Summary:

- Bitfarms is the most efficient Bitcoin miner, which should lead to a premium in its share price.

- The company is expanding its mining capacity and securing low-cost electricity supply agreements, enhancing its efficiency.

- Despite the departure of its CEO, Bitfarms remains a strong investment opportunity with a target price of $7.

quantic69

This will be my third article on Bitfarms (NASDAQ:BITF); the first, published in May 2023, discussed Bitfarms’ strategy of placing its farms worldwide and its attempts to improve its balance sheet. I set a target of a 100% increase in share price, which was hit in September 2023. The second article, published in October 2023, considered the efficiency of Bitfarms mining operations, noting that it appeared to be the most efficient of all the miners. When the second article was published, the shares were valued at $1, and I set a price target of $3.50. That target was hit in December. The two trades made Bitfarms my most profitable company of 2023.

Bitfarms shares are now back below $2, and I am ready to buy again with a target of $7.

Bitcoin Mining

Bitcoin mining has business similarities with gold and oil mining. A miner cannot develop brand loyalty with its customers; no one will pay a premium for a bitcoin mined by Bitfarms over one mined by Riot Platforms (RIOT) or any other miner. Miners cannot increase their prices; they can only improve their costs. Consequently, the efficiency of operations will be an area of competitive advantage.

I believe that Bitfarms is the world’s most efficient miner and, as a result, will eventually be the world’s most profitable miner; it should command a share price premium over its peers. That premium is likely to appear as the market continues to mature.

Mining Efficiency and Value for Money

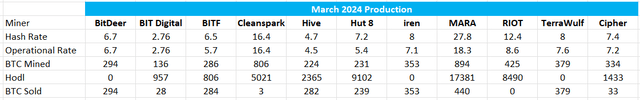

Every month, the miners release a production update; below are the figures from the March 2024 update of most of the miners I track. (I have excluded those with a market cap of less than $100 million and those not traded on a US exchange.)

Operational Updates March (Author)

If you would like to look at the performance updates for this and previous months, I have provided the relevant links in this table.

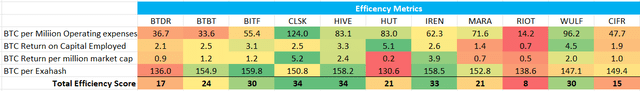

To compare the different miners’ efficiency, I first examined how many Bitcoins each miner produced in the first quarter of 2024 relative to its total operating expenses, Capital Employed, Market Cap, and Exahash.

In the following table, I have combined the operational updates for January, February, and March 2024 with each company’s latest quarterly financial results filed at the SEC. They are not exact date matches in all cases, but it is the latest data we have.

Efficiency Measure (Author)

I calculated the Total Efficiency Score by awarding 11 points when a miner was top-rated, 10 when second, 9 when third, etc, and then totalling the scores. This score suggests that five miners are significantly more efficient than the rest: Bitfarms, CleanSpark (CLSK), HIVE Blockchain Technologies (HIVE), Iris Energy (IREN), and TeraWulf (WULF).

A key efficiency measure is the BTC per Exahash, which I discussed in my second article. It shows how many Bitcoins a miner can get from each mining machine. It reflects the proprietary software they each use and the ability of their respective technical teams to keep the miners running at optimal performance. Bitfarms is the clear leader on this metric for Q1 2024 as it was for 2023 (see article 2).

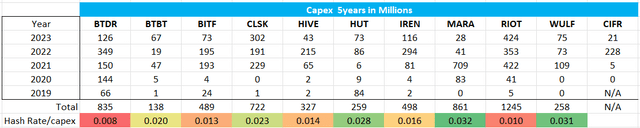

You cannot look at production efficiency without considering how much money has been spent to attain this figure. As a proxy for investment, I used the last five years of Market Cap. This is not the perfect figure, as companies will have been spending Capex on building non-mining facilities, and those moving into data centers and other areas will likely be penalized by this measure.

Capex Figures (Author Database)

Hash Rate/capex tells us how much hash rate has been developed per million dollars of capex spent, and as a result, low figures are best. Of the five miners identified as efficient, Bitfarms has spent less per exahash. Hive is next, followed by IREN, CLSK, and WULF. WULF is the second worst performer in this measure, just ahead of MARA.

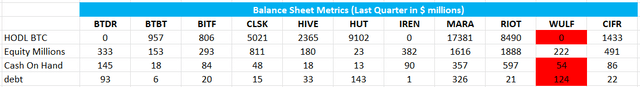

Next, I looked at the balance sheets; I am choosing a miner to invest in and want one with a solid balance sheet.

Balance Sheet Line Items (Author Database)

Of the five companies that seemed efficient on my first metric, one failed this test. WULF has a high debt load; indeed, its debt is more than twice its cash balance, and it has zero Bitcoins in its reserve.

That leaves four companies to investigate further: BITF, CLSK, HIVE, and IREN.

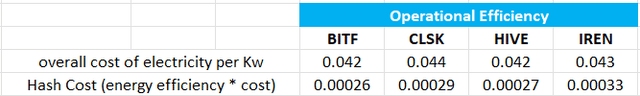

My final measure is hash cost, I define hash cost as the cost of electricity per kWh multiplied by mining efficiency (1/BTC per Exahash in the earlier table)

Hash Cost (Author)

The overall cost of electricity comes from the latest quarterly earnings call; the actual cost of electricity is very close in all cases, as might be expected.

Bitfarms has the lowest hash cost, a feature of its electricity cost, and the most efficient mining operation per exahash.

In my second article, I predicted that Bitfarms would become the lowest-cost producer soon, and these calculations suggest that Bitfarms is exactly that.

Bitfarms The Future

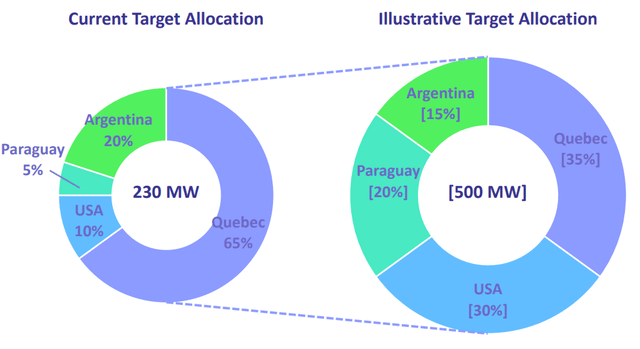

The first article I wrote on Bitfarms discussed their plan to place mining facilities in North and South America to take advantage of low-cost energy and friendly geo-political environments.

This strategy continues at pace. In late 2023, Bitfarms announced its plan to increase capacity from 6.5 Th/s to 21. Recent news releases suggest this trebling in capacity will be complete by the end of 2024, making Bitfarms one of the largest miners in the world. On the 24th of January 2024, they announced they had purchased land in Paraguay near the third-largest hydropower dam in the world. On the 11th of March, they announced the purchase of 51,908 new mining rigs that will take the EH/s to the targeted 21; all the rigs are due for delivery this year.

This massive 223% growth has come at a cost to shareholders: in November 2023, a private placement with an institutional investor for CAD$60 million (CAD$1.35 for 1 share and half a warrant; the market price at the time was below this figure) was announced, and an ATM for $375 was announced in March this year. Dilution is often the cost of growth.

The focus on electricity cost reduction has continued; in November, the Rio Cuarto site in Argentina negotiated its electricity price down to 2.1 cents from 3.2 cents per kWh, a 34% reduction. That made the electricity cost of a Bitcoin $7,700 in Argentina. (analyst day presentation)

As Bitfarms grows, its geographical spread of operations changes as it allocates growth to lower-cost areas. Paraguay and the US are seeing growth at the expense of the Canadian operation. The Canadian operation was hit by a VAT charge of 15% on electricity; Bitfarms appealed this (CFO earnings call); without the tax, the electricity cost would have been $0.037, but it is now $0.43, above the average. The VAT led to an electricity cost of $16,200 per bitcoin in Canada.

Change in Geographical Spread (Bitfarms)

Source Analyst Day presentation Sept 2023 slide 11

In the Q4 2023 earnings call, the CEO said that the new Paraguay facility will have an electricity cost of 3.9 cents per kWh, significantly below the 4.2 cents average. It is a fixed-cost deal and not subject to any inflation or other increases (despite the Paraguayan inflation rate being over 3%), nor is it subject to power curtailment requirements, which is almost unheard of and will lead to 100% uptime on renewable energy. Paraguay has low labor costs and construction prices, further enhancing efficiency.

Finances

As previously guided, Bitfarms paid its remaining debt in February and now has a flawless balance sheet. They have around $84 million in cash and over $30 million in Bitcoins with zero debt; during Q4 2023, they raised $42 million from selling Bitcoins and added 101 coins to the treasury. An operating loss of $13 million was reported, including a $22 million depreciation charge, and a Net Loss of $57 million, including net financial expenses of $45 million, mainly relating to re-evaluating warrant liabilities. (Q4 earnings)

Bitfarms follow IFRS rules, meaning they do not use the unrealized gains and losses on their Bitcoin holdings in their income statement or EBITDA calculations. Bitfarms remains the only miner using a top 4 accountancy firm, and their EBITDA is a measure of cash profitability for Bitcoins mined in the quarter. In Q4 2023, profit was $11,200 on each of the 1,236 Bitcoins mined.

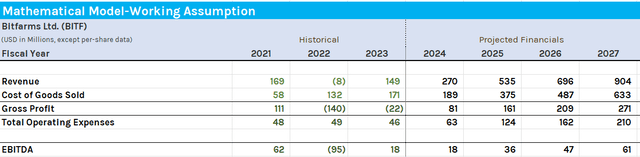

Forecasting the future financial performance of Miners is very difficult; the fluctuating value of Bitcoin adds an inevitable degree of uncertainty. However, bearing in mind everything I have reported so far in terms of hash rate growth and the guidance given by the CFO in the latest earnings call, plus the previous performance of miners following a halving event, my current working assumption is: (I usually call this a mathematical model but for a miner the future is just too uncertain).

Key Line Item Forecast (Author Model)

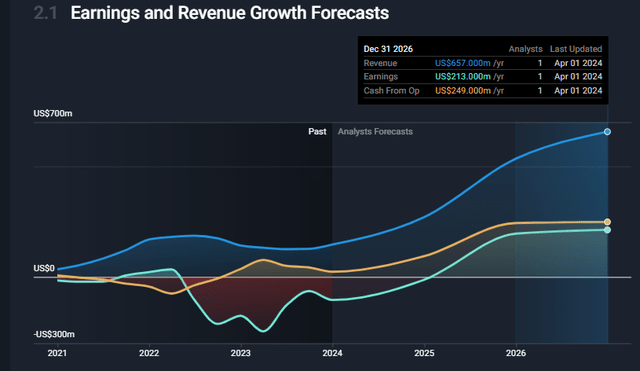

Comparing my forecasts with those of Wall Street analysts shows a high degree of revenue agreement. I have 2026 at $696 million, and Wall Street has $657 million, a difference of only 6%; however, we differ significantly in earnings and cash generation. Wall Street has cash generation from operations at $249 million in 2026.

Wall Street Forecast (Simplywall.st)

I wonder if Bitfarms will ever seek to deliver positive cash flow. I think it is likely that they will only sell the Bitcoins they need to cover costs and continue to HODL as many as possible, assuming that they will continue to grow in value over the longer term. As a result, my model has much lower earnings and cash flow figures, making any discounted cash flow model of little value. It may be in the future, they begin to sell bitcoins in the treasury to pay a dividend.

I have some sympathy for this strategy, as the economics of Bitcoin has changed in the last couple of years. After China banned miners, the playing field for miners became level; the Bitcoin ETF funds require 2,800 Bitcoins a day, and before the halving, only 900 were produced. This mismatch of demand and supply will drive prices higher over the longer term, and will likely intensify as the number of new bitcoins produced after the halving is much lower. It makes a new Bitcoin bubble quite likely as surging prices draw in more investors, fuelling the fire.

A significant fall in the price of Bitcoin is always a possibility; however, prices have made a new high, confirming the upward trend of higher highs and higher lows. Investors in Bitcoin and its ecosystem are getting used to this volatility. I used to see it as an added risk factor, but the longer the asset keeps an upward trend in place and the more established it becomes, the less the volatility concerns me.

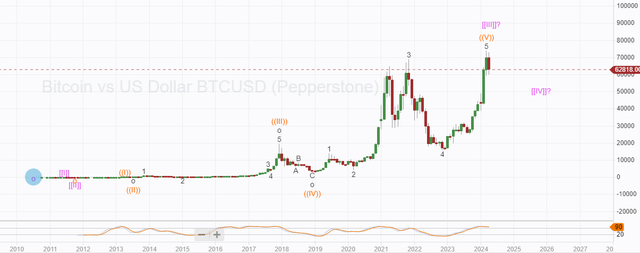

BTC-USD price Chart (Author)

The chart is a monthly one showing my EW theory prediction for Bitcoin. It looks oversold, and a short-term top may be in place, perhaps leading to a pullback to around $50K. After that, a wave V move higher could take Bitcoin prices towards or even past one million dollars.

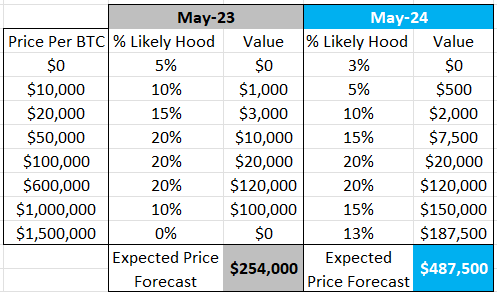

In my second article, I presented a price target of $254,000 by 2030. The target was based on applying a percentage likelihood of each Ark investment forecast (from the Big Ideas 2023 document) playing out. As time progresses, the Bitcoin market becomes increasingly mature; we now recognize ETF products, have demand greater than supply, and what is proving to be a secure ledger to maintain the fidelity of Bitcoin. As a result, I am changing the percentages likelihood and adding a 13% probability of Bitcoin reaching $1.5 million in the medium to long term.

Updated BTC forecast (Author)

$1.5 million is the current forecast from my EW chart, I have reduced the chance of a decline toward zero, but it is still a material possibility. My new Bitcoin forecast is $487,500, 92% higher than it was this time last year.

Combining this new forecast for Bitcoin, the proven excellence of Bitfarms operations, its continued best-of-class efficiency, and the plan to treble its hash rate by the end of 2024 leads me to increase my Bitfarms target from $3.50 to $7 and confirm my Strong Buy recommendation.

Risks

Apart from the obvious ones of investing in the highly volatile Bitcoin ecosystem, there is one additional threat I am concerned about.

On the 25th of March, Bitfarms announced that the CEO, Geoff Morphy, would be leaving the company. This is a significant loss; Mr Morphy has been the driving force behind everything I like about Bitfarms. He led the international expansion, the modernization of management and operations, and delivered the mining efficiencies that distinguish Bitfarms from the rest. It will be a huge loss; the company has begun a CEO search, and Mr Morphy will stay on until that is complete.

I will watch future news releases and press conferences very closely for signs of the new CEO bringing a new strategy. I suspect I will close any trades if they talk about expanding into other areas (data centres, AI and the like). It is the corporate strategy that I like, with a focus on efficiency and cost reduction and a concentration on making the company the best Bitcoin miner in the world. Mr Morphy spread operations worldwide and seemed an excellent negotiator who could deliver outstanding energy supply deals. Deviation from the current focused path is not something I want to see.

Mr Morphy has done an outstanding job and has had a material impact on my personal finances through my trading on BITF. He is a winner, and I like investing in winners. I will follow him and hope he joins another company where he can have a similar impact.

I will follow this story with further articles on Bitfarms when the new CEO is in place and will likely begin coverage on any company Mr Morphy joins.

Conclusion

Bitfarms seems to be the most efficient miner of those I follow. In the long term, this should enable the company’s share price to trade at a premium to its peers.

The company has planned and is executing a significant expansion in 2024, trebling its hash rate. It has signed further low-cost electricity supply agreements, including a fixed-fee deal. Bitfarms is pivoting its capacity towards areas with lower costs, further enhancing its industry-leading efficiency.

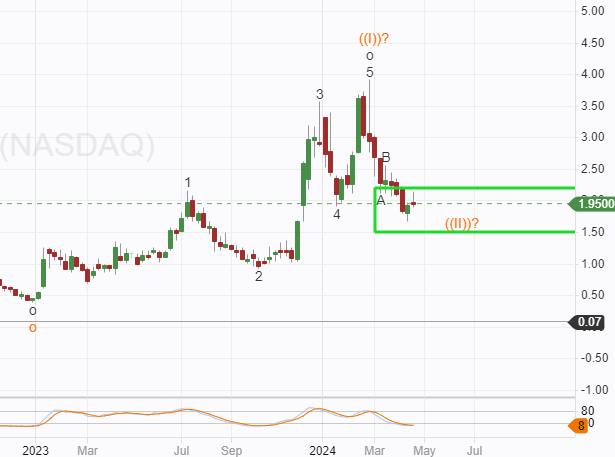

Bitfarms stock price has pulled back from a recent high and is an area where a turn higher might be expected. The stock appears to be oversold, adding to the sense that this could be a good point to buy; however, this forecast contradicts the Bitcoin chart presented earlier, so some short-term move lower would not be completely unexpected.

BITF Weekly Price Chart (Author)

I will watch the price action in the coming days and intend to buy with a price target of $7. My confidence in this particular story is higher than in the past, so my next trade will be more of a medium-term one rather than the two shorter-term trades of 2023. I expect to hold Bitfarms for the next 2-5 years and will update in the comments section when I take the trade and how it progresses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BITF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.