Summary:

- Your Bitcoin outlook will ultimately determine whether BITF should accept RIOT’s offer to acquire at $2.30 per share.

- RIOT’s interest in acquiring BITF makes tactical sense because BITF rivals CLSK (the sector’s best) in several key areas while being priced 60% lower than CLSK.

- Despite BITF’s competitive performance, BITF could only justify a 5% upside ($2.15 target) assuming a peak of $100,000 Bitcoin for the next 4 years, making RIOT’s offer compelling and fair.

- BITF is unlikely to make it into our portfolio during a potential Bitcoin bull run by 17th October 2024.

Yves Adams/DigitalVision via Getty Images

Introduction

The Bitcoin mining market is a winner-takes-all market because the Bitcoin rewards are fixed. The side with the most network share (which is the capacity over the sum of the capacity of all other miners combined) wins (earns the most reward).

Expanding organically (sourcing for power, leasing lands, building the infrastructure, purchasing the fleeting fleets, hiring, etc) is time-consuming at the very least. That is why the ability to acquire other Bitcoin miners is highly valuable.

About half a year ago, we suggested how Bitfarms (NASDAQ:BITF) could benefit from a potential sector-wide consolidation after the halving event occurred in April by acquiring other underperforming Bitcoin mining companies cent on the dollar. We cited BITF’s ability to operate efficiently and maintain network share to maintain profitability, a feat few could achieve at the time. Specifically:

BITF’s cost basis is still relatively lower than its comps which positively contributes to its resilience. This resilience can help BITF outlast competitors and capture more network share. BITF can reverse its declining network share and further decrease mining costs if it can meet its 12 EH/s guidance.

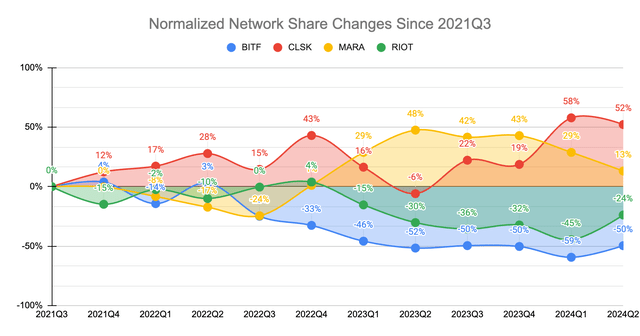

Fast-forward to today. BITF’s capacity is nearing 12 EH/s guidance, and true enough, BITF has been able to stop any further decline since 2023Q2. This is a good performance, considering Marathon Holdings (MARA) is losing its network share advantage.

Fig 1. Normalized Network Share Changes of Major Bitcoin Mining Companies (Author)

Our analysis of Riot Platforms (RIOT) mentioned that its attempted acquisition of BITF makes strategic and tactical sense. In many ways, BITF is similar to CLSK in performance, while its market cap is less than half of CLSK’s.

But what about from BITF’s perspective? Does it make sense for BITF shareholders to reject the takeover? How should it impact our investment thesis? This article aims to discuss the questions above and establish our investment thesis for BITF in preparation for a potential Bitcoin bull run by exactly one month.

Similar Performance as Sector’s Best, But At Lower Prices

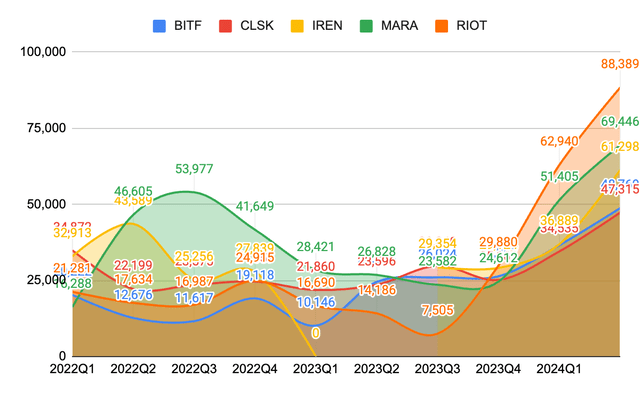

Firstly, BITFs are comparable to CLSKs in terms of cost efficiency. BITF’s all-in cost basis per Bitcoin in 2024Q2 initially appears to be the highest at $142k. During the quarter, BITF incurred an operating cost of $87mil, which consists of $20.4mil electricity cost, $57.3mil depreciation cost, and $12.4mil SG&A cost, minus the sales tax recovery of $25.7mil pro-rated over 9 quarters. With 614 Bitcoins produced, this equates to $142k per Bitcoin.

In April 2024, the Company received confirmation from the Provincial tax authorities that Canadian sales taxes paid by the Company from February 5, 2022 onwards are refundable

|

Company |

BITF |

CLSK |

IREN |

MARA |

RIOT |

|

Cost Basis on Quarter |

142,092.00 |

73,045.00 |

94,757.00 |

112,109.00 |

132,583.00 |

From the breakdown above, BITF’s depreciation costs account for 65% of the total cost. However, we found that depreciation costs should be consistent across the sector; only the depreciation rate should vary due to varying accounting methods. For instance, CLSK and RIOT have the same purchase price of $16mil per 1 EH/s. RIOT recently reduced depreciation costs on paper by extending the expected useful life of its mining fleets from 2 years to 3 years.

Effective January 1, 2024, the Company changed the estimated useful life of its miners and mining equipment from2 years to 3 years.

Depreciation and amortization for the three months ended March 31, 2024 and 2023, was $32.3 million and $59.3 million, respectively, a decrease of approximately $27.0million. The decrease was primarily due to the change in the estimated lives of our Bitcoin miners from 2 years to 3 years.

Therefore, we’ve excluded depreciation cost in comps because BITF’s high depreciation cost could be a side-effect of a more aggressive depreciation policy.

After excluding depreciation cost, BITF’s total cost basis dropped to $49k, rivaling even CLSK’s best-in-class cost efficiency. Going back to 2022Q1, we can see that BITF’s cost efficiency (excluding depreciation cost) was consistently among the lowest.

|

Company |

BITF |

CLSK |

IREN |

MARA |

RIOT |

|

Cost Basis (w/o depreciation) |

48,769.00 |

47,315.00 |

61,298.00 |

69,446.00 |

88,389.00 |

Fig 2. All-in cost basis per Bitcoin (excluding depreciation costs) of major Bitcoin mining companies (Author)

Secondly, BITF is now comparable to CLSK in terms of capacity growth. Referring back to Fig 1, we can see that CLSK enjoyed a significant increase in network share thanks to its aggressive expansion efforts. As a result, we saw CLSK outperforming the market by a considerable margin but also extended into overvaluation territory. It may appear that we called the top on this one, but we felt that the odds were pointing to the downside at the time, nothing more. This series of price actions suggest that the network share gained by CLSK has been priced in and is now in the past. What counts are future performances because the stock market is forward-looking.

With this in mind, even though BITF’s network share remained flat from 2023Q1 to 2024Q2, BITF guided an 86% increase from August’s 11.3 EH/s capacity to 21 EH/s by the end of 2024. This is actually one of the highest in the sector right now.

A clear guidance with a defined timeline, this is what we like. The guidance timeline matters because valuations are based on assumed future capacity, and the guidance timeline dictates the time period required to achieve the assumed capacity.

Guidance Timeline is crucial for our strategy, particularly because our strategy is considered timing the market. We’re looking for Bitcoin miners to tilt (sell Bitcoins for Bitcoin miners) into when we receive the 2 confirmations for a Bitcoin bull run by 17th October. This strategy of tilting our crypto portfolio worked wonders for us in the past, such as with CLSK and BITF, all documented here on Seeking Alpha.

We annotated (*) CLSK’s and RIOT’s capacity growth guidance to indicate the longer time horizon required to achieve their guidance. CLSK has higher growth guidance, but the timeline is unknown; RIOT has similar growth guidance, but it takes 5x longer to achieve (BITF’s 1 quarter vs RIOT’s 5 quarters).

Table 1. Guidance and IBP of Major Bitcoin miners

|

Company |

BITF |

CLSK |

IREN |

MARA |

RIOT |

|

Latest Capacity (Aug) |

|||||

|

Guided Capacity |

21.00 |

50.00 |

30.00 |

50.00 |

41.00 |

|

Capacity Growth Guidance |

86% |

121%* |

88% |

42% |

76%* |

|

Guidance Timeline |

2024Q4 |

? |

2024Q4 |

2024Q4 |

2025Q4 |

|

Current Market Cap |

900 |

2,301 |

1,373 |

4,614 |

2,122 |

|

Adjusted Book Value |

439 |

1,333 |

848 |

2,431 |

2,174 |

|

Cost Basis on Quarter |

142,092.00 |

73,045.00 |

94,757.00 |

112,109.00 |

132,583.00 |

|

Cost Basis (w/o depreciation) |

48,769.00 |

47,315.00 |

61,298.00 |

69,446.00 |

88,389.00 |

|

IBP |

163,429 |

90,939 |

118,281 |

117,796 |

112,871 |

|

IBP w/o Depreciation |

76,253 |

69,549 |

84,822 |

92,651 |

79,334 |

Two relevant expectations to this thesis are Bitcoin reclaiming ATH by 17th October and peaking at $100k by the end of March 2025.

In CLSK’s case, its current market cap of $2.3 bn may be justified with the lowest Implied Bitcoin Price (‘IBP’; excluding depreciation cost) of $69k, assuming a 50 EH/s capacity. However, even if Bitcoin reaches $69k by 17th October, its current market cap of $2.3bn can’t be truly justified yet because it has not realized its assumed 50 EH/s capacity.

The same goes for RIOT. RIOT may have an IBP of $79k (similar to BITF), but its market cap still can’t be justified when Bitcoin reaches $79k during the 2nd half of the Bitcoin bull market (October 2024-March 2025) because it has yet to achieve its assumed 40 EH/s capacity.

In contrast, BITF is expected to achieve its guided 20 EH/s before Bitcoin reaches $79k before March 2025, justifying its market cap in a timely manner. Therefore, BITF presents the best upside potential considering both the timeline and IBP.

In short, BITF can rival CLSK in terms of performance.

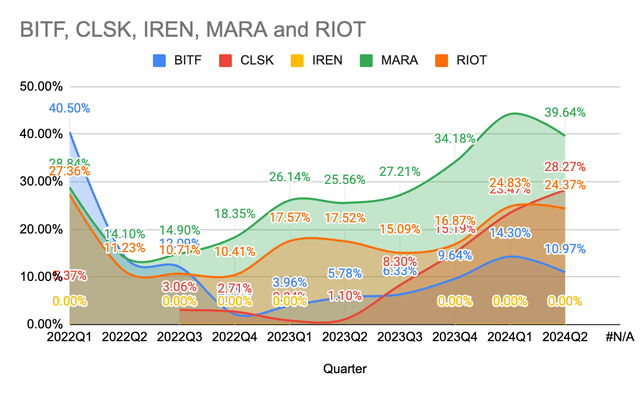

The Implied Bitcoin Price (‘IBP’) is a valuation model we developed to account for both book value and profitability prospects. The IBP is the Bitcoin price that can justify a Bitcoin miner’s current market cap assuming a 1x adjusted book value (excluding intangibles) + 5x earnings multiples. The lower, the better. This metric works because profitability must justify the premium on book value. For instance, we’re observing an ongoing mean reversion of the price-to-book value ratio (‘PBR’) taking place (fig 3). The market is pricing the Bitcoin mining sector at around 2x PBR or a 1x premium. Hence, these miners must be able to provide the value of the 1x PBR premium through profitability. That’s why the IBP is usually higher than the all-in cost basis per Bitcoin, except for when market cap is below book value (like in RIOT’s current case)

Valuations: RIOT’s Offer Was Fair

Our findings suggest RIOT’s offer to wholly acquire BITF at $2.30 per share was fair.

At our expected peak of $100,000 Bitcoin price, BITF’s adjusted book value would be worth $477mil (Tangible assets + Bitcoin reverse valued at $100,000 per Bitcoin), up from $439mil from the current adjusted book value, relatively insignificant due to BITF having the lowest Bitcoin % over total assets (Fig 3; ignoring IREN, which never HODL).

Fig 3. Value of Bitcoin reserves over Total Assets (%) (Author)

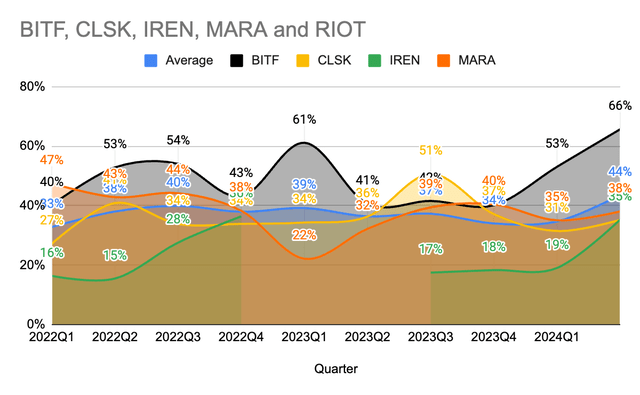

Referring to Table 1, BITF’s profit per Bitcoin mined is implied to be between $51k profit (ignoring depreciation cost) and $42k loss (assuming full official depreciation cost). Since depreciation cost is an actual cost and shouldn’t be ignored, we only use the $51k profit per Bitcoin as a reference to compute BITF’s highest justifiable intrinsic value.

On the top end (at $51k profit per Bitcoin), assuming a 21 EH/s capacity at a 60% network hash rate growth rate, BITF’s operational value at 5x earnings would be valued at $800mil. Combined with its $477mil book value, BITF can justify a $1.27bn market cap, or $2.80 per share (40% upside).

For a more realistic estimation, we can use the sector’s average of 33%. Data shows that the average % depreciation cost to total cost is about 33% (Fig 4). The implied BITF’s all-in cost basis would be $69.6k, or $30.4k profit per Bitcoin. This then implies an operational intrinsic value of $475mil. Combined with its $477mil book value, BITF can justify a $950mil market cap, or $2.15 per share, which is today’s price.

Therefore, it is reasonable to suggest that RIOT’s offer to wholly acquire BITF at $2.30 was actually fair.

Fig 4. % Depreciation cost over Total Operating Cost (excluding impairment costs) (Author)

Verdict

Your Bitcoin outlook will ultimately determine whether BITF should accept RIOT’s offer to acquire at $2.30 per share. This offer presents a 40% return payday based on May’s share price. In comparison, our model suggests that BITF’s valuation should peak at around $2.15 only, assuming a new ATH at $100,000 per Bitcoin for the next 4 years. By this standard, as shareholders, we would’ve accepted RIOT’s offer. RIOT’s offer looks even more compelling when factor in the probability that BITF’s actual depreciation cost could be much higher than the sector’s. This could explain the controversy surrounding BITF’s poison pill event and proposed board shuffling.

Based on the thesis presented in this article, BITF is unlikely to make it into our portfolio. Currently, we plan to tilt into CLSK and MARA if signs for a potential Bitcoin bull run emerge. In the following articles, we’ll examine whether Iris Energy (IREN) deserves a place in our portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, BITO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.