Summary:

- Boeing booked 15 airplane orders in February, with a third of the orders for wide body airplanes.

- Deliveries for Boeing in February dropped compared to the same month last year, with a decrease in Boeing 737 MAX deliveries.

- Airbus saw an increase in deliveries in February, widening the gap between Boeing and Airbus deliveries.

Wirestock

Boeing (NYSE:BA) is having a rough start to the year as the company is facing intense scrutiny from the regulator following an in-flight accident with the Boeing 737 MAX 9. As a result, stakeholders, including airline executives, seem to have lost confidence in Boeing leadership, which led to the departure of Boeing CEO David Calhoun by year-end and the immediate departure of Stan Deal, CEO of Boeing Commercial Airplanes. Due to the eventful start of the year for the jet maker, I have not been able to provide the monthly order and delivery report on the regular schedule. This report, however, will be discussing the orders and deliveries for February 2024. I believe that, especially under the current circumstances, having access to detailed orders and delivery reports is important, as it gives us a sense of customer confidence in Boeing as well when analyzing orders and the deliveries give us a sense of how Boeing and its supply chain are performing amidst intensified scrutiny as the FAA has put additional eyes in the Boeing factories and in the factories of suppliers such as Spirit AeroSystems (SPR).

Boeing Orders Do Not Reflect Crisis

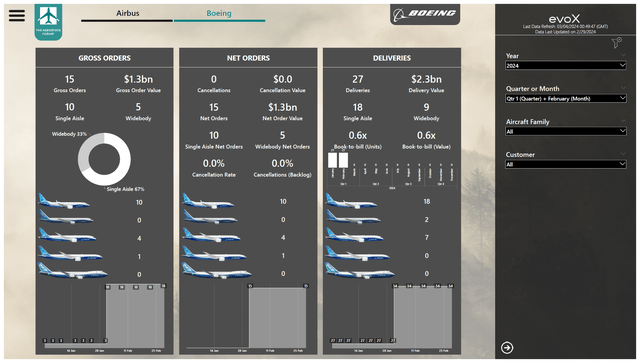

Boeing booked 15 airplane orders in February with a value of $1.3 billion. A third of the orders were for wide body airplanes, with the remaining 67% for single aisle airplanes:

- Royal Air Brunei ordered four Boeing 787-9s.

- An unidentified customer ordered 10 Boeing 737 MAX airplanes.

- An unidentified customer ordered one Boeing 777F.

Boeing also processed several mutations in the order book:

- Donghai Airlines, 9 Air, Shandong Airlines and Xiamen Airlines were identified as customer for one Boeing 737 MAX each.

- Orders for 30 Boeing 737 MAX airplanes previously listed under the name of 777 Partners are now allocated to Phoenix Aviation Capital.

- Thai Airways International was identified as the customer for 45 Boeing 787 airplanes.

As Boeing processed no cancellations during the month of February, its net order tally was also 15 orders valued $1.3 billion. In the same month last year, the US jet maker booked five gross orders valued $261.3 million and two net orders valued $104.5 million. So, from the monthly orders, it cannot be concluded that Boeing is seeing any reduction in orders due to the fresh problems at the plane maker. The year-to-date numbers, however, do show a decline. Gross orders dropped from 60 orders last year to 18 orders this year, with order value dropping from $5.2 billion to $1.4 billion. On a net basis, the net orders dropped from 18 orders valued $3 billion to 15 orders valued $1.2 billion. While the current environment is not a strong one for Boeing to cumulate orders due to uncertainty regarding certification of new airplanes and the production rate profile, we are not seeing a significant reduction in orders yet. However, selling airplanes under these circumstances will be challenging, meaning that some of the momentum in airplane sales observed last year might not repeat this year.

Boeing certainly did not have an impressive start to the year, and given the problems Boeing faces with the Boeing 737 MAX 9 after an in-flight accident earlier this year, the focus in January certainly was not on finalizing orders.

Boeing Airplane Deliveries Drop

The start of the year tends to be a slow one for jet makers. For Boeing, the expectations are that deliveries will be even softer than initially expected due to a more intense scrutiny on Boeing’s production processes, and the company is also aiming to reduce traveled work from suppliers, which basically means that fuselages are not shipped until all work on the fuselages is performed to satisfaction. The aim for a reduction in traveled work should result in more standardized assembly routines and a higher focus on quality.

In February 2024, Boeing delivered 27 airplanes valued $2.3 billion:

- Boeing delivered 18 Boeing 737 airplanes, including one P-8A Poseidon and 17 MAX airplanes.

- Boeing delivered two Boeing 767s, one Boeing 767-2C, which functions as the base aircraft for production of the KC-46A tanker, and one Boeing 767-300F.

- Boeing delivered seven Boeing 787-9s.

- There were no deliveries for the Boeing 777 program.

During the same month last year, Boeing delivered a total of 28 airplanes valued at $1.9 billion. Year-on-year, Boeing improved its delivery value. That was driven by higher Dreamliner deliveries compared to last year. Boeing 737 MAX deliveries, however, dropped from 25 to 18 units, which I believe clearly demonstrates a lower output due to changes in Boeing procedures and integration of increased FAA oversight on the production process. Furthermore, there were no Boeing 777 deliveries, which I believe is caused by a shortage of GE90 turbofans (GE). Earlier, Air France-KLM (OTCPK:AFRAF) already reported an increase in stationary engines in its engine shops due to shortages of GE90 parts.

Year-to-date, Boeing delivered 54 airplanes valued at $3.9 billion, compared to 66 deliveries valued at $4.1 billion a year ago. Softness in Boeing 737 MAX and Boeing 777 deliveries are partially offset by higher Dreamliner deliveries, but overall we do see that Boeing is having a hard time getting Boeing 737 MAX airplanes to customers.

During the month, the book-to-bill ratio was 0.6 in terms of units as well as value, reflecting a low order intake as well as a low delivery volume. Year-to-date, the book-to-bill ratio is 0.3 in terms of units and 0.4 measured by value. ASC 606 adjustments, which adjusts for orders in the backlog for which not all requirements beyond the existence of a purchase agreement are met, reduced by four units at 586. Under the current circumstances, Boeing is not able to count these orders towards the firm backlog, which currently stands nearly 5,600 units (excluding the adjustments). The positive, however, was that the ASC 606 reduction were driven by orders meeting additional criteria, so Boeing can add them to the backlog again.

How Many Airplanes Did Competitor Airbus Deliver?

While Boeing delivered 27 airplanes, competitor Airbus (OTCPK:EADSF) (OTCPK:EADSY) delivered 49 airplanes in February. So, what we’re seeing is that the gap between Boeing and Airbus deliveries grew in February and that was to be expected. Whereas Boeing is seeing lower deliveries in the first two months of the year, Airbus saw its deliveries increase from 66 units to 79.

Conclusion: Boeing Braces For A Tough Year

Looking at orders for commercial airplanes, we do not see customers walking away from Boeing and net orders in the first two months of the year are only marginally lower than last year. However, I believe it will be more difficult for Boeing to copy last year’s sales success. Production rates are much lower than the 38 airplanes per month at which the FAA froze 737 production. With uncertainty regarding the ramp up profile and delays in the Boeing 737 MAX 10 certification, which should have taken a bigger share in the MAX 737 orders, there is little incentive besides discounts for customer to order Boeing 737 MAX airplanes. Essentially, this means that order strength as well as pricing power that Boeing enjoyed last year are likely to fade. At this stage, it simply does not make sense for customers to order airplanes if they do not even know when the airplanes that are already on order will arrive.

On the delivery side, we clearly see the impact that intensified scrutiny from the FAA, Boeing’s emphasis on safety and quality and a reduction in traveled work have on the ability to deliver jets. I believe that for the quality of the product that is a good thing, but it also does show that the entire process is much slower and one can wonder at which delivery rate Boeing will be able to stabilize its deliveries this year. I believe it will be interesting to see whether Boeing can get its production and delivery rates anywhere near the 38 airplanes per month that the master schedule dictates. Not getting to those rates would provide a strong indication of how much Boeing had to reform its procedures and how time-consuming the process of integrating intensified scrutiny from the FAA will be. I believe that Boeing is making small steps in the right direction by changing its leadership, but in the coming months, it will be pivotal for Boeing’s business to see whether the company can combine higher deliveries with a higher quality product. I am maintaining my buy rating as I believe that the company will finally implement a healthier corporate culture which core engineering values in mind, but I am downbeat on Boeing’s financial performance this year and believe that achieving the 2025-2026 financial targets will be a challenge. Although, as long as Boeing does the right thing this time with a focus on quality, I would not mind the company missing its 2025-2026 financial targets for the simple reason that I would like the company to focus on safety and quality and grow its production rates in line with that and from there the free cash flow will grow. What I do not want to see is the company taking a free cash flow oriented approach where quality is a function of financial metrics.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF, SPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.