Palantir’s Stock Is Now Overvalued (Rating Downgrade)

Summary:

- Palantir’s stock has rallied by 52% year-to-date and now looks overvalued from the discounted cash flow simulation perspective.

- The company’s profitability metrics have improved, but there is a substantial level of uncertainty regarding Palantir’s ability to sustain revenue growth for longer.

- To justify the current valuation, a solid revenue growth outlook boost is needed, which looks unlikely to me.

Alex Wong/Getty Images News

Investment thesis

My previous bullish thesis about Palantir’s (NYSE:PLTR) stock aged well, as the stock rallied by 47% over the last three months, compared to an 11% increase in the S&P 500 (SPX). Today I want to update my thesis with the review of recent developments and valuation update. PLTR rallied by 52% since the beginning of 2024 and my valuation analysis suggests that the stock is now around 15% overvalued. While I reiterate my long-term bullish opinion about PLTR, I think that buying the stock with a 15% premium is highly risky and there likely will be better buying opportunities ahead. Therefore, I am downgrading PLTR from “Strong Buy” to “Hold”.

Recent developments

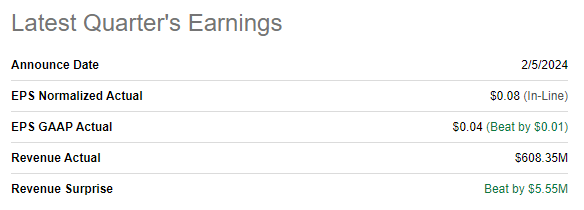

The latest quarterly earnings were released on February 5, when PLTR slightly topped revenue consensus estimates and was in line from the bottom line perspective. I always pay attention to the profitability metrics dynamics, especially for companies that are scaling up aggressively, as PLTR does. It is crucial because margin expansion suggests the strength of the business model and increases the probability of future potential to absorb the economies of scale effect.

Seeking Alpha

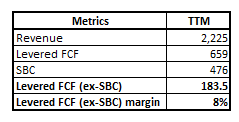

From the perspective of profitability ratios, Palantir did extremely well, with the gross margin expanding from 79.5% to 82.1% on a YoY basis. The gross margin expansion, together with the SG&A to revenue ratio improvement, allowed to expand the operating margin from -3.5% to 10.8%. Another bullish factor is that the operating margin expansion was achieved without sacrificing innovation, as the R&D to revenue ratio grew from 16.1% to 18% YoY. The double-digit operating margin allowed PLTR to generate a stellar 30% TTM levered free cash flow [FCF] margin. A notable portion of the FCF is represented by the stock-based compensation [SBC], however even ex-SBC the TTM FCF margin is 8%.

Author’s calculations

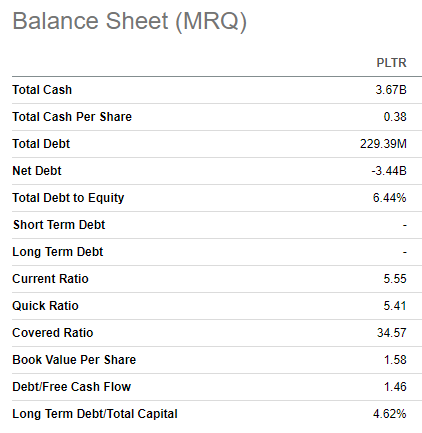

Rapidly improving FCF margin helps PLTR to solidify its financial position. The company had almost $3.7 billion in cash as of the latest reporting date, with almost no debt. Therefore, the company has a vast potential to reinvest in innovation or in acquisitions to boost future growth. With almost no leverage, PLTR is also positioned well to raise debt financing on favorable terms, which is also a strategic strength.

Seeking Alpha

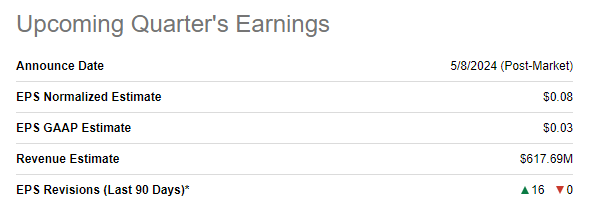

The upcoming quarterly earnings are scheduled for May 8. Consensus estimates project a 17.7% YoY revenue growth and an adjusted EPS expansion from $0.05 to $0.08. Wall Street analysts are quite optimistic about the earnings release, since there were 16 upward EPS revisions over the last 90 days.

Seeking Alpha

While I understand the vast potential of Palantir for a long-term growth and profitability improvement, there are a couple of signs that make me more cautious from the tactical perspective. The Q1 adjusted EPS is expected to be flat sequentially despite a projected by consensus QoQ revenue growth, which might indicate that PLTR is close to realizing its full potential in the operating leverage.

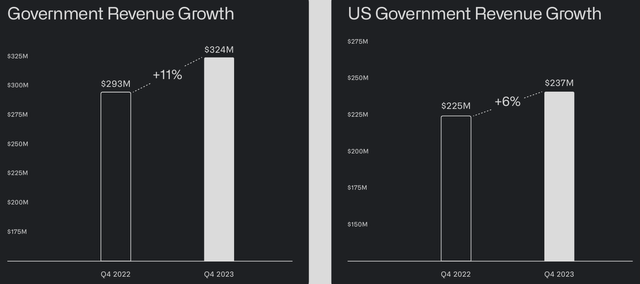

Another sign that makes me cautious is the recent dynamic of government revenue growth. The U.S. government revenue growth was very modest at 6% in Q4 and the total government revenue growth is also moving closer to single digits with an 11% YoY growth.

Palantir’s latest earnings presentation

Of course, a 70% YoY revenue growth in the U.S. commercial and a 32% growth in the total commercial revenue is very impressive, but I prefer to look at the context as well. In absolute terms, commercial revenue grew by $69 million YoY, which looks shallow for a company with almost $60 billion market cap. Furthermore, the comparatives are very low in the commercial segment, which makes them easy to beat by staggering percentage points. However, as this segment expands, revenue growth will also likely naturally decelerate.

Palantir’s stellar profitability expansion and strong revenue growth track-record add to my long-term optimism, but it is apparently that the company will need to unlock new revenue drivers within the next few quarters to be able to sustain its confident double-digit revenue growth. This will be either through new products introduction or acquisitions but since recent developments suggest nothing in these directions, there is a significant uncertainty for me regarding the revenue growth pace within the second half of 2024.

Valuation update

PLTR rallied by 220% over the last 12 months and had a stellar beginning of 2024 with a 52% YTD share price growth. Almost all valuation ratios look extremely high, but a 1.68 forward non-GAAP PEG looks moderate. After the massive last year’s rally, PLTR market cap is over $57 billion, and I want to compare it with my fair value estimation.

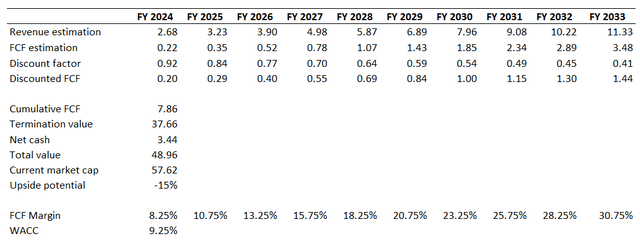

For growth stocks, I use the discounted cash flow [DCF] approach. I am using a 9.25% WACC, which is my previous discount rate less three expected rate cuts in 2024, 25 basis points each. Long-term consensus revenue estimates did not change much; therefore, just slight amendments are made to the top line, a forward 10-year CAGR is 17%. What improved significantly is the free cash FCF margin ex-SBC. TTM FCF ex-SBC margin is 8% and this is two times better than I incorporated into my previous valuation. I use an 8% as my first year FCF margin assumption and expect an aggressive 250 basis points yearly expansion.

Author’s calculations

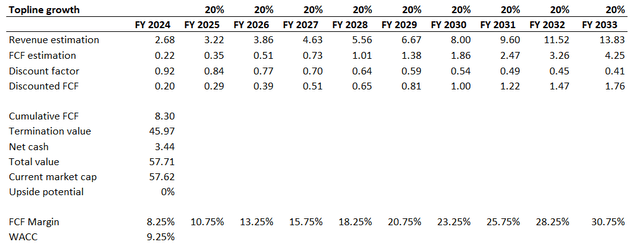

According to my first scenario, the business’s fair value is around $49 billion, which is notably lower than the current market cap. This likely suggests that the recent rally went too far and an upgraded revenue guidance during the next earnings release is priced in by the market. To demonstrate the revenue growth rate which will justify the current capitalization, I will run another scenario. A 20% revenue CAGR with all other assumptions remaining unchanged gives the company’s total fair value at around $58 billion, which matches with the current market cap.

Author’s calculation

For a company with rapidly growing comparatives and five quarters in a row with revenue growth below 20% it is difficult to imagine that the long-term revenue CAGR estimates from Wall Street analysts will be upgraded by around three percentage points. Therefore, I believe that PLTR is notably overvalued at current levels. I take a 15% haircut from the last close, which gives me a $22 target price.

Risks to my thesis

The fair value of the business not only depends on the revenue growth profile, but profitability in general and the FCF margin particularly also significantly affect fair value estimates. Since PLTR has been improving its profitability aggressively in recent months, the new quarterly earnings might surprise from the profitability perspective, which also might be a solid catalyst for the stock price. Or the Fed might move with rate cuts faster than expected in case the economy starts cooling off not in the way the Fed expected.

Apart from that, the rally might be driven by special events. For instance, Palantir periodically wins large governmental and military contracts, which improves sentiment around the stock. A new large governmental contract worth hundreds of million USD might also lead to a short-term spike in the share price. For example, recently the company won a large $178 million contract with the U.S. army and the stock delivered a 5% one-day jump in the price.

Important to remember that we are currently in the market, which is likely largely influenced by FOMO-investors. It looks like the 2020-2021 stock market mania when electric vehicle [EV] companies with zero deliveries achieved sky-high market capitalizations, and currently investors are experiencing the aftermath of this frenzy. We currently see something alike around the AI. While I am generally optimistic about Palantir, I find the current valuation unjustified even for a such high-quality company. But the current market sentiment might fuel further rally, and I am quite uncertain about how long this FOMO-driven rally might last.

Bottom line

To conclude, PLTR is a “Hold” at these stock price levels. Recent developments add to my optimism about the company’s long-term prospects, but tactically, a 15% premium to the fair value does not look like a good deal for investors. To justify such a generous valuation, the management should boost guidance substantially, which looks unlikely in the reality of decelerating governmental revenue growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.