Bottom Fishing Salesforce (Technical Analysis)

Summary:

- This is a technical analysis article. Salesforce, Inc. has killed portfolio performance for over a year now and still apparently has not hit bottom. It should during this bear market.

- Usually bottoms are identified by exhaustion selling, when the news is so bad that the last holdouts finally dump their shares on the market.

- For over a year now, we have seen orderly selling as portfolio managers were steadily unloading their positions on the market.

- Now comes the reorganization, and top executives are leaving. Could Salesforce be slashing headcount like Twitter and others?

- The final selloff should take Salesforce to its ultimate bottom. Then the bottom fishers should come in, because its core business is still good.

Tunatura/iStock via Getty Images

The bottom fishers are searching for stocks like Salesforce, Inc. (NYSE:CRM) as they approach their bottom. Portfolio managers were unloading CRM for over a year as it dropped from $312 to $130. Now it appears to be in the final stages of reaching the bottom, as executives bail out of the company. The final shoe to drop, usually creates what is called “exhaustion selling.” That happens when the last, long-suffering holders can’t take the latest bad news and just dump their shares on the market in disgust and finally move on.

Now the bottom fishers have become interested, as CRM finally hits bottom, providing a bargain price because their core business is still growing nicely. Usually as a stock hits bottom, the dead wood is gone and the successful operations are still attractive at what is now a bargain price.

What is that price for CRM? Let’s be generous and give CRM a P/E of 20 and based on next year’s projected earnings of $5.63 (listed on Seeking Alpha) that gives us a target of $113. As you can see, our calculated bottom is lower than where price is. Maybe that is why price continues to drop looking for a bottom.

The P/E of 20 is generous because CRM is not growing at 20%. The $5.63 in projected earnings by analysts is generous because of the bear market and executives exiting CRM. Usually executives stick around, if earnings are going to be great. Analyst projections usually drop during a bear market, so the projected earnings we are using may come down.

The Seeking Alpha quant ratings give CRM a “D+” rating for valuation. That is problematic in a bear market with revenue growth and earnings under pressure. For growth, CRM only gets a grade of “C” and that does not support a non-GAPP, high forward P/E of 27 vs 19 for the sector median. Revenues are projected to grow at only 11% next year. You can see that the high P/E is not supported by high growth. However, higher growth may return after the recession.

CRM only receives a “C-“ grade for momentum, but rings the bell with an “A+” grade for profitability and a “B+” for revisions. Bottom fishers will be interested in these high grades once price comes down and valuation improves. That will be the bottom for CRM. It is not there yet.

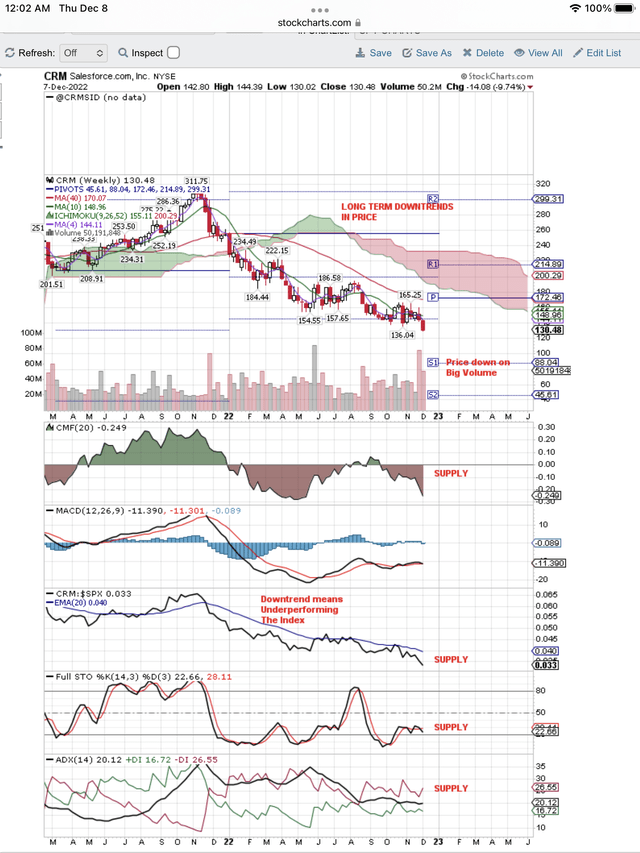

Here is our weekly chart showing all the technical sell signals. When these signals turn up, it will indicate the bottom fishers have started buying.

Salesforce Looking For A Bottom (StockCharts.com)

NOTE: Supply signals continue to take price lower until the bottom is reached. Then bottom fishing buyers come in and turn these signals up, as Supply switches to Demand readings on the chart.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Use our free, 30 day training program to become a successful trader or investor. Join us on Zoom to discuss your questions.