Summary:

- Broadcom reported strong Q1’24 with 34% YoY revenue growth, driven by data center and hyperscaler demand for AI infrastructure.

- The company expects growth in AI-enabling infrastructure and networking equipment throughout eFY24, while wireless, storage, and broadband segments to be pressured.

- VMware’s partnership with Nvidia for GPU acceleration is expected to drive further growth and value as companies seek faster compute performance.

G0d4ather

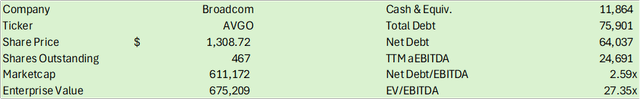

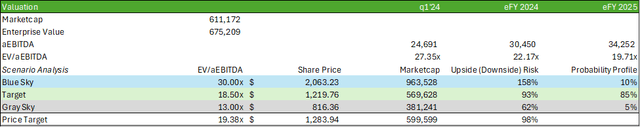

Broadcom Inc. (NASDAQ:AVGO) reported a strong start to FY24 with strength across the data center and hyperscalers as AI infrastructure is adopted across various industries to accelerate business optimization. With 34% y/y revenue growth in Q1’24, Broadcom is well-positioned to cater to the next generation of IT infrastructure in the coming years. Given the firm’s central role in data center software and now a hyperconverged spectrum of infrastructure, I believe Broadcom will realize significant strength in eFY24 as companies scale their infrastructure to cater to AI capabilities. I anticipate their more consumer-centric products to lag throughout eFY24 and part of eFY25 as consumers remain pressured by higher inflation on non-technology spending. I provide AVGO shares a BUY recommendation with a price target of $1,283/share at 19.38x eFY25 EV/aEBITDA.

Operations

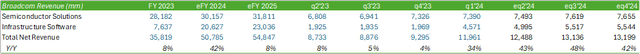

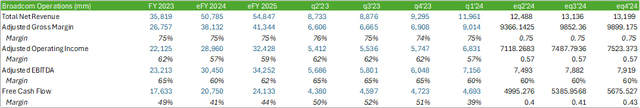

From a high-level thematic macro viewpoint, I believe Broadcom’s strength will be driven by corporate and hyperscaler AI adoption and related infrastructure build outs. I believe that like other semiconductor designers, Broadcom’s growth will be concentrated with corporate customers. I anticipate retail consumption to remain relatively flat or down for handhelds, laptops/desktops, gaming, and smart devices as consumers face uneven inflationary pressures on daily necessities. On the corporate side, I anticipate AI-enabling infrastructure to drive growth for companies like Broadcom as companies seek to improve operational efficiencies while cutting down on costs. Gartner forecasted 8% growth in global IT spend for 2024 with the highest growth rate across software. IT services spending is expected to grow by 10.4% in 2024, which, I believe, will drive growth in the VMware Cloud Foundation, especially given their announced partnership with Nvidia for performance acceleration. Overall, management expects to drive topline growth to $50b in eFY24, up from $36b in the previous reported fiscal year. Considering Broadcom’s 34% aggregate revenue growth rate in Q1’24, management’s growth trajectory is expected to accelerate even further throughout eFY24. On average, this will require a ~42% y/y growth rate in the coming three quarters. Consensus estimates anticipate growth to moderate in eFY25 as the new revenue base normalizes higher with AI-enabling infrastructure becoming more saturated in the market and less novel.

Looking across Broadcom’s operations, aside from AI-related semiconductors, Broadcom experienced a significant pullback in revenue generation across some segments while others thrived, with server storage down -29% y/y, broadband down -23% y/y, and wireless down -4% y/y. Networking grew by 46% y/y as the firm experienced strength in AI accelerators across their two hyperscale customers. Management expects strength in sales growth for networking equipment to continue throughout eFY24 with an expected 35% y/y growth rate.

Though wireless didn’t experience as drastic of a pullback as storage and broadband, management expects this segment to remain relatively flat throughout eFY24. Management at QUALCOMM Incorporated (QCOM) also anticipated a flat handheld market in eFY24 as consumers sought to push out mobile device upgrades.

Management also revised their eFY24 guidance with server storage expected to decline by mid-20% vs. high-teens and broadband down -30% vs. mid-teens. Despite this more negative outlook, the firm is expected to retain some growth traction as AI is expected to drive support and growth for revenue. Management guided eFY24 semiconductor solutions revenue to grow by mid-to-high single-digits as more revenue is generated resulting from AI-related semiconductors. Management anticipates revenue to grow to $50b in eFY24 and expects to retain their 60% aEBITDA margin.

The addition of VMware contributed significantly to Broadcom’s infrastructure software sales with the segment growing by 153% y/y to $4.6b inclusive of VMware. VMware accounted for 38% of segment sales and helped drive the segment gross margin to 88% for Q1’24.

Management anticipates strength in VMware growth as the firm pushes towards customer migration to VMware Cloud Foundations, or VCF. Though the firm still sells and supports the legacy vSphere infrastructure, management is pushing customers to make the transition to their cloud-based virtual platform as part of an integrated software stack that includes compute, storage, and networking. To further push their VCF platform, VMware and NVIDIA Corporation (NVDA) entered into a partnership called VMware Private AI Foundation that enables customers running VCF to utilize Nvidia’s GPUs as they deploy their AI models both on-prem and in the cloud. I believe this partnership will create significant value as firms seek to accelerate AI adoption, whether to cut down on operating costs or optimize operations, or both.

In terms of financial performance, management anticipates aEBITDA to maintain its more modest 60% margin, down from 65% in FY23, as the firm’s segment mix adjusts to cater more towards infrastructure software. I believe the virtual cloud environment driven by VMware/Nvidia will bolster growth across this segment as Broadcom’s hyperconverged infrastructure takes shape.

Forecasting growth and operations, I anticipate Broadcom to shift their focus towards topline growth to take advantage of the AI boom. I believe that this will challenge margins slightly in the near term as the firm focuses on carving out their AI market share. I anticipate eFY25 to be a year for more moderated topline growth with the focus shifting back to profitability.

Valuation & Shareholder Value

AVGO shares have experienced a significant run-up in their valuation and are currently sitting at 27.35x EV/aEBITDA, well above their historical range of ~11-18x. Like other firms that are front and center in the AI renaissance, I believe AVGO shares will retain this new valuation base as the firm experiences a new growth phase. Other companies that I have covered that fall into this category include Nvidia, CrowdStrike Holdings, Inc. (CRWD), Super Micro Computer, Inc. (SMCI), and Palantir Technologies Inc. (PLTR). There are some firms that cater to the consumer side of AI that I anticipate not to realize this level of expansion until a year or two out as consumers grapple with inflationary pressures on spending, such as Qualcomm.

Using a range of valuations and a probability factor, I believe AVGO shares should be valued at 19.38x eFY25 EV/EBITDA for an equity value of $600b. I provide AVGO shares a BUY recommendation with a price target of $1,283/share.

In terms of a more bearish outlook, further downward guidance across infrastructure and broadband can push shares into my gray sky territory. I believe that any hints of a slowdown in AI adoption can add pressure to shares as lofty expectations for the AI space are well baked into the market. Though my case for growth does not include handhelds, pushing out the return to handheld growth can pose challenges to future growth as AI-enabling technology moderates. I believe the bull case for Broadcom far outweighs the bear case.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.