Summary:

- Harley-Davidson is a well-known brand and a profitable business in a growing market.

- However, since 2014, the company has lost market share and is selling in total about half as many bikes as at the top.

- The lower stock price reflects that. However, I do not think it has fallen enough to offer a high enough margin of safety for a ride.

Shofi –

Harley-Davidson, Inc. (NYSE:HOG) has been coping with a set of challenges not just over the last few years, but in fact even over the last decade. Harley has not achieved new record sales since 2014, despite inflation, while pressured margins have led to disproportionately lower earnings and cash flows.

However, not known to many, Harley-Davidson has been a very aggressive cannibal, meaning it has bought back a big chunk of its stock outstanding. As long as a business is relatively stable, it does not even have to be a growth story to achieve great returns for shareholders.

On the surface, Harley-Davidson still not being dead, could be a lucrative opportunity, at least in the short- to medium-term, as it has announced a buyback of the equivalent of 20% of its outstanding equity.

However, there are reasons why I am not euphoric.

Why this is rather not a no-brainer at a P/E of 8x

Harley-Davidson was founded in 1903, while today’s company has been publicly tradable since 1986.

Today, it is still mainly a combustion engine motorcyclist company with a financing arm. Its third pillar, called LiveWire, is the attempt to modernize the company by offering electrically powered motorcycles. However, this adventure has been loss-making so far, and it is rather questionable whether a typical Harley customer will switch to a soul-less noiseless alternative. Even if, this would more likely cannibalize existing products and not necessarily ignite a whole new growth story.

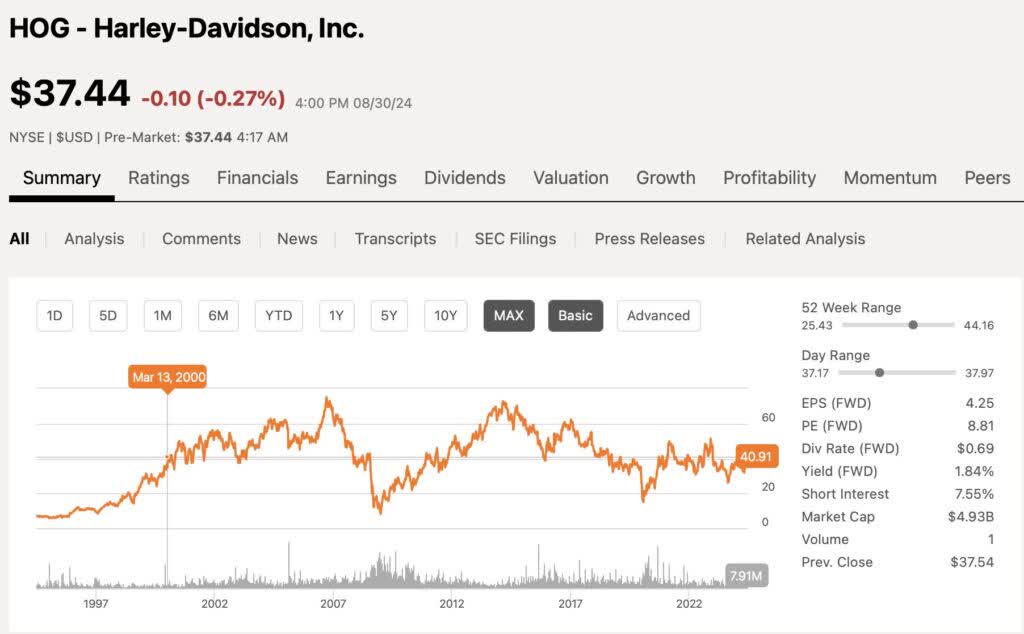

Leaving this aside, below on the stock chart we can see as a first impression, that the company has been struggling since at least 2014, when its last significant high was made – almost double as high as today’s stock price. To make it even worse, Harley-Davidson’s stock is trading where it was 24 years ago, which didn’t even have anything to do with the Dotcom bubble, as you can see the stock did not experience any bust of the same, continuing to rise as if nothing were.

Seeking Alpha

Though of course not identical, this price chart instantly reminded me somehow of tobacco stocks with their troubled legacy businesses. In the case of Harley-Davidson, we do not need to make a secret out of it that the brand has been having difficulties to expand.

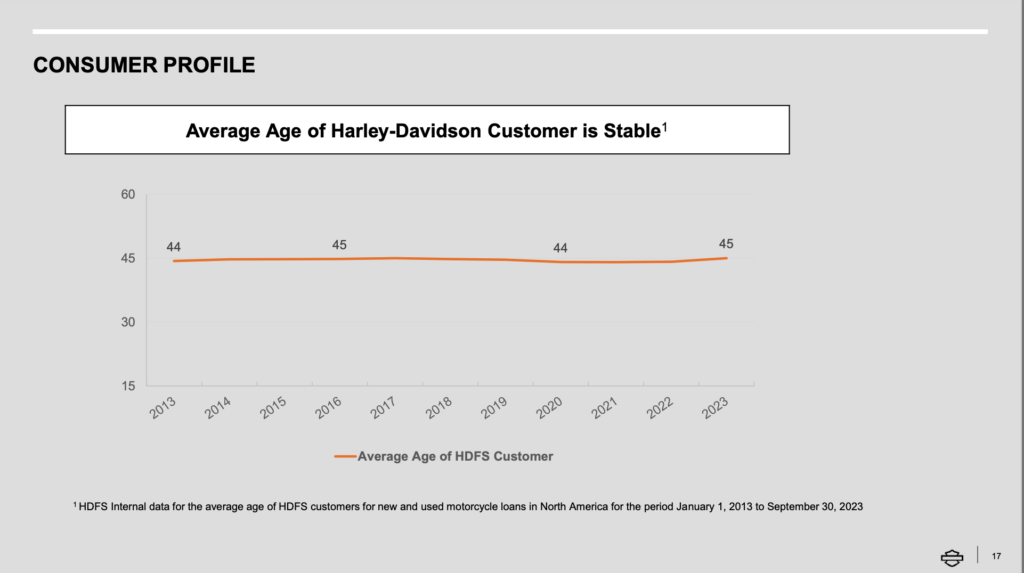

However, contrary to the belief of many, it has nothing to do with not enough new, younger customers buying a Harley, as the average rider is 45 years of age – almost exactly the same as ten years ago – as the company showed during its recent earnings call presentation.

Harley-Davidson

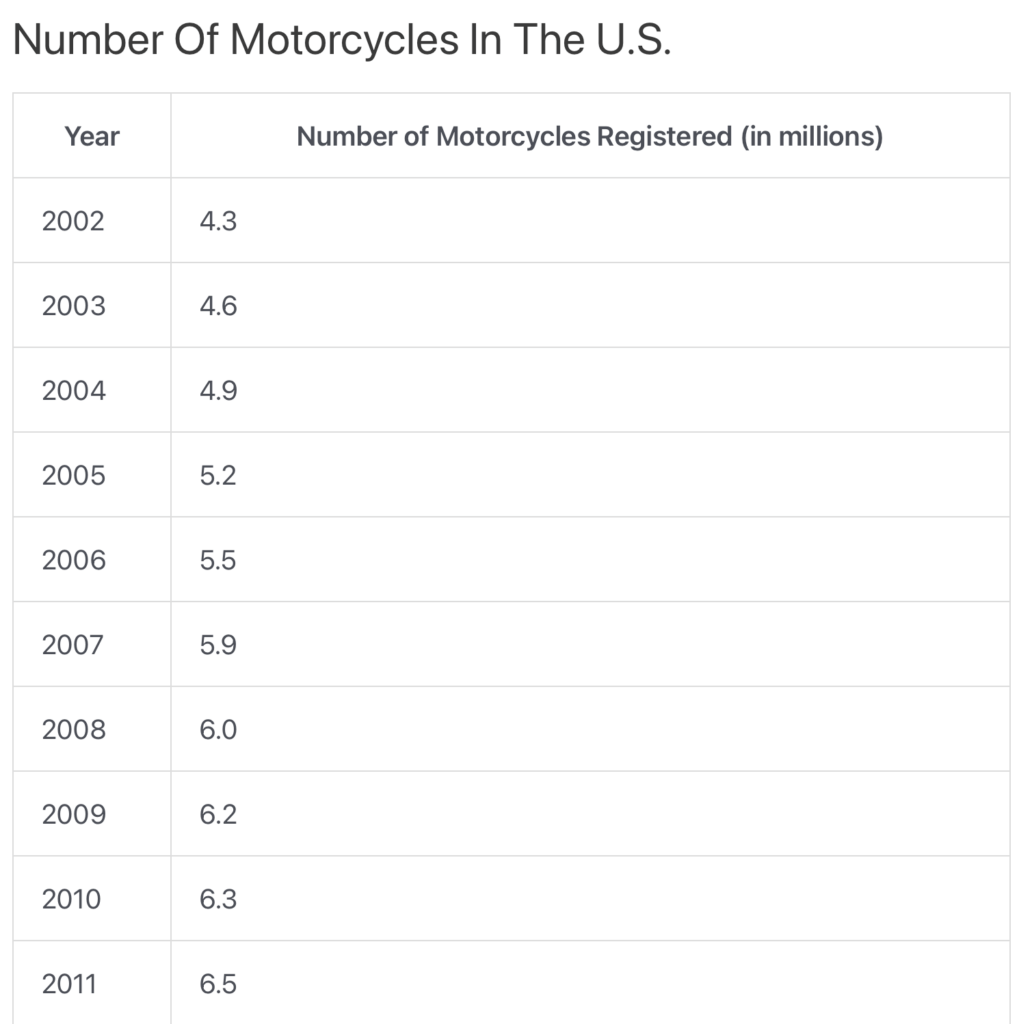

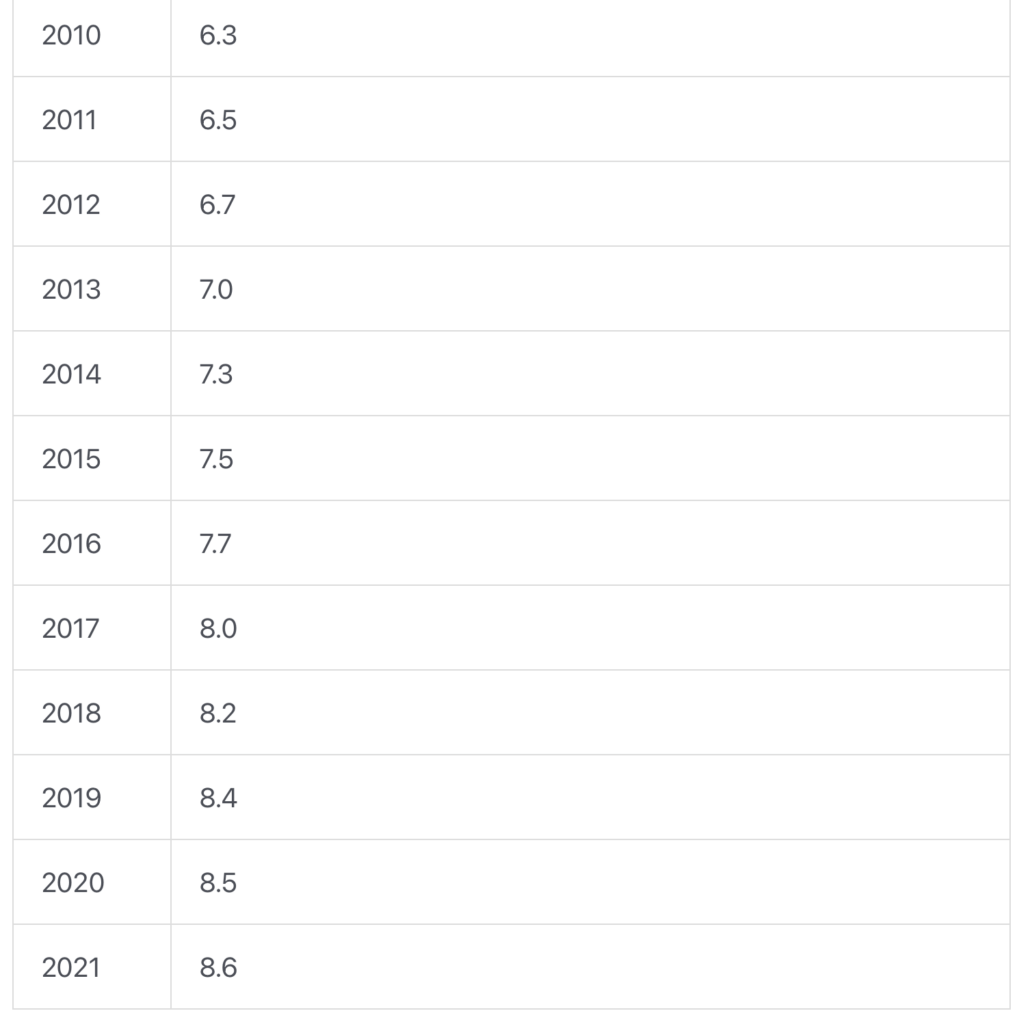

The stock of Harley-Davidson has fallen over the last decade due to structural issues. When looking at the number of registered motorcycles in the US, we can see that at least until 2021 the total number has been growing, even despite the 2020 and 2021 lockdowns.

motor and wheels motor and wheels

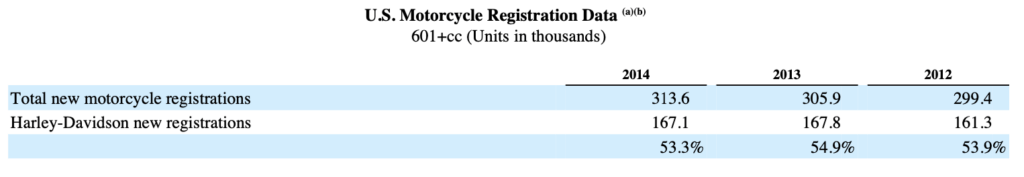

I am purposefully looking here at the US market, as Harley there at least in the past had an impressive market penetration with more than every second motorcycle being a Harley (which wasn’t and isn’t the case in other markets). Besides, Harley is generating about two-thirds of its sales in the US.

Harley-Davidson 2014 annual report

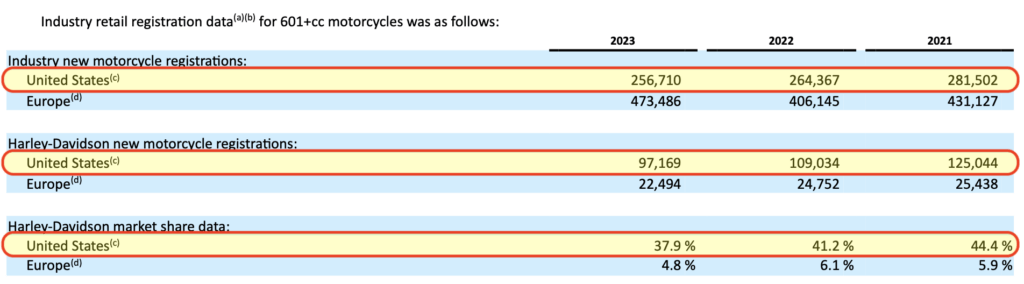

Looking into the latest annual report for the year 2023, we indeed find that Harley has lost massively on market share, falling even below 38% for new registrations. Notice also the decline in Europe below 5%.

Harley-Davidson, 2023 annual report

This speaks a clear language. Harley, despite still having a recognized brand, has not been able to ride along the growing market it is operating in. At the peak in 2014, 167k Harley machines were registered in the US. Last year, the number fell below 100k.

Even though I couldn’t find any average selling price numbers, it is safe to say that a unit drop of 48% is hard to digest – this would have required a price double only to keep sales stable. I know the business is not just about sold new units, but also about spare parts, accessories and other stuff, but that’s the main driver, also influencing the other categories.

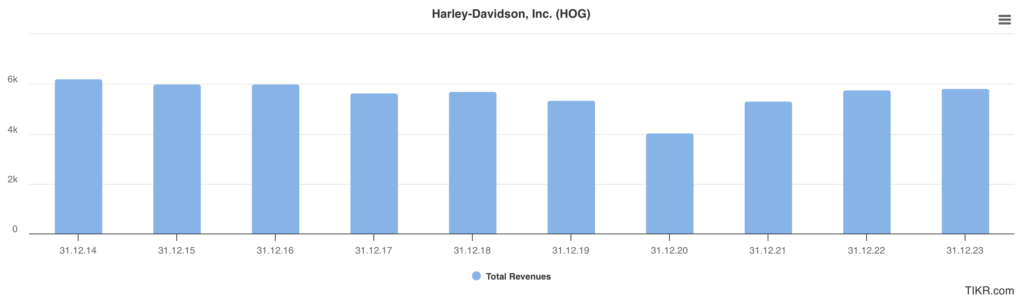

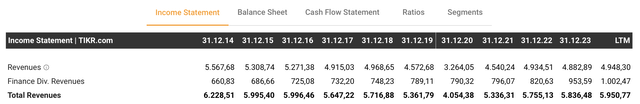

To put more meat on the bone after this birds-eye overview, Harley-Davidson has seen its sales still being ~5% below where they were in 2014 – 6.2 bn. USD then vs. 5.9 bn. USD in 2023.

TIKR

This even masquerades the details a bit, as motorcycle sales are even 11% lower than a decade ago, while financial services brought in 50% more revenues!

TIKR

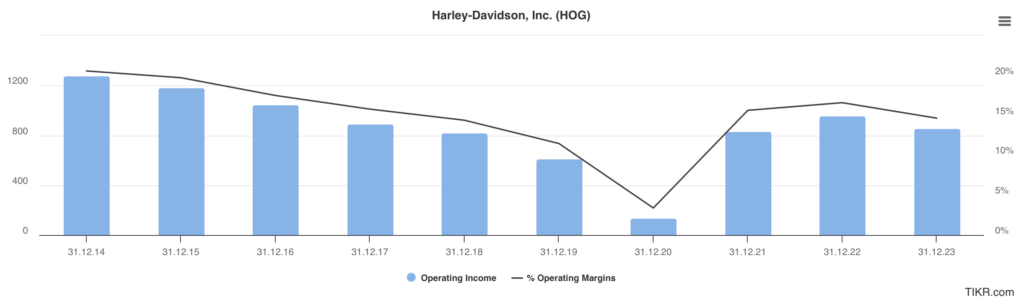

At the same time and not necessarily surprising, operating margins and earnings have seen even a bigger decline which makes sense for a manufacturing company with certain fixed costs, but fewer sold units.

TIKR

So, a troubled and seemingly out-of-favor company with sales and earnings headwinds has seen its stock decline – as it looks like not undeserved.

There are even quite a few bull arguments worth talking about.

Here are some bull arguments

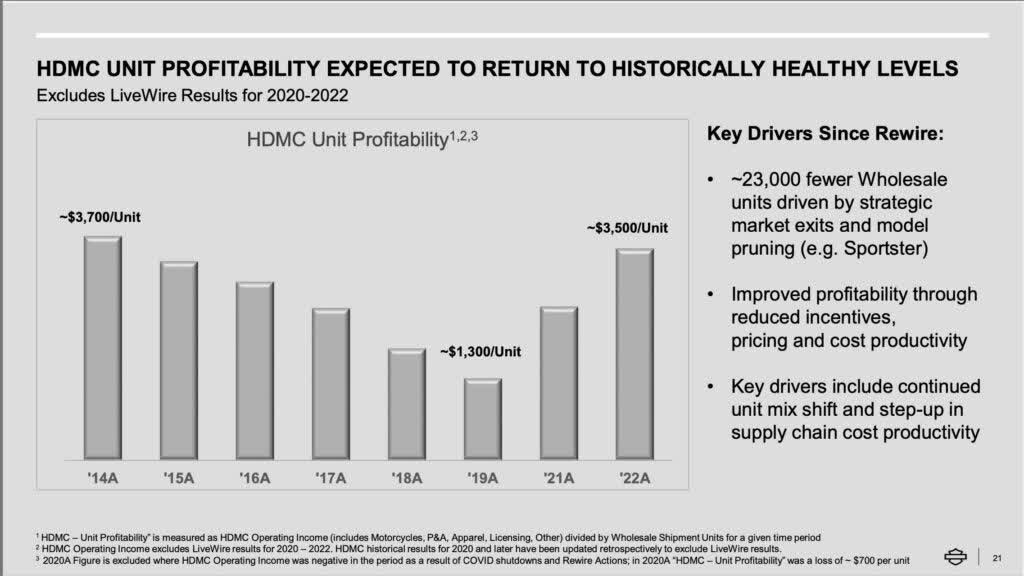

A few weeks before the earnings call, a new general investor presentation has been uploaded which includes an interesting sheet.

It shows that profitability per unit sold has been on the rise again. Despite still being below the 2014-high, in 2022 (I don’t know why they haven’t shown 2023 figures as we’re in summer 2024…) the company has reached the second-highest level for this period which is encouraging that despite less units, margins could be improved again. At least on a per-unit basis.

Harley-Davidson July 2024 presentation

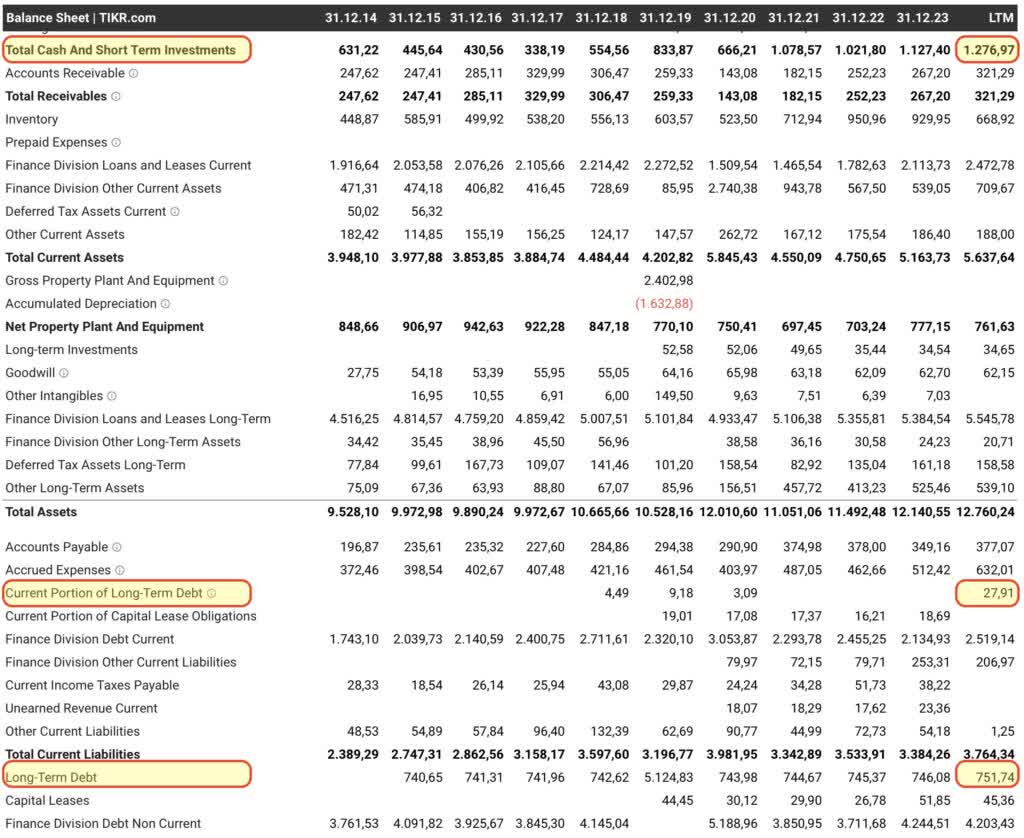

Looking at the balance sheet, one needs to consider that the financial arm stretches it – taking the respective debt and financing assets (loan receivables) of the financing division out again, the company even has a net cash position of give or take 400 mn. USD – so it is not in imminent danger of a liquidity collapse.

TIKR

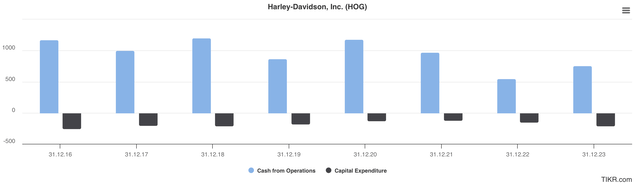

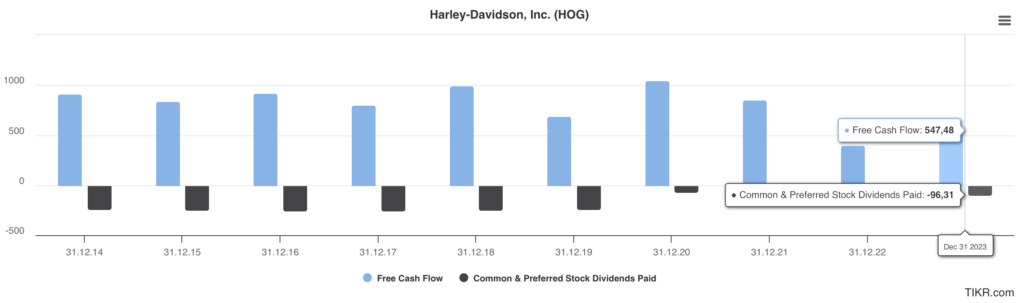

Let’s look next at the cash flow statement. With operating and free cash flows (OCF – CAPEX or higher blue bar than black) having always been strongly positive over the last ten years, this is a financially sound company.

Also on the positive side: buybacks. Harley-Davidson has been a pretty aggressive repurchaser of its own stock. I mean, really aggressive.

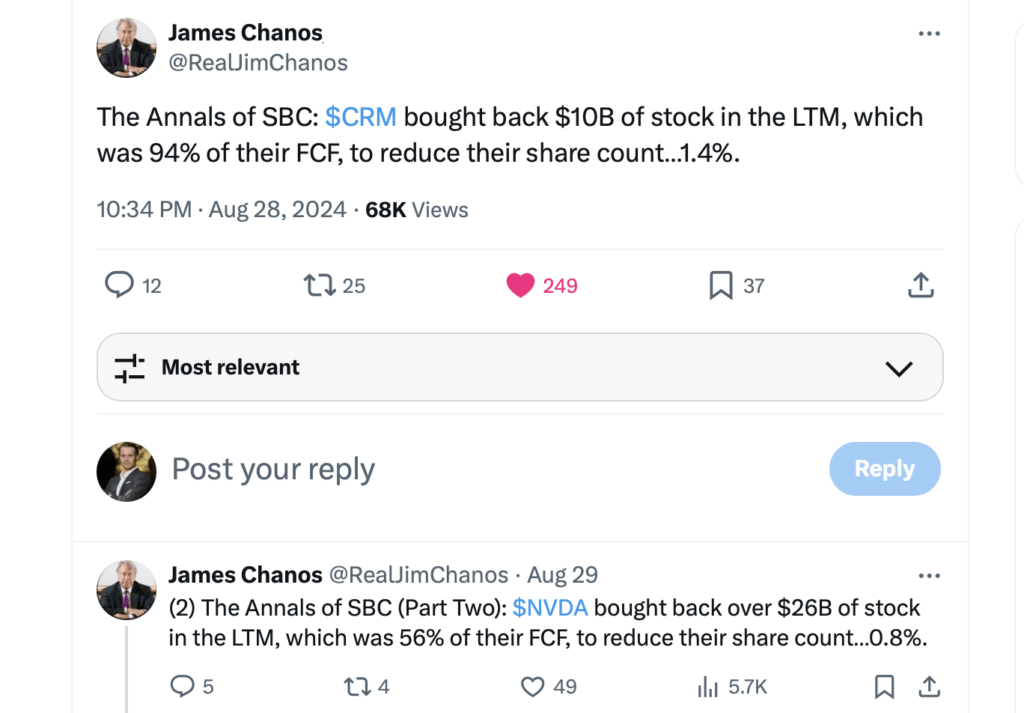

When I hear that one of those big techs has spent billions on buybacks in the double-digits (billions of USD), I can only shake my head, as the bottom line is often that big headlines don’t automatically result in meaningful share count reductions. Famous short seller Jim Chanos recently posted this on X (Formerly Twitter):

Twitter / X

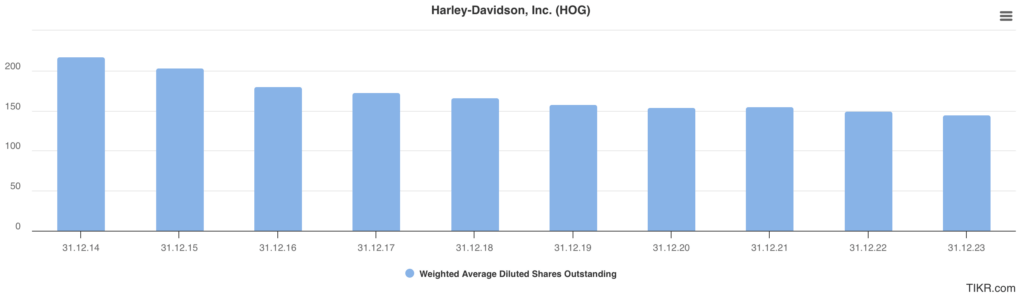

Not so regarding Harley. Over the last ten years, share count was reduced by not less than 37% on a fully diluted basis. Since 2010, it’s even 42%.

TIKR

And now recently, management announced a new one billion USD buyback program – that’s 20% of the current market cap! The only caveat: the program spans until the end of 2026, i.e., over two and a half years. Nonetheless, this is an impressive figure many only can dream about.

With annual free cash flows of somewhere between 500 mn. USD and even more in the recent past (and the dividend not costing them more than 100 mn. USD annually after the cut in 2020), this looks like an easy hurdle to comfortably step over.

TIKR

Fair value estimation

The negative development since 2014 has led to a compressed stock price and also valuation multiples. Today, one can buy the stock at an EV / FCF of 8-9x (4.5 bn. USD / 0.5 bn. USD) or a free cash flow yield of 11-12% which sounds pretty attractive.

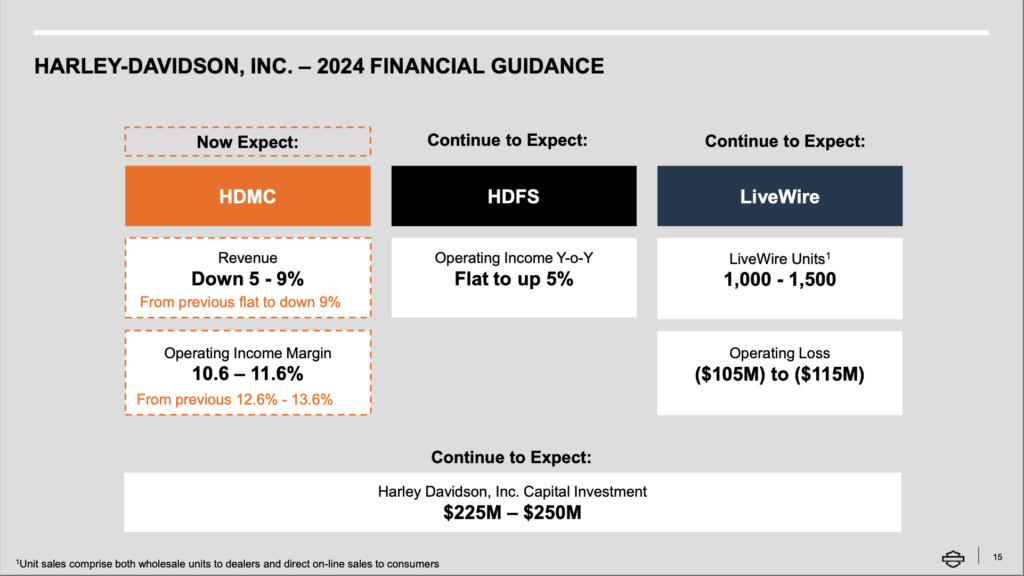

However, the problem is that we are currently past the economic up-cycle. Harley, being a cyclical business, already adjusted its guidance lower with the last set of results. Sales will be down between 5-9% while the previously rising operating margin is also expected to turn southwards again.

Harley-Davidson

While they haven’t given any FCF guidance, it is rather to be expected that in the core non-financial business cash flows will likely also be negatively affected.

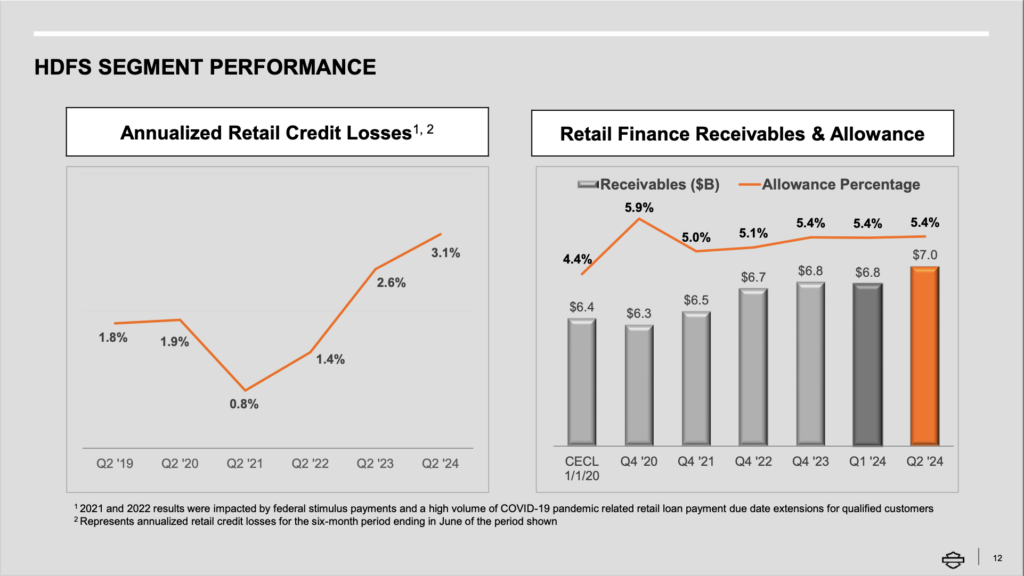

Adding to this, despite management still seeing operating income for the financial services division being flat to even up by 5%, there is also bad news on this front as credit losses are on the rise as well as receivables and allowances (money put aside for potential credit defaults). When these measures rise, the consumer is clearly not in the best shape.

Harley-Davidson

So in practice, this means, depending on how the current new environment plays out, it is absolutely possible that the current guidance will have to be lowered again. And quite honestly, an FCF yield of only 11-12% does not offer a high enough margin of safety for my taste, as we are dealing with a melting ice cube. Having these two negative forces, organically from within and externally from the side of the economy, this seems to be a risky adventure.

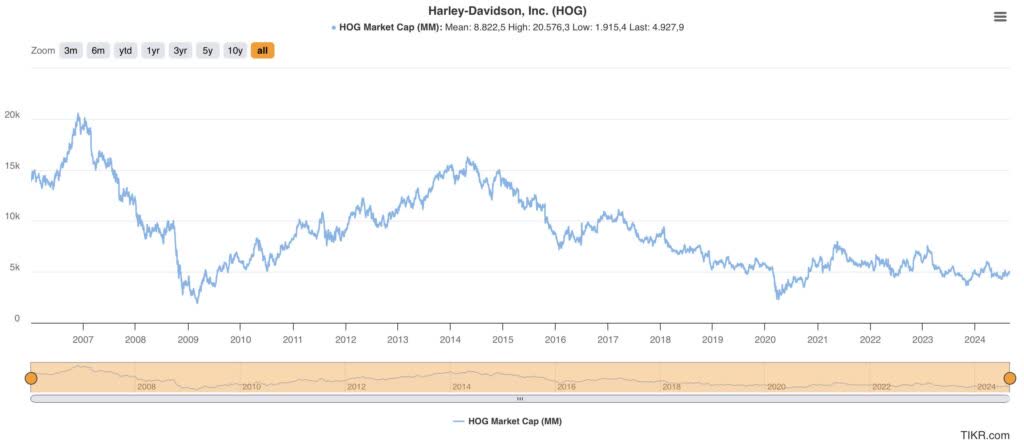

Despite the aggressive buybacks, these efforts have done rather little to the stock price, except for some cosmetics. What I like to do when share counts change dramatically – whether up or down – is to take a look at the development of the market cap as I view this as an answer to whether the whole business has made a jump forward or whether it’s in a bigger decline than the stock price might show. Unfortunately, but not surprisingly, the picture looks rather grim for Harley-Davidson:

TIKR

The company’s market capitalization is near its lowest level in 15 years, when we exclude the dips in 2009 and 2020. While the company does not have to grow to justify its current valuation multiples (which is not imaginable for me at the moment) – buybacks have only slightly held up the stock. Over the last ten years, the stock is down by 42% and over the last five years up by just 17%.

Seeking Alpha Seeking Alpha

I did a few DCF (discounted cash flow) scenarios to answer this final question. My assumptions are:

- starting FCF of 500 mn. USD.

- growth rate for the first ten years (including buybacks): -5%, 0% and +5%.

- terminal growth rate 0%.

- discount rate: 15% (in this case, I want a higher margin of safety than the usual 10%).

- 139 mn. diluted shares outstanding as of now.

The resulting fair values are 17.50 USD (-5% growth per share), 23.20 USD (0%) and 31.37 USD for the upside case.

As the stock is trading currently at 37 USD, we are unfortunately very far away from this range, where the mid-point of 23-24 USD might seem plausible for a high enough margin of safety to consider a ride.

Let’s see, how things evolve! With the business momentum now tilted to the downside again, I tend to stay away from this story. I’ll put it on my watch list, for maybe there’ll come a time when the company will be declared dead.

Risks to my thesis

It is entirely possible that the economy recovers quicker than thought. Likewise, Harley’s transition to electric rides could be an under-appreciated success story.

With a clean balance sheet and a big buyback program and assuming cash flows don’t crater, the buyback effect alone could be meaningful by retiring a big part of stock outstanding.

Conclusion

Harley-Davidson is a well-known brand and a profitable business in a growing market. However, since 2014, the company has lost market share and is selling in total about half as many bikes as at the top. The lower stock price reflects that. However, I do not think it has fallen enough to offer a high enough margin of safety for a ride.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.