Summary:

- The deterioration of consumer demand for Truly brand has majorly impacted business performance. Wider than expected loss in Q4 and weaker full-year profit forecast for 2023.

- While SAM maintains a healthy balance sheet, gross margins are declining, and top brands are unpopular amongst consumers.

- Cautious of alcohol headwinds hitting SAM harder than competitors, and ongoing production mix and supply chain inefficiencies.

Rob Kim

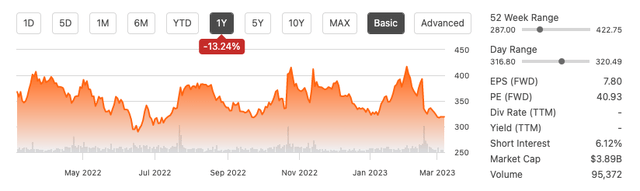

Boston Beer Company, Inc. (NYSE:SAM) is in a bad spot. It heavily invested its resources into no longer popular products and has been paying the price over the last financial year. The stock market has lost confidence in the stock, and we have seen the price decline by 13.24% over the previous year and short interest increase to 6.12%.

One-year stock trend (SeekingAlpha.com)

The company invested heavily in hard seltzers, Truly. While there was an initial demand which led to a major sales increase for the company. Moving into 2021 and 2022 SAM has continued to push Truly, which has truly lost its customer appeal. Its price-to-earnings ratio of 40.90 is well above its alcohol stock peers, indicating, although the stock price has significantly dropped, it may still be overvalued. To save face, SAM is investing in rebranding efforts. However, is this enough to turn around the downward trending financial performance? SAM highlighted its Twisted Tea success, which only accounts for a small percentage of the overall profits. With a long road ahead and no clear growth strategy from the management team, I do not recommend buying this stock but giving it a hold rating.

Overview

SAM, the company to revolutionise craft beer, was founded in 1984 and IPOd in 1995. Although most famous for its beer brands, the company has been transitioning to a broader beverage company, aiming to be a leading supplier of high-end and beyond beer alcohol categories. It produces and sells alcoholic beverages under several different brands. However, only two brands have solid performances: Twisted Tea and the Dog Fish head craft beer. Unfortunately, these are not the brands that SAM has been heavily investing in, forecasting significant demand for Angry Orchard and Truly brands, which has not materialised.

The Boston Beer Company brands (Bostonbeer.com)

These days, SAM is making more seltzers and tea than beer, with only about 10% of their portfolio focused on beer. The management is taking another shot at reinventing its hard seltzer brand with a new branding effort. There is little confidence within the stock market regarding these efforts and the impact on their downward-trending sales.

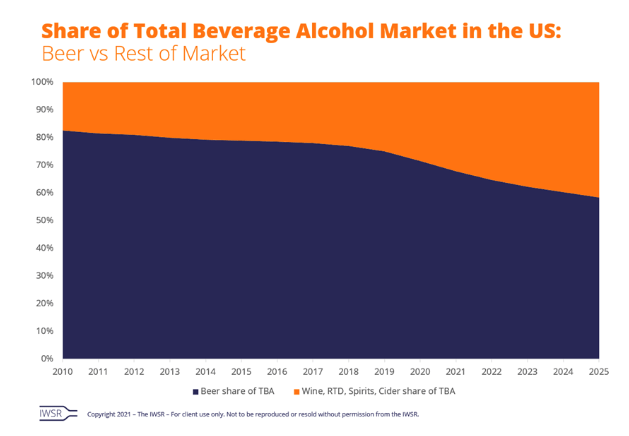

Beer industry challenges, along with fierce competition

The beer industry has been facing significant headwinds for decades, competing against increasing demand for hard liquors. Over the last few years, many beer companies have followed similar transitional strategies to diversify their brand portfolio within the fiercely competitive beverage alcohol market.

Beer consumption decrease (Theiwsr.com)

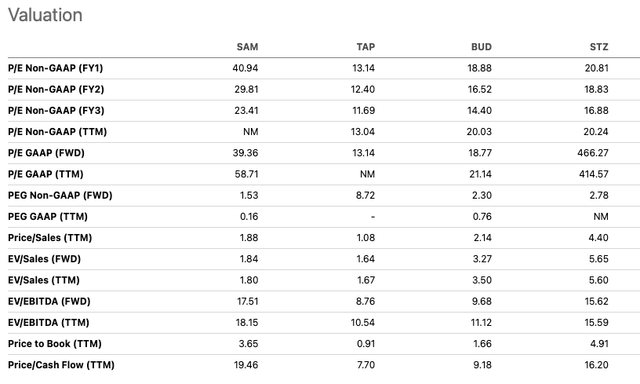

While the market has seen a general slowdown, SAM has fallen further behind its competitors. It is underperforming the market and losing brand prestige in its traditional beer sales and hard seltzer beverages. Unfortunately, SAM’s performance has worsened over the last period, mainly due to betting on the wrong products in their portfolio. SAM has invested a lot in Truly and Angry Orchard, and consumers are not interested in those products. Since 2021 the company has been overbuying and dealing with the costs involved. If we compare SAM to Constellation Brands (STZ), which also has a broad and diverse portfolio, the management team have made better decisions on which products to focus on. If we look across the valuations of SAM and some of its larger peers, Molson Coors (TAP), STZ, and Anheuser-Busch (BUD), we can see that the stock is overvalued across its P/E ratio and EV/EBITDA ratios.

Relative peer valuation (SeekingAlpha.com)

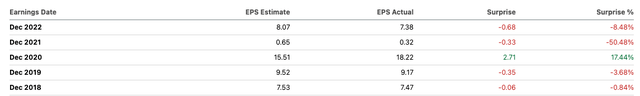

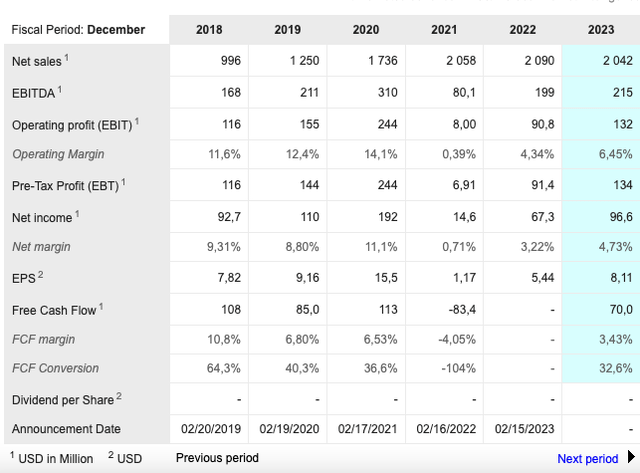

Q4 and FY2022 Earnings release

SAM released its fourth-quarter and full-year earnings report in February 2022. The results were mixed. The company improved revenue YoY in Q4 2022 by 28.6% to reach $447.5 million, and shipment volume increased by 16.7% to around 1.71 million barrels. It has also doubled its revenue since 2019 to reach $2.1 billion in sales for FY2022. However, SAM has only surpassed EPS expectations once in the last four quarters. For Q4, the company reported EPS of negative $0.92, missing expectations by $1.51. We see underwhelming results from the annual EPS actual performance over the last five years.

Annual earnings estimates versus actual (SeekingAlpha.com)

We can see a decreasing operational margin to 4.34% this year, considering that FY2021 was an outlier. In 2019, earnings fell by -8.50%. In 2020 earnings fell by -16.43%. In 2021 earnings fell by -15.38%, and in 2022 earnings fell by -71.72%. The average annual earnings decline has come to 28.01% since 2019. The management team expects to start the new financial year with a net loss for Q1 2023 and estimates GAAP EPS between $6.00 to $10.00 for the full financial year of 2023, which falls under the consensus of $11.47.

Financial overview (Marketscreener.com)

Balance sheet

SAM has a strong balance sheet and positive free cash flow, meaning the company can invest in the business and reward shareholders. It ended the year with $182 million in cash, $150 million in unused credit lines and $55.60 million in debt. It has a positive levered free cash flow of $107.92 million. The company expects capital expenditure between $100 million and $140 million for 2023 to improve efficiencies and build capabilities. While SAM did not repurchase any shares in the financial year 2022, for FY 2023, the company has purchased $8.9 million in shares, with $81.5 million remaining.

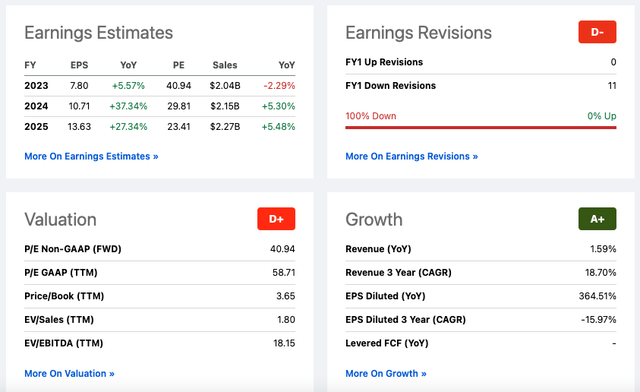

Valuation

For the next financial year, the estimated EPS is $7.80, with an FWD price-to-earnings ratio of 40.94. SAM’s stock price reached a high of $1200 in 2021 and fell to nearly $317. Seeking Alpha’s Quant rating for SAM’s valuation is a D+. The stock has been heavily criticised due to its disappointing bottom-line performance. The stock has lost much appeal over the last year, and many analysts have downgraded their ratings to underperform and neutral.

Quant Grading (SeekingAlpha.com)

Final thoughts

Although SAM doubled its revenue between 2019 and FY2022 to reach $2.1 billion in sales, it has not been delivering on its earnings. While hard seltzer pushed along the growth initially, consumer demand for the product has drastically dropped, which has pulled down the financial results. The management team mispredicts consumer demand, and the stock market has not reacted well to its most recent earnings report and predictions for the next financial year. While the company has a healthy balance sheet, I believe the management team needs to do more than revamp their failing Seltzer brand. Therefore I recommend a hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.