Summary:

- Block’s slowing GPV growth and volatile Bitcoin investment have contributed to the stock’s underperformance compared to its fintech peers.

- This is despite the bottom-line beat FQ2’24 earnings call and raised FY2024 guidance, triggering the promising consensus forward estimates.

- Despite the near-term uncertainty from its ongoing reversal, we maintain our long-term optimism surrounding SQ’s prospects, as observed in the highly sticky Cash App/SaaS offerings.

- This is on top of the cheap PEG non-GAAP ratio and the double-digit capital appreciation prospects over the next few years.

- Even so, we shall discuss why SQ’s love story with Bitcoin may trigger H2’24 uncertainty.

Jonathan Knowles

SQ’s Bitcoin Thesis Dilutes Its Fintech Performance

We previously covered Block (NYSE:SQ) in July 2024, discussing the stock’s underperformance despite the double beat FQ1’24 earnings results and raised FY2024 guidance, with the stock’s FWD valuations also consistently moderated compared to their 1Y and pre-pandemic means.

Perhaps part of the headwinds might be attributed to the management’s intensified investments in bitcoins, a development that might trigger its further underperformance until the market was convinced about the fintech’s prospects along with bitcoins’ appreciation potential.

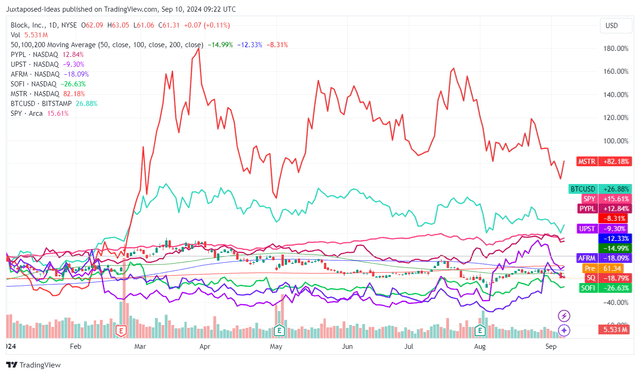

SQ YTD Stock Price

TradingView

Since then, SQ has lost -11.7% of its value compared to the wider market at -4%, as the management reported a mixed FQ2’24 performance worsened by the tumbling Bitcoin prices by -11.4%.

The stock’s underperformance compared to the wider market and its fintech peers is unsurprising indeed, given that the fintech has shown signs of decelerating YoY growth across most of its Gross Payment Volumes [GPV], with the discounted stock prices/valuations warranted until the management is able to drive new growth opportunities.

Based on these developments, it appears that SQ may be losing ground as SoFi (SOFI) and PayPal (PYPL) continue to report improved performances in the latest earnings call on a QoQ/YoY basis.

This is especially since the former’s Bitcoin ambitions has pulled down its overall performance – with the fintech segment’s growing net revenues of $3.53B (+9.6% QoQ/+12.7% YoY) moderated by the underwhelming Bitcoin revenues of $2.61B (-4.3% QoQ/+9.2% YoY) in FQ2’24.

The QoQ/YoY decline in SQ’s bitcoin revenues is unsurprising indeed, given the halving event in April 2024 and the ongoing consolidation before the supposed “significant rally” in 2025.

Even so, with the company also reporting a higher Bitcoin volume of 8,211 (+2.1% QoQ/NA YoY) worth $514.58M (-10.2% QoQ/+133.9% YoY) held for investment purposes, it is unsurprising that market sentiments surrounding its prospects have also been impacted.

This is despite SQ’s growing fintech subscription and services-based revenues to $1.78B (+5.9% QoQ/+21.9% YoY) in FQ2’24, with it underscoring the growing stickiness of its Cash App platform at $1.42B (+6.7% QoQ/+37.8% YoY) and to a lesser extent, Square platform at $323M (+9.1% QoQ/-15.2% YoY).

With the subscription and services-based segment being the clear bottom-line driver at increasingly rich gross profit margins of 83.6% (-0.3 points QoQ/+2.8 YoY), it is unsurprising that the fintech has reported a bottom-line beat in the FQ2’24 earnings call, despite the top-line miss.

Despite SQ’s uncertain GPV growth, readers must note that Cash App (including Card, Borrow, and BNPL offerings) continues to report robust growth in inflows per active users at $1,243 (-1% QoQ/+9.6% YoY) and active users to 57M (in line QoQ/+3M YoY).

This is on top of the increasing Cash App Card monthly actives to 24M (in line QoQ/+13% YoY) and over $2B in loan originations in Cash App Borrow (nearly 3x YoY), with it implying the management’s early success in expanding its Cash App ecosystem beyond the P2P payment/digital wallet platform.

At the same time, the management has taken great steps to drive GPV growth, by tapping into Nick Molnar, CEO and co-founder of Afterpay, as a leader of centralized sales function in an effort to “reinvent sales at its payment terminal company Square after slowing growth” while looking to launch new partnerships and intensify their high return marketing efforts.

As a direct result of their confidence in its future reversal, SQ has already raised its FY2024 adj EBITDA guidance to $2.9B at the midpoint (+62% YoY), up from the original guidance of at least $2.63B (+46.9% YoY) offered in the FQ4’23 earnings call.

This is on top of the raised Rule of 40 target of up to 35% in 2024 (+6 points YoY) up from the original guidance of 28% (-1 point YoY) and reiterated target of 40% by 2026.

These numbers do not appear to be overly aggressive as well, based on adj EBITDA of $1.46B (+94.6% YoY) and Rule of 40 at 38.6% in H1’24 (based on +20.6% YoY growth in gross profit and 18% in adj operating margin), with the management seemingly well on track to delivering the raised FY2024 guidance.

The Consensus Forward Estimates

Tikr Terminal

As a result, it is unsurprising that the consensus has raised their forward estimates, with SQ expected to generate an accelerated top/bottom-line growth at a CAGR of +11.6%/+36.4% through FY2026.

This is compared to the previous estimates of +11.8%/+18.3%, while building upon the historical growth of +67.7%/+53.1% between FY2017 and FY2023, respectively.

SQ Valuations

TradingView

As a result of the accelerated bottom-line growth prospects, we believe that SQ remains cheap at FWD non-GAAP P/E valuations of 17.30x compared to the relatively lower sector median of 11.49x.

This is attributed to the former’s cheap FWD PEG non-GAAP ratio of 0.42x compared to the sector median of 1.24x and its profitable fintech peers, including SOFI at 0.71x and PYPL at 1.21x.

As a result of its highly profitable fintech business, we maintain our belief that SQ has been overly discounted at current levels, with it offering interested investors the opportunistic chance of capital appreciation.

So, Is SQ Stock A Buy, Sell, or Hold?

SQ 3Y Stock Price

TradingView

For now, SQ has been unable to retain most of its recent gains, while currently trading below its 50/100/200 day moving averages and retesting its support levels of $60s.

We had previously offered a fair value estimate of $40.20, based on the FWD non-GAAP P/E valuations of 22.35x and its FY2023 adj EPS of $1.80. This is on top of the long-term price target of $123.80, based on the consensus FY2026 adj EPS estimates of $5.54.

Based on the LTM adj EPS of $2.78 ending FQ2’24 and the moderated FWD non-GAAP P/E valuations of 17.30x, we are looking at an updated fair value estimate of $48.10. Based on the consensus raised FY2026 adj EPS estimates of $5.68, we are looking at an updated (and lower) long-term price target of $98.30.

The downgrade is not overly bearish as well, as observed in SQ’s sideways trading pattern since May 2022 and the GPV underperformance compared to its peers.

Even so, we are reiterating our Buy rating here, attributed to its cheap PEG non-GAAP ratio and the still excellent upside potential of +60.5% to our updated long-term price target. This is on top of the fintech’s highly sticky Cash App offerings and accelerated profitability thus far.

Risk Warning

It goes without saying that SQ’s conviction/love story with Bitcoins may trigger more volatility in the near. Analysts already expect Bitcoin to potentially dip to $45K after the Fed (supposedly) pivots by 25 basis points in the upcoming FOMC meeting in September 2024, with it implying a downside of -39% from current levels of $74K.

The same volatility has also been observed in another Bitcoin proxy stock, MicroStrategy (MSTR), with it remaining to be seen when the cryptocurrency may break out of the all-time H1’24 resistance levels of over $90K, significantly destabilized by the ongoing US elections and the volatile geopolitical issues in Ukraine and Gaza.

As a result, we believe that SQ is only suitable for investors with higher risk tolerance, since things may get much worse before eventually getting better.

Patience may be more prudent for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.