Merck: We Were Wrong, But The Exuberance Is Overly Done Here (Rating Upgrade)

Summary:

- We have been overly cautious in our previous articles, as MRK runs away to outperform the wider market, thanks to the ever increasing Keytruda indications and successful acquisitions.

- With Keytruda receiving 14 new approvals in 2022, 15 in 2023, and 3 YTD, the management is working hard to extend the LOE while introducing a new subcutaneous administration.

- We may also see the FY2024 guidance moderately raised, given the recently approved Winrevair, with it expected to generate up to $8.2B in peak annual sales.

- MRK has a GLP-1 candidate in the clinical trial phase 2, efinopegdutide, with it outperforming semaglutide for weight loss and liver fat content moderation.

- However, with the stock currently priced for perfection, interested readers may want to add after a moderate pullback for an improved margin of safety.

Klaus Vedfelt

We previously covered Merck (NYSE:MRK) in November 2023, discussing its intermediate term uncertainty as Keytruda faced the first patent expiry in the US by 2028.

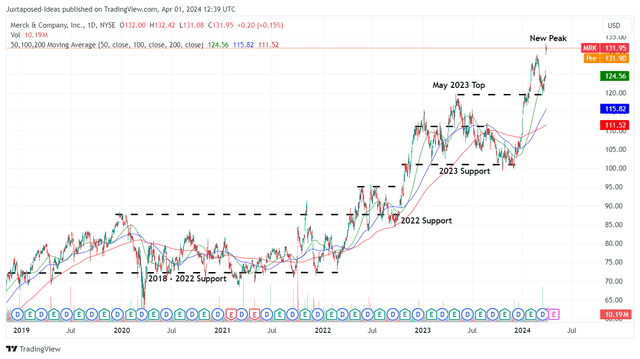

As a result, we believed that the management might engage in further acquisitions and partnerships to bolster its pipeline, potentially eroding its balance sheet. Combined with the stock’s lower lows and lower highs since the May 2023 top, we were uncertain if there was any margin of safety then, resulting in our Hold rating then.

In this article, we shall discuss why MRK has been upgraded to a Buy, with us being overly cautious in our previous articles, as the stock runs away to hit a new peak at the time of writing.

With MRK currently priced for perfection, interested readers may want to add after a moderate pullback for an improved margin of safety and expanded dividend yields. Then again, with it continuously generating alpha despite the notable Keytruda headwinds, we believe that investors may chase this alpha at any dips.

We Had Been Overly Bearish On MRK Indeed

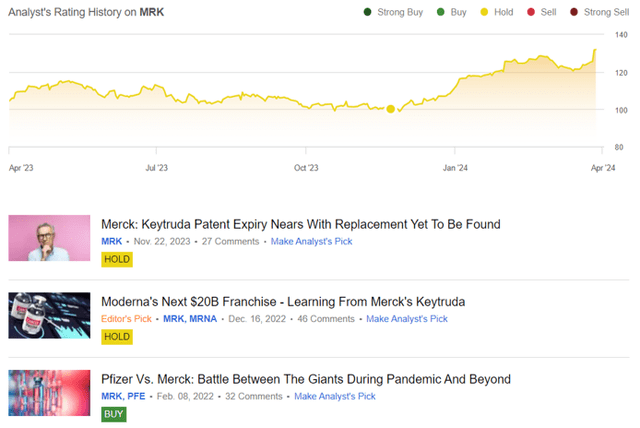

Author’s Historical Rating

It is apparent by now that we have missed the boat, with us erroneously rating MRK as a Hold during the October/ November 2023 bottom, as the stock charts an impressive +27.4% return since then, well outperforming the wider market at +15.4%.

With Keytruda receiving 14 new approvals in 2022, 15 in 2023, and 3 YTD, it is apparent that we have been overly cautious then, especially since the management continues to expand the therapy’s indications with 13 other clinical trials/ reviews ongoing.

In addition, with over 35 indications already approved in the US, it is apparent that the expiry timeline of 2028 may be eventually prolonged, depending on when the specific indication is approved by the US FDA.

For example, while MRK’s type 2 diabetes therapies, Januvia/ Janumet XR, was expected to expire in the US by 2023, as a result of favorable court rulings and settlement agreements related to a later expiring patent directed to a different form of the therapy, Januvia/ Janumet XR’s market exclusivities had been extended to July 2026 instead.

Perhaps this is why the MRK management has aggressively expanded Keytruda’s indications, while also attempting to introduce a new method of subcutaneous administration with clinical trials to be completed by 2026.

As a result, it appears that Keytruda may remain the top/ bottom line driver through the end of the decade, with the therapy recording an impressive annualized FQ4’23 global sales of $26.4B (+4.2% QoQ/ +21.1% YoY).

In addition, MRK has already offered a rather optimistic FY2024 revenue guidance of $63.45B (+5.5% YoY) and adj EPS guidance of $8.51 (+10.2% YoY) at the midpoint, beating the consensus estimates of $63.31B (+5.3% YoY) and $8.42 (+9% YoY), further demonstrating its profitable growth trend thanks to Keytruda.

We may also see this guidance moderately raised over the next few quarters, attributed to the recently approved pulmonary arterial hypertension therapy, Winrevair, with the latter expected to generate up to $8.2B in peak annual sales.

While we have been previously concerned about MRK’s balance sheet health with growing net debt of $26.59B (+5.4% QoQ/ +70.9% YoY), those fears may have been unfounded after all, based on the estimated net-debt-to-EBITDA ratio of 1.42x in FY2023, compared to 0.58x in FY2022 and 0.62x in FY2019.

Most importantly, MRK’s leverage ratio appears to be reasonable compared to its peers, such as AbbVie (ABBV) at 1.50x, Pfizer (PFE) 4.26x, and the average general drug manufacturer at 2.04x.

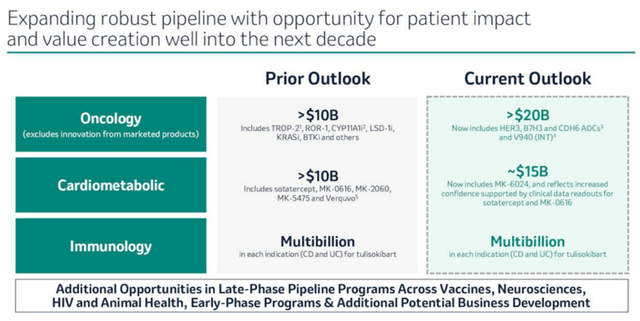

MRK’s Raised Next-Decade Guidance

With Winrevair being a result of the $11.5B Acceleron acquisition in 2021, it is apparent that MRK’s numerous acquisition sprees have worked as intended, with the management also doubling their next-decade oncology guidance from over $10B to over $20B.

If anything, the pharmaceutical company has a GLP-1 candidate in the clinical trial phase 2, efinopegdutide, with the therapy triggering an expanded weight loss by -8.5% and liver fat content moderation by -72.7%, compared to the semaglutide at -7.1% and -42.3% by week 24.

With the FDA fast track designation already obtained, we may see efinopegdutide potentially be MRK’s top/ bottom line driver, similar to Novo Nordisk’s (NVO) Wegovy/ Ozempic and Eli Lilly and Company (LLY) Mounjaro/ Zepbound.

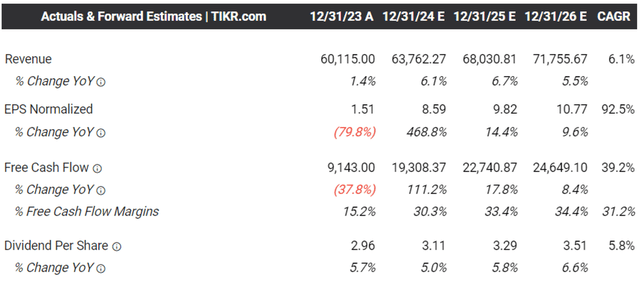

The Consensus Forward Estimates

Consequently, we can understand why the market has further raised their forward estimates, with MRK expected to generate a top/ adj bottom line growth at a CAGR of +6.1%/ +11.7% through FY2026.

This is compared to the previous estimates of +4.8%/ +9.3%, while building upon its historical growth of +6.1%/ +10.7% between FY2016 and FY2023, respectively.

MRK Valuations

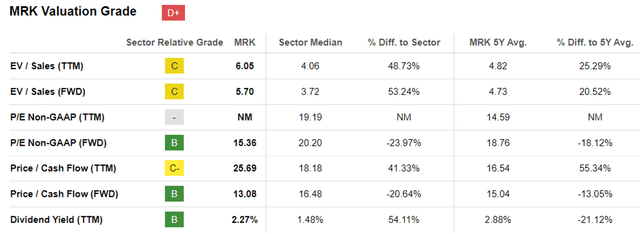

Perhaps this is why the market continues to reward MRK richly, with FWD P/E valuations of 15.35x and FWD Price/ Cash Flow of 13.08x near to its 1Y mean of 16.60x/ 18.35x and 3Y pre-pandemic mean of 15.89x/ 19.88x.

The same has been observed in its pharmaceutical peers facing similar LOE issues, such as ABBV at 16.21x/ 14.83x and PFE at 12.53x/ 9.90x, respectively, implying the market’s exuberance regarding their abilities to weather the top/ bottom line headwinds.

So, Is MRK Stock A Buy, Sell, or Hold?

MRK 5Y Stock Price

For now, MRK has already recorded an impressive recovery from the October 2023 bottom, while charting a new peak at the $130s.

Based on the FY2023 adj EPS of $7.72 (including certain business development transactions) and the FWD P/E of 15.36x, it is apparent that the stock is trading near our fair value estimate of $118.50.

On the one hand, based on the consensus FY2026 adj EPS estimates of $10.77, there seems to be an excellent upside potential of +25.3% to our long-term price target of $165.40.

This is on top of MRK’s relatively friendly shareholder friendly policies thus far, with a 5Y Dividend Growth Rate of +8.84% and forward dividend yield of 2.33%, compared to the sector median of +6.28% and 1.57%, respectively.

On the other hand, with Keytruda’s US patent expiry by 2028 and three biosimilar candidates already in clinical trials with an estimated completion by mid-2025, it remains to be seen how the new Keytruda subcutaneous formulation may perform.

This is especially since the US comprises $15.11B (+19.1% YoY), or 25.1% (-3.8 points YoY) of MRK’s FY2023 overall sales, with the management already anticipating the “sales of Keytruda to decline substantially” after LOE.

Combined with the YTD rally of +21.03% and the current retest of the $130s peak, we believe that we may have been too late to this game, with the stock running away from us.

As a result, we are finally re-rating the MRK stock as a Buy, though with no specific entry point since it depends on individual investors’ dollar cost averages and portfolio allocation.

At the same time, they must also size their portfolios accordingly, with Keytruda’s eventual LOE in 2028 potentially triggering a similar halving in stock value as observed in PFE, if a successor is not found.

While past performance is not indicative of future returns, we believe that MRK may continue to generate alpha for long-term shareholders, both in capital appreciation and dividend incomes, with the stock being one that investors may chase at every dips, especially since it mirrors the wider market returns over the past few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.