Summary:

- Bitfarms’ stock has appreciated significantly since November 20, coinciding with the election of the new President of Argentina.

- The Bitcoin miner has launched mining operations in the country where Bitcoin is viewed as a hedge against inflation, also benefiting from lower electricity costs there.

- The company’s cost of operations is expected to decrease, making it more competitive in the mining industry.

- At the same time, the value of Bitcoin has appreciated by more than 50%.

- Therefore, it deserves better valuations, by 15%, but investors are also made aware of the volatility risks associated with this asset class.

Aleksandra Zhilenkova

The last time I covered Bitfarms (NASDAQ:BITF) on September 4, I had a hold position on the stock because of gloomy mining economics or relatively higher production costs, while Bitcoin’s (BTC-USD) market price slid below the $30K support level.

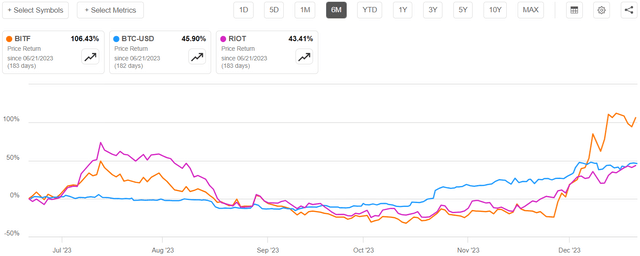

The stock has appreciated by more than 100% since as shown in the orange chart below, with the bulk of the upside occurring since November 20, which coincided with the election of Javier Milei as the President of Argentina.

Comparing Price Returns (seekingalpha.com)

Now, in addition to explaining the relationship between Bitfarms’ upside and the election, this thesis aims to make a bullish case, this time through improving mining economics which should put the miner on par with the most efficient ones in the industry and is also favorable given the impending halving event, synonymous with a substantial reduction in the amount obtained for minting digital coins.

Bitfarms’ Argentinian Operations

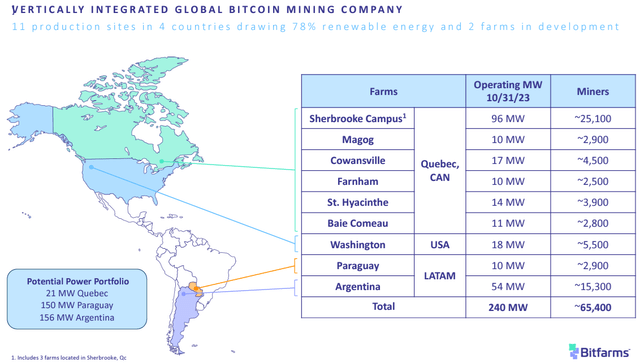

First, coming back to the above chart, I also included Bitcoin and another miner in the form of RIOT Platforms (RIOT) to show that the reason for Bitfarms’ stock better appreciation was due to more than just enthusiasm for crypto. The reason was the launch of mining operations in Argentina more specifically in Rio Cuarto where it powered up its first crypto warehouse in September. As of October 31, it had approximately 15.3K mining rigs consuming 54 MW in that site which is second only to the Sherbrooke Campus in Quebec, Canada as shown below.

Q3-2023 Earnings Call Presentation (seekingalpha.com)

Now, the new President is viewed as being Bitcoin-friendly as he spoke positively about the cryptocurrency before the elections, and this could be because one of the objectives behind the creation of the cryptocurrency was to act as a hedge against inflation. In this case, unlike fiat currencies which can be printed at will by the Central banks of their respective countries, Bitcoin is limited in supply as only a total of 21 million can be mined which means that its value should increase over time. Moreover, we are currently at the 19 million level signifying that less than 10% can be mined.

From this perspective, the President’s enthusiasm for Bitcoin is understandable given the country’s currency the Argentine Peso is highly depreciated relative to the U.S. dollar. Also, its Central bank’s printing notes have fueled runaway inflation severely impacting the purchasing power of the people.

Now, Bitfarms had been holding some of its investment in that country while awaiting the outcomes of the elections as a leader averse to Bitcoin could have put in jeopardy the lower cost of electricity it benefits in that country, which would have been detrimental to mining economics, or the need to keep production costs as low as possible.

Improving Mining Economics

In this context, Bitcoin is based on the “proof of work” system where thousands of mining rigs (or computing devices), solve mathematical problems that allow a new transaction or block to be added to the blockchain. This involves intense competition as there are also other miners trying to be the first to complete transactions. Furthermore, after adding a new block, miners are rewarded in Bitcoins, but the problem is that this reward is halved every four years according to the halving principle, defined from the start in the Bitcoin white paper. To date, this reward is 6.25 BTCs per validated block, compared to 3.125 BTCs at the next halving which will take place in the coming April.

Therefore, given that mining equipment is energy-intensive, this means that miners have to become more efficient, as, in addition to the problem of increasing mining difficulty due to the competition intensifying, halving will reduce rewards by 50%. Before that, there were halving events in 2012, 2016, and 2020, and up to now, miners have been able to adapt by making up for the revenue shortfalls by both upgrading their mining rigs with more power-efficient ones and looking for cheaper electricity sources.

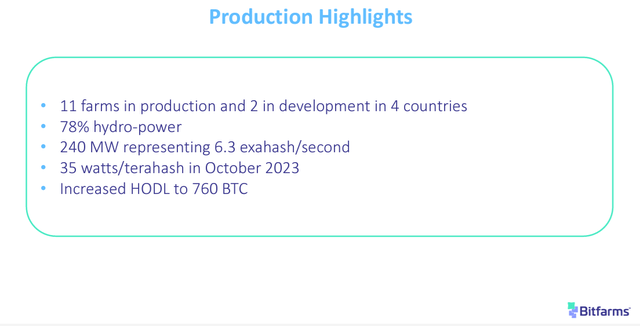

Thus, Bitfarms installed approximately 2,900 new Antminer S19j Pro+ in one of its Quebec sites to replace the older generation equipment during the third quarter of fiscal 2023 (Q3) and is focusing on low-cost hydropower in Canada and Latin America to more efficiently expand its operating capacity.

static.seekingalpha.com/uploads/sa_presentations/615/97615/original.pdf

Talking mining economics, Bitfarms’ cost per BTC was $22,700 in Q3 which included G&A (General and Administrative) expenses. Looking across the industry, this is about the same as for HIVE Digital Technologies (HIVE) whose average cost of production per Bitcoin was $22,639 for the same period but, noteworthily, excluding SG&A. However, Bitfarms’ costs are much higher than RIOT whose year-to-date average cost to mine was $5,537 per Bitcoin for the quarter ending on September 30 (Q3).

Diving deeper, RIOT had a higher production capacity at the end of Q3, reaching a production capacity or hash rate of 10.9 EH/s compared to only 6.1 EH/s for Bitfarms. Moreover, the larger miner’s flexible energy contracts enable it to take advantage of highly discounted prices during periods of low demand. It can then scale back during periods of high demand thereby saving on costs. This flexibility has positioned it as the miner with the lowest cost of production as it paid only 2.8 cents per kWh according to an August report which is about 2.5 times less than for other industrial use cases.

However, Bitfarms is catching up with its Rio Cuarto farm in Argentina benefiting from around $0.03 (or 3 cents) per kWh during the month of summer which started in October and would end in April 2024, coinciding with the halving event. Tellingly, this is Bitfarms’ lowest-cost facility and makes for about 23% of the miner’s total operating capacity.

Valuing Bitfarms

Looking at historical performance, it has been able to reduce operating loss significantly from above $150 million in 2022 to $15 million-$25 million. Now, based on kWh pricing, it could also benefit from about the same average cost to mine a Bitcoin as RIOT or roughly $5.5K, which is about four times less than the $22.7 it currently incurs. Even if this price is effective for 23% of its production, or the portion that originates from Argentina, this could accelerate break-even status. This implies that Bitfarms can become profitable earlier than the third quarter of 2024 as expected by analysts as shown below.

Earnings estimates per quarter (seekingalpha.com)

Looking further, Bitfarms could also achieve profitability status faster through improved revenues, namely by harvesting more money for the same quantity of crypto produced, made possible by the higher market price of Bitcoin. As such, quarterly revenues have varied between $30 million to $35 million this year depending mainly on the quantity of Bitcoins sold and its unit price.

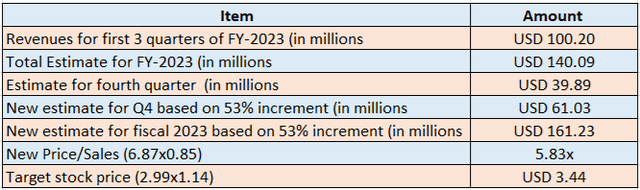

Now, since the value of one BTC has appreciated from less than $28K in the third quarter to more than $43K currently, this means that revenues can potentially increase by at least 53% (43/28) for the fourth quarter (Q4 which lasts from October to December) from $39.89 million to $63.03 million as calculated in the table below. As a result, total revenues of $140.09 million for FY-2023 could be incremented to $161 million which translates to a lower forward P/S of 5.83x. This ultimately means a target of $3.44 based on the current share price of $2.99.

The table was built using data from (www.seekingalpha.com)

Therefore, with its Argentinian operations, Bitfarms appears in a better position to face up to next year’s halving event which is expected to increase Bitcoin’s production cost to about $40K for miners who do not have access to low-cost electricity. Thinking aloud, some will not be able to survive halving if the price of Bitcoin is not sustained at current levels. This means that fewer blocks will be added to the blockchain, which may ultimately reduce the supply of the cryptocurrency, thereby increasing its price.

A Buy but Risk Awareness Remains Key

However, in addition to a possible reduction in supply, higher crypto prices have also been driven by two factors. The first is the Federal Reserve turning more dovish as to monetary policy with three successive pauses or neutral instances, and more in the market pricing rate cuts for next year. This has boosted the value of tech and crypto stocks. Second, there is a higher expectation of a Bitcoin spot ETF to be approved as early as next year after applications have been filed by some of Wall Street giant issuers including BlackRock (BLK). There is also the fact that crypto asset manager Grayscale Investments has emerged victorious in its court appeal against the SEC (Security Exchange Commission) for launching a similar ETF.

Conversely, any signs of rates staying higher for longer or the SEC delaying the approval of a spot ETF may result in abrupt market volatility for cryptos, possibly in January according to a recent update by the SEC’s Chairman as his team of regulators scan through applications. Therefore, in case you have missed the upside, you may want to stay on the sidelines and wait for a better margin of safety. This said, $3.44, is a fair target given that the market appears to already have priced most of the Argentinian opportunity.

Finally, with $46.8 million in cash in its balance sheet and 703 BTCs worth around $33 million (based on a $43K per unit price) in its treasury as of September 30, 2023, the company can easily pay its debt of $26.3 million. It also raised $31 million through an equity offering during Q3. Thus, it can further invest in production capacity in Argentina where Bitfarms benefits from one of the cheapest electricity rates in Latin America to drastically reduce the cost of operations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.