free cash flow growth of 24.34% year over year. Profitability with margins still remain healthy as well, with an EBITDA margin of 17.85% that remains higher than the sector median EBITDA margin of 11.73%.

PEP Annual Report

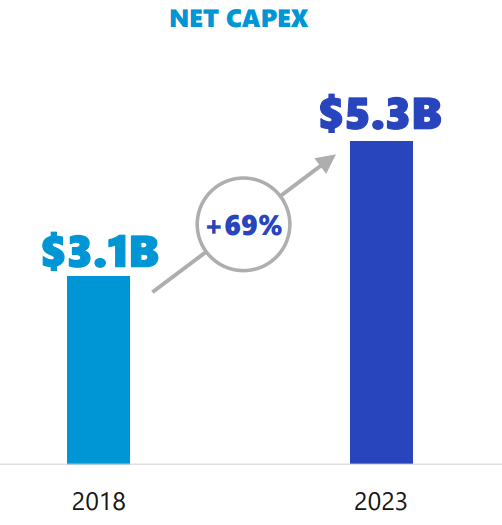

Lastly, their high levels of capital expenditure being poured back into the business should assist with offsetting any potential losses. We can see that there has been a 69% increase in net capex spend since 2018. Advertising and marketing spend has also increased by 36% since 2018. The international markets still have plenty of opportunity for growth, and I think they will see tremendous strides of growth once we get out of this high inflationary period.

Vulnerabilities

The consumer price index climbed 0.4% in March, which happens to be slighter higher than the 0.3% increased that was anticipated. High levels of inflation continue to put pressure on American spending dollars. Groceries are one of the segments that saw the highest level of price increases that most average consumers felt the impact of. As a result, I anticipate a shift in consumer spending during a time where the cost of living continues to rise. To combat this rise, consumers will begin to change how they spend their dollars in all areas of their life.

One area that specifically effects PEP would be the snack and drink categories. Buying the Pepsi-branded chips like Lay’s or Doritos becomes less enticing when the store-branded alternative snacks offered by companies like Kroger (KR) or Target (TGT) have options that taste similar. Most importantly, these store branded items are typically more cost-efficient options. We’ve already seen data that supports this shift as well, with 54% of shoppers saying that they’ll go with the store-brand groceries over the name brand from now on.

This shift will continue to steal away market share from companies like Pepsi and Coca-Cola until inflation starts to settle down. This leaves PEP vulnerable because a part of their strategy to offset the lower sales volume was to increase pricing. However, increasing pricing means that more people are likely to shift to buying more store-branded items. It can be a vicious cycle depending on how long inflation levels remain elevated. For now, PEP has the cash and sales volume to manage, but it does level a level of vulnerability for future growth.

Takeaway

PepsiCo (PEP) has come down in price and the valuation looks much more attractive at these levels. Based on my valuation metrics, there is a potential upside of 12.8% with an estimated fair price of $189.64 per share. When we combine this with the dividend yield of 3%, we have the possibility of capturing double-digit returns. While PEP and KO are both dividend kings, PEP offers a much higher level of dividend growth, which adds to the total appeal. As a result, I am upgrading my rating to Buy because of this potential upside and capex spending to fuel more growth. Management has done a great job with cash management to ride out sector headwinds.

However, although PEP’s product mix in more diverse than KO’s, they do remain vulnerable to the high levels of inflation. More consumers are willingly shifting their dollars towards store-branded items. This may steal market share away from PEP the longer this high inflationary period lasts. PEP has temporarily offset this with higher pricing, but I do not think it’s a long-term solution as of yet, so I plan to revisit once the macro environment improves.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.