Summary:

- Micron Technology, Inc. may see growth as the market sees signs of growth through recovering consumer sentiment and declining inflation expectations.

- However, Samsung’s determination to maintain CAPEX and production goals in 2023 is a risk.

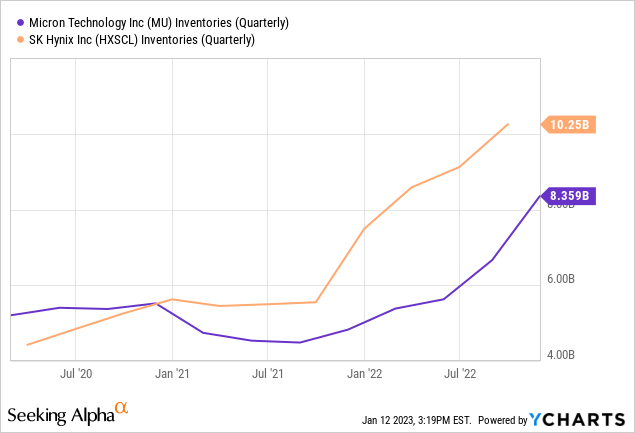

- Micron and SK Hynix also have massive inventory that has yet to start declining.

- It may be premature to start investing in Micron Technology, Inc.

vzphotos

Introduction and Thesis

The semiconductor industry is highly cyclical, and within the industry, the memory chip market is even more cyclical than its logic chip counterparts it is heavily dependent on economic conditions. Thus, key memory chip companies including Micron Technology, Inc. (NASDAQ:MU) saw deteriorating share prices throughout 2022. The weakening macroeconomic conditions and fears of a looming recession caused by inflation and high-interest rates have pressured Micron.

However, going into 2023, some investors point out that the memory chip market will bottom and return to growth in late 2023 or in 2024 making Micron a prime buy target today. The reasoning behind this is recovering consumer sentiment and a declining inflation rate, which may be an early signal of recovery. However, I believe it may be premature to call out an all-clear sign. Memory chip makers’ inventory continues to be at record levels while Samsung (OTCPK:SSNLF) continues to maintain the decision to continue normal operations without cutting supply. Therefore, despite an early sign of a potential market recovery, I believe investors should continue to look for more clarity before entering the market.

Bulls May Say…

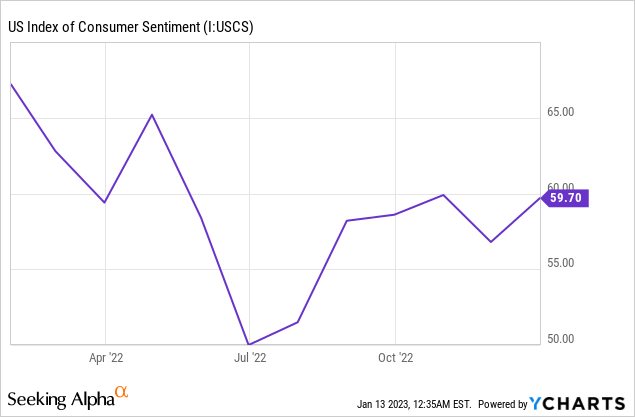

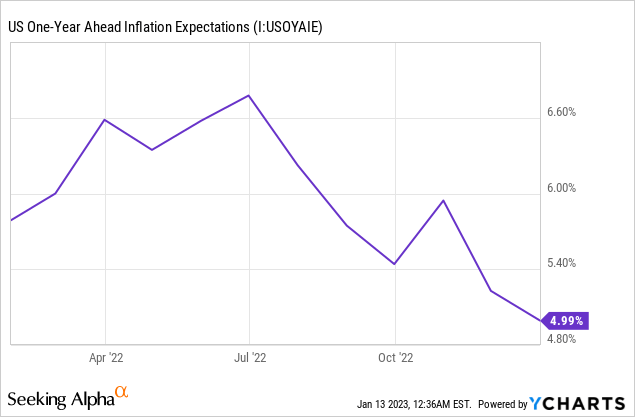

The memory chip market fell in 2022 as the consumer demand for electronics sharply plummeted. However, some investors point out that the recovering consumer sentiment levels [source] and expected future inflation rate [source] may lead to a strong recovery in the demand for electronics and ultimately the memory chip industry. As the charts below show, the consumer sentiment data has changed a trajectory while the consumer inflation expectation reflects a slowdown in inflation, which can lead to more confidence.

However, looking at the current market conditions and Samsung’s decision to carry on its normal operations, I believe it may be premature to determine that the memory chip market is ready for a recovery.

Current Market Conditions

2022 has been a terrible year for the memory chip industry, and 2023 will likely be no better than 2022. Slowing consumer demand for electronics has slowed the demand for memory chips causing Micron’s revenue to decline by 47% year-over-year in 2022Q3.

2023 is expected to be a terrible year for a memory chip maker as well. The market is expected to contract 16.2% year-over-year. As a result, Micron has cut its CAPEX by 40% to attempt to find a balance between supply and demand. SK Hynix, another major player in the memory chip market, has also announced a 50% CAPEX cut.

However, as I will discuss later because Samsung has announced that the company intends to carry on investments instead of cutting CAPEX to win more market share, the effectiveness of SK Hynix and Micron’s CAPEX cut will be significantly limited. This may push back the recovery time for the memory chip market and lengthen the pain for Micron.

Further, as the chart above shows, Micron and SK Hynix’s inventory has ballooned significantly through 2022, and because the memory market recovery will only start to come after the inventory levels show signs of decline, it may be premature to argue that the memory market may be recovering in the near future.

Wild Card: Samsung

However, Samsung is a current wild card in the memory industry that can determine the investor and market sentiment for the upcoming year.

In 2022, as the memory market decelerated at a record pace, major players in the memory market announced a CAPEX cut to address declining demand and ballooning inventory. Micron has announced a 40% CAPEX reduction in 2023 while SK Hynix has announced a 50% CAPEX reduction. However, Samsung has yet to announce any measures to address declining demand, ASPs, and increasing customer inventories.

In fact, Samsung has doubled down on announcing that its future investments will happen as planned. For example, the start of a new 12nm DRAM production can add up to 10% to Samsung’s capacity. This action by Samsung will certainly increase the duration of the memory chip market weakness as demand continues to outpace supply and delay the market return. Thus, because the bullish thesis of the memory market returning to growth relies on Samsung’s decision to cut its CAPEX to some magnitude, I believe it may be premature to rush into Micron.

Why is Samsung pushing for a chicken game?

Samsung has historically benefited from a memory market downturn by maintaining or increasing capacity while lowering DRAM prices, which has led to market share gains. Samsung is again pushing for a similar chicken game leveraging its massive cash position and business diversification. Samsung has about $89 billion in short-term investments and cash with only about $440 million in long-term debt compared to Micron’s $10.6 billion in cash and short-term investments with about $9.3 billion in long-term debt. Further, unlike Micron, Samsung’s business is more diversified into smartphones, displays, general consumer electronics, and home appliances beyond the memory chip market. In other words, Samsung can take temporary downturns in return for future gains.

There is still some hope for Micron as Samsung’s Q4 earnings are expected to drop by 69% year-over-year. The massive deceleration and the potential for further deterioration upon continuing a chicken game may pressure Samsung to adjust its strategy. Thus, investors should keep an eye out for Samsung’s earnings report on January 31st, 2023.

I believe being dependent on Samsung, Micron’s key competitor, for the recovery of the memory industry is a significant risk that can even overshadow the likely return to the growth trajectory of the market in 2024. Investors, if Samsung continues its current stance in its next earnings report, will adjust future expectations more negatively. Thus, I believe investors should hold Micron until further clarity in the markets.

Summary

More risk-tolerant investors who wish to ride out the memory market drama in the coming few quarters may find Micron Technology, Inc. attractive today. Consumer sentiment is certainly trending upwards with the memory market expected to hit the bottom in 2023. However, I believe it may be better to wait before accumulating more shares of Micron Technology, Inc. Inventory levels continue to be too high while Samsung continues to plan to maintain its production capacity at high levels. Therefore, until there are more signs of clarity in the market, I believe it may be better for investors to wait on Micron Technology, Inc.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.