Summary:

- Block’s monetization rate reached an all-time high in Q4.

- Management intends to live by its 12,000-employee cap for years.

- Block’s balance sheet position and cash flow profile have never been better.

- Expect blowout Q1 earnings ahead.

- Block stock is still trading at depressed valuations.

PM Images

Introduction

We’ve done a lot recently to reduce our costs. Now we’re going to focus on growth.

That pretty much sums up Block’s (NYSE:SQ) Q4 earnings results — Block has restructured its organization in such a way that it is well-positioned to drive profitable growth for years to come.

Furthermore, management issued strong 2024 guidance, which sent the stock higher following earnings. However, the stock has withered over the past few months as the broader market pulled back.

This creates a great buying opportunity for investors.

With Block expected to drive meaningful operating leverage in the next few years and with a strong outlook ahead, momentum seems to be building up for Block stock.

Growth

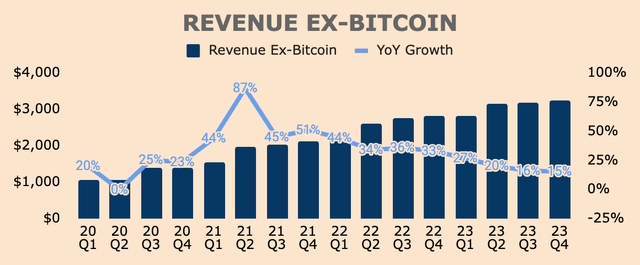

Looking at growth, Q4 Revenue was $5.8B, up 24% YoY, beating analyst estimates by $60M. This was driven by ecosystem growth and, more prominently, the rapid rise in the value of Bitcoin, which increased nearly 60% in Q4. Bitcoin Revenue was $2.5B, up 37% YoY — excluding Bitcoin, Revenue would have been $3.3B, up 15% YoY.

Author’s Analysis

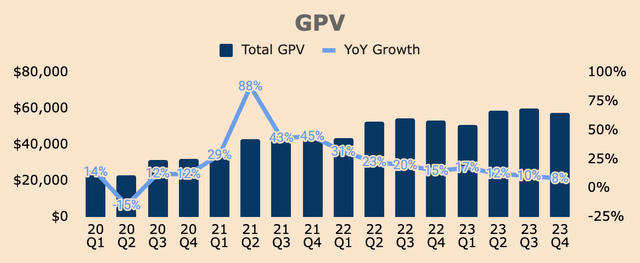

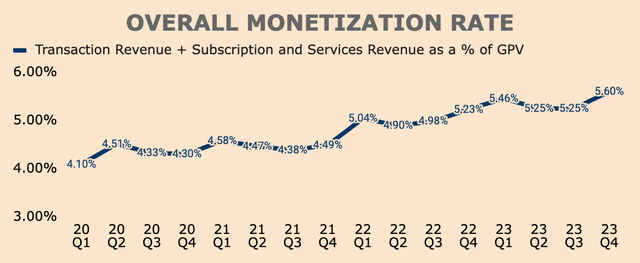

In Q4, Gross Payment Volume (GPV) was $57B, up 8% YoY. As you can see, GPV growth has been slowing down over the past few quarters as Block grows over a larger base. Slower consumer spending also contributed to the growth deceleration. However, notice how Revenue Ex-Bitcoin is growing much faster than GPV.

Author’s Analysis

This is due to higher Overall Monetization Rates, which I define as Transaction Revenue plus Subscription and Services Revenue, divided by GPV. As you can see, Q4 Monetization Rate was 5.60%, up 37 basis points YoY. The metric also rose to its highest point ever, signifying strong monetization within the Block ecosystem.

Author’s Analysis

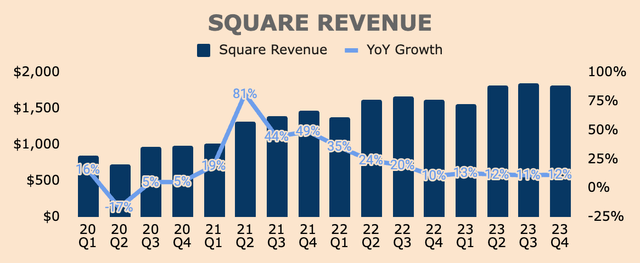

Breaking it down by segment, Q4 Square Revenue was $1.8B, up 12% YoY, with Square GPV at $54B, up 10% YoY. Growth for the segment seemed to have stabilized in the low teens. Some highlights for the quarter include:

- Positive Gross Profit retention across all annual cohorts, which implies high stickiness and engagement within the Square ecosystem.

- International GPV grew 26% YoY. US GPV, on the other hand, grew only 7% YoY.

- Vertical point-of-sale solutions grew 27% YoY.

- Square Loans expanded 22% YoY, with $1.4B of loan originations.

Author’s Analysis

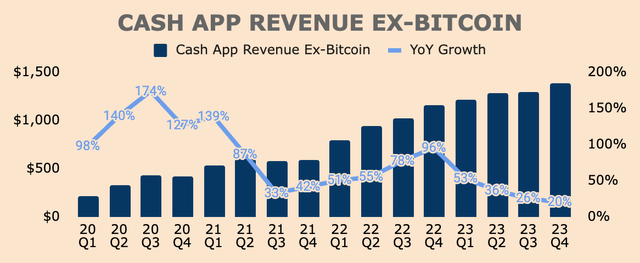

Turning to Cash App, Q4 Revenue for the segment was $3.9B, up 31% YoY. Excluding Bitcoin, Cash App Revenue was $1.4B, up 20% YoY. As you can see, growth has slowed down significantly, which should eventually follow the same trajectory as Square. Nevertheless, Cash App growth was driven by:

- 56M monthly transacting actives, up 9% YoY.

- $63B of inflows, up 18% YoY.

- 1.48% monetization rate, which increased 9bps YoY and 5bps QoQ.

Author’s Analysis

In other news, engagement growth in the Cash App ecosystem remains robust:

- Just like Square, Cash App recorded positive Gross Profit retention across all annual cohorts.

- 23M Cash App Card monthly actives, up 20% YoY.

- 3M Cash App Pay monthly actives, up from 2M last year.

- $325M of BNPL Revenue, which increased 23% YoY. BNPL GMV was $8.6B, up 25% YoY.

- $3.6B of loan originations through Cash App Borrow, growing 74% YoY.

As a whole, while growth is slowing down, Block’s growth story remains intact as fintech adoption continues to gain steam.

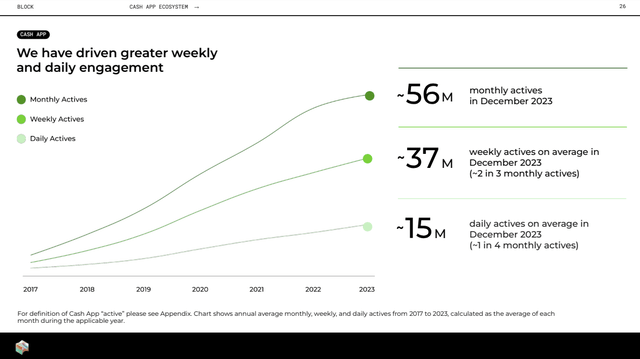

More importantly, Block continues to attract more users to the platform, with Cash App monthly actives at 56M as of the end of Q4. The number of users is a leading indicator of future Revenue growth, so it’s great to see that Block continues to grow its user base.

Not only that, but Block is driving higher engagement as seen by the rise in average weekly and daily actives on the platform.

Block FY2023 Q4 Investor Presentation

Furthermore, management aims to make Cash App their customers’ primary bank, and with only 2M actives — or 3% of monthly transacting actives — having signed up for direct deposit, Cash App still has a long growth runway, not only in terms of user base, but monetization as well. Maintaining robust growth in these two areas should drive profitable growth moving forward.

Profitability

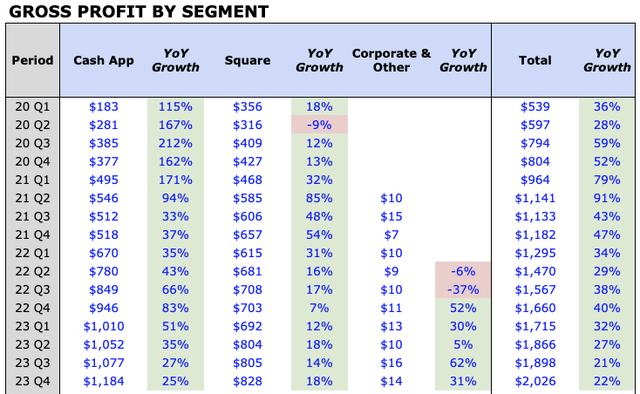

Speaking of profitability, Q4 Gross Profit was $2.0B, up 22% YoY. This consists of:

- Cash App Gross Profit of $1.2B, up 25% YoY.

- Square Gross Profit of $828M, up 18% YoY.

Looks fine from a Gross Profit standpoint.

Author’s Analysis

For the remaining profitability metrics, I will analyze margins as a percentage of Gross Profit, instead of Revenue — this is how management calculates margins as well, which removes the volatile impacts of Bitcoin Revenue.

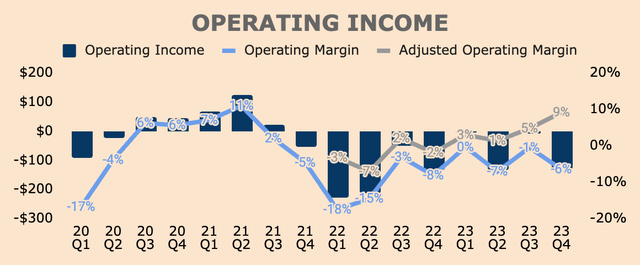

That said, Q4 Operating Income was $(131)M, representing an Operating Margin of (6)%. The dip QoQ was due to a $132M Goodwill Impairment charge related to TIDAL, as well as a $117M restructuring charge. Adjusting for these items, Adjusted Operating Income was $185M, representing an Adjusted Operating Margin of 9%.

Author’s Analysis

As announced in its Q3 earnings release, Block intends to operate with an absolute cap of 12,000 employees. As of the end of Q4, Block has reached that cap, down from over 13,000 employees in Q3. This is why Adjusted Operating Margin improved 1,100bps YoY and 400bps QoQ.

Moving forward, management intends to implement the 12,000 cap for years, until they feel like they need to grow their employee base to stimulate further growth. This operational discipline should drive meaningful operating leverage and profitable growth.

We’re under our 12,000 people cap. This constraint forces us to prioritize more impactful work, which we believe will lead to growth. We’re going to operate under this cap until we feel it’s holding us back, which is likely years out, and continue to look critically at our organization and priorities.

(Block FY2023 Q4 Shareholder Letter)

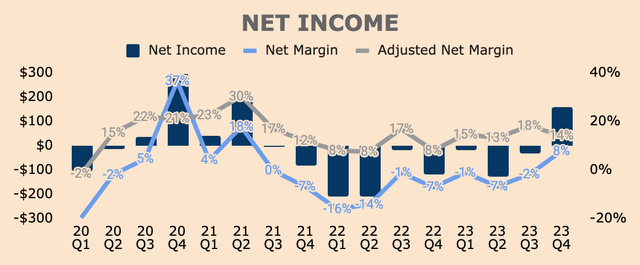

In terms of the bottom line, Block turned GAAP Net Income profitable in Q4, which probably sparked the post-earnings rally. In Q4, GAAP Net Income was $158M, which was an 8% Net Margin. This was primarily driven by the revaluation of its Bitcoin holdings.

Adjusting for this Bitcoin impact and other non-cash and one-time charges, Adjusted Net Income was $285M, representing a 14% Adjusted Net Margin, which improved 600bps YoY.

Author’s Analysis

As you can tell, Block’s profitability metrics are improving across the board. I particularly like the 12,000-employee cap as it forces the company to maximize the potential of its human capital, ultimately driving incremental growth at minimal costs.

This should drive further operating leverage, which should accelerate earnings growth moving forward.

Health

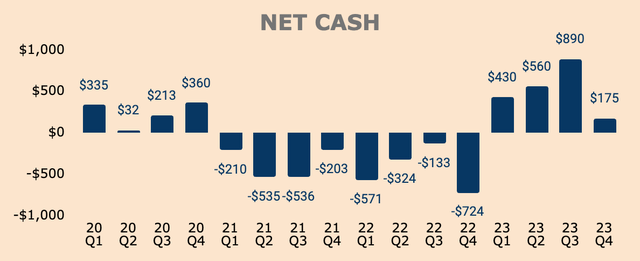

As of Q4, Block has $6.2B of Cash and Short-term Investments with $6.1B of Total Debt, which put its Net Cash position at about $175M.

As you can see, Net Cash dropped $715M QoQ, mainly due to “the funding of seasonally higher BNPL consumer receivables originations, which are historically collected in the following quarters”. In addition, Block had to make a $350M deposit for a processor in Q4, which negatively affected cash flows.

Author’s Analysis

Regardless, Block’s annual Net Cash position should improve moving forward as the company focuses on profitable growth.

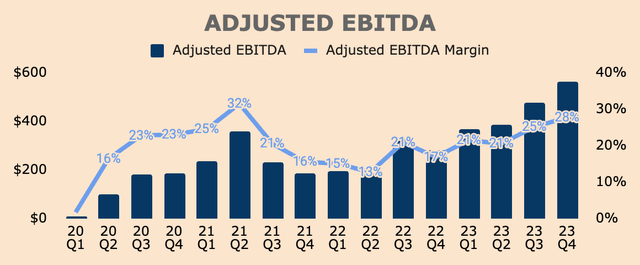

This is reflected in the company’s improving Adjusted EBITDA profile, which was $562M in Q4, representing an Adjusted EBITDA Margin of 28%. Adjusted Free Cash Flow also improved in 2023, which was $515M in 2023, up from $(346)M in 2022.

Overall, Block’s balance sheet position and cash flow profile have never been better.

Author’s Analysis

Outlook

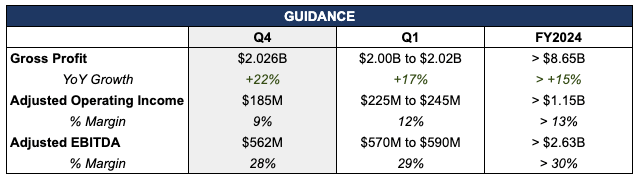

In terms of the outlook, management provided the following guidance (I have included Q4 results for comparison):

Author’s Analysis

In Q1, management expects Gross Profit of $2.01B, up 17% YoY, which is a slowdown from Q4’s growth of 22%. Q1 results are set to be released on May 2.

While growth is expected to decelerate, profits are set to expand further. In Q1, management expects Adjusted Operating Income of $235M, representing a 12% Margin, which is a 300bps improvement QoQ. Similarly, Adjusted EBITDA is expected to be $580M, representing a 29% Margin, which is a 100bps improvement QoQ.

In my view, given the fact that Bitcoin jumped 50%+ in value in Q1, we could see blowout Q1 earnings as Block beats internal guidance across all metrics.

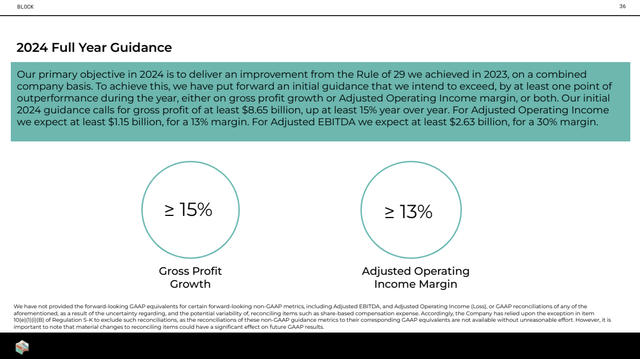

For the full year, management issued an “at least” guide, meaning Block could very likely produce far better results than its guidance.

That said, management expects 2024 Gross Profit of at least $8.65B, up at least 15% YoY. Management also raised its full-year 2024 profit guidance:

- Raised 2024 Adjusted Operating Income guide by $240M to at least $1.15B, representing a 13% Margin.

- Raised 2024 Adjusted EBITDA guide by $230M to at least $2.63B, representing a 30% Margin.

In other words, expect strong operating leverage moving forward.

Management also remains committed to reaching its Rule of 40 target:

- In 2023, Block achieved Rule of 29 (24% Gross Profit growth + 5% Adjusted Operating Margin).

- In 2024, management strives to do better with “at least one point of outperformance” over 2023 (at least 15% Gross Profit growth + 13% Adjusted Operating Margin).

Despite its strong guidance, I believe Block will outperform expectations and easily beat its guidance. For instance, Block has already achieved Rule of 31 in Q4, so I expect Block to achieve Rule of mid-30s in 2024, far exceeding its guidance of at least 28%.

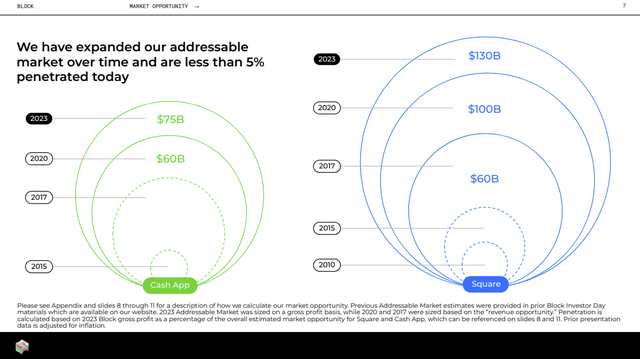

Block FY2023 Q4 Investor Presentation

Whatever it is, Block still has a long growth runway ahead as Square and Cash App combined have less than 5% market penetration today, with over $205B of Gross Profit opportunity up for grabs. Given its strong brand, network effects, and technology moats, I believe Block will end up devouring a significant chunk of this fintech pie.

Block FY2023 Q4 Investor Presentation

Valuation

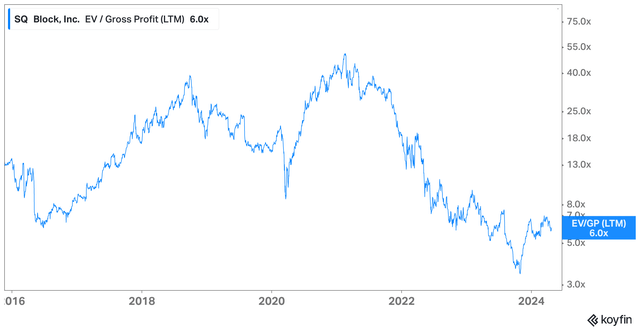

As I have briefly discussed above, Block issued very strong guidance, which led to a 16% pop in share price following its Q4 earnings release. However, the stock gave up all its gains as the overall market pulled back.

As it stands, Block trades at an EV to Gross Profit multiple of just 6x, which is pretty much the cheapest it has ever traded outside its November bottom, despite being a much larger and more profitable company than ever before.

Koyfin

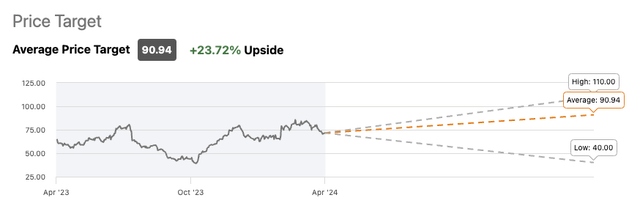

Analysts have an average price target of $91, which represents an upside of about 24%.

Seeking Alpha

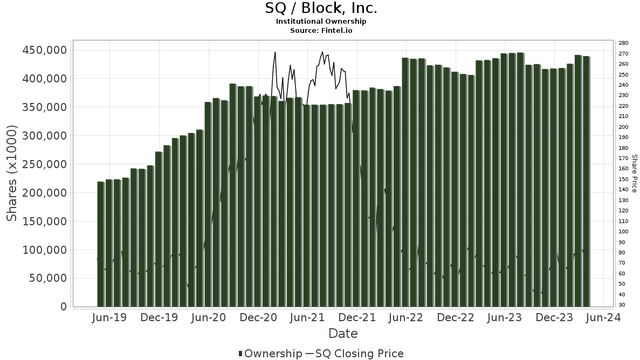

Institutions have also been buying Block stock, signifying general bullishness on the stock, which should limit downside as well.

Fintel

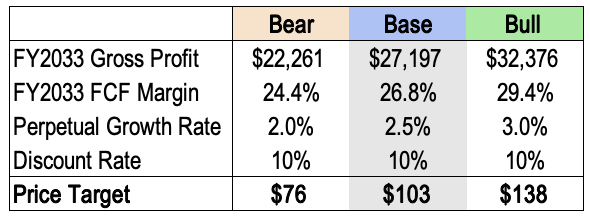

As for me, I maintain my 1-year base-case price target of $103 a share, which represents an upside potential of about 40% from the current price of $73. My assumptions are laid out below.

Author’s Analysis

Risks

- Competition: the fintech landscape is highly competitive with payment processing giants like PayPal (PYPL) and Adyen (OTCPK:ADYEY), which could limit Square’s upside potential. Furthermore, there are other digital banking offerings like SoFi (SOFI) and Chime, which could hinder Cash App’s growth ambitions of becoming a next-generation bank.

- Bitcoin Proxy: with the price of Bitcoin at all-time highs, a correction may be on the horizon. If that happens, Block’s financials may take a slight hit.

Thesis

The company has done a lot to optimize its cost structure and is now well-positioned to drive profitable growth.

More specifically, the 12,000-employee cap sets the tone for meaningful operating leverage as the company works its way towards the Rule of 40.

Despite being a fundamentally stronger company today, Block still trades at depressed valuations, which offers a wonderful buying opportunity for investors today.

As I mentioned in my previous article, Block’s turnaround story is underway — and with strong Q4 results in the books, momentum is building for Block stock.

This should set the stock well for 2024 and beyond.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.