Summary:

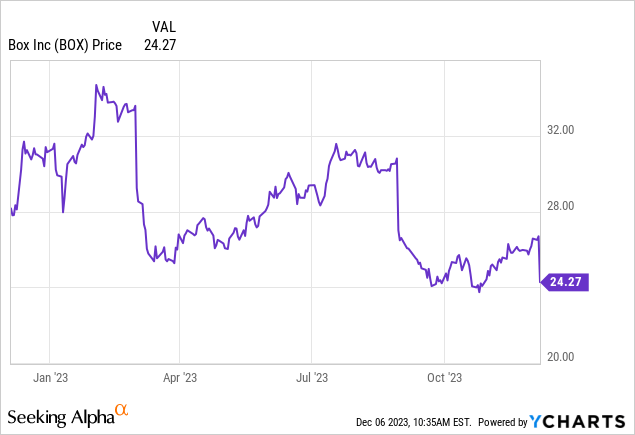

- Box stock drops 9% after Q3 earnings, bringing year-to-date losses to over 20%.

- Despite slower growth, Box’s low valuation and sticky customer base make it an attractive investment.

- Box’s revenue grew 5% YoY, but billings declined and net revenue retention rates contracted in Q3.

- With a P/E ratio under 14x, Box remains undervalued despite its slower growth rates.

Justin Sullivan

More often than not over the past several years, shares of Box (NYSE:BOX) dip tremendously after earnings. Wall Street usually pans the company’s slowing growth and conservative outlooks, causing sharp post-earnings drops. Then, as investors weigh the damage, shares of Box gradually creep back up as the market considers Box’s tremendously low valuation.

This boom-and-bust cycle has played out over the past two earnings quarters for Box, and now, just after the company reported fiscal Q3 results, the stock has dropped a fresh ~9%, bringing year-to-date losses to just above 20%. It’s a great time, in my view, for investors to capitalize on yet another bottom in the Box cycle.

I last wrote a bullish article on Box in September, after the company’s Q2 earnings release in which the stock suffered another ~20% peak-to-trough decline, before recouping a large majority of the losses. My continued recommendation here: ignore the short-term fluctuation in Box shares, and focus on the fact that A) the stock is incredibly cheap, and B) it has a tremendously sticky customer base and margin expansion to justify the stock rising to meet at least a market-average valuation multiple.

Now, I will acknowledge this: Box is certainly far from perfect. The company has certainly fallen a long way from several years ago when it was still growing north of 20% y/y. But time and again, we have to come back to the fact that this slower growth is already reflected in Box’s valuation.

At current share prices near $24, Box trades at a market cap of $3.50 billion. After we net off the $439.7 million of cash and $370.3 million of debt on Box’s most recent balance sheet, the company’s resulting enterprise value is $3.43 billion.

Meanwhile, for next fiscal year FY25 (the year for Box ending in January 2025), Wall Street analysts have a consensus pro forma EPS target of $1.78 for Box, representing 19% y/y EPS growth against this year’s $1.49 consensus; on $1.12 billion in revenue, or 7% y/y growth. Taking consensus estimates at face value, we arrive at valuation multiples of:

- 3.1x EV/FY25 revenue

- 13.6x P/E

For this price – I think we can shoulder single-digit revenue growth, as long as earnings are still growing at a healthy pace through a combination of both margin expansion plus Box’s share repurchases, of which it has $84 million in remaining authorization left to execute.

As a reminder to investors who are newer to this stock, here is what I view to be the long-term bull case for Box:

- Box’s product portfolio expansion has led to a $74 billion market. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is winning- More than two-thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led- Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Enterprise orientation- Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as key distinguishers versus the likes of Dropbox.

- Growth plus profitability in one package- Box touts “growth + FCF margin” as its key metric for balancing revenue and profitability, and this has marched steadily upward to 37% in FY23. Box hopes to hit 40-42% by FY25.

This is yet another buy-the-dip moment for Box. Though the stock is unlikely to deliver startup-like gains (no AI boost for Box!), I view this as a safe hold that is backed by both fundamentals and value.

Q3 download

Let’s now go through Box’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

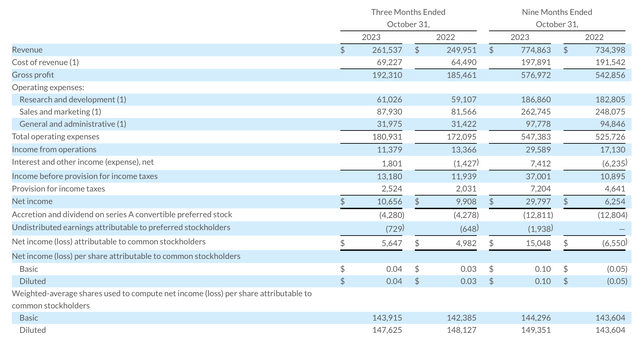

Box Q3 results (Box Q3 earnings release)

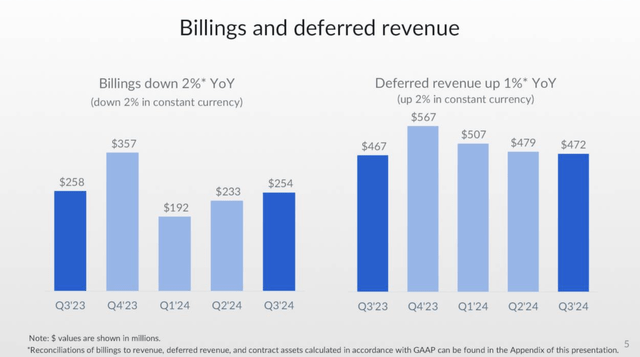

Box’s revenue grew 5% y/y to $261.5 million, slightly missing Wall Street’s expectations of $262.0 million. Yet it was the billings trend that concerned investors more: as seasoned software investors are aware, it’s billings that represents a better long-term picture of a recurring revenue company’s growth trajectory, as it captures deals signed in the quarter that will be recognized as revenue in future quarters.

As shown in the chart below, Box’s billings of $254 million not only declined -2% y/y, but also fell below revenue in nominal terms: indicating that sequentially, Box actually drained its deferred revenue balances.

Box Q3 billings trends (Box Q3 earnings release)

Do note, however, that Q3 has an unusually tough comp in the third quarter of last year, with many customers opting to make large multi-year prepayments.

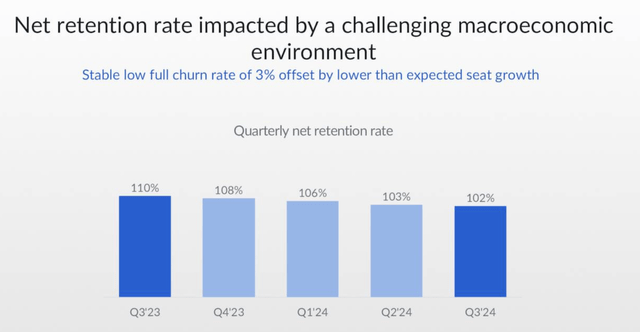

Pouring more flames on the wound: Box’s net revenue retention rates continued to contract sequentially, down to 102% in the third quarter – indicating very little net upsell after churn.

Box net retention trends (Box Q3 earnings release)

The positive news is that Box has managed to push through several price increases and maintain limited churn. The bad news is that Dylan Smith, the company’s CFO, noted on the Q3 earnings call that he expects these macro-based headwinds to persist into Q4:

Our net retention rate at the end of Q3 was 102% as we continue to see pressure on seat growth within existing customers. Our annualized full churn rate remains strong and stable at 3% as customers continue to prioritize the value that the Box platform provides. We’ve also continued to achieve year-over-year pricing increases despite the pressures on IT budgets.

In Q4, we expect both our full churn rate and our net retention rate to remain roughly flat with our Q3 results. As seat growth returns to more normalized levels and as we continue driving pricing improvements, we are confident that our best-in-class full churn rate and expanding our suite of innovative products will enable a higher net retention rate over time.”

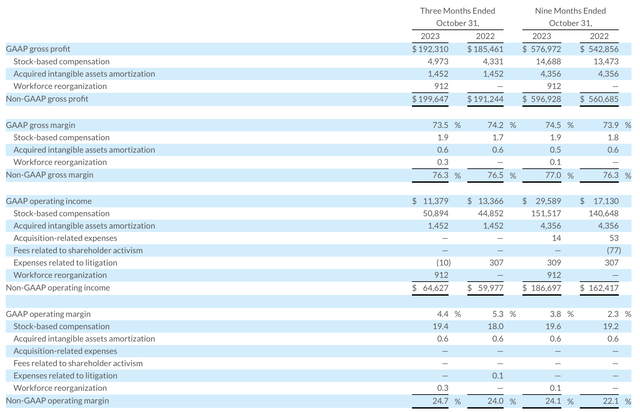

Where Box makes up for the more sluggish top-line results, however, is in margin expansion. Pro forma operating margins grew 70bps y/y to 24.7%, as shown in the chart below:

Box margins (Box Q3 earnings release)

Note as well that pro forma EPS expanded 16% y/y to $0.36, which had $0.03 of impact from FX headwinds as well.

Key takeaways

No, Box’s results don’t inspire confidence in substantial growth going forward – but at a ~13x P/E ratio, I think Box is quite undervalued for double-digit EPS growth. This is a stock that requires patience, but historically – buying Box on post-earnings dips has yielded profits.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.