Summary:

- Blink Charging stock surged 32% after posting better-than-expected preliminary fiscal 2023 fourth-quarter earnings. Revenue is set for 86% year-over-year growth to $42 million.

- BLNK’s low valuation compared to its historical average could potentially set bulls up for medium-term outperformance if the Fed cuts rates.

- Interest rate cuts and a dip in inflation could help reverse the slowdown in EV sales and negative investor sentiment toward the industry.

Laser1987

Blink Charging Overview

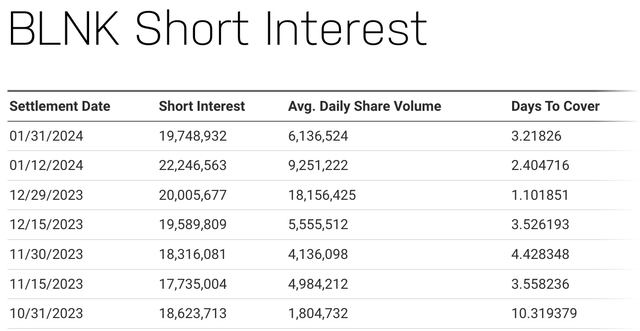

Blink Charging’s (NASDAQ:BLNK) 32% intraday surge after it posted preliminary fiscal 2023 fourth-quarter earnings that surprised consensus to the upside possibly reflects two factors. The first is that EV sentiment has been driven too low, despite the continued strength of new EV uptake in the US and beyond. The other is that a 19,748,932 share short interest, nearly 33% of its diluted weighted average number of common shares outstanding as of its last reported quarter, got caught in a squeeze.

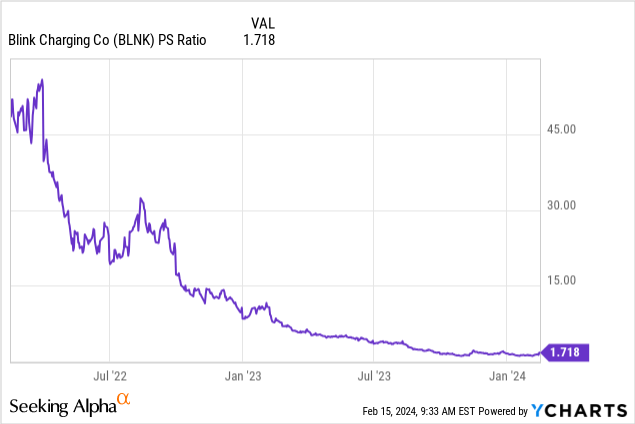

The conditions for a short squeeze had been building up following a more than 65% dip in the common shares over the last 1 year. BLNK is now comparatively cheap when compared to its historical average. You can pick up commons for roughly 1.7x sales, near the lowest level in more than half a decade, despite the continued but flagging momentum of EV sales in its core developed market.

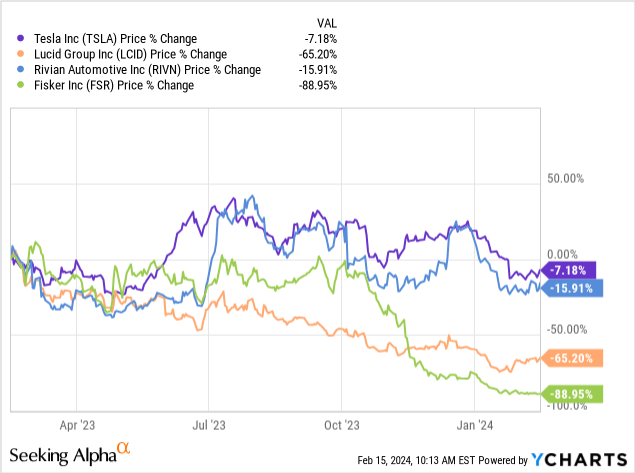

Critically, the downward reset of expectations around the rapid uptake of EVs will continue to form a headwind against broader sentiment towards EV charging tickers, but BLNK’s low comparative valuation could set the ticker up for medium-term outperformance. When I last covered the ticker, I flagged collapsing investor sentiment and liquidity in the sector. The situation has worsened since then with Tesla (TSLA), Lucid Motors (LCID), Rivian (RIVN), and Fisker (FSR) amongst others giving up significant value since November of 2023.

Preliminary Earnings, BLNK Stock Valuation, And Flagging EV Sales

BLNK will likely report its full fourth-quarter and full-year 2023 earnings on the last week of February or early March, but has yet to provide a date. The company is set to report revenue of $42 million, up 86% from $22.6 million in its year-ago comp and significantly above consensus of $34.4 million. Revenue for the full year is set to notch $140 million at minimum, ahead of a prior range for full-year revenue of $128 million to $133 million. This demand for its EV charging products and services reflects the sustained pull-up of new EVs on the road.

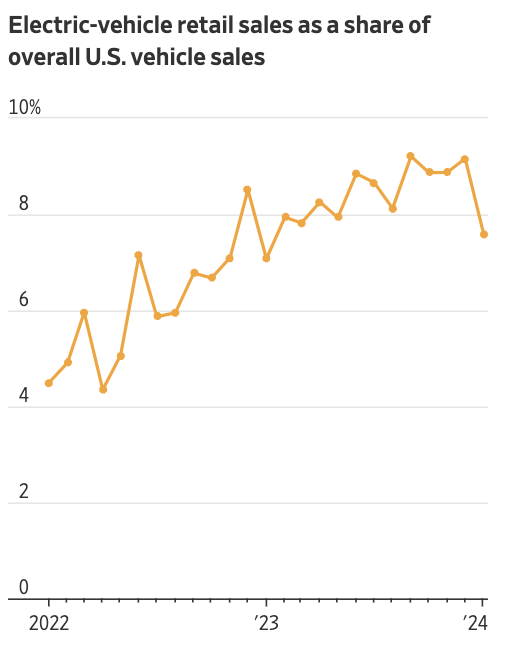

According to the US Department of Energy, 2023 saw the sale of more than 1.4 million EVs in the US, a 50% increase over its year-ago comp. There are now more than four million new EVs on the road since 2020 with EV sales as a percent of overall US vehicle sales reaching a new high just north of 9% in 2023. However, momentum has started to slow down, with this percentage materially dropping towards the end of 2023. Elon Musk, Tesla’s CEO, has come out to say that 2024 will mean lower delivery growth for Tesla, with other EV upstarts like Lucid and Fisker recently underperforming on their delivery targets.

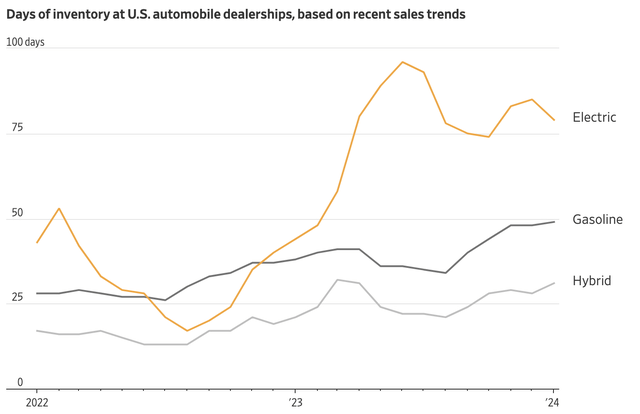

WSJ

The fear here is that the period of blistering growth is behind the industry, with the easy wins in terms of new EV drivers already converted. Bears argue that the industry will struggle to expand its market share until new EV models are released that address consumer concerns around range, costs, and charging times. EV range anxiety remains a pertinent barrier and when aggregated with higher base prices compared to internal combustion engine vehicles means there will always be a ceiling on new uptake. The situation for the EV manufacturers is deteriorating with poor sales of upstarts like Fisker whose stock has now dropped below the minimum required for continued NASDAQ listing. Ford (F) has also pared back on its EV investments on the back of material losses in the segment.

Fed To The Rescue?

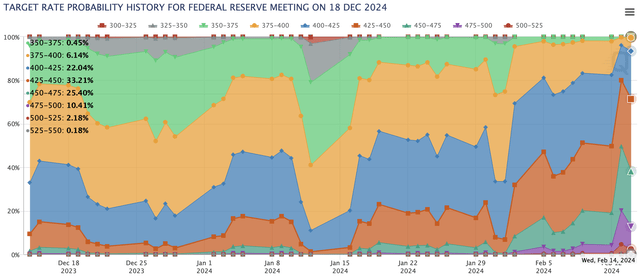

The huge uptick in days of EV inventory at US automobile dealerships also reflects flagging consumer adoption of EVs. This now sits at just above 75 days, up from under 20 days roughly a year prior. EVs have in one year seen both consumer and investor sentiment get entirely inverted to the negative. Higher interest rates and a high cost of living have played a significant role in this, with the cost of financing new car purchases through debt rising to match a Fed funds rate currently at a 22-year high of 5.25% to 5.50%. Market expectations are for a drop to 4.25% to 4.50% exiting 2024.

A reversal of this in aggregate with inflation rates normalizing will likely help deliver a boost to new EV sales. For BLNK, this is critical in seeing a reversal of torrid market sentiment towards its stock. To be clear, the market wants growth, and BLNK functions as a pick-and-shovel play on the growth of EVs in the next decade and beyond. A recovery of its multiple is tethered at the hip to a full recovery in EV sales momentum. The intraday rally on the release of preliminary fourth-quarter earnings foreshadows for bears the potential upside on a ramp of this momentum, for bulls it’s a reason to maintain a hold on the common shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.