Summary:

- Boston Beer Company’s hard seltzer brand, Truly, has been impacted by evolving consumer tastes and increased competition.

- The success of Truly was followed by a burst in the hard seltzer market, leading to a decline in sales and market share.

- Despite challenges, Boston Beer Company has the potential to adapt and grow through innovation, strategic partnerships, and entering new beverage categories like RTD.

Bloomberg/Bloomberg via Getty Images

Introduction

Do you remember hard seltzer?

I sure do. Hanging out at the beach, sitting out at a picnic, cruising around on the boat, a hard seltzer just did the trick. At least it used to…

But now more than ever, I find myself gravitating towards ready-to-drink beverages or avoiding alcohol entirely. This shift away from hard seltzer has impacted one public company more than almost any other: Boston Beer Company (NYSE:SAM), maker of the Truly Hard Seltzer brand.

Recognized for its influential role in the craft beer movement, particularly through its Sam Adams brand, Boston Beer ventured into the hard seltzer market early on in 2016 as part of its strategic diversification. For a time, the launch of the Truly brand resulted in incredible market success, aligned with a growing consumer preference for lighter, health-conscious alcoholic options.

Nevertheless, evolving consumer tastes and increased competition have shaken the company and had a major financial impact greater than most expected.

In this article, I’ll examine Boston Beer Company’s expansion into the hard seltzer arena, the challenges Boston Beer encountered with the Truly brand, and provide an analysis of the company’s future direction.

Boston Beer Company: Pioneering Brews

Before delving into its tumultuous hard seltzer endeavors, let’s take a brief look back at the roots of the Boston Beer Company. Founded by Jim Koch with a respect for traditional brewing techniques and a pioneering spirit, Boston Beer was at the forefront of the craft beer revolution. Its early commitment to quality and flavor innovation earned it a loyal consumer base and industry acclaim, leading to many referring to Jim as a grandfather of the craft brewery movement.

However, recognizing changing consumer tastes, much like it did with craft beer, Boston Beer Company took a hard pivot away from beer and ventured into the hard seltzer market, identifying it as a burgeoning niche that resonated with health-conscious consumers and those seeking a lighter alternative to traditional beer and ciders.

Truly, alongside the even more popular White Claw, capitalized on the market’s zeitgeist with its flavored offerings and appealing brand persona. The success story of Truly and hard seltzer broadly in 2019-2021 was nothing short of spectacular, with sales and profits soaring to unprecedented heights, and to many, seemed to signal a new era for the company.

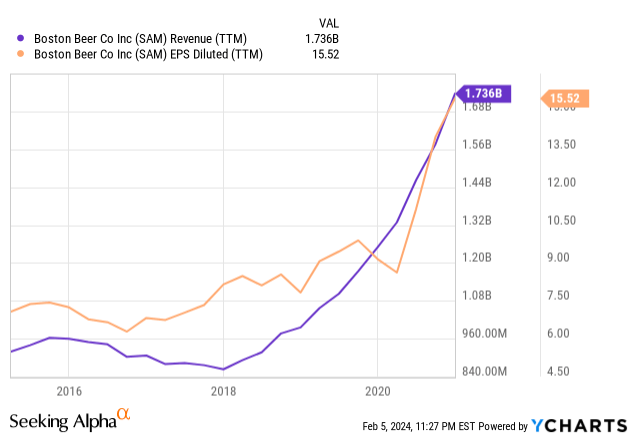

In fact, the growth was so strong that at one point, sales were doubling year over year, with the company noting, “Truly continues to generate triple-digit volume growth, and we are continuing to expand package and draft distribution across all channels” in 2020.

The pitch of a 100-calorie beverage, with low/no added sugars and a light flavor that was easy to sip on, just resonated with people.

For a while, it seemed like hard seltzer could not be stopped.

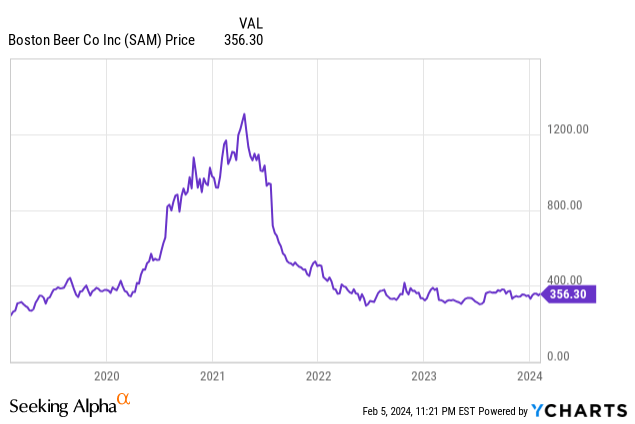

Sales, followed by earnings, rapidly increased as the company doubled in size in a mere matter of months. Such rapid growth led to impressive earnings gains for investors but ultimately, as we shall see, also led to some growing pains.

The Bursting Bubble: Easy Come, Easy Go

Despite the initial triumph of Truly, quite soon, some harsh realities were realized. What was once a blue ocean of opportunity, the hard seltzer market rapidly transformed into a red ocean of cutthroat competition. New entrants flooded the market, each vying for a slice of the lucrative seltzer pie with products almost identical to Truly’s low-calorie, low-flavor spiked seltzer.

Hard seltzer, once a unique selling point (compared to beer), quickly became commoditized as more and more competitors flocked in. Shortly after that, making matters worse, the burgeoning popularity of Ready-To-Drink (RTD) beverages, offering diverse flavors with real spirits, further intensified the competition. High Noon and other such brands began chipping away at Truly’s market share by leveraging what many consumers believed to be superior liquor and flavors.

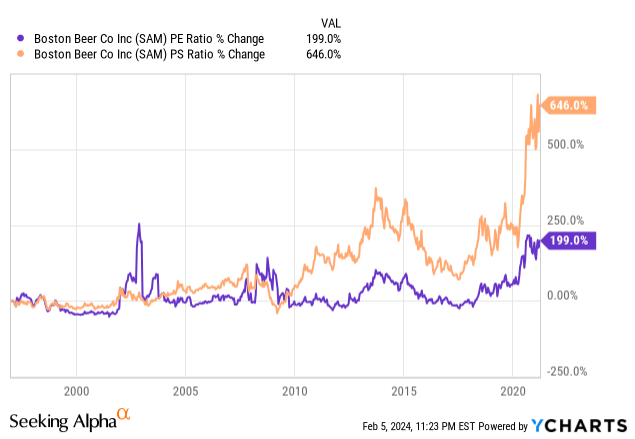

The result of the increased competition was a stark and swift reversal of fortunes for Truly and Boston Beer– sales plateaued, and the market’s exuberance gave way, leading to a valuation bubble that inevitably burst.

Financial Repercussions and Missteps

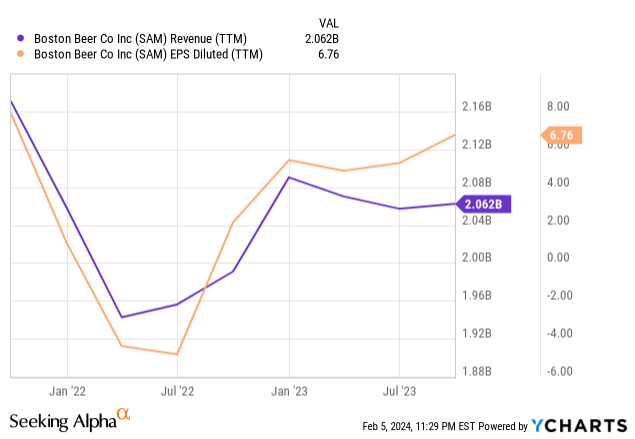

Given the scale of its new business line, the downturn in Truly’s fortunes had far-reaching financial implications for Boston Beer Company. The stark contrast between supply and waning demand led to overproduction, culminating in the distressing decision to dispose of surplus stock.

Thousands of gallons of Truly were simply and quite literally poured down the drain.

Earnings per share, once over $15 a share, soon became negative as revenues cratered, and the floor seemingly just fell out. All bets were off.

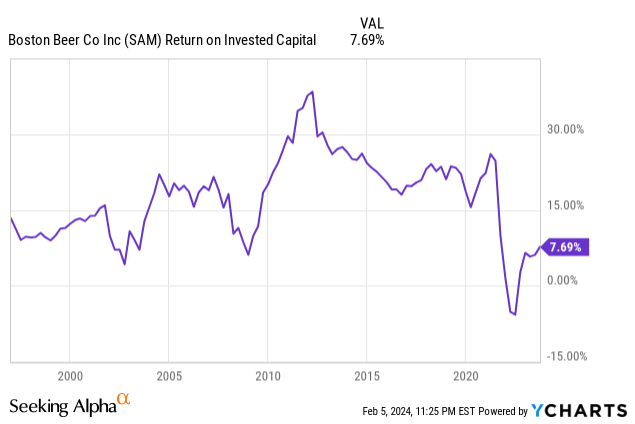

As a result, the impact on the company’s return on invested capital was profound, prompting introspection about the efficiency and foresight of its investment strategies.

Historically, at Boston Beer, returns on invested capital were around 15% or higher almost every year; after the Truly mishap, returns on capital dropped and never recovered to those same historical levels.

Adaptation and Forward Momentum

But despite these challenges, I believe the fundamental strengths of Boston Beer Company should not be underestimated. The company’s history of innovation, it’s robust brand portfolio, and agility are potent differentiators.

Without a doubt, the lessons learned from the Truly episode will help inform and refine the company’s future strategies. For example, it’ll help them balance their aggressive strategy of entering new niches in the beverage space with safer demand forecasts. This should continue to be useful as they explore new categories like RTD, a category that could be a major growth driver for the wider industry.

According to research from IWSR, “The RTD category is expected to grow by +12% in volume between 2022 and 2027, hitting $40bn by 2027 across 10 key markets. This growth will be driven by the key cocktails/long drinks sub-category and products that sit within the premium-and-above price bracket.”

The company’s endeavors in the RTD segment, such as Dogfish head canned cocktails, potential for strategic partnerships with established spirits brands, and its commitment to expanding its product portfolio to cater to a diverse consumer base indicate a proactive and resilient posture.

Navigating Risks and Seizing Opportunities

According to a recent McKinsey report, there’s a marked shift in Gen Z’s alcohol consumption patterns, veering away from traditional alcoholic beverages towards healthier, nonalcoholic alternatives. Popular choices for Generation Z shoppers include functional and fermented drinks like kombucha, which resonate with Gen Z’s preference for health-benefiting beverages.

These insights from McKinsey indicate a substantial transformation in consumer behavior, driven by heightened health consciousness and changing taste preferences, signaling a major evolution in the beverage industry shaped by the younger generation’s values and lifestyle choices. However, this shift presents notable challenges for companies like the Boston Beer Company. The growing trend of reduced alcohol consumption, particularly among Gen Z and Millennials, is reshaping the industry’s landscape as the increasing preference for moderation or complete abstinence from alcohol alters the market.

In this context, Boston Beer Company’s focus on acquiring and nurturing growth brands becomes even more critical. While somewhat infrequent, Boston Beer has shown they will acquire a business outright. In 2019, The Boston Beer Company acquired Dogfish Head Brewery in a $300 million deal, creating a leading American-owned craft beer platform and preserving its independent status.

Deals like this show that when Boston Beer sees an opportunity to buy its way into a new market or consolidate market share, it is more than happy to do so.

As a smaller company, these transactions can move the needle more significantly than they might for larger companies. Future M&A will be something that I pay close attention to as I weigh a longer-term position in the company.

Conclusion

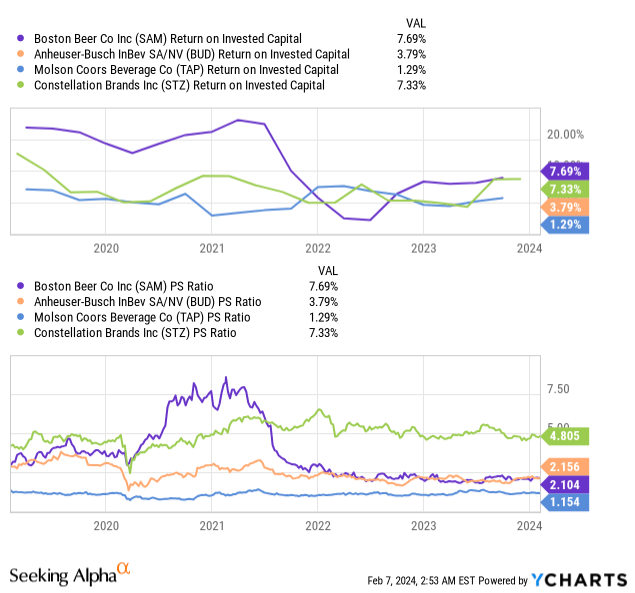

As mentioned earlier, historically, Boston Beer’s returns on invested capital have been best-in-class, and likewise, its valuation was at or near the top of the pack. Nowadays, its valuation is much, much lower, in line with AB InBev (BUD), despite having returns on invested capital similar to Constellation Brands (STZ) (7.7% vs 7.3%), which has the highest price-to-sales multiple at 4.8X sales.

That’s a strange combination of above-average returns on invested capital with a mere average valuation. I can understand how concerns regarding the Truly debacle may weigh on investors, but the rest of the business still looks strong, and Truly appears to be stabilized.

In conclusion, from my perspective, a bet on Boston Beer is a bet that it can return to its former glory. Given the Truly inflicted trauma, I highly doubt they will repeat the same mistakes.

As such, while I still have some worries, I rate Boston Beer stock a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.