Buying Carnival At This Dip Is Still Premature

Summary:

- CCL has already returned much of its hyper-pandemic gains, once Mr. Market realizes that the elevated interest rate environment may persist for a little longer.

- Despite the expanding Net Per Diems and Net Yields, it is apparent that the cruise line’s profitability continues to be impacted, worsened by the volatile fuel prices.

- It also remains to be seen if CCL may be able to sustain its robust booking trends, with the inflationary pressures proving to be stickier than expected.

- As a result, we concur with the management’s commentary that it “still have a ways to go to reach investment-grade leverage metric in 2026,” with any prior stock recoveries likely to be premature.

mikkelwilliam

We previously covered Carnival Corporation & plc (NYSE:CCL) in June 2023, discussing the massive optimism embedded in the stock valuations and prices. This was attributed to the record expansion in its consumer deposits and bookings through 2024, with the management also guiding a return to positive adj EPS by FQ3’23.

However, we had continued to rate the stock as a Hold (Neutral) then, with the growing interest expenses still posing headwinds to its profitability and eventual deleveraging.

In this article, we will be discussing CCL’s drastic reversal in sentiments over the past few months, with the stock similarly losing much of its recent gains despite the expanding profitability.

Despite the cruise line’s growing momentum in bookings, we maintain our belief that its reversal may take longer than a few more quarters, especially with the overly sticky inflationary pressures.

The CCL Investment Thesis Remains Underwhelming, Until Fundamentals Improve By 2026

For now, CCL has delivered a double beat FQ3’23 earnings call, with revenues of $6.85B (+39.5% QoQ/ +59.2% YoY) and adj EPS of $0.86 (up QoQ from -$0.31/ up YoY from -$0.58).

Much of the tailwind is attributed to the expanding net per diems of $197.64 (+16.4% QoQ/ NA YoY) per Passenger Cruise Days and net yields of $215.22 (+29.3% QoQ/ NA YoY) per Available Lower Berth Day, compared to FY2019 levels of $189.37 and $213.91, respectively.

While CCL’s long-term debts have remained range-bound at $29.51B (-7.6% QoQ/ +3.5% YoY), its annualized interest expenses are still elevated at $2.07B (-4.4% QoQ/ +22.7% YoY) by the latest quarter.

This is compared to its FY2019 levels of $9.68B (+22.5% YoY) and $206M (+6.1% YoY), respectively.

However, this headwind has been well balanced by CCL’s expanding adj EBITDA generation of $2.2B (+223% QoQ/ +633.3% YoY), triggering the increased adj EPS and adj Free Cash Flow of $1.1B in FQ3’23 (+76% QoQ/ + 667% YoY).

With only $1.39B of its long-term debts maturing through 2025, it appears that the cruise line has more than enough time to slowly navigate the elevated interest rate environment and tightened discretionary spending, as the US federal student loan restarts from October 2023 onwards.

For now, CCL’s customer deposit remains excellent at $6.3B (-12.5% QoQ/ +31.2% YoY) by the latest quarter, compared to FY2019 levels of $4.9B, implying the robust demand for its cruise offerings and strategically bundled onboard packages.

The same has also been reported by the management in the recent earnings call, with its 2024 booking trends already well ahead of 2023 and 2019 levels at higher ticket prices, with reduced remaining inventory for sale despite the increased capacity by +5% YoY.

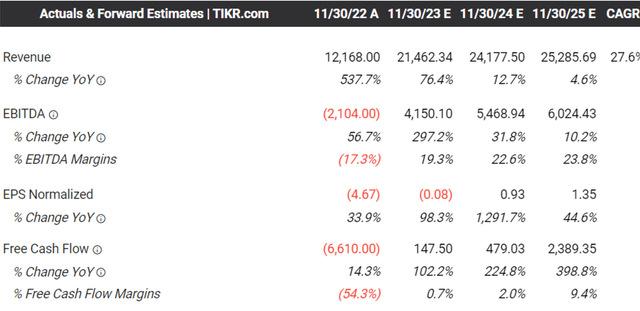

As a result, it appears that the company may very well slowly-but-surely deleverage its balance sheet, with its Free Cash Flow generation likely to expand from henceforth, as projected by the consensus below.

However, investors may also want to note that 62% (+1.4 points QoQ/ -1.9 YoY) of CCL’s revenues are based in North America by the latest quarter, potentially triggering further volatility in its bookings moving forward.

With the inflation remaining overly sticky and the Fed only expecting a normalized economy only by 2026, investors may want to temper their near-term expectations as discretionary spending may be further tightened with a pivot yet to occur.

In addition, with fuel prices remaining volatile as the WTI crude oil prices hit over $80s at the time of writing, compared to 2019 averages of $60s, we believe that CCL’s fuel expenses may trigger further headwinds to its profitability, with FQ3’23 already recording a “-$130M drag.”

As a result, we concur with the management’s commentary that it “still have a ways to go to reach investment-grade leverage metric in 2026,” with any prior stock recoveries likely to be premature.

So, Is CCL Stock A Buy, Sell, or Hold?

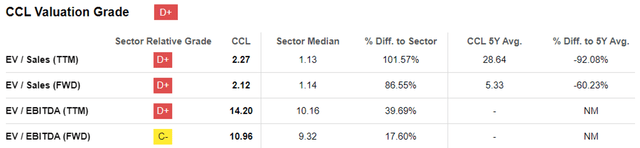

CCL Valuations

For now, CCL’s FWD EV/ EBITDA valuation of 10.96x still appear to be inflated, compared to its 3Y pre-pandemic mean of 9.34x and the sector medians of 9.32x.

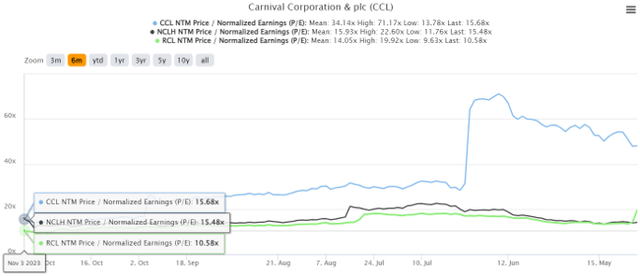

CCL FWD P/E Valuations

The same has also been observed in CCL’s FWD P/E valuation of 15.68x, compared to its 3Y pre-pandemic mean of 13.65x and the sector median of 13.94x.

The Consensus Forward Estimates

Perhaps part of the optimism is attributed to the optimistic consensus estimates, with CCL expected to generate a robust adj EBITDA of $4.15B in FY2023 and $5.46B in FY2024, nearing its FY2019 levels of $5.43B.

Then again, with an impacted projected EPS and FCF generation over the next few years, we believe that the stock’s valuations remain over inflated here, offering investors with a minimal margin of safety.

Based on CCL’s FY2023 adj EBITDA guidance of $4.15B (+297.2% YoY) and its 1.39B shares outstanding, it appears that we are looking an underwhelming estimated adj EBITDA per share of $2.97 (+266.8% YoY), still behind FY2019 levels of $7.85 (+4.3% YoY).

This alone exemplifies that the stock’s earlier recovery in June 2023 has been too optimistic.

Based on the stock’s normalized P/E valuation of 13.65x and the consensus FY2025 adj EPS estimates of $1.35, it appears that there is a minimal upside potential to our long-term price target of $18.42 as well.

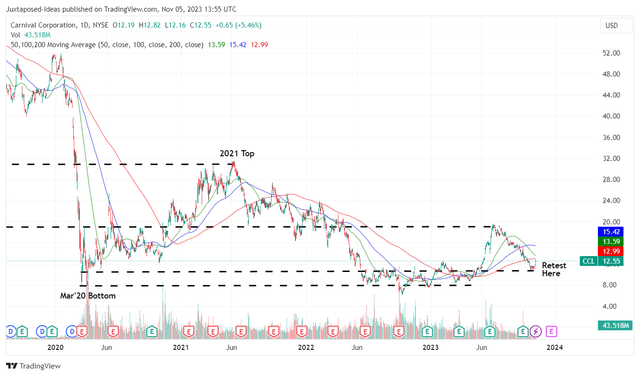

CCL 4Y Stock Price

For now, CCL has also returned much of its hyper-pandemic gains, with it remaining to be seen if the recent bounce is sustainable.

While the stock appears to have met robust support at $10s, we do not recommend anyone to add here, since its recovery may remain prolonged over the next few years of elevated interest expenses and inflated debt levels.

With many other investing opportunities, such as the higher yielding US Treasuries, we prefer to rate the CCL stock as a Hold (Neutral) here, with it remaining to be seen when its dividends may be reinstated.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.