Beware Of Netflix’s Q1 2024 Sudden Disclosure Changes (Rating Downgrade)

Summary:

- Netflix, Inc.’s valuation has increased by over 84% in the past year due to its recovering market share gains and consistent margin expansion.

- The company’s newly introduced ad strategy remains in focus, as much of Netflix’s current valuation premium relies on its ability to execute and turn ads into a margin accretive factor.

- However, management’s recent decision to stop disclosing key performing metrics beginning 2025, citing a greater focus on driving earnings and free cash flow growth, is a potential cause for concern.

Wachiwit

Netflix, Inc.’s (NASDAQ:NFLX) valuation has surged more than 84% over the past year as it regains its grip on market share and margin expansion following the roll-off of post-pandemic demand. Admittedly, Netflix’s moat has remained strong, with many of its initiatives launched over the past year – spanning ad integration, paid sharing, and an expanding foray in sports – starting to pay off. This has reinforced its market leadership, which leads peers’ by wide margins.

By being the only profitable constituent in the heated streaming content arms race, alongside market-leading reach, the additive growth stemming from ad sales represents total addressable market, or TAM, expansion. And Netflix is only just starting to take part in said opportunities. This is reinforced by its robust Q1 outperformance, and management’s continued optimism for ad-driven growth and margin expansion to ramp through the remainder of the year.

In fact, margin expansion, free cash flow (“FCF”) growth, and a pivot in focus on scaling ad operations has driven management’s decision to remove subscription and ARM disclosures beginning 2025. The stock’s adverse response in late trading following the Q1 earnings release potentially highlights the market’s pricing of uncertainties ahead. Particularly, by removing performance metrics such as paid subscriptions and ARM, it becomes increasingly difficult to partition Netflix’s growth and, inadvertently, margin drivers ahead.

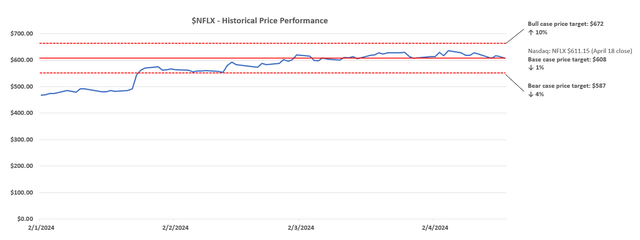

The latest update also does not bode favorably with Netflix valuation at current levels, which is entering rich territory. The stock currently trades at 7.1x estimated sales and 35.9x estimated earnings. From an earnings multiple perspective, Netflix currently trades at a slight premium over its megacap peers’ average of about 34x. Meanwhile, its sales multiple trails the 8.5x megacap peer group average, but is consistent on a relative basis to Netflix’s growth outlook.

The diversion potentially suggests the contradicting forces between rapid margin expansion and slowing revenue growth amid a normalizing rate of subscription expansion and early ramp of ad sales. It also potentially implies investor focus on Netflix’s growth prospects still, with further room for upside potential in the stock dependent on when ad-tier revenues become margin accretive to the existing business.

Although we remain confident in additive growth opportunities from Netflix’s advertising strategy, we believe the stock’s valuation is reflective of the company’s current roadmap. Meanwhile, the latest bombshell on the company’s upcoming performance metric disclosure changes backtracks on transparency and risks ushering further volatility in the near-term. As such, we are downgrading our rating for Netflix from buy to hold.

Understanding Netflix’s Ad Progress

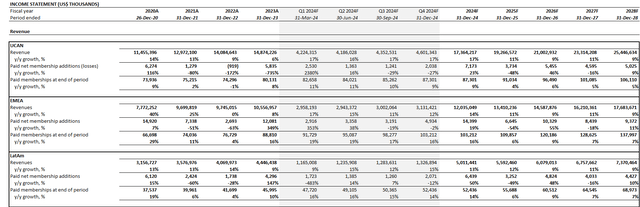

Netflix grew ARM by 1% y/y in Q1, complementing continued net adds stemming primarily from robust traction for the ad-supported tier and paid sharing conversions. We believe Q1 ARM growth also reflects tailwinds from the increase in subscription prices in October 2023. However, the slowing pace of subscription growth in Q1 potentially highlights normalizing net adds driven by down-tiering to the ad-supported option and conversion of previous free-riders to paid sharing after the feature’s roll-out about a year ago. The results also suggest slow accretion from ad-related revenues – particularly from ad sales, despite robust subscription adds on the ad-supported tier with 23 million paying users based on management’s latest disclosure, up from 15 million last reported in November.

Specifically, management disclosed 65% q/q ad-supported tier membership growth in Q1, largely in line with 70% q/q growth observed in each of the preceding two quarters. The ad-supported tier currently accounts for 40% of quarterly new sign-ups, highlighting continued interest for the lower priced alternative.

Netflix currently charges $6.99 per month for the ad-supported tier in the U.S. – its largest and most profitable region. This compares to the UCAN segment’s ARM of $17.30 in Q1. To narrow the difference between the ad-supported tier’s subscription rate and ARM, Netflix would need to ramp up its revenue generated from ad sales. And this figure will primarily depend on several key metrics, spanning 1) cost per mille (“CPM”), which measures the price that advertisers are charged per 1,000 impressions; 2) ad-tier subscriptions and viewing hours, which determine Netflix’s ad reach and engagement; and 3) ad load per hour, which represents the amount of filled ad inventory.

- CPM: As discussed in a previous coverage, Netflix had rolled out its ad product at a premium price on a relative basis to peers. Specifically, Netflix had initially asked advertisers for “more than $60 per thousand viewers,” which is almost double the average market rate at the time. In the latest update reported by Wedbush Securities, Netflix currently charges in the “low-to-mid $40 range” per thousand viewers, which is still a premium to the ~$20 average rate observed at peers today. The company aspires to raise CPM further in 2024.

- Ad-tier subscriptions and viewing hours: Increasing ad-tier subscription volumes and content viewing hours would reinforce engagement and the number of ads delivered, hence driving ad sales growth. Netflix had previously reported 65 viewing hours per month on average per subscriber before the roll-out of new features such as the ad-supported tier and paid sharing. This compares to “at least two hours per month” of content viewing per ad-tier subscriber on average as disclosed by management in January during CES 2024. This represents significant growth headroom until ad-tier subscribers reach its steady-state monthly content viewing hours, even if it will inherently be lower than premium subscribers due to additional time allocated towards ad views and potentially lower usage commitment.

- Ad load per hour: Netflix had initially planned to show fewer than “five minutes of ads per hour.” In 2023, during the early stages of ad inventory ramp, Netflix showed as little as “three minutes of ads per hour.” As inventory continues to expand, we expect Netflix to average about four minutes of ads per hour over the near-term. This is consistent with incremental inventory stemming from stiffening competition following Amazon Prime Video’s (AMZN) incorporation of ads earlier this year.

Near-Term Drivers to Ad Sales Accretion

Looking ahead, Netflix still has several levers to pull to boost the three factors underpinning ad sales, as discussed in the earlier section.

Ad-Tier Subscriptions and Viewing Hours

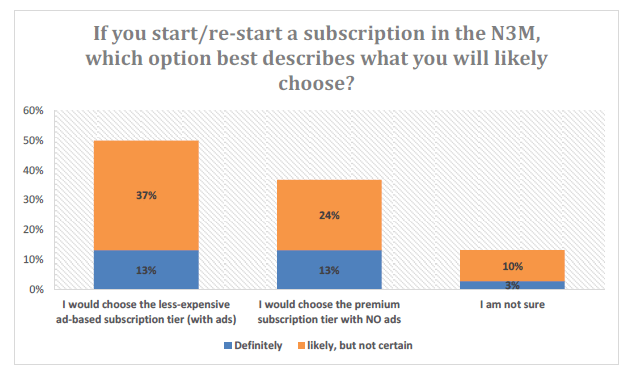

A competitive content slate is critical to increasing ad-tier subscriptions and viewing hours organically (i.e., not from down-tiering / paid sharing conversion). And Netflix remains well-positioned on this front. Despite a modest Q2 slate compared to Q1, with the most attention-grabbing release potentially being Bridgerton Season 3, Netflix is likely to increase its capture of ad-supported subscriptions. Specifically, new season releases typically drive returning subscribers that have previously churned. Recent industry data shows that returning subscribers are more likely to sign up for the ad-supported tier.

Momentive, Wedbush Securities

This is consistent with typically higher ad tolerance across prospective and existing streaming platform subscribers. Specifically, American households are currently subscribed to 3.7 streaming services on average, up from 3.5 in 2021. More than a fifth of streaming users “prefer ads to subscriptions on an absolute basis” due to price sensitivity. Yet, household income appears to play a lesser role in determining ad tolerance when compared to age. Users above the age of 44 have demonstrated greater ad tolerance.

Meanwhile, recent industry surveys conducted by RBC Capital Markets have showed “no significant correlation around pricing or preference for subscription over advertisements.” In fact, American households with an annual income of $100,000+ are only willing to pay $6.40 per month on average for ad-free streaming, compared to $7.10 observed across those with an annual income below the $100,000 threshold.

Looking ahead, subscription volumes – particularly the ad-supported tier – are likely to gain further momentum in 2H24. This is further supported by the highly anticipated Jake Paul vs. Mike Tyson duel in July, which would make Netflix’s third live sport streaming event in its history. The upcoming event highlights Netflix’s ongoing efforts in homing in on its foray in live sports streaming. Historically, major sporting events have been a key driver of ad revenue in traditional linear TV. For instance, the 2024 Super Bowl alone generated approximately $485 million in ad revenue. The upcoming Summer Olympics is also expected to generate as much as $1 billion in incremental ad revenue this year.

And this momentum is gradually making a transition to streaming platforms. Comcast (CMCSA) disclosed $1.2 billion on Summer Olympic ad placement sales earlier this month, with its digital formats being a key beneficiary of the event. This accordingly highlights the value of Netflix’s ad inventory, especially with its deeper push into live sporting events over time.

Increasing Ad Load

As discussed in the earlier section, Netflix’s latest results continue to showcase how its advertising business remains in early ramp-up. While recent industry data shows that Netflix’s ad placements are showing improvements to about four minutes of ads per hour, there is still work to be done to ramp this number up to the initially intended five minutes per hour.

We believe upcoming cyclical tailwinds this year, alongside broader secular strength in digital advertising – particularly for AVOD formats – will be favorable to Netflix’s efforts on this front. Specifically, demand for ad placements on AVOD platforms is expected to grow 13% y/y and exceed $10 billion in 2024. And Netflix remains well-positioned for further capture of related growth opportunities, given its newly introduced ad-supported tier’s expansive and still growing reach.

To date, Netflix garners subscriptions from more than 270 million households across over 190 countries, reaching over “half a billion people” in viewership. However, the company still accounts for less than 10% TV share time in each country its platform is available in, highlighting significant headroom for growing its reach. And with additional consideration that the ad-supported tier is accounting for an increasing mix of new sign-ups, we believe Netflix remains well-positioned to maintain its leading reach required by advertisers.

Meanwhile, cyclical events and the ensuing incremental ad spending this year also highlight how Netflix’s deeper push into live sporting could help improve its ad inventory and placements over time to improve ARM. Given the combination of cyclical and seasonality tailwinds in digital advertising heading into 2H24, we expect improvements pertaining to Netflix’s ad placements to be weighted towards the back half of the year.

Given Netflix’s commitment to innovation, we think there are still opportunities for the company to revolutionize its AVOD ad format and further improve its ad load in the long-run. For instance, the company attributes little leverage to AI technology in helping advertisers streamline their campaign creation to deployment process.

Currently, buying ads on Netflix – and many other streaming platforms – require a process similar to traditional linear TV placements. Advertisers need to fill out a request form through Microsoft (MSFT) – Netflix’s ad technology partner – and wait to hear back from a sales representative to directly buy ad space. Alternatively, businesses can partner with a marketing / advertising agency to have their ads for Netflix set up. This makes the process less accessible compared to rivaling high-growth digital walled gardens such as Google Search (GOOG / GOOGL) and YouTube, which already rely on AI-enabled tools for its advertisers (e.g., Performance Max). While Netflix’s current process is similar and likely more familiar to navigate for legacy linear TV advertisers making their transition to streaming, it has yet to address growing demands for ad spend optimization.

Specifically, 70% of ad content creation will be overtaken by AI-enabled computer generation over the longer term. And given Netflix’s pioneering role in long-form video streaming, and more recently, paid sharing, we believe it will be inevitable for the platform to lead the change in how ads are created and deployed on AVOD formats. For advertisers, this will be an opportunity to enable better returns on ad spending (“ROAS”) by optimizing time and costs in the campaigning process. And for Netflix, increased automation and self-service for the advertising process would also improve its advertising margins by reducing sales costs attributable to manual labor requirements.

Increasing CPM

Another way to improve ad sales accretion for Netflix in the near term is to drive up CPM. Although Netflix has dialed down its CPM to about the low-to-mid $40 range – which is still a premium to the average industry rate – pricing remains below its initial ask of more than $60. Industry checks currently estimate Netflix’s CPM is likely to rise through 2024.

The anticipated rise in CPM is consistent with our foregoing discussion that Netflix will be generating greater value to advertisers as ad tier subscribers continue to grow and inventory increase. This would be key to driving reach, engagement and conversion, which are critical considerations for advertisers – especially given Netflix’s premium pricing charged compared to its peers.

However, we believe that the ad sales growth driven by CPM improvements will not become as accretive until 2025. This is due to expectations for ongoing early ramp-up challenges, such as ongoing adjustments to back-end technology supporting Netflix’s advertising operations to ensure targeting and performance measurement metrics are effective. But Netflix remains well-positioned for building price leadership, given its robust cash flows to support value-adding features critical to advertisers. These include investments in original and licensed content to bolster subscription and reach, and investments into tools critical to addressing ROAS optimization for advertisers.

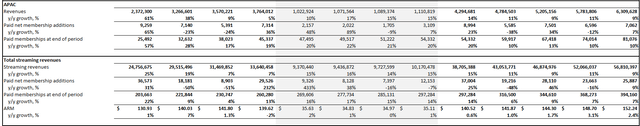

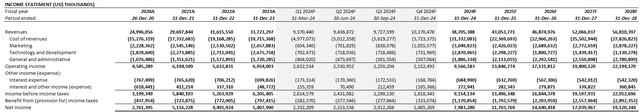

Fundamental Considerations

Taken together with consideration of Netflix’s actual Q1 performance and management’s Q2 and full-year revenue guidance, we expect the company to grow its revenue by 15% in the current year to $38.7 billion. We believe incremental growth driven by paid sharing contributions will continue to taper off, with value accretion from the advertising business to pick up exiting 2024.

This is consistent with our expectations that Netflix will continue to attract a greater volume of ad-tier subscribers, which will inadvertently reinforce ad demand due to its extensive reach. Improving CPM and ad placements will also improve ARM over the longer-term and become increasingly margin accretive for Netflix.

Price Considerations

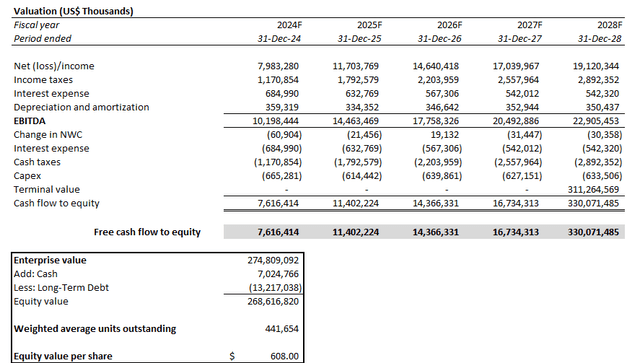

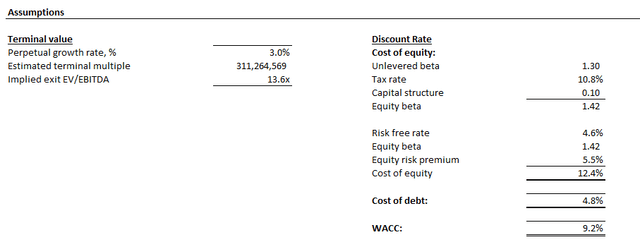

Based on the foregoing fundamental analysis, we are setting a base case price of $608 for Netflix.

The base case price target is computed based on the discounted cash flow approach. The analysis considers Netflix’s cash flow projections over a five-year discrete period taken with the base case fundamental forecast discussed in the earlier section. We have applied a WACC of 9.2%, which is reflective of Netflix’s risk profile and capital structure, to the analysis. A perpetual growth rate of 3% is also applied on 2028E EBITDA, which is in line with Netflix’s continued focus on margin expansion and free cash flow growth as it continues to prioritize scaling its ad strategy.

Conclusion

Coming out of Netflix’s robust Q1 results, we remain confident in its growth and earnings outlook, especially given additive opportunities from its emerging advertising operations. However, we believe upside potential attributable to its current roadmap – particularly pertaining to ad sales accretion – has been priced in.

This is consistent with Netflix’s valuation on a relative basis to its megacap peers at current levels. Specifically, Netflix is currently trading at about 36x 2024 earnings, which is slightly above the Magnificent 7 average of about 34x despite exhibiting a similar earnings growth profile.

Paired with the upcoming disclosure changes, which reduces transparency over Netflix’s progress in ramping its newly introduced ad strategy to scale, we believe Netflix, Inc. stock could become exposed to increased volatility. We also believe Netflix would need additional accretive catalysts to unlock further upward valuation re-rate to the stock from current levels. This includes materialization of new margin drivers, such as increased automation to the ad sales process, which we expect Netflix to potentially pioneer in the longer-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!