Summary:

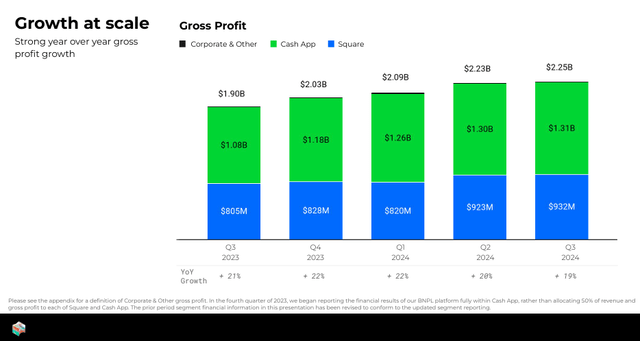

- Block continues to increase its revenue, and gross profit, as on a YoY basis, they have increased by 8.88% and 14.47%, while the gross profit margin expanded to 36.35%.

- SQ is now profitable and is expected to grow their EPS by 59.04% over the next 2 years, placing their forward P/E under 20 based on 2026 earnings.

- A lower rate environment is bullish for SQ, as it could lead to increased loan originations and increased merchant transactions.

PM Images

Block, Inc. (NYSE:SQ) isn’t one of my favorite companies, and I am not a shareholder, but I have to respect their progress despite their excessive stock-based compensation payouts. Now that a new administration is coming in that is pro-crypto and David Sachs has been appointed the AI and crypto czar, I think there is going to be a resurgence in the crypto industry that will benefit SQ tremendously. SQ has been delivering on many of its objectives, and after going through the Q3 report, I find it hard not to believe they will do well in the future. SQ has a strong ecosystem and balance sheet, and I can’t ignore that their forward EPS and revenue growth rates make the current share value look inexpensive. I don’t think it will be as easy to find depressed value plays in 2025, but shares of SQ look like they are breaking out and can continue to grow. I am now bullish on SQ, and I am considering starting a position before 2024 is over. I think that the tailwinds will be too strong for SQ to come back down into the $60s, and even though shares are up more than 27% YTD, there is still plenty of upside for investors who have time on their side.

Seeking Alpha

Following up on my previous article about Block, Inc.

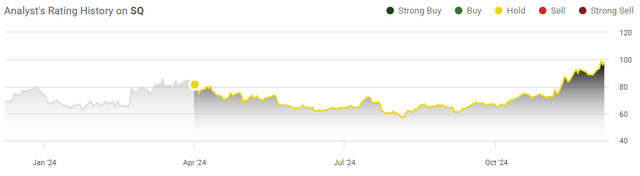

SQ is a company that many investors ask me about, and I previously wrote an article about it back in April (can be read here). Once I became very bullish on PayPal (PYPL) I started really paying attention to SQ. In my last article, I explained why I was neutral, and for a period of time, it looked like not going bullish was the right call until it wasn’t. Shares of SQ have been breaking out and have almost doubled from their 52-week low. A lot has changed since my last article as SQ has strung together several consecutive quarters of profitability, a new administration is coming in that is pro-crypto, and the Fed has started cutting rates. I am upgrading my investment thesis on SQ to bullish as the narrative is changing, and I think they will continue to do well over the next several years.

Seeking Alpha

Risks to my investment thesis on Block, Inc.

Just because I am turning bullish on SQ and looking to start a position does not mean that I am correct or that this investment will work out. There are several risk factors that could negatively affect my investment thesis. SQ has more exposure to Bitcoin (BTC-USD), and if BTC-USD experiences a decline in value, it could negatively impact SQ’s share price. While the new administration is taking a pro-crypto stance, until we see their official position, there could still be regulatory uncertainty and potential challenges for SQ. Cybersecurity threats continue to increase, and SQ is a leading fintech company that is a high-profile target for cyberattacks. If a hacker group is successful, it could lead to reputational damage and SQ’s user base moving its assets off the Cash App environment. In the event that we experience macroeconomic headwinds, consumer spending could be impacted, which would negatively impact the revenue generated from SQ’s merchant activity. Investors should consider these risk factors and do their own due diligence before making an investment in SQ.

I am still not thrilled with the amount of stock-based compensation being awarded at Block, Inc.

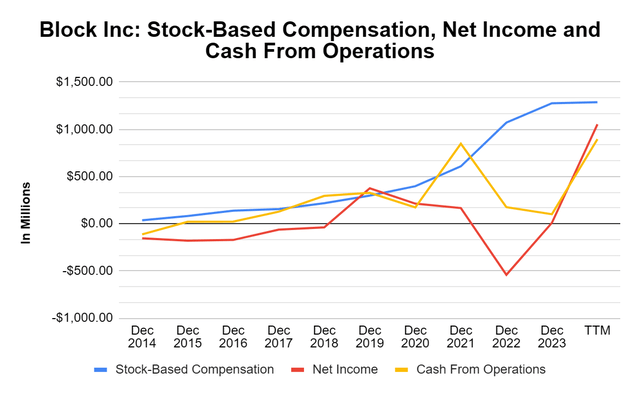

One of my biggest criticisms about SQ is the amount of stock-based compensation they are issuing compared to their level of profitability. I am not opposed to companies issuing stock-based compensation as part of their incentive structure to retain and motivate employees, but at some point, it becomes excessive. The fact is that since the 2014 fiscal year, SQ has generated $670.40 million in net income and has been profitable for 5 out of the past 11 years, assuming they maintain profitability in 2024 once the Q4 results are released. In 2023 alone, SQ issued $1.28 billion in stock-based compensation, which is more than the past 11 years of profitability. Over the past 11 years, SQ has issued $5.57 billion in stock-based compensation, which is drastically more than the $670.40 million in net income generated over this period, and more than the $2.88 billion in cash from operations or $1.86 billion in free cash flow (FCF) generated since the 2014 fiscal year.

To me, this looks like corporate greed, and it was the main reason why I never became a shareholder. It’s hard for me to justify why a company would pay $1.28 billion in stock-based compensation in 2023 when the company generated $9.8 million in net income and -$50.20 million in FCF. The numbers look much better in the trailing twelve months (TTM), but the $1.29 billion in stock-based compensation SQ has paid is still more than the $1.05 billion in net income and $717 million in FCF generated. The only saving grace at this point is that SQ is generating more profitability than it ever had, and it looks like they are in a position to scale the amount of cash from operations and net income their underlying businesses are producing. Just because I am turning bullish on SQ doesn’t mean that I am turning a blind eye to these metrics, and I will continue to monitor if they improve.

Steven Fiorillo, Seeking Alpha

Block, Inc. is delivering for shareholders and I think that the macroeconomic environment sets up well for them

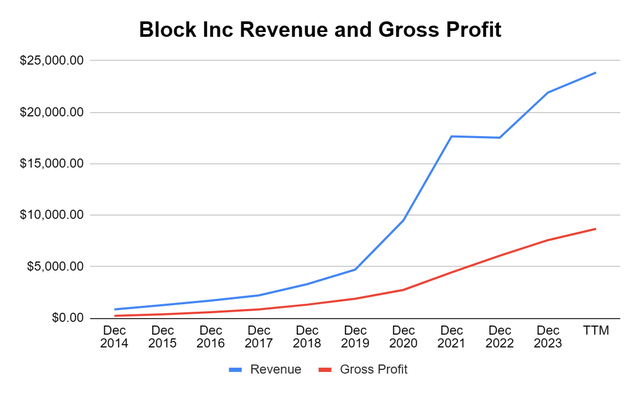

It’s hard to deny that SQ is operating a successful business in which many individuals find value. From providing merchant services to businesses and a suite of financial products to individuals, SQ is able to generate tens of billions in revenue on an annual basis. Since 2014, SQ’s revenue has increased by 2,706.57% ($23.01 billion) from $850.20 million to $23.86 billion, while its gross profit has grown 3,719.55% ($8.45 billion) from $227.10 million to $8.67 billion. On a YoY basis, SQ has grown its revenue by $1.95 billion (8.88%) and its gross profit by $1.09 billion (14.47%) in the TTM. SQ is also improving its gross profit margin as it’s increased from 25.15% in 2021, when shares were at all-time highs, to 36.35% in the TTM. The trajectory of revenue and gross profit growth is what I want to see when I research a company. SQ continues to get bigger, and the analyst community believes that revenue will continue to grow at a double-digit pace over the next several years.

Steven Fiorillo, Seeking Alpha

SQ’s strategy is working, and they are looking to transform roughly 24 million Cash App Cards into what they believe will be a stronger alternative to traditional credit cards when Afterpay is launched on the Cash App Card. SQ’s ecosystem of Square Loans, Afterpay Buy Now Pay Later, and Cash App Borrow are critical to their continued success and margin expansion. Since 2013, SQ has underwritten $22 billion in global loans with an aggregate loss rate that is below 3%. SQ may have found a way to outcompete traditional credit card companies by going after an underserved market of U.S. adults who are unable to access credit through the traditional financial sector. SQ acquired Afterpay and launched Cash App Borrow, which has been a success. Since the acquisition of Afterpay, consumers have exceeded $72 billion in spending, which has led to more than $1 billion being saved on late fees and interest. Afterpay has created an ecosystem that has become a driver of advertising revenue for SQ, as it’s created 460 million leads to merchants over the TTM while having over 138 million customer visits. SQ’s underwriting and actuarial process has allowed them to sustain a loss rate that is roughly 1% for buy now pay later, under 3% for Cash App Borrow, and 4% or less for recipients of Square Loans.

Block, Inc.

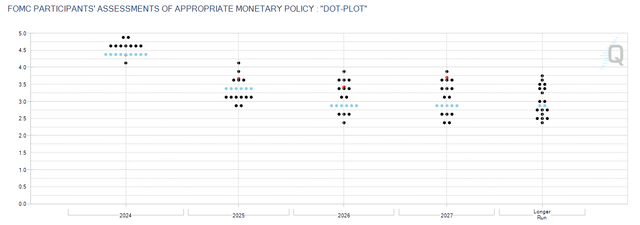

I like the metrics and the top and bottom-line growth I see in SQ’s underlying businesses and their quarterly numbers. CME Group is projecting that there is an 85.1% chance that the Fed will cut rates by another 25 bps later this month, while the Fed Dot Plot indicates that rates will decline to 3.5% in 2025 and 3% in 2026. A lower-rate environment is bullish for SQ as it will lower its borrowing costs, stimulate the economy, and incentivize businesses to tap into the debt markets to grow. Of the $22 billion in loans that SQ has provided, 58% of Square Loans are to women-owned businesses, and 36% were to minority-owned businesses. When interest rates decline, the cost of capital becomes cheaper, and it is likely that merchants utilizing SQ’s services will continue obtaining loans from SQ. This is only the first part of the flywheel because SQ is likely to benefit from increased consumer activity and benefit from additional payments flowing through their merchant portals.

CME Group

I think there is value to be unlocked in Block, Inc. and shares will continue to rally

SQ increased its Q4 guidance for Adjusted EBITDA, Adjusted Operating Income, and their margins. Previously, SQ guided for $2.9 billion in Adjusted EBITDA and $1.44 in adjusted operating income. They raised guidance after Q3 and are now projecting that their Adjusted EBITDA will be $3 billion and Adjusted Operating Income will come in at $1.56 billion. The margins will increase from 33% to 34% for Adjusted EBITDA and increase from 16% to 18% for Adjusted Operating Margin. In Q4, SQ is guiding for $2.31 billion in gross profit, which is a 14% YoY growth rate. SQ has a strong balance sheet with $8.86 billion in cash and short-term investments on hand, with only $5.93 billion in long-term debt. Now that SQ is profitable, their lending business become less risky, and there is more than enough cash on the balance sheet to facilitate increased originations from a lower rate environment.

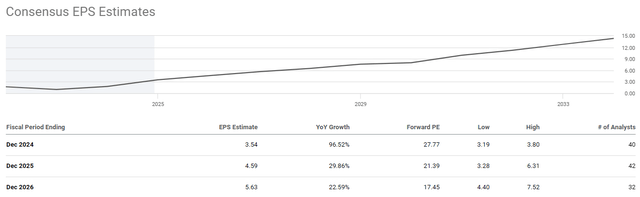

I have to agree with the bulls that SQ is going higher after going through the data and looking at the consensus estimates. SQ is expected to deliver $3.54 in EPS in 2024, placing its P/E at 27.77 based on this year’s earnings. SQ is expected to deliver 29.86% EPS growth next year and another 22.59% in 2026. Over the next 2 years, SQ is expected to grow its EPS by 59.04% as they add an additional $2.09 of EPS to its bottom line. This means that SQ is trading at 17.45 times their 2026 estimates, which is cheap, in my opinion, based on their growth trajectory. SQ’s revenue forecast also looks strong, as it’s supposed to grow at double-digit rates for the next several years and exceed $30 billion in 2026. I think there is a lot of value to be unlocked as long as SQ keeps delivering.

Seeking Alpha

Conclusion

I am not currently a shareholder of SQ, but I see that changing over the next several weeks. I am not catching SQ at the bottom, but when I look at a long-term chart, I find this price point very interesting. Investors are able to purchase shares for the same price as they were at the end of 2018 while the company was still unprofitable at a much cheaper valuation. I think that shares are starting to break out and will continue higher over the next several quarters. If SQ goes to $150, I don’t think anyone would be surprised, considering it is trading at less than 20 times 2026 earnings, and investors still remember the days when SQ had a share price that exceeded $200. I think SQ will benefit from a strong economy and that the macroeconomic environment is setting up well for its underlying businesses. SQ should also benefit from a pro-crypto environment, as there could be more transactions on Cash App for BTC-USD and other cryptocurrencies over the next several years.

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a shareholder of Block Inc yet, but I plan on becoming a shareholder in the future

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.