Summary:

- Box reported Q1 FY25 sales of $264.7 million, beating estimates and attributing growth to sustained demand among enterprise customers.

- The company’s profitability metrics, including a gross profit margin of 78% and record operating income, showed stronger signs of growth.

- The overall outlook for BOX remains clouded by its inconsistent performance and lack of double-digit growth, leading to a recommendation of a Hold rating.

PM Images

Investment Thesis

Box, Inc. (NYSE:BOX) reported its Q1 FY25 earnings results yesterday that beat estimates. The maker of workforce synchronization, content management, and productivity cloud software is currently in the midst of a metamorphosis as it attempts a fundamental turnaround in its business in the face of AI.

Although Box beat estimates, my opinion of the Redwood City, CA-headquartered company remains the same: the overall outlook continues to be clouded by the wide range of performances that it has been posting in the last 12-15 months. The company has transitioned to selling its content management & productivity cloud software to leverage the vast amounts of unstructured data that its customers were storing on Box’s cloud storage products. In addition, the company also launched BoxAI last year and targeted larger enterprise customers as part of its growth re-acceleration strategy.

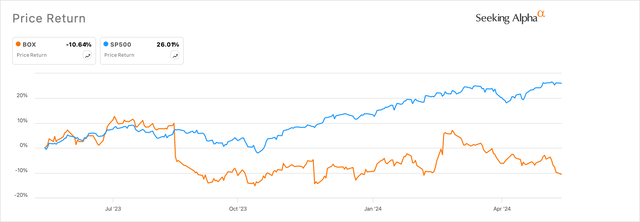

But I have yet to witness any traces of double-digit growth. This has also affected the stock’s price, which severely lags all indices so far, as seen in Exhibit A below.

Exhibit A: Box Inc lags the broader markets on a trailing twelve-month basis (Seeking Alpha)

The results are not exciting enough, and I expect the stock to remain range-bound and drift away. For now, I recommend a Hold rating.

Nothing Out of the Ordinary for Growth

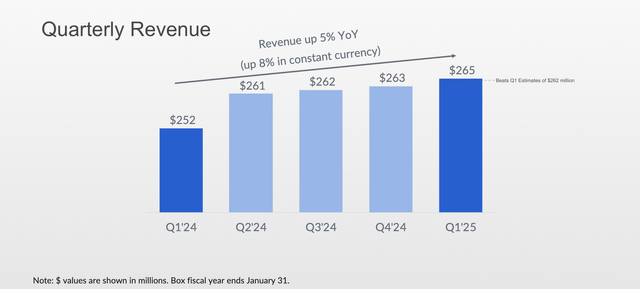

In Box’s first quarter of FY25, the company reported total sales worth $264.7 million that increased 5% y/y and beat the consensus mark of ~$262 million, as illustrated in Exhibit B below.

Exhibit B: Box Q1 FY25 revenue rose 5% year-on-year (Q1 FY25 Earnings Results, Box Inc.)

Box’s management attributed the growth in their revenue to the sustained single-digit demand seen among their enterprise customers. Box has launched its Enterprise Plus pricing for enterprise customers and tracks conversions to its Suites, its multi-product offering. On the last earnings call, management mentioned:

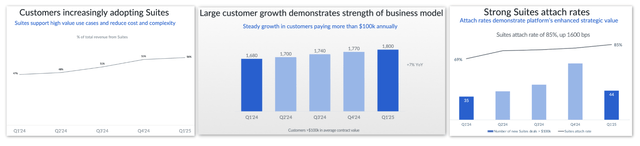

Suites represented 81% of deals over $100,000, up from 72% a year ago. We saw continued solid suites attach rates in large deals across all geographies.”

Suites customers now account for 55% of our revenue, a significant improvement from 46% in Q4 of last year and from 51% in Q3.”

In Q1 FY25, Suites customers accounted for 56% of Box’s total quarterly sales, as seen in Exhibit C below. At the same time, the company made some more headway in penetrating the larger customer segment, as seen by the growth in the volume of customers > $100k in average contract value.

Exhibit C: Enterprise customers add more momentum to Box as witnessed by Box’s customer and Suites growth rates (Q1 FY25 Earnings Results, Box Inc.)

The attach rates for Suites, the rate at which the win deals by also upselling target customers with Suites in their annual contracts, showed some improvement, as compared to the same quarter last year when the Suites attach rate metric was showing signs of decline (page 19).

The company’s net retention rate has shown some signs of stabilizing at the 101% mark after eight straight quarters of decline. I believe the net retention rate will be a key metric to watch, as it will point to the spending appetite Box’s current customers have for the company’s line of content storage and management products. Any drop below the 100% mark would indicate contracting revenue, assuming their customer base does not increase.

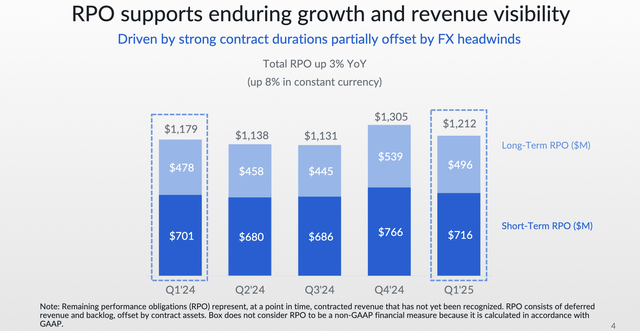

One of the alternate ways the company likes to track the growth in its enterprise customer base is by measuring the company’s ability to sign customers for longer leases. For management, that means tying down customers for longer annual contract tenures. That can be seen in Exhibit D below, which shows that while total RPO was up 3% y/y, long-term RPO was up 3.8% y/y outpacing total RPO growth.

Exhibit D: Box Remaining Performance Obligation Trends (Q1 FY25 Earnings Results, Box Inc.)

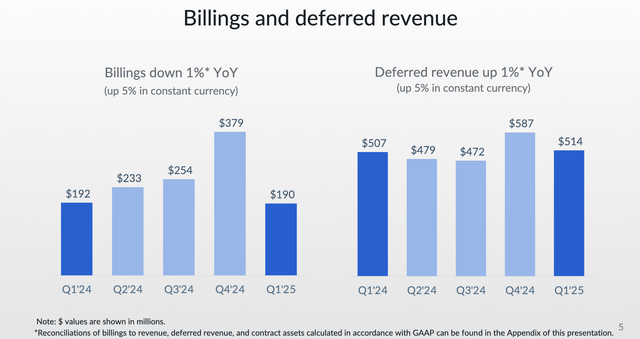

But I will take that with a grain of salt because it does not necessarily paint the right picture when looking at their Billings and Deferred Revenue metrics that are barely growing, as seen in Exhibit E. Granted that Q1 quarters are the weakest for SaaS companies, Box’s management will need to do more to convince its investors of strong, long-term, sustainable growth, in my opinion.

Exhibit E: Box Deferred Revenue and Billings growth (Q1 FY25 Earnings Results, Box Inc.)

Profitability Showing Stronger Signs of Growth

On the other hand, Box’s profitability metrics looked far more promising. At 78%, Box’s Q1 GAAP gross profit margin was one of the strongest I have seen in the longest time, possibly since October 2014.

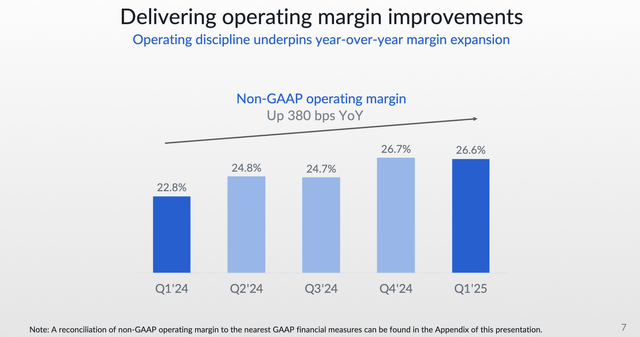

In Q1, Box reported Q1 FY25 non-GAAP earnings of 39 cents per share, or 8 cents on a GAAP basis, beating consensus estimates by 8.3% and increasing 21.9% y/y. In the quarter, Box also reported record operating income worth $70.4 million, rising 22.6% y/y on an adjusted basis. This resulted in the adjusted operating margin expanding by 380 b.p. to 26.6%, as seen in Exhibit F below.

Exhibit F: Box delivers robust margin expansion in operating income on an adjusted basis (Q1 FY25 Earnings Results, Box Inc.)

In prepared remarks to analysts during the call to discuss Q1 earnings, management said:

We are pleased to have delivered Q1 revenue growth of 5% year-over-year, or 8% in constant currency. Continued focus on operational discipline resulted in Q1 operating margin and EPS both strongly above our guidance, record non-GAAP gross margin of 80%, and free cash flow growth of 14% year-over-year. We remain focused on delivering revenue growth while maintaining our commitment to continued cost savings and driving operating margin expansion.”

At the same time, the company’s balance sheet remains stable, with about $552 million in debt and operating leases. The company should be able to service the principal portion of its 2026 Senior Notes worth $345 million, since it currently holds ~$450 million in cash.

With growth yet to show signs of re-accelerating, I am encouraged by management’s signs to deliver profitable growth and maintain a stable balance sheet, which should be able to support the company well during this transitional period.

Box’s Valuation Is Not Enticing Enough

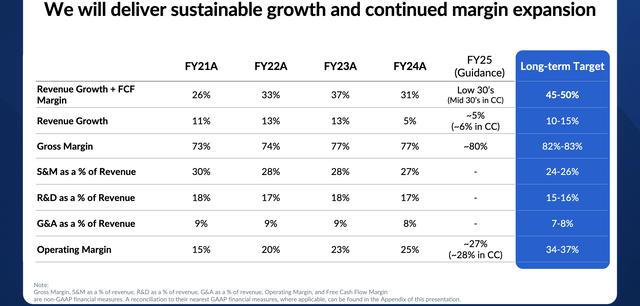

Unfortunately, Box’s tepid growth rates are not exciting enough for me to get excited by the company’s outlook. The company’s Q1 results have been ordinary so far and did not stand out to me. When modeling my outlook for Box, I factored in the company’s long-term goals that were laid out in the company’s Financial Analyst Day presentation in March. Here is a screenshot of the guidance summary from that presentation.

Exhibit G: Management’s long-term growth targets (FY25 Financial Analyst Day, Box Inc.)

Here are my assumptions that are factored into my outlook:

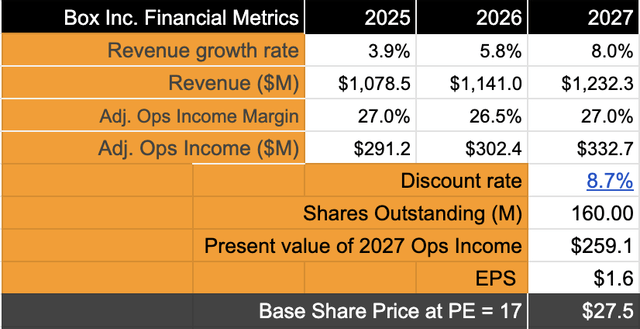

- Based on the historical trends and future growth rates projected by management, I will assume Box grows its sales in the mid-single-digit range. This implies a 6-7% compounded growth rate between FY24 and FY27, as illustrated in Exhibit H.

- Per the Q1 report, management mentions that they have raised revenue guidance for FY25. But on deeper analysis, I see that it is only on a constant-currency basis. The reality is that revenue guidance for FY25 has been pulled in slightly, from previous targets of $1.08-$1.085 billion issued last quarter to updated targets of $1.075-$1.08 billion issued this quarter.

- I expect Box to continue to deliver strong margin expansion in their operating income on an adjusted basis, as stated by management’s previous intentions and targets. I expect some flatlining over the next year since I believe management may increase SG&A to better target enterprise customers, but I expect that to normalize. Over time, Box should deliver faster growth in adjusted operating income, growing in the 9-10% range.

- I have assumed a discount rate of 8.7% based on the estimations listed here.

Exhibit H: Box’s valuation model points to minimal upside (Author)

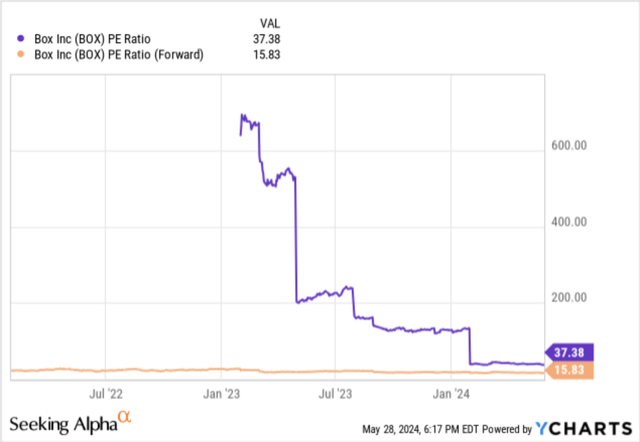

If I compare the growth rates from my assumptions to the long-term growth rates of the S&P 500, I believe the company warrants a forward PE of 16-17, in line with the general forward earnings multiple expectations as seen in Exhibit I below. My model implies 9% upside, but this is not exciting enough given the lack of growth catalysts for Box in the face of fundamental risks.

Exhibit I: Box’s forward PE trends (YCharts)

Risks & Other factors to look for

Most content storage & management cloud software solutions, such as Box, Dropbox (DBX), and DocuSign (DOCU) have faced uncertain environments since macroeconomic and geopolitical risks shifted forces in the markets that most of these companies operate in, especially in the SMB markets.

I acknowledge Box’s management efforts to revitalize its overall business strategy and product development, but it faces headwinds from larger technological shifts, as seen in AI, as well as vendor consolidation with larger platform providers, which has continued to pressure Box. Box has made some acquisitions to enter new markets, such as e-signature, but those markets have rapidly saturated, leaving Box to pivot again.

Plus, the pressure faced by Box’s original target market, SMBs, still plagues Box, in my opinion, forcing Box to spend more on Sales and Marketing to target large enterprises. So far, the company has shown some improvement, albeit with low single-digit growth.

Takeaway

Box’s quarter did not excite me, leaving me looking for traces of more catalysts as I scanned through the earnings report. Unfortunately, those growth catalysts still appear to be out of reach for Box, leaving management to become further disciplined about maintaining strong profitability. Fortunately, the profitability story in Box seems more promising to me.

For now, I recommend being neutral on Box, despite the ~9% upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.