Summary:

- Positive Q1 results suggesting free cash flow is finally positive.

- CEO exit and takeover attempt by rival Riot create uncertainty in leadership and future direction.

- Given the recent halving of BTC in April, we’ll also want to see what that suggests for financial results going forward.

Inside Creative House

When I last covered Bitfarms (NASDAQ:BITF), I noted that it had a lot going for it among Bitcoin (BTC-USD) miners but that it needed positive free cash flow. Q1 results also turned out very good, but with the exodus of its CEO Geoff Murphy, takeover attempts by its rival, and weakened production after the halving, there’s a lot going on, too much for me to feel good about buying, and so I’ve maintained my Hold rating.

Recap

During my last thesis, I highlighted it had a lot going for it:

- Positive operating cash flows (unlike other miners)

- Low-cost electrical expenses

- No debt

- Declining share dilution

- Tailwinds from election of Milei in Argentina

I also noted some downsides:

- Negative free cash flow

- The hash rate arms race over time

- Potential for unfavorable BTC prices post halving

I ultimately waited for the situation to develop more, and it has! Let’s start by looking at Q1 results.

Q1 Results

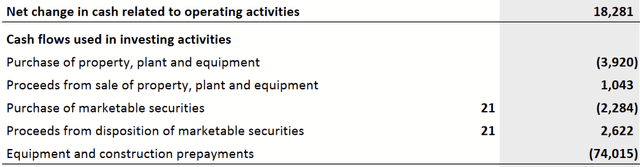

So Q1 2024 had a great milestone. They finally had a period of positive free cash flow.

Cash Flow Statement (Q1 2024 Financial Report)

Kind of. Looking there, we see that operating cash flows were $18.2M, on top of $3.9M of capex. That would normally be considered free cash flow, but an interesting item appears down there, with $74M also spent on “equipment and construction prepayments. Their quarterly report (pg. 24) explains it:

During the fourth quarter of 2023, the Company placed a firm purchase order for 35,888 Bitmain T21 Miners (the ”Purchase Order”) totaling $95,462 with deliveries scheduled from March 2024 to May 2024 and made a non-refundable deposit of $9,464. In addition, the Company secured a purchase option for an additional 28,000 Bitmain T21 Miners (the ”Purchase Option”) totaling $74,480 and made a non-refundable deposit of $7,448. This Purchase Option gives the Company the right, exercisable until December 31, 2024, but not the obligation, to purchase, up to 28,000 additional Bitmain T21 Miners.

Back in Q4 2023, that had already broken ground by buy the first ever BTC miner call option. With 2023’s capex total $73.7M, it looks like they used the option to go ahead and lock in a price for 2024’s payments? Why?

During the earnings call, management explained this a bit. Chief Mining Officer Ben Gagnon said:

We analyzed over six years of purchase history for every miner…What we found is that the most important factor for determining a good miner investment is timing, as timing ultimately determined costs…in November 2023 with Bitcoin around $37,000 and the halving just months away…We secured some of the lowest prices seen in years and negotiated a miner option, an industry first. We moved quickly and launched our fleet upgrade plan, and in March followed up with even more miner purchases, purchasing nearly an additional 24,000 of the best-performing machines on the market with competitive pricing.

It seems that management really believes it can control its miner costs with these moves, thereby keeping capex down in the long term. It will ultimately depend on if they get to exercise these miner calls at favorable prices, but it does seem like the company is making headway to free cash flow, with its high OCF and strategy for capex.

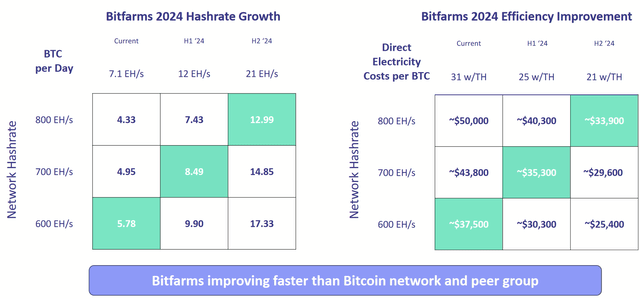

Operationally, Q1 showed the company make great strides in its hash rate growth, doing so at a faster rate than the whole market. As I mentioned last time, this is key in being able to mine BTC at a faster rate.

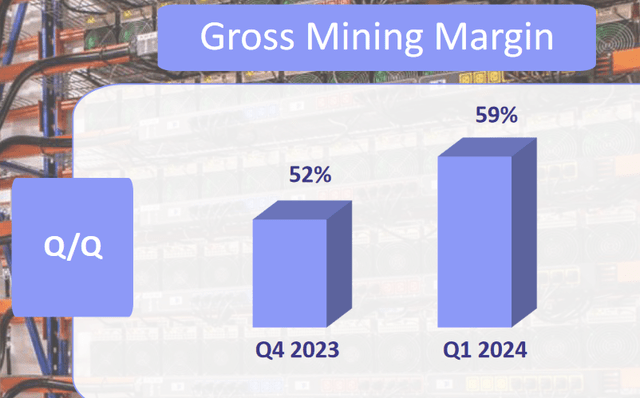

They also enjoyed margin improvement, benefiting from rising BTC prices and their own efficiencies. These advantages helped to drive the strong operating cash flows.

CEO Exit and Takeover Target

Former CEO Geoff Murphy announced plans to depart in March, shortly after my first article. The initial announcement was calmer. Murphy left sooner than expected on May 10, after initiating legal proceedings against Bitfarms in a $27M suit. Obviously, that has potential to be expensive for the company at a time where it needs to preserve cash flow, on top of damaging to their brand and reputation.

As if that weren’t the only power struggle, Riot (RIOT), their competitor, attempted a takeover of the company. In late May, they acquired over 9% of the company and offered to buy the whole entity for $950M, which Bitfarms flatly refused.

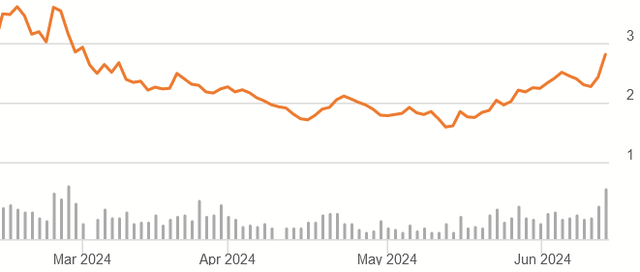

BITF Recent Price History (Seeking Alpha)

These events show Riot clearly pouncing on the recent drop in BITF’s price. The offer caused a turnaround in the share’s movement, but Riot wasn’t done. Just this week, Riot executed Plan B, steadily increasing its position to 12%. This prompted a threat by Bitfarms to sell more shares and dilute Riot, if they increased their stake to 15%.

This also makes Riot the largest shareholder, and they can use their clout to influence the structure of the Board of Directors. With Murphy gone, Chairman Bonta serving as Interim CEO, and this takeover attempt, I think the future leadership of Bitfarms is in question.

Riot’s new stake is concerning because they are a far-less effective operator. I covered them back in January, and considering how much poorer they do, I don’t see what positive impact they could have here. Moreover, if they continue to have financial issues, they too would be vulnerable to a takeover, and Bitfarms is exposed to that risk now that Riot has a position in them.

I think investors will need to watch these upcoming events carefully. An investment in BITF right now is not to be made lightly.

Don’t Forget Q2

One of the concerns I have is how much cash from operations will continue to be what it was in Q1, now that the latest BTC halving event has passed, as of April, which would not show in Q1 results.

BTC 6M Price History (Seeking Alpha)

The price of BTC has not moved much. While improved hash rates suggest they can handle the halving better, half the rewards for the same work means the Q1 margin improvement is going to be lost. For May, the company already reported significantly less BTC production, something I warned in my first coverage. We will need to see the material impact to cash flows before we can properly assess.

Valuation

While there’s long-term potential in BITF, we’ve yet to see if their capex will be managed well enough to produce their first year of free cash flow. Even if it turns positive, it’s a $1 billion valuation on what may only be tens of millions in FCF. Whatever growth or discount rates one wants to use, it would take an unprecedented spike in the price of BTC to make this market cap attractive.

Muddled by mutual threats of takeovers and dilution, individual shares look even worse. $2.81 might be fair but suggests no margin of safety, in my eyes. It’s a valuation that assumes more good news than bad.

Conclusion

Good operating results in Q1 were counterbalanced by the loss of an effective CEO, turned litigious, which created new legal and financial risks for BITF.

On top of that, their strength has drawn the unwanted attention of Riot, a less effective, but larger operator, whose intentions are unclear and whose influence may undermine Bitfarms’ more effective model (if we just go by financial results). Management’s efforts to prevent a takeover, with a threat of dilution, would also affect other shareholders as collateral damage.

It’s not in financial distress, but with the halving, Bitfarms needs a rise in BTC prices before it becomes attractive, amid these problems. With BTC somewhat flat since the halving, we need to see Q2 results before we can say more with confidence. For now, given these concerns, the shares are just a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.