Summary:

- Broadcom’s stock dropped 7% after its revenue forecast of $50 billion fell below analysts’ estimates but has since recovered most of its losses.

- The company has a massive opportunity in the AI industry, with generative AI potentially becoming a $1 trillion opportunity by 2032.

- Broadcom’s valuation is steep according to most traditional metrics, but its forward PEG ratio suggests that the market may be undervaluing the stock.

G0d4ather

Broadcom (AVGO) was up 104% in 2023, one of the bigger beneficiaries of the Artificial Intelligence (“AI”) revolution. However, investors were not enthused after the company released its first-quarter earnings report, showing management’s annual FY 2024 revenue forecast of $50 billion was below analysts’ estimates of $50.2 billion. Although the company’s FY 2024 estimates would be approximately 40% above (“FY”) 2023 results, a vast acceleration over FY 2023 year-over-year annual revenue growth of around 8%, analysts and investors appear to have wanted to see more growth. The stock dropped 7% after the company released earnings on March 7. On March 15, the stock closed at its lowest point post-earnings, down 12%.

The stock has since recovered most of its paper losses for several reasons, including what investors and analysts heard at the AI Enabling Infrastructure Investor Meeting. Suppose you believe generative AI will become a huge driver of global growth; the company should benefit from its leading position in AI networking components like switches, custom accelerators, and other components over the long term. This article will discuss Broadcom’s opportunity in AI, review the company’s earnings report, review its valuation and risks, and discuss why I consider this stock a buy.

What the company does

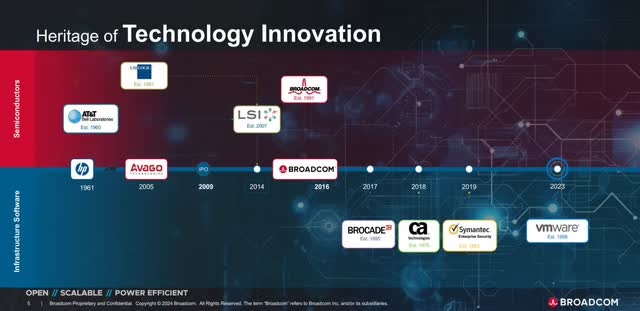

Broadcom is a massive conglomeration of various technologies that it has acquired over time. The company can confuse some people because it has dived into opportunities in such a wide range of technologies. The image below shows that modern-day Broadcom has roots in AT&T (T) and HP (HPQ). Until 2016, the company was primarily a mix of various hardware technologies. However, starting in 2017, it began dipping its toe into the software business, starting with its acquisition of Brocade. Software is now a growing part of its business.

Enabling AI Infrastructure Presentation

Management’s overall strategy is to identify markets that they believe will last ten years or longer and establish leadership in that market. Once it attains a leadership position in a market that will last ten years, management will refer to that market as a “sustainable franchise.” Broadcom President of the Semiconductor Solutions Group, Charlie Kawwas, said at the Enabling AI Infrastructure Investor Meeting on March 20, 2023:

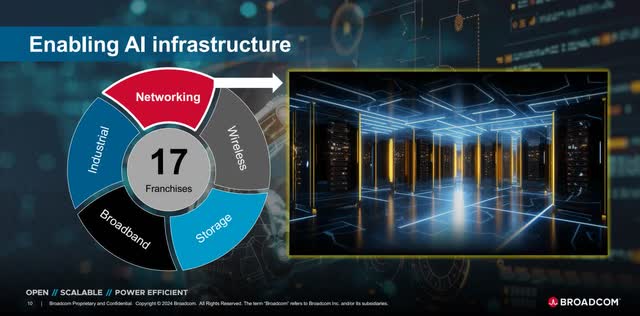

We have coined a term that’s called sustainable franchise. And that is the core definition of every business unit or division we have. So today in Broadcom we have 26 of them and inside the Semiconductor Group there’s about 17 of them. Now out of these 17 we’ve selected five end markets that we play in. Networking, which is the largest market for us and the largest business for us, wireless, server storage, broadband and industrial. And as I said, out of the 26 sustainable franchises, 17 of them are part of this group. Today, we’re going to focus on networking and inside networking, we’re going to double click on the subsegment, that is AI and how do we enable AI in infrastructure.

Source: Enabling AI Infrastructure Investor Meeting.

While many parts of Broadcom’s business are fascinating, this article will primarily focus on the one that should be the company’s locomotive for growth: networking, highlighted in red in the following image from the Enabling AI Infrastructure Conference.

Enabling AI Infrastructure Presentation

The article’s next section will discuss the overall opportunity in AI and why networking is vital for its growing usage.

The company’s massive opportunity in AI

Recently, JPMorgan (JPM) published an article in which its research team estimated that “generative AI could increase global GDP by $7–10 trillion, or by as much as 10%.” Statista projects that the global generative AI market will grow from $44.89 billion at the end of 2023 at a Compound Annual Growth rate (“CAGR”) of 24.40% to reach $207 billion in 2030, a conservative assessment, as some industry analysts forecast the opportunity will reach over $1 trillion by 2032. Broadcom separates the hardware side of that market into two segments: Consumer AI and Enterprise AI.

Enabling AI Infrastructure Presentation

Enterprise AI is for public cloud providers and large businesses that use on-premises computing. NVIDIA (NVDA) is Enterprise AI application’s dominant AI infrastructure provider. However, Broadcom management believes the Enterprise AI market has yet to fully evolve. Charlie Kawwas said the following about Enterprise AI (Emphasis added):

The enterprise side, which could be cloud or on-prem. In this space, a lot of people are trying to invest in AI, but to be honest with you, the business case is yet to be proven. I think there’s lots of initiatives, AI initiatives. I’ve spoken to several CIOs [Chief Information Officers] yesterday. It’s still wait and see. Each of these folks are building small clusters to trial these. Even the cloud guys are trialing some, but there is no real tangible business case as we see on the consumer AI.

Source: Enabling AI Infrastructure Investor Meeting.

Broadcom provides networking infrastructure for companies in the Consumer AI space, which consists of consumer-facing AI applications like search, social media, and e-commerce. During the Enabling AI Infrastructure conference, Charlie Kawwas said the following about Consumer AI (Emphasis added):

[The consumer AI] space…has very few players, but these few players have billions of users. And the way they make money is based on ad and end-user and consumer engagement. The interesting thing over the past few years that we’ve learned with them is that, engagement is directly coupled to the amount of investment that they put in artificial intelligence and machine learning. And as a result, each of these consumer AI players, who are the majority of the market today are investing tens of billions of dollars in this space.

Source: Enabling AI Infrastructure Investor Meeting.

Various publications have stated that analysts believe that two of Broadcom’s current consumer AI customers are Alphabet’s (GOOGL) Google and Meta Platforms (META). During the investor meeting, Charlie Kawwas disclosed that the company had recently gained a new unnamed customer. Several analysts have speculated that the new customer could be ByteDance, the owner of TikTok, Amazon (AMZN), or Apple (AAPL). Broadcom offers its customers two sets of AI infrastructure products: customized AI accelerators and various AI networking products.

Different companies call their accelerators different things. NVIDIA calls its AI accelerator a GPU (Graphics Processing Unit), which is used more for general-purpose AI in the public cloud or on-prem. Advanced Micro Devices (AMD) and Intel (INTC) are NVIDIA’s most direct competitors for producing GPUs for AI accelerator applications. Amazon or Google generally orders GPUs from NVIDIA for their public cloud services.

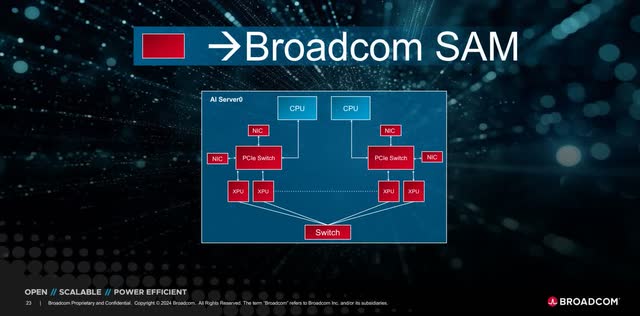

The downside of a GPU is that it consumes massive amounts of power and can be extremely expensive. Consumer AI companies prefer to use custom-made AI accelerators that use ASIC (Application-Specific Integrated Circuits) technology, which are chips designed to perform specific tasks instead of general-purpose use. ASICs use less power and are cheaper. There are several types of ASIC technologies. There is the TPU (Tensor Processing Unit), NPUs (Neural Processing Unit), and XPUs (Auxiliary Processing Unit). Broadcom uses a customized XPU for its AI accelerator. When Meta Platforms or Google orders an XPU from Broadcom, those companies use it to enable AI in search or social media. So, Broadcom’s XPUs only indirectly compete with NVIDIA’s GPUs.

However, for these XPUs, TPUs or GPUs to be useful, they must be connected. In interviews with the news media, Charlie Kawwas, referred to generative AI workloads as “elephant workloads” and talked about how a single AI accelerator is unable to process those massive workloads by itself. Only a network of thousands of AI accelerators can process generative AI workloads.

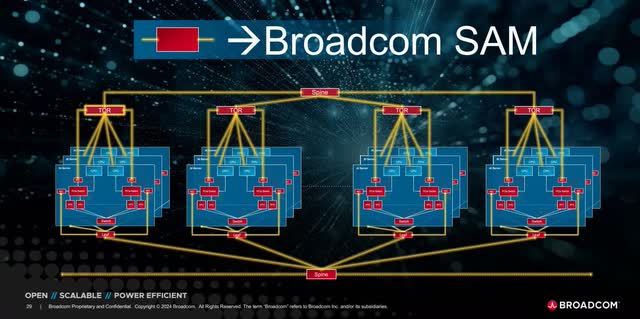

During the Enabling AI Infrastructure Conference, Charlie Kawwas explained how Broadcom builds an AI network of XPUs. It starts by connecting eight XPUs together with Central Processing Units (CPUs). Broadcom doesn’t manufacture CPUs; they come from other players. However, it does make many of the components on an AI card. The image below shows the basic configuration of how it connects its XPUs on a card.

Enabling AI Infrastructure Presentation

Everything highlighted in red is components that Broadcom provides on an AI card. A NIC (Network Interface Card) allows an AI card to network with other AI cards. A PCIe switch (Peripheral Component Interconnect Express switch) is a specialized switch that routes data to multiple components on a card. For an AI card to be useful for things like providing search functionality, Broadcom connects the card with thousands of other AI cards. The image below is an example of how the company connects AI cards.

Enabling AI Infrastructure Presentation

The above image is an example of leaf and spine network architecture, part of an AI cluster. Like the previous image, Broadcom provides all the components highlighted in red, including the leaf, spine, and TOR (Top of Rack) switches. Additionally, Broadcom provides the fiber optic lines symbolized by the golden line and fiber channel optical transceivers (not shown). Broadcom has maxed out its AI cluster size at around 30,000 XPUs. Today, going beyond that requires too much power. Charlie Kawwas said the following about the power issue:

And just to give you an example, remember the lowest power XPU that’s in the industry today is ours. That’s about 600 watts. The next one that’s coming out either from Broadcom or others would be in the range of probably 1,000 watts. If you want to do 30,000 of these this year, just the XPUs will use 30 megawatt of power. Well, guess what? Most data centers, that’s the maximum power they can give you.

Source: Enabling AI Infrastructure Investor Meeting.

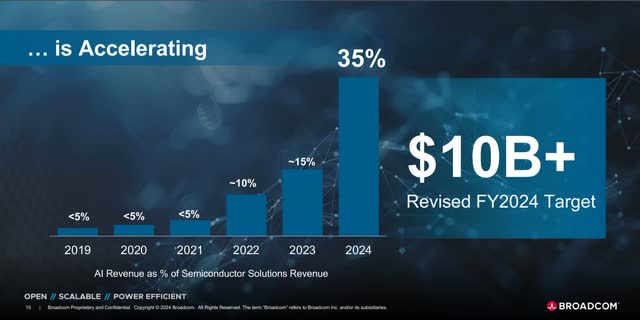

During the investor meeting, management highlighted an aspiration for the industry to achieve +1 million XPUs in an AI cluster in 2027 or beyond, something that may be necessary for generative AI to fulfill its promise. However, scaling beyond 30,000 XPUs will present challenges. Broadcom believes it will require multiple companies to cooperate to achieve AI clusters beyond 30,000. The company also thinks those advancements will only take place on open-source networking technology like Ethernet, as it may be nearly impossible to bring together multiple companies on a proprietary technology with one company acting as a toll booth for generative AI infrastructure. Still, that is another problem for another day. Let’s look at what management expects providing all these components to its customers will do for its business in the near term. The chart below shows that AI revenue is accelerating and that the company projects $10 billion in revenue for FY 2024.

Enabling AI Infrastructure Presentation

Management’s presentation to analysts and investors during the Enabling AI Infrastructure Investor Meeting on March 20 is helping Broadcom inch back toward the price it was at before releasing earnings on March 7. TD Cowen upgraded the stock on March 21 from Market Perform to Outperform due to the Investor Meeting. The same day, Oppenheimer let the market know it was maintaining its Outperform rating. A Seeking Alpha article stated, “For Oppenheimer, Broadcom is a core AI name and remains a top AI pick.”

An excellent earnings report

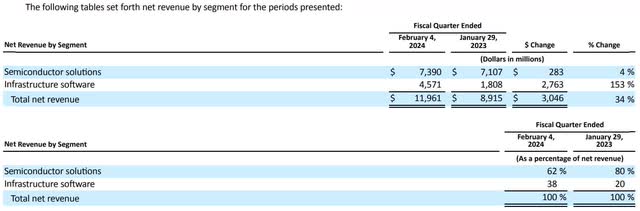

Broadcom generated first-quarter FY 2024 revenue of $11.96 billion, up 34% over the previous year’s comparable quarter. This number beat analysts’ consensus revenue of $11.72 billion. One thing to note is that Broadcom closed its acquisition of VMware on November 22, 2023, after China approved the deal. The company counted 10.5 weeks of VMWare’s revenue in the $11.72 billion. Chief Executive Officer (“CEO”) Hock Tan said, “Excluding VMware, consolidated revenue was up 11% year-on-year,” signaling there is still organic demand for its products.

Broadcom reports in two segments: Semiconductor Solutions and Infrastructure software. VMware boosted Infrastructure Software revenue by 132% sequentially and, as the following image shows, by 153% year over year.

Broadcom First Quarter FY 2024 10-Q

VMware should help Broadcom in the near- and long-term. CEO Tan said, “We expect continued strong bookings at VMware will accelerate revenue growth through the rest of fiscal 2024.” Seeking Alpha posted an article immediately after the acquisition with a comment from KeyBanc Analyst Weston Twigg:

Analyst Weston Twigg said the deal should boost earnings per share and gross margins instantly, as VMware is “highly complementary” to Broadcom’s infrastructure software and semiconductor franchises. He also said that it strengthens Broadcom’s ability to go across public, private and hybrid clouds; it boosts cash flow generation and diversification; and lastly, there are “sizable” synergy potentials.

Source: Seeking Alpha

Broadcom focuses intensely on businesses that not only produce revenue growth but also lead to increased cash flow. Management doesn’t seem to invest much in business lines with a lot of empty calories, meaning high revenue growth but little to no cash flow. In future articles, I will discuss the Software and VMware components of Broadcom’s business.

In the Semiconductor segment, the Wireless, Industrial, Storage, and Broadband sustainable franchises are still in a cyclical downturn. The massive rise in AI revenue, up around four times the previous year’s comparable quarter to $2.3 billion, helped keep the Semiconductor segment in growth mode at 4% year over year. CEO Tan said in the company’s earnings release, “Strong demand for our networking products in AI data centers, as well as custom AI accelerators from hyperscalers, are driving growth in our semiconductor segment.” That’s a statement investors want to hear. Generative AI has created a lot of buzz in the investment community. When management comments about AI driving growth for the company, it increases investors’ interest. I believe investors hope AI revenue will continue its robust growth moving forward and that other sustainable hardware franchises like wireless and broadband will rebound and return to contributing to revenue growth.

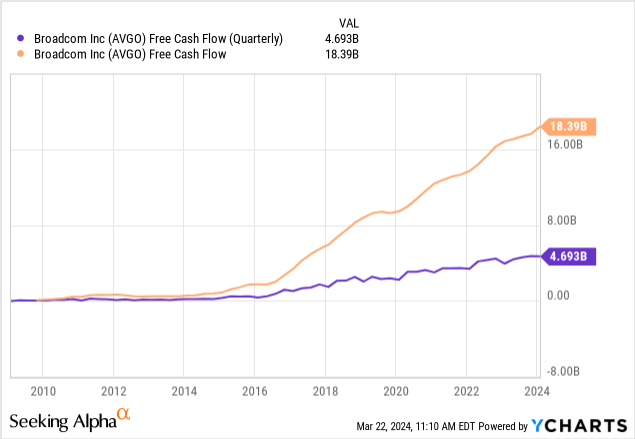

Investors are also likely interested in Broadcom because a decent portion of its revenue results in free cash flow (“FCF”). During the first quarter, the company produced a quarterly FCF of $4.69 billion, an FCF margin of 39.2%. Its trailing 12-month (“TTM”) was $18.39 billion, an FCF margin of 47.31%.

Broadcom has one of the best FCF margins among hardware and software companies. The following table compares Broadcom to a few popular tech names.

| Company name | FCF TTM margin |

| Broadcom | 47.31% |

| NVIDIA | 44.35% |

| Adobe (ADBE) | 35.76% |

| Arista Networks (ANET) | 34.10% |

| Meta Platforms | 32.50% |

| Microsoft (MSFT) | 29.63% |

| Apple (AAPL) | 27.70% |

| Cisco Systems (CSCO) | 23.69% |

| Alphabet | 22.60% |

| Taiwan Semiconductor (TSM) | 13.26% |

| AMD | 4.93% |

| Intel | negative FCF margins |

The company produced an adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $7.156 billion for the first quarter, nearly 60% of revenue, showcasing high profitability. The company also forecasts an adjusted EBITDA margin of 60% for FY 2024. Broadcom’s adjusted EBITDA highlights its operating profitability from operations minus non-cash expenses and potentially some one-time costs. The company’s high operating profitability and robust FCF are attractive to investors who use valuation metrics based on FCF.

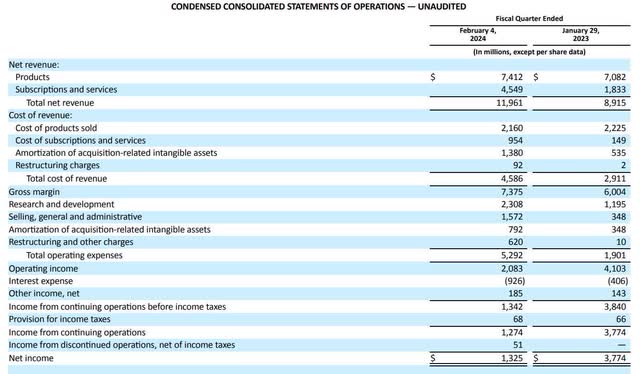

Next, let’s look at GAAP (Generally Accepted Accounting Principles) profitability. The chart below shows the amortization of acquisition intangible assets and restructuring charges on the cost of revenue and operating expenses lines, which are the costs of digesting a significant acquisition like VMware. Those costs impacted the bottom line and were the primary reason its GAAP net income was down around 65% year-over-year in the first quarter to $1.325 billion. First quarter GAAP diluted earnings-per-share (“EPS”) was down 68% year-over-year to $2.84. Although investors may have expected GAAP earnings to go down because of the acquisition, the downdraft in bottom-line profitability may have been more than some had expected.

Broadcom First Quarter 2024 10-Q

The good news is that the company used some of the FCF it generated to pay down debt in the first quarter. Chief Financial Officer Kirsten Spears said during the earnings call:

We ended the first quarter with $11.9 billion of cash and $75.9 billion of gross debt. The weighted average coupon rate and years to maturity of our $48 billion in fixed rate debt is 3.5% and 8.4 years, respectively. The weighted average coupon rate and used to maturity of our $30 billion in floating rate debt is 6.6% and three years, respectively. During the quarter, we repaid $934 million of fixed rate debt that came due. This week, we repaid $2 billion of our floating rate debt, and we intend to maintain this quarterly repayment of debt throughout fiscal 2024.

Source: Broadcom First Quarter FY 2024 Earnings Call

Broadcom paid $926 million in interest expenses in the first quarter. If the company continues paying down its debt, maintaining top-line growth, and controlling costs, its net income profitability should grow throughout 2024. If that scenario occurs, investors who primarily use valuation metrics based on Broadcom’s EPS should see the stock’s valuation improve.

Risks

Broadcom has a net debt-to-EBITDA ratio of 3.13, above the market’s 3.0 benchmark. The market generally considers companies with a net debt-to-EBITDA ratio of below 3.0 as a company capable of paying down their debts. When the ratio exceeds 4.0, investors may become concerned about a company’s ability to pay down its debt. Broadcom is not in danger of having distressed debt today. Still, its debt situation requires monitoring. Management has likely started paying down debt because if the net debt-to-EBITDA ratio continues rising, it could have negative repercussions like higher interest expenses (reducing earnings), reduced investment opportunities, and limited financial flexibility. An offshoot to this high debt risk is that if FCF or EBITDA declines substantially, investors may become concerned about the company’s ability to pay down its debt.

Broadcom also has a high customer concentration risk. The company’s latest 10-Q states (Emphasis added):

A relatively small number of customers account for a significant portion of our net revenue. Direct sales to WT Microelectronics Co., Ltd., a distributor, accounted for 27% and 22% of our net revenue for the fiscal quarters ended February 4, 2024 and January 29, 2023, respectively. We believe aggregate sales to our top five end customers, through all channels, accounted for approximately 40% and 35% of our net revenue for the fiscal quarters ended February 4, 2024, and January 29, 2023, respectively. We believe aggregate sales to Apple Inc., through all channels, accounted for approximately 17% and 20% of our net revenue for the fiscal quarters ended February 4, 2024, and January 29, 2023, respectively. We expect to continue to experience significant customer concentration in future periods.

Source: Broadcom First Quarter FY 2024 10-Q

Broadcom losing a top customer is more than a theoretical risk. Apple is a significant customer of its wireless modem products, and it plans to wean itself off Broadcom’s products by 2025 and use an in-house design. Additionally, although Broadcom management made it seem like it doesn’t compete directly with NVIDIA, that may change soon. NVIDIA management has decided to throw its hat in the ring of customized AI chips and compete more directly with Broadcom. If NVIDIA can successfully enter the customized chip market, it may limit the growth opportunities for Broadcom over time. Even worse, if NVIDIA successfully takes an existing AI customer away from Broadcom, it could greatly impact the company.

Valuation

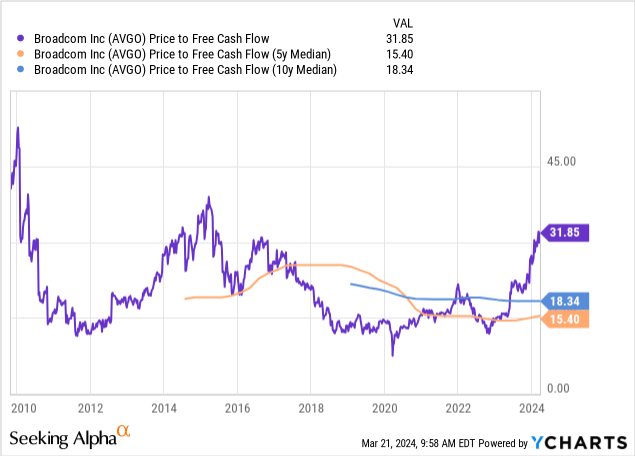

According to traditional valuation metrics, Broadcom sells at a steep price. Value investors should consider steering clear of this one. Seeking Alpha’s quant rates the stock’s valuation as a D-. The stock sells at a price-to-earnings (P/E) ratio of 48.09, above the sector median of 29.53 and the S&P 500 P/E ratio of 28.53. The chart below shows that Broadcom sells at a price-to-FCF of 31.85, well above its five- and ten-year median — a potential sign that the market may overvalue the stock.

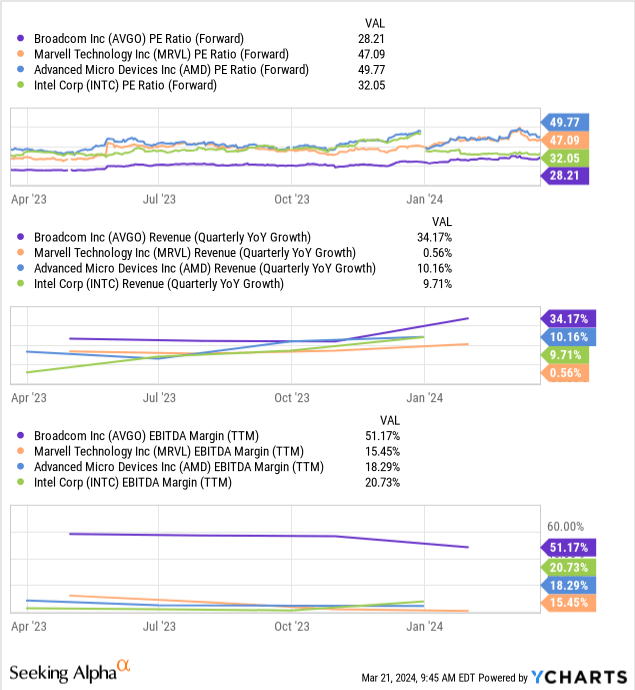

The chart below shows Broadcom trading at a forward P/E of 28.21, well below some of its peer chip and networking companies, although it’s growing its revenue faster and has more profitability than its peers. On a relative valuation basis based on a forward P/E, the market may undervalue the stock.

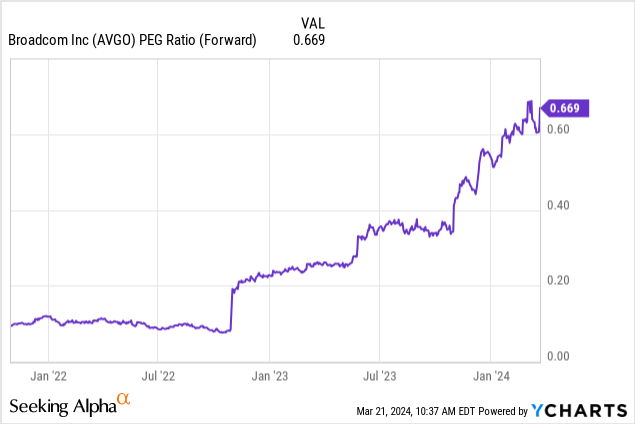

Broadcom’s forward Price-to-Earnings-to-Growth (“PEG”) Ratio is 0.67. A PEG ratio below 1.0 may indicate that the market undervalues the stock.

The following reverse DCF shows the implied free cash flow (“FCF”) growth rates over the next ten years for Broadcom’s closing price of $1,353.47 on March 22, 2024.

Reverse DCF

|

The first quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$18,393 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 14.3% |

| Stock Price (March 22, 2024, closing price) | $1,353.47 |

| Terminal FCF value | $67.923 billion |

| Discounted Terminal Value | $374.106 billion |

| FCF margin | 47.31% |

Based on my assumptions about the discount and terminal growth rates, the above reverse DCF calculation states that Broadcom needs to produce a FCF growth rate of 14.3% over the next ten years to justify its March 22, 2023, closing price. Analysts believe Broadcom should grow revenue at 18.32% between 2023 and 2028. Broadcom has also grown its FCF at a rate of 15.75% over the last five years. Suppose the company can maintain that FCF growth rate over the next ten years; its intrinsic value would be $1502.99, 11% above its March 23 closing price. If the generative AI revolution becomes as large as some people believe and it can continue growing its AI revenue and its other revenue-producing segments come out of the doldrums, the market may undervalue this stock at the current price. How investors value Broadcom partially depends on how well it can continue to benefit from the proliferation of generative AI and how well the other parts of its business grow. If the company can maintain its FCF margin above 45% and revenue growth rates at 15% or above for the next ten years, I believe it can exceed the FCF growth rates implied by its March 21, 2024, closing stock price.

Consider buying the stock

While Broadcom may look overvalued to some, it doesn’t look as overvalued as some other companies that are beneficiaries of generative AI, in my opinion. It is also one of the most profitable hardware or software companies. The company holds a dominant position in networking and the design of custom AI chips. Although rumors suggest NVIDIA, a formidable competitor, will attempt to enter the custom AI chip space, it has fewer advantages in the custom AI chip market than it does within the generalized AI chip space.

Some large enterprises don’t want to sole-source AI chips from one vendor and may look to diversify away from NVIDIA’s proprietary solutions like InfiniBand and CUDA. Broadcom uses and promotes open-source networking solutions like Ethernet. When Broadcom talks about needing the cooperation of other companies to scale AI clusters beyond 30,000 AI accelerators, the companies that do collaborate to accomplish that feat are more likely to use open-source technology than proprietary technology.

Value investors may want to avoid Broadcom at current prices. However, growth investors looking for a beneficiary of the generative AI revolution should consider putting Broadcom on their buy list. I rate Broadcom a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.