Summary:

- Broadcom Inc. stock has grown by over 28% since March 2024, outperforming the S&P 500 by six times. I believe it’s just the beginning.

- Recent financial reports show strong revenue growth, particularly in AI-related revenues and infrastructure software.

- We already see that the integration of VMware has simplified operations and significantly reduced costs.

- I expect AVGO’s margins to improve as the product mix balances out and the high-margin AI and networking solutions continue to grow.

- My calculations indicate an upside potential of 36.7% for the next 12-16 months as the company keeps exceeding estimates and holding its P/E at or above 30x.

G0d4ather

My Thesis

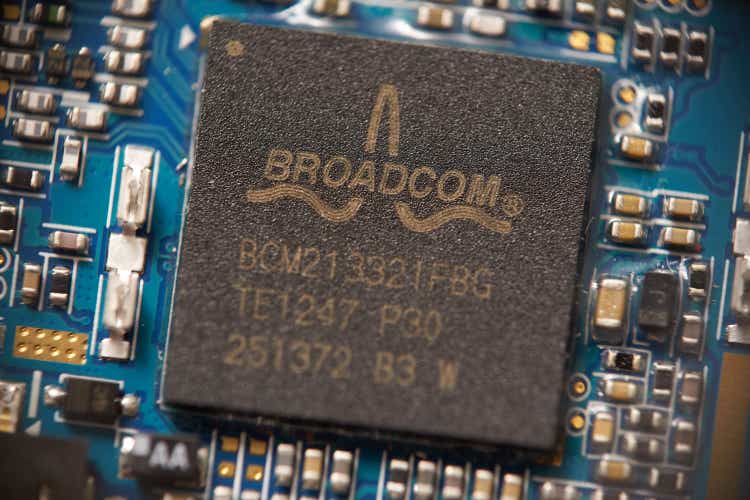

I first initiated coverage of Broadcom Inc. (NASDAQ:AVGO) on March 22, 2024, stating that the company’s strong financials, sales structure updates, and AI prospects pointed to further outperformance in the future. Since then, the stock has grown by over 28%, outperforming the S&P 500 by approximately six times, becoming one of my best calls on Seeking Alpha so far for such a short period of time.

Seeking Alpha, Oakoff’s coverage of AVGO stock

Given the fact that AVGO recently reached the target price I calculated for it last time, I decided to update my coverage today. My current thesis remains largely unchanged: Moreover, I believe the recent stock price appreciation is just the beginning for Broadcom, as the recent corporate events clearly indicate that growth expectations for the company are likely well-founded, and we should expect more top-line growth, higher margins, and continued dividend growth supporting the high valuation multiples.

My Reasoning

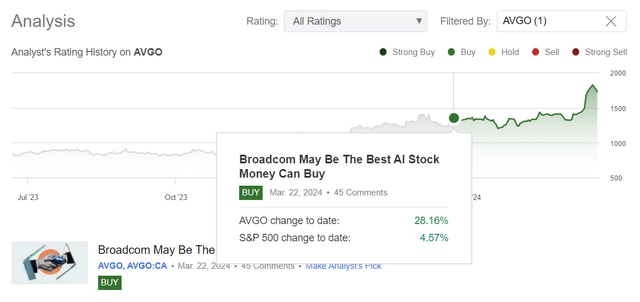

As usual, I’d like to start with an analysis of the latest financial report (fiscal Q2 2024), which was released on June 12. Broadcom’s revenue reached $12.49 billion (+43% YoY and +4% QoQ), beating the consensus estimate of $12.01 billion by ~$500m. According to Seeking Alpha, the company also beat the consensus estimate by about 1% with non-GAAP earnings of $10.96 per diluted share (+6% YoY). The main growth driver for the quarter was AI-related revenues: CEO Hock Tan emphasized (in the press release) that these increased by 280% to $3.1 billion, up from $2.3 billion in the previous quarter.

Seeking Alpha, AVGO

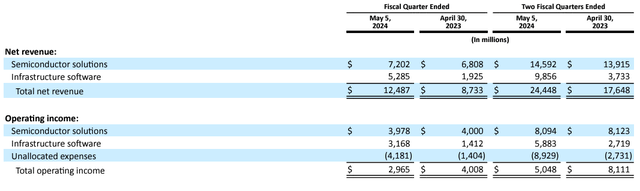

Now let’s take a look at the segments’ performance. As you might know, AVGO has only 2 business segments: Semiconductor solutions (shortly “SS”, 57.7% of total sales in Q2) and Infrastructure software (“IS”, 42.3%).

AVGO’s 10-Q

Although SS’s revenue was slightly down sequentially, it went up 6% on a YoY basis. As the press release notes clarified, generative AI solutions played a significant role in SS structure, representing over 40% as of Q2. Also, this segment saw substantial growth from its Ethernet products and custom AI accelerators for major hyperscale customers. Networking revenue, which is also an important part of SS, reached $3.8 billion (+44% YoY and +15% QoQ) as Broadcom doubled the number of switches sold year-over-year, particularly Tomahawk 5 switches and Jericho 3 AI routers.

In addition to its focus on AI and networking, Broadcom is expanding its wireless segment by increasing its share of 5G handsets, backed by a multiyear, multibillion-dollar agreement with Apple (AAPL) to develop and produce 5G RF components. The company is also addressing weaknesses in the storage connectivity and broadband segments by increasing content per server and expanding cloud data center deployments. Despite the current decline in broadband revenues due to weak telecom spending, Broadcom seems to be well-positioned to benefit from a future recovery. Moreover, Broadcom’s comprehensive platform of plug-and-play silicon IP hyperscalers enables rapid development and deployment of AI clusters, positioning the company for significant revenue growth as AI adoption continues to accelerate, in my opinion.

In infrastructure software, we saw revenue growth of 175% (from $1.9 billion in the previous year to almost $5.3 billion) thanks to the integration of VMware’s assets and revenues. In fact, VMware contributed $2.7 billion in revenue in the second quarter, up from $2.1 billion in Q1. As management noted in its comments, the VMware acquisition has been transformational: Broadcom has modernized VMware’s product offerings from over 8,000 SKUs to four core products; simplification has eliminated many sales conflicts and streamlined operations. I also like the fact that AVGO made some crucial post-acquisition cost-cutting measures: VMware’s spending run rate declined from $2.3 billion per quarter pre-acquisition to $1.6 billion in Q2, with further expectations to reduce it to $1.3 billion by the end of FY2024.

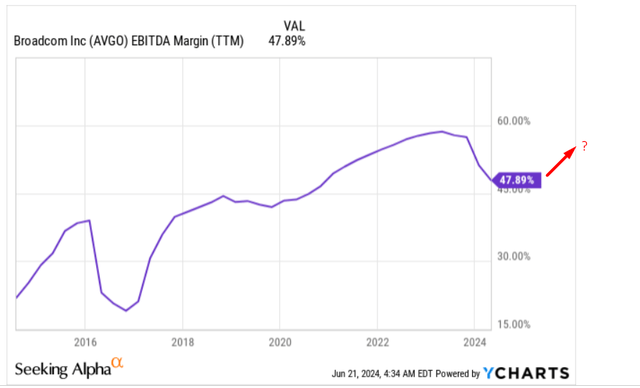

The acquisition of VMware and its integration into Broadcom’s business structure has put considerable pressure on margins in recent periods. Also, AVGO’s margins were under pressure due to a higher mix of custom AI accelerators. They typically include a significant amount of high-bandwidth memory (HBM), which is supplied by 3rd parties so Broadcom doesn’t charge a significant margin markup on these components. Given the recent changes in post-acquisition cost reductions, and assuming the cyclicality of the semiconductor product mix recovers and that the company continues to expand its high-margin AI and networking solutions, I believe there should be opportunities for margin improvement going forward.

YCharts, Oakoff’s notes added

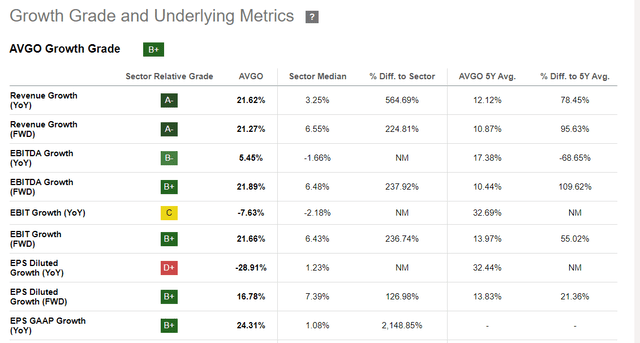

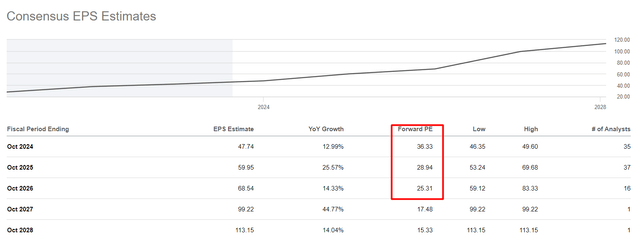

The market appears to agree with my assessment regarding the future of AVGO margins: Wall Street consensus estimates predict a 5-year CAGR for EPS of around 18.8%, which is about 575 basis points higher compared to revenue CAGR for the same period. As you can guess, this is significantly higher than the median values for the entire IT sector. According to Seeking Alpha’s Quant Rating, AVGO exceeds growth standards on most metrics:

Seeking Alpha, AVGO’s Growth

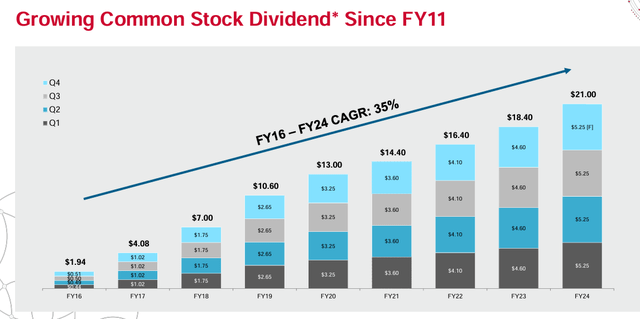

However, if we compare the current consensus forecasts with the development of AVGO’s earnings per share over the last 10 years, we can see that the market is now applying a certain discount to Broadcom’s potential earnings growth. Over the last 10 years, AVGO’s diluted earnings per share CAGR has been around 25%, while the dividend CAGR since 2016 has been even higher (around 35%), according to IR materials.

IR materials

I think Broadcom has a better chance of achieving its usual 25% CAGR in EPS over the next 5 years, which is well above what the market is predicting today. This is mainly due to the fact that VMware already seems to be almost fully integrated into the company’s ecosystem, and also the demand for AI solutions is expected to increase more than previously expected.

The analysts at Morgan Stanley support my view (proprietary source), noting that Broadcom has “the second-largest AI exposure (in absolute dollars) in their coverage” – just behind Nvidia (NVDA), I suppose. They expect Broadcom to benefit significantly from the AI boom: They forecast AI-related revenues to grow from $4.2 billion in FY2023 to $14 billion in FY2025 (a 2-year CAGR of ~82.6%), accounting for ~39% of the company’s semiconductor revenues. The bank expects this growth to be driven by the deployment of Ethernet in AI data centers, Google’s (GOOG) continued TPU expansion, and two new ASIC customers.

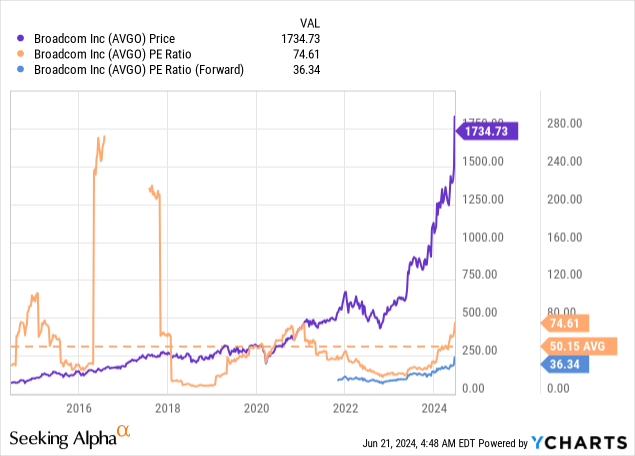

I, therefore, assume that many market participants are ignoring AVGO’s current valuation, which has become quite high when looking at the TTM values. However, it’s also important to mention that on a forwarding basis, AVGO’s P/E ratio of ~36x doesn’t look scary in a historical context.

Looking again at Seeking Alpha’s data on consensus estimates, we see that AVGO stock should trade at 29x by the end of fiscal 2025, which is still a lot in absolute terms, but will be perfectly fine in terms of AVGO’s historical norms.

Seeking Alpha, Oakoff’s notes added

If AVGO’s EPS growth rates indeed exceed consensus numbers, the implied P/E ratio should be even lower – according to my calculations, AVGO would trade at 22x by FY2025 with a premium to the current EPS growth forecast. I don’t think this ratio is realistic – most likely AVGO will keep its P/E ratio at ~30x (if not higher). Thus, the company’s growth potential can reach about 36.4% compared to the current stock price. Therefore, I believe that my previous estimates of AVGO’s growth prospects were actually too conservative. The rapid rally we have seen in recent weeks is just the beginning, in my opinion.

Risks To My Thesis

Although the market for customized AI silicon chips is promising and Broadcom’s market positioning clearly differentiates it from other peers, there are some key risks that any potential buyer of Broadcom stock should consider.

One major concern is potential competition from Nvidia, which could impact Broadcom’s market share. In addition, Morgan Stanley points out that there are press reports suggesting that Google could develop its own ASIC, possibly in collaboration with MediaTek, which could jeopardize Broadcom’s Google TPU business. There is also the risk of a continued downturn in semiconductors and challenges in integrating VMware into its portfolio that we shouldn’t ignore.

Although the company has been conservative in its customer assessments – we can see that from the earnings call – any EPS shortfalls could lead to massive multiple contractions. Say, AVGO’s P/E multiple drops to just 22x (FY2025), and the consensus estimate for EPS of $59.95 holds. In this case, Broadcom’s stock price could drop to $1,319 – that’s 31.5% lower than the latest market price.

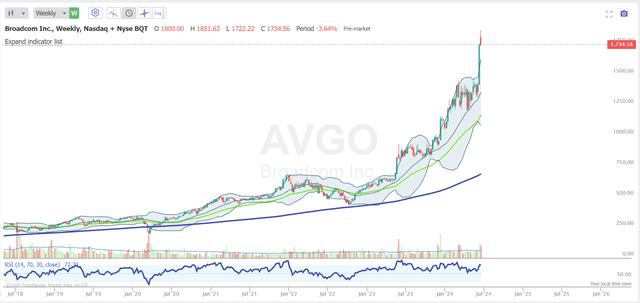

I’m also confused by the fact that AVGO shares look quite stretched technically: The stock will most likely go through a consolidation phase, and for new buyers, now may not be the best time to buy.

TrendSpider Software, AVGO weekly, Oakoff’s notes

Your Takeaway

Despite the many risks – both fundamental and technical – I still believe that the strength we have seen in AVGO stock over the past few months is just the beginning. In my opinion, Broadcom is poised for strong future growth through a number of strategic initiatives. AVGO is expanding its AI and networking solutions, growing its presence in the wireless segment through key partnerships, and addressing challenges in storage connectivity and broadband. We already see that the integration of VMware has simplified operations and significantly reduced costs. Although margins have come under some pressure due to the higher proportion of custom AI accelerators, this is expected to improve as the product mix balances out and the high-margin AI and networking solutions continue to grow.

My calculations indicate an upside potential of 36.7% for the next 12-16 months as the company keeps exceeding estimates and holding its P/E at or above 30x (thanks to the premium AVGO obtains). Therefore, I reiterate my “Buy” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.