Summary:

- Boeing booked 113 airplane orders in March, including 85 Boeing 737 MAX jets from American Airlines.

- Deliveries decreased by 35 units compared to the same month last year, with a significant weakness in Boeing 737 MAX and Boeing 777F deliveries.

- Boeing expects a free cash flow burn of $4 billion to $4.5 billion for Q1.

- I’m downgrading Boeing stock from Buy to Hold amidst uncertainties.

the_guitar_mann

It’s an understatement to say that The Boeing Company (NYSE:BA) is having a horrible start to the year following the in-flight accident with the Boeing 737 MAX 9 in January. Production rate increases on the Boeing 737 MAX program have been prohibited, whistleblowers are testifying against Boeing and Boeing’s leadership will materially change by the end of the year as David Calhoun will depart as CEO of The Boeing Company. I recently weighed in on what’s next for Boeing in a Seeking Alpha roundtable. What’s clear, however, is that Boeing is missing any form of stability at this time.

While things are not looking pretty at all, I strongly believe that we should be looking at figures to see how bad things really are. Analyzing the monthly orders and deliveries of commercial jets is a key element of that. In the report covering the February numbers, I concluded that while there’s an undeniable drop in deliveries Boeing was not seeing a notable drop in airplane orders. To me that shows that while Boeing is facing a difficult time, there still is confidence in Boeing’s ability to turn things around. In this report, I will be discussing the airplane orders and deliveries for March and continue to emphasize the importance of monthly analysis as it provides us with the earliest indications of an improvement in Boeing’s delivery flows or the lack thereof.

Boeing Collects 737 MAX and 777X Orders

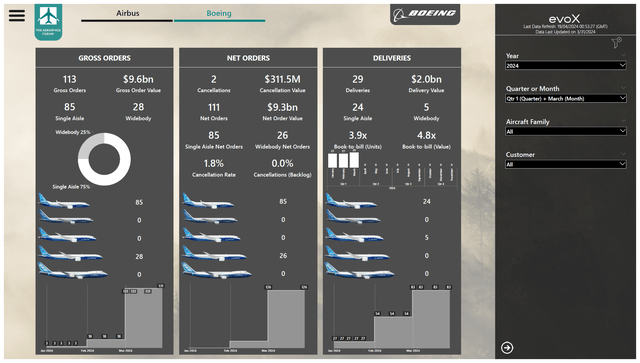

In March, Boeing booked 113 airplane orders with a value of $9.6 billion. 75% of the orders were for single aisle jets with the remainder for wide body airplanes:

- American Airlines Group Inc. (AAL) ordered 85 Boeing 737 MAX airplanes.

- Ethiopian Airlines Group ordered eight Boeing 777X airplanes.

- An unidentified customer ordered 20 Boeing 777X airplanes.

Boeing also processed several mutations in the order book:

- Ethiopian Airlines cancelled orders for two Boeing 777Fs.

- Azerbaijan Airlines converted orders for eight Boeing 787-8s to the bigger Boeing 787-9.

- An unidentified customer selected General Electric Company (GE) as the turbofan supplier for 14 Dreamliner airplanes on order.

- Donghai Airlines was identified as the customer for one Boeing 737 MAX.

- Gol Linhas Aéreas Inteligentes S.A. (OTCPK:GOLLQ) was identified as the customer for one Boeing 737 MAX.

- Air China was identified as the customer for three Boeing 737 MAX airplanes.

- China Eastern Airlines was identified as the customer for one Boeing 737 MAX.

- Shenzhen Airlines was identified as the customer for one Boeing 737 MAX.

- Xiamen Airlines was identified as the customer for one Boeing 737 MAX.

- Juneyao Airlines was identified as the customer for one Boeing 787-9.

While Boeing booked orders from just three customers during the month, it was still an important boost. At a time when United Airlines is reducing exposure to the Boeing 737 MAX 10 due to an uncertain certification timeline, American Airlines went big on the Boeing 737 MAX 10 ordering 85 new jets, converting orders for 30 Boeing 737 MAX 8s to MAX 10s with options for purchase rights for another 75 jets. While I have little doubt significant discounts have been obtained and there likely are contractual provisions for American Airlines to convert to other variants of the MAX family as well, Boeing will be keen to have this order added to the books as it tries to get the MAX 10 certified. The order from Ethiopian Airlines for the Boeing 777X also was a boost for the program along with the 20-unit order from an unidentified customer. The Ethiopian Airlines order comes with purchase rights for another 12 jets, but at the expense of orders for two Boeing 777Fs.

During the month, Boeing booked 113 gross orders and two cancellations bringing its net orders for the month to 111 airplanes valued at $9.3 billion. In the same month last year, Boeing booked 38 net orders valued at $3.4 billion. The difference was primarily driven by the order from American Airlines for 85 jets partially offset by higher cancellations last year. Year-to-date, Boeing has booked 126 net orders valued at $10.5 billion compared to 56 net orders valued at $6.4 billion in the same months last year.

The current environment is not a strong one for Boeing to cumulate orders due to uncertainty regarding the certification of new airplanes and the production rate profile, but we’re not seeing a significant reduction in orders yet. However, selling airplanes under these circumstances will be challenging, meaning that some momentum in airplane sales observed last year might not repeat this year.

Boeing Airplane Deliveries Are Under Pressure

The first quarter tends to be a slow one for jet makers, but for Boeing, there’s additional pressure due to increased scrutiny, production rate freezes on the Boeing 737 MAX program, and a shortage of GE90 turbofans which is affecting Boeing 777F deliveries.

In March 2024, Boeing delivered 29 airplanes valued at $2 billion:

- Boeing delivered 24 Boeing 737 airplanes.

- Boeing delivered no Boeing 767 or Boeing 777 airplanes.

- Boeing delivered five Boeing 787s, including three -9s and two -10s.

During the same month last year, Boeing delivered a total of 64 airplanes valued at $4.4 billion. Year-on-year, Boeing deliveries decreased by 35 units as the typical quarter-end surge in deliveries remained absent. Year-to-date, Boeing delivered 83 airplanes valued at $5.9 billion compared to 130 airplanes valued at $8.5 billion as there is a significant weakness in Boeing 737 MAX and Boeing 777F deliveries.

During the month, the book-to-bill ratio was 3.9 in terms of units and 4.8 in terms of value, reflecting a high order intake against a low delivery volume in combination with a favorable order mix. Year-to-date, the book-to-bill ratio is 1.6 in terms of units and 1.9 measured by value. ASC 606 adjustments, which adjusts for orders in the backlog for which not all requirements beyond the existence of a purchase agreement are met, increased by five units to 591. Under the current circumstances, Boeing is not able to count these orders towards the firm backlog, which currently stands at nearly 6,250 units (excluding the adjustments).

How Many Airplanes Did Competitor Airbus Deliver?

While Boeing delivered 29 airplanes, competitor Airbus delivered 63 airplanes. What we’re seeing is that the gap between Boeing and Airbus deliveries grew in March and that was to be expected as Boeing’s production is under pressure while Airbus is executing the typical delivery ramp-up. Whereas Boeing is seeing lower deliveries in the first three months of the year, Airbus saw its deliveries increase from 127 units to 142.

Boeing Cash Flow Targets Are Sliding

Due to the weak start to the year, Boeing expects a free cash flow burn of $4 billion to $4.5 billion for the first quarter compared to a nearly $800 million burn in the same period last year. Furthermore, the company expects that not all of that shortfall will be covered within the year, leaving it with a free cash flow of low single-digit billions. Boeing is still holding on to its target of $10 billion in free cash flow, but expects that cash flow target to be hit later in the 2025-5026 time frame. The reason without doubt is a slower than anticipated ramp-up in Boeing 737 MAX production rates.

Given the weaker than anticipated production ramp-up, free cash flow pressure, uncertainty regarding Boeing’s leadership changes, and pressure on the 2025 targets, I’m downgrading Boeing stock to a hold as its risk-reward profile does not look favorable to me.

Conclusion: Boeing Risk-Reward Profile Is Significantly Less Attractive

Boeing’s commercial airplane orders are still looking strong, which says something about the continued strength of the demand environment and the longer-term confidence of customers for Boeing to make the necessary changes to improve its product quality. However, at the end of deliveries, we’re seeing continued weakness without any sign of it getting better any time soon. That’s the price Boeing is rightfully paying at this moment. In combination with an uncertain production ramp-up profile, uncertainties regarding the path the next CEO will be heading, and free cash flow pressures I believe that Boeing is a better hold than buy at this point in time.

It’s not the case that I believe that Boeing will not get on top of things as I believe that Boeing has a strong engineering core that can thrive once again absent of management pressure induced by a financial framework that operations need to fit in. In my view, Boeing can be financially successful while also designing and manufacturing high quality jets. So, for the long term, I do believe that Boeing is a buy, but for now, I’m rating it a hold as we need to see tangible improvements in Boeing’s corporate culture coupled with improvements in deliveries. The deliveries will, of course, drive free cash flow, but I view an increase in deliveries as a sign that Boeing is operating more in line with the FAA requirements, and for that reason, I am keeping an eye on airplane deliveries.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.