Summary:

- Canoo has historically relied on dilutive capital raises to fund its operations.

- While Canoo has access to $240.6 million in dilutive capital, I expect it to raise an additional $150 million to support its production ramp-up this year.

- I expect Canoo’s outstanding shares to increase by 210% this year, which could negatively impact its share price.

- Accounting for the possible dilution, my price target for Canoo is $0.2, implying 92% downside.

Arsgera

Canoo Inc. (NASDAQ:GOEV) is an emerging EV maker that is targeting commercial fleet, government, and military customers. While the company has finally entered into its revenue-generation phase as it expects to start realizing meaningful revenues from vehicle sales this year, I’m bearish on its stock given its weak balance sheet. Canoo stated in its latest 10-K filing that it is operating on a going concern basis with a cash balance of $6.4 million.

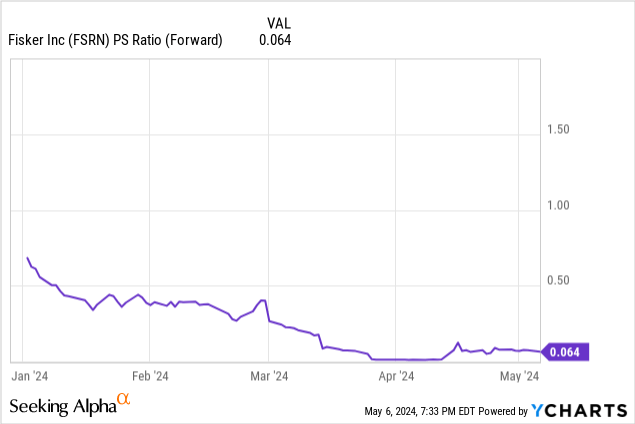

In my opinion, Canoo’s cash on hand isn’t enough to support a production ramp up this year in order to reach its full-year revenue guidance of $50 to $100 million. I believe Canoo at its current state is in a similar position to another ambitious EV maker, Fisker (OTC:FSRN), which is currently in a liquidity crunch that has led it to pause production despite its “asset-light” business model.

Although Canoo has access to around $240.6 million from its ongoing ATM program, warrants with Yorkville, and $62 million it received last March, I still expect it to raise an additional $150 million this year due to the capital intensive nature of ramping up EV production. Therefore, I see Canoo’s outstanding shares increasing by 210% this year, which is why I’m rating it as a strong sell with a price target of $0.2 per share, implying 92% downside from current levels.

Persistent Dilution

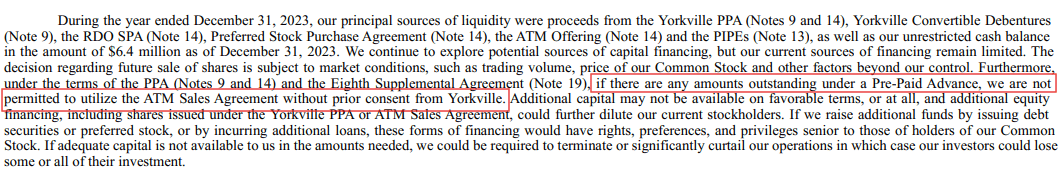

In its latest 10-K filing, Canoo stated the following.

During the year ended December 31, 2023, our principal sources of liquidity were proceeds from the Yorkville PPA (Notes 9 and 14), Yorkville Convertible Debentures (Note 9), the RDO SPA (Note 14), the Preferred Stock Purchase Agreement (Note 14), the ATM Offering (Note 14) and the PIPEs (Note 13), as well as our unrestricted cash balance in the amount of $6.4 million as of December 31, 2023.

What stands out to me is that most of Canoo’s funding comes from dilutive convertible debt arrangements with Yorkville. The company’s relationship with Yorkville started in July 2022 when both parties entered into a prepaid advance agreement (PPA) that provides the company access to $300 million. Under this agreement, Yorkville has the right to convert the funds under the agreement into shares of Canoo at the lower of 120% of the VWAP of the day prior to a made prepaid advance or 95% of the VWAP of the day prior to the conversion, with a floor price of $1 per share or $23 after last March’s 1-for-23 reverse split.

The conversion terms were then amended after the third prepaid advance to the lower of 110% of the VWAP of the day prior to the prepaid advance or 95% of the VWAP during the five trading days prior to the conversion date, with the floor price also decreasing to $0.5 per share, $11.5 on a post split basis. The floor price was then lowered to $0.1 per share, $2.3 on a post split basis, after shareholder approval in the shareholder meeting last October.

As of March 25, Canoo has drawn down $299.9 million of the $300 million under the PPA and has $45 million in outstanding balance under the PPA. The last payment under the PPA was last March, where Canoo received $62 million. Canoo also entered into other convertible debt arrangements with Yorkville over the course of last year in April, June, August, and September.

The April notes were for $48 million and were fully paid through the issuance of 95.4 million shares, or 4.1 million shares on a post split basis. The June Notes were for $26.6 million and were also fully paid off through the issuance of 101.6 million shares, or 4.4 million shares on a post split basis. The August notes were for $27.9 million and were partially paid off through the issuance of 97.6 million shares, or 4.2 million shares on a post split basis.

Considering that the interest rate on the August notes is 3% and the company incurred $300 thousand in interest expenses related to the August notes, per the 10-K filing, this means that around $10 million are outstanding under the August notes. The September notes were for $15 million and haven’t been paid off, according to the latest 10-K filing.

The conversion terms for both the August and September notes are for the lower of $0.5 per share, $11.5 on a post split basis, or 95% of the lowest daily VWAP during the 5 days prior to the conversion, with a floor price of $0.1, $2.3 on a post split basis. These terms are similar to the final PPA conversion terms. Overall, there are $25 million outstanding under both the August and September notes and $45 million under the PPA, which means that $65 million worth of convertible notes could be converted into equity at any time.

In addition to convertible debt, Canoo and Yorkville entered into a warrant cancellation and exchange (WC&E) agreement on March 12, post the reverse split, where Yorkville agreed to exchange warrants it had into new warrants. The new warrants are for the sale of 10.3 and 10.9 million shares at an exercise price of $1.37 per share, exercisable beginning on September 12, 2024, which would be a 48% discount compared to Canoo’s current share price of $2.63.

If Yorkville exercises these warrants, Canoo would receive nearly $29.2 million in exchange for issuing 21.3 million new shares, which would increase its outstanding shares by 33%. That said, I believe these funds will be crucial for Canoo in order to move forward with its production ramp up plans to achieve its revenue guidance of $50-100 million this year, per the Q4 earnings call.

In addition to Canoo’s reliance on dilutive convertible debt, the company has an active ATM program to raise $200 million, which was announced in August 2022. The company has successfully raised $49.3 million under the program in 2022 and $1.2 million in 2023, which means that it has access to $149.5 million under the program.

At the current share price of $2.63, raising the full amount available under the program entails the issuance of 56.8 million shares, which means that Canoo’s outstanding shares would increase by a staggering 88%. That said, it should be noted that under Canoo’s PPA agreement with Yorkville, it isn’t permitted to raise capital under the program without Yorkville’s consent as long as there are amounts outstanding under the PPA, which is the case at the moment.

10-K Filing

Production Ramp Up Requires More Capital

With only $6.4 million in cash on hand, Canoo’s dilution may increase this year as it ramps up production to meet demand. In the Q4 earnings call, management guided revenues between $50 and $100 million this year and cash outflow between $45 and $75 million per quarter, which would amount to $240 million on an annual basis.

In my opinion, Canoo is in a similar position to Fisker which started deliveries of its Fisker Ocean in Q2 2023. In the 9 months ended September 30, Fisker’s operating cash outflow increased 52% YoY from $341.4 million to $517.5 million as a result of beginning production at a high scale. I’m using that figure since Fisker hasn’t filed its annual report yet.

I expect Canoo’s operating cash outflow to increase at a similar rate to Fisker this year. Since Canoo’s operating cash outflow was $251.1 million in 2023, I’m forecasting its operating cash outflow to be $380.7 million this year. With that in mind, Canoo has raised $62 million in March from the 8th prepaid advance and has access to $29.2 million if Yorkville exercises the WC&E warrants in September and $149.5 million under the ATM program. This leaves a $133.6 million gap to fill, which will have to be filled through dilution or more convertible debt, in my opinion.

Assuming that Yorkville exercises its WC&E warrants and Canoo raises the remaining $149.5 available under the ATM offering at the current share price of $2.36, I’m forecasting its outstanding shares to reach 199.5 million by the end of the year if it raises $200 million. In that case, Canoo’s outstanding shares would increase by 210% which will certainly have a negative impact on its share price in my opinion.

|

Projected OCF |

-380,698,637 |

|

Outstanding Capital |

$247,074,914 |

|

Needed Capital |

$133,623,724 |

|

Projected Capital Raise |

$150,000,000 |

|

Shares from Potential Capital Raise |

57,034,221 |

|

Outstanding WC&E Shares |

21,299,937 |

|

ATM Shares |

56,844,106 |

|

Reported OS |

64,397,326 |

|

Projected OS EoY |

199,575,590 |

*The reported outstanding share count is on a post-split basis since the reported figure was as of March 25th while the reverse split was effected on March 8th.

Valuation

At the high end of Canoo’s revenue guidance of $100 million, it’s trading at a forward P/S of 1.89. Considering Canoo’s weak balance sheet and its reliance on dilutive convertible debt, I believe it is extremely overvalued at its current valuation. Since Fisker, which I believe to be a fair comparison to Canoo, was trading at a forward P/S near 0.4 earlier this year before its eventual delisting, I believe Canoo’s current state justifies a similar multiple.

At the company’s last reported outstanding shares count of 64.3 million, an 0.4 sales multiple would lead to a market cap of $40 million at the high end of management’s guidance. This would result in a price target of $0.62 per share, 76% lower than Canoo’s current share price of $2.63.

|

High End Revenue Forecast |

$100,000,000 |

|

Target P/S |

0.4 |

|

Market Cap |

40,000,000 |

|

OS |

64,397,326 |

|

Price Target |

$0.62 |

|

Share Price |

$2.63 |

|

Downside |

-76% |

However, when taking potential dilution into consideration due to Canoo’s need to raise capital in order to support its production ramp up, my price target would be $0.2 per share, representing 92% downside.

|

Projected OS EoY |

199,575,590 |

|

High End Revenue Forecast |

$100,000,000 |

|

Target P/S |

0.4 |

|

Market Cap |

$40,000,000 |

|

Price Target |

$0.20 |

|

Share Price |

$2.63 |

|

Downside |

-92% |

Upside Risks

As my bearish thesis on Canoo is its need to raise capital to support the production ramp up, the only risk to my thesis would be the company receiving a loan under the DOE’s ATVM program. The program includes $2 billion in grants and up to $10 billion in loans to support EV manufacturing. As such, Canoo receiving a portion of these loans would help it ramp up production with minimal to no dilution. However, it should be noted that the program states the following.

In order for an applicant to be eligible under the ATVM Program, the applicant must be “financially viable” without the receipt of additional Federal funding associated with the proposed eligible project.

Meanwhile, the company stated this in its latest 10-K filing.

Our management has performed an analysis of our ability to continue as a going concern and has identified substantial doubt about our ability to continue as a going concern. If we are unable to obtain sufficient additional funding or do not have access to capital, we may be required to terminate or significantly curtail our operations.

Therefore, I believe Canoo may have to resort to raising capital through dilutive methods including share offerings or convertible debt in order to be financially viable for receiving a loan under the ATVM program.

Conclusion

While Canoo is approaching a key revenue inflection point, I’m bearish on its stock due to its history of dilution. As is, the company has been reliant on dilutive convertible notes and share offerings to fund its operations. Although Canoo has access to $240.6 million in dilutive capital through its active ATM program, warrants with Yorkville, and $62 million it received last March from the Yorkville PPA, I expect it to raise an additional $150 million to support its production ramp up as I’m forecasting its operating cash outflow this year to be around $380.7 million. As such, I expect Canoo’s outstanding shares to increase by 210% this year to reach 199.5 million by the end of the year. Considering the company’s weak balance sheet and the potential dilution, my price target for Canoo is $0.2, representing 92% downside from current levels.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.