McDonald’s Management Undervalued Despite High Food Prices

Summary:

- McDonald’s Corporation reported impressive financial performance for Q1 2023, resulting in positive share price Momentum.

- Despite its large size, I believe McDonald’s is fast-moving with new product and process launches while maintaining customer favoritism.

- Overall, McDonald’s has brilliant prospects. Despite high valuations, I believe mispricing exists due to an exceptional management team, resulting in a strong Shareholder Yield that raises my rating to a Buy.

Neilson Barnard/Getty Images News

Investment Thesis

McDonald’s Corporation (NYSE:MCD) recently reported impressive financial performance for Q1 2023, initially increasing its share price momentum. The earnings reveal that the corporation’s historically strong profitability continues. In addition, the longer-term performance seems to trend in McDonald’s favor. Despite its large size, I believe the company is fast-moving with its new product and process launches while maintaining customer favoritism.

Upper management successes affirm the strength of McDonald’s strategies. This is made evident by steady internal improvements and share price increases. While strong forward prospects do not necessarily result in an appealing investment, I believe the company’s management is the true source of undervaluation.

The current high-priced valuation of McDonald’s may deter traditional value investors; however, I believe their impressive management team appears to be steadily driving the stock forward, resulting in my rating of McDonald’s as a Buy.

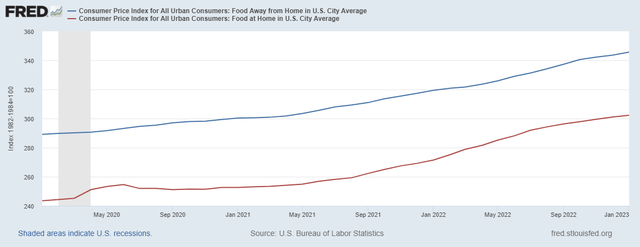

Food Prices Plateau, For Now

According to the US Consumer Price Index, food prices have increased considerably across both food away from home and food at home since 2020. So far, in 2023, customers have accepted restaurants’ price increases more than grocery stores’. In fact, a February weekly restaurant survey highlights a 28% increase in 3Y sales for fast-casual dining overall. That is up 1% from January.

I believe consumers may prefer the convenient low-cost of McDonald’s sandwiches over paying up for the same food prepared at home. January price changes appear to support this, as the cost of beef dropped while egg prices soared. Thus it might feel easier for consumers to stop by McDonald’s than to make the same type of food at home. In addition, while food prices have risen a lot, the month-over-month pace plateaued relative to last year’s increases.

Federal Reserve Bank of St. Louis

McDonald’s earnings report communicated that higher prices led to higher profitability. This bolstered the stock somewhat. Today, MCD ranks 11th out of 42 stocks in the restaurant industry. A 3-place improvement from the week prior to earnings. MCD is also the largest name in the restaurant industry by cap-size.

The company noted in their 10-K that while they “temporarily closed restaurants in Russia and Ukraine due to the ongoing war in the region” during Q1 2022, sales of business in Russia followed in Q2. In addition, Ukraine’s restaurants reopened as early as September 2022. Their reopening coincided with a 15-year purchase agreement with EDF for low-carbon electricity, with a 2024 delivery expectation. Thus ensuring that MCD continues to innovate.

Lifting news up, the Fast Food Post reported that MCD recently added a classic lemonade to its beverage menu. It uses real lemon juice and cane sugar at just around a buck-fifty launch price. This could attract more health-conscious customers and compete with Wendy’s lemonade offerings. Thus preventing Wendy’s from maintaining their advantage in the lemonade niche they’ve become known for on social media.

In addition, MCD partnered with Beyond Meat (BYND) for now-newly-launched plant-based McNuggets and a McPlant burger. MCD is also testing Krispy Kreme (DNUT) ‘s donuts across 160 Kentucky restaurants starting March 21st. If successful, this could increase the firms’ stock prices, just as it allegedly has for BYND’s stock price previously. Other notable news is MCD’s recent launch of a “Better Burger” program and the $1.52/share dividend payout upcoming March 15th.

At the same time, while global food prices recently reverted to pre-2022 levels, the future may not be so kind. In Ukraine, the “bread basket of the world,” grain exports appear to be decreasing. This coincides with eastern shipping bottlenecks and western droughts’ negative impact on crop yields. Ultimately culminating in higher food prices on a go-forward basis.

Throughout all this news, one thing stands true. MCD is surprisingly agile, using its size to expand across numerous areas simultaneously.

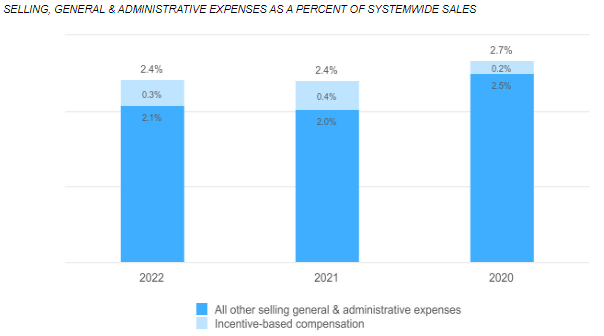

As mentioned in the 10-K, “Franchised restaurants represented 95% of McDonald’s restaurants” I believe this decreases the number of potential distractions for management and improves overall efficiency firm-wide, enabling greater agility in the process.

McDonald’s Corporation 2022 Annual Report

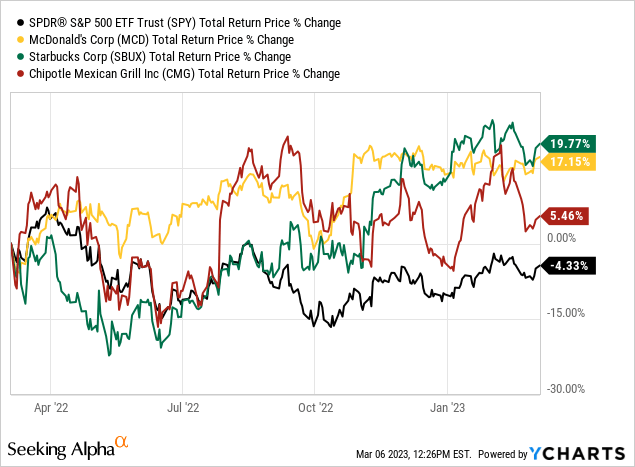

In this analysis, I will provide a performance comparison of MCD to its largest competitors in the Restaurant industry; Starbucks Corp (SBUX), and Chipotle Mexican Grill, Inc. (CMG). I also use the SPDR S&P 500 Trust ETF (SPY) as a general performance benchmark that shows a high differential in single-stock performance from the larger market. Afterward, I will shift focus to MCD’s valuation and risks.

MCD’s Momentum Has Quality Volatility

From the performance chart below, it seems easy to assume that McDonald’s and its peers are all still a safe bet. All three candidates outperformed the market over the past 1Y with positive returns. Let’s dive deeper into the overall Momentum for these restaurants relative to SPY over this period.

In the Momentum significance analysis table below, all three candidates maintain positive 9-month Momentum, whereas SPY maintains a relatively consistent negative Momentum. MCD is the only ticker offering positive performance across all subperiods tested; however, the 2-week and 1-month periods are typically the most likely to reverse.

| Momentum Signal | MCD Performance Over Period (as of Friday, March 3rd) | SBUX Performance Over Period (as of Friday, March 3rd) | CMG Performance Over Period (as of Friday, March 3rd) | SPY Performance Over Period (as of Friday, March 3rd) |

| 12-Month (excluding the past two weeks) | 16.04% | 19.31% | 9.93% | -4.98% |

| 12-Month | 16.27% | 16.93% | 3.27% | -5.73% |

| 9-Month | 10.18% | 34.45% | 9.81% | -0.26% |

| 6-Month | 6.93% | 27.41% | -6.59% | 3.95% |

| 1-Month | 2.42% | 0.74% | -10.81% | -1.98% |

| 2-Week | 0.23% | -2.38% | -6.66% | -0.75% |

Compiled by Author using data from YCharts

In addition, while CMG lacks positive Momentum over the 6-month subperiod, it has relatively low Momentum overall. SBUX may also offer a Momentum opportunity for swing traders due to its strong 12-month,9-month, and 6-month Momentum, which are unlikely to reverse over this quarter.

MCD has a low 20% volatility, likely due to its high-quality brand name and management. As discussed in a prior article, low volatility is favorable as it can often represent high stability of Momentum going forward.

Undervaluation by Shareholder Yield

Refocusing back on MCD alone, it’s more of the same when looking at traditional stock valuation. Overvalued, fair valued, overvalued… until we include a look at the Dividend/Price and Shareholder Yield metrics.

| As of 3/3/2023 | Book/Price | Cash Flow/Price | Earnings/Price | Sales/Price | Dividend/Price | Shareholder Yield |

| MCD | -3.05% | 3.85% | 3.10% | 11.8% | 2.10% | 13.4% |

Compiled by Author using data from Alpha Architect, FactSet.

Shareholder Yield originates from the research of O’Shaughnessy Asset Management, which they explain as follows:

At OSAM, our approach aims to capture the benefits of both dividends and buybacks. Shareholder Yield is the sum of a stock’s dividend yield (paid over previous twelve months minus special dividends) and the percentage of net share buybacks over the previous twelve months. It is a powerful tool for identifying good management teams.

I believe the metric seems to be working, reflecting MCD’s strong management team, as revealed earlier. MCD is at the 80th percentile of US stocks on the Shareholder Yield metric. This is also unsurprising given its 5.96% and 8.00% 3 and 5-year dividend growth rates, respectively. The undervaluation reflected in the Shareholder Yield metric matches the narrative of a formidable McDonald’s brand and management team resulting in mispricing.

On the other hand, some unforeseen risks could be ignored in chasing a single valuation metric over others.

Counterargument: Popularity Poses Risks Too

During their fiscal Q4 earnings call, the President and CEO, Christopher J. Kempczinski, stated, “You’ve heard me say McDonald’s is one of the world’s greatest brands,” before discussing their various marketing efforts.

While the earnings went well for the company, and it has an impressive brand, it’s worth noting that popularity amidst strong earnings can result in stock overvaluation. As a result, investors in MCD risk falling into the “Good Company is a Good Investment” fallacy. Companies fitting that fallacy tend to have high earnings growth, high projected growth, and high valuations. The valuation metrics other than Dividend/Price and Shareholder Yield would appear to reflect this. By every other value metric, MCD appears to be fairly valued at best and overvalued at worst.

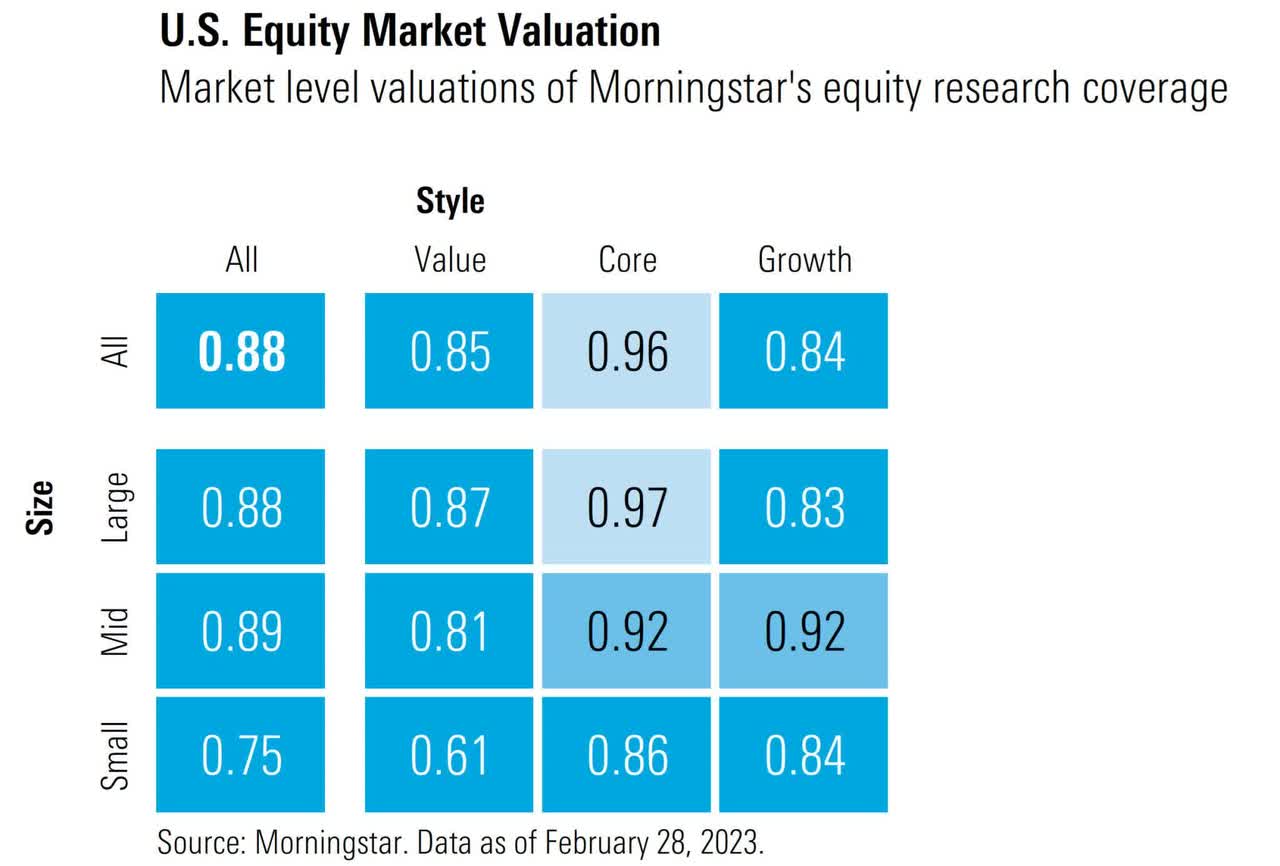

As a further counterargument, one might refer to Morningstar’s research that US stocks – including growth stocks – look cheap.

Morningstar

However, Morningstar’s Head of Client Solutions and Asset Management, Ben Johnson, CFA, explained on Twitter, “These figures represent rollups of analysts’ fair value estimates for individual companies–outputs of their discounted cash flow models, based on fundamental, bottom-up research.”

This methodology can present bias in the results, as was also noted in response by Matthias Hanauer, CFA, “Given that analyst tend to extrapolate past growth too much into the future.” Well, I suppose that is a potential counterargument to this article by its very nature. Thankfully, as explained in my first article, I view stocks primarily from a Value and Momentum factor perspective, not Growth.

Takeaway

Ultimately, McDonald’s has an impressive brand and management team as reflected by its favorable Shareholder Yield. Although, the stock also appears to be overvalued by more traditional metrics. Data suggests MCD delivers strong Momentum balanced by yield & management-driven undervaluation, making it a Value play.

However, by chasing too hard after popular names, investors could fall into the “Good Company is a Good Investment” fallacy or follow analysts extrapolating past growth too much into the future. Thus emphasizing the importance of thorough due diligence of McDonald’s stock and its peers. Especially so given recent food price increases with more on the way.

Overall, McDonald’s has brilliant prospects. Despite high valuations, I believe mispricing exists due to an exceptional management team, resulting in a strong Shareholder Yield that raises my rating to a Buy for MCD stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.