Summary:

- Beyond Meat’s Q1 report showed ongoing troubles, with a decline in revenues and gross margins, and sizable cash burn.

- The company’s balance sheet continued to weaken, with a decrease in working capital and $1.15 billion in convertible notes due in 2027.

- Analysts have lowered their price targets for the stock, and the valuation here is difficult to justify compared to other players in the industry.

JHVEPhoto

After the bell on Wednesday, we received first quarter results from Beyond Meat (NASDAQ:BYND). The plant-based meat company has been one of the market’s biggest losers in recent years, as growth expectations have not materialized and large losses have resulted in significant cash burn. The Q1 report was not the worst we’ve seen from the name in recent periods, but it showed that the name’s troubles still continue to grow.

Looking back at my bearishness:

I last covered the name back in August 2023, right after the company had issued its latest major revenue warning. Despite significantly reduced analyst estimates over time, management found a way to still disappoint, cutting both its sales and margin guidance for the year. Since then, shares have tanked almost 37% (not counting Wednesday’s post-earnings reaction), compared to a more than 15% rise for the S&P 500.

The theme of not growing as fast as previously hoped has continued into this year. When I wrote that article, analysts were looking for over $427 million in revenues during 2024. Going into this week’s Q1 report, that number had come down by almost $100 million. Since then, the balance sheet has weakened further, and I have continued to worry about the $1.15 billion in convertible notes that are due in less than three years.

Q1 2024 results:

For the first quarter, revenues came in at $75.6 million. This number just missed street estimates, but it also was an 18% drop over the prior year period. The decrease in revenues was primarily driven by a more than 16% decrease in the volume of products sold and a 2.3% decrease in net revenue per pound. These results were actually helped a little by favorable changes in foreign currency rates.

The major problem over the years has been the company’s cost structure. In Q1, gross margins were less than 5%, and that number was down almost two percentage points over Q1 2023 levels. While management has been able to trim some operating expenses over the past year, it is still running at an adjusted quarterly operating loss of $46 million.

When it came to guidance, management reiterated its yearly sales forecast. Revenues are expected to be in the range of $315 million to $345 million, which is quite a wide range being more than third through the year already, but the midpoint was basically in-line with the street’s average estimate for $329.54 million. However, Q2 revenues are expected to be in the range of $85 million to $90 million, which was well below the more than $98.3 million the street was looking for. This puts a lot of pressure on the company in the back half of the year to meet its full-year forecast.

The weakening balance sheet:

With large ongoing losses, Beyond Meat has continued to burn through a lot of cash. In the first quarter, cash burn was over $33 million, and that’s despite a benefit of more than $10 million from a decrease in inventories and a rise in accrued expenses and other liabilities. The company has slashed its inventory balance by almost 57% in the past two years, providing quite a bit of cash, but that’s not a tailwind that can continue forever.

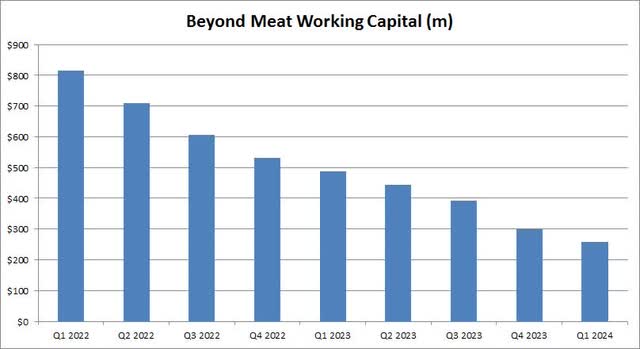

As the chart below shows, overall working capital continues to come down quarter after quarter. The end of Q1 figure was just $257 million, which was almost halved in the past twelve months. With losses likely continuing for several more quarters, this number could easily worsen. Management did file a mixed shelf offering in recent months to potentially raise $250 million, but this can’t solve the big problem.

Beyond Meat Working Capital (Company Earnings Reports)

In March 2027, the company’s convertible notes come due, with a principal balance of $1.15 billion. Since the initial conversion price was $206 per share, it appears highly unlikely that this borrowing can be swapped for equity. The stock went into the Q1 report trading with a market cap of just over $532 million, before shares declined by double digits (percent). Meaning, Beyond Meat would have to dilute investors multiple times over to pay this debt back. The chances of bankruptcy appear to be increasing by the quarter unless management can somehow find a major capital infusion or get this company acquired.

Hard to make the valuation argument here:

As of Wednesday close, Beyond Meat shares were trading for a little more than 1.6 times their expected sales for this calendar year. If we look at some other larger players, Tyson Foods (TSN) went for just 0.40 times its expected revenues for its September 2024 fiscal year, while Hormel Foods (HRL) went for 1.57 times its October 2024 fiscal year expected revenues. It’s hard to argue investors should pay up for Beyond Meat, when you can invest in more stable companies elsewhere in this space.

As for the street, analysts saw this name as worth $6.50 going into earnings. That number represented considerable downside from the day’s close, and analysts had cut their average by about 50% over the past year. The street average peaked almost five years ago at around $165, just a little while after shares had surged past $230 a share, but it has been all downhill ever since.

Final thoughts / recommendation:

Beyond Meat reported another lackluster quarter on Wednesday afternoon. Revenues dropped over the year ago period, slightly missing street estimates, while the company reported another large loss and more cash burn. While management reiterated its yearly revenue forecast, Q2 guidance was very disappointing, increasing execution risk for the back half of the year. The balance sheet continues to weaken here, and we are now less than three years from a mountain of debt coming due.

Until this company can finally start to show some decent revenue growth and a chance of surviving, I will continue to rate shares as a sell. Losses and cash burn did improve over the prior year period, but not even progress is being made currently. Even if the company raises a full $250 million from the mixed shelf, it still needs roughly double its current market cap on top of that to pay back those 2027 notes. Given that the stock went into this report trading well above the average prices to sales valuation of two major peers in this space, the 12% after-hours fall isn’t surprising and a new low this year is not out of the question.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.