Summary:

- Canopy Growth Corporation’s weak financial results have caused its stock to trade lower, leading to a loss of investor interest.

- The company reported another disastrous quarter with a weak adjusted gross margin, a large net loss, and negative adjusted EBITDA.

- The stock has an EV topping $1 billion, which is mismatched with the weak financial results.

Taizhan Sakimbayev/iStock via Getty Images

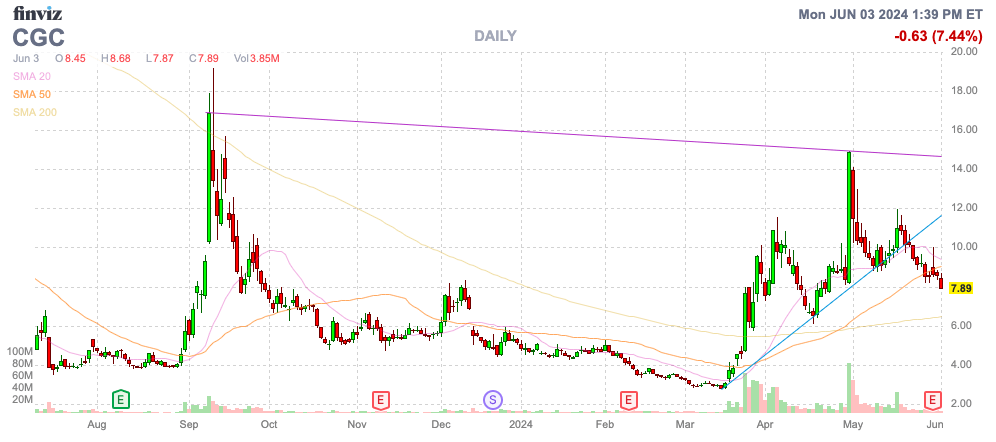

After the big rally, Canopy Growth Corporation (NASDAQ:CGC) is starting to trade back lower, in line with weak financial results. The Canadian cannabis LP still can’t even get close to producing positive adjusted EBITDA after years of promises. My investment thesis remains Bearish on the cannabis stock as investors lose interest in the company.

Source: Finviz

Another Ugly Quarter

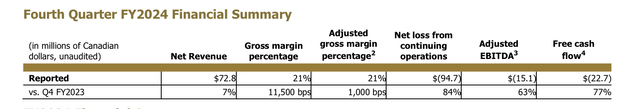

Canopy Growth spent a lot of the initial FQ4 ’24 earnings release discussing the fiscal year improvements. Revenues for the March quarter were actually up 7% YoY and supposedly 16% when excluding divested businesses.

The cannabis company reported the following FQ4 numbers that highlight the disastrous business. Canopy Growth only reported an adjusted gross margin of 21% with a large net loss and an adjusted EBITDA loss of C$15 million. The company even burned another C$23 million in cash during the quarter in a never-ending waste of cash.

Source: Canopy Growth FQ4’24 earnings release

After all the restructuring for multiple years, Canopy Growth is still nowhere close to running a sustainable cannabis business. As with the past complaints of the company, the business is too far-flung to effectively manage with no base business to support the investments around the globe.

Canopy Growth had promising international cannabis sales growth of 32% to reach C$12 million. While this business is solid, the Canadian cannabis business remains a struggle, with the primary adult-use business reporting sales dipping 4% YoY.

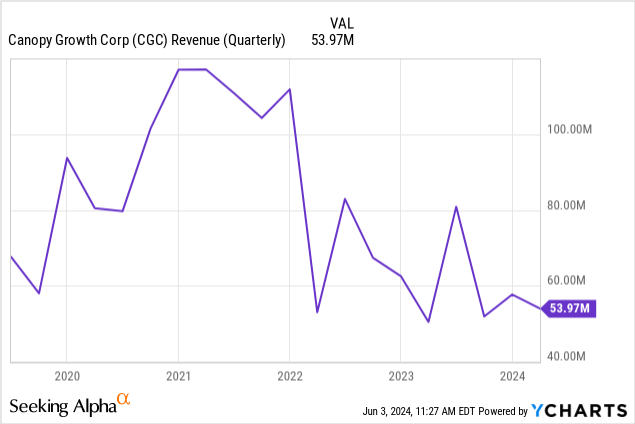

In general, Canopy Growth just circulates from one business of success to another struggling one to never lead to much progress in the overall business. The FQ4 revenues were actually close to the lowest level in the last 5+ years. Canopy Growth actually produced over double the revenues back at the 2021 peak sales.

Investors have no reason for interest in Canopy Growth based on a turnaround in existing operations. The only real hope is for the U.S. investments to ultimately payoff.

U.S. Play

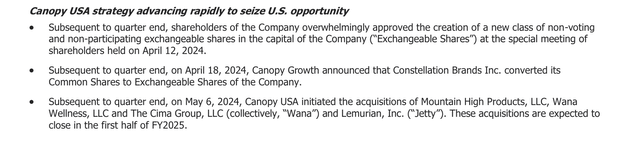

Canopy Growth has spent the last year making further investments into the U.S. via a complex structure as described below:

Source: Canopy Growth FQ4’24 earnings release

Originally, Canopy Growth wasn’t allowed to control the U.S. cannabis business due to the listing requirements. U.S. MSOs (multi-state operations) weren’t allowed to list on major stock exchanges due to operating illegal businesses, per the U.S. federal government.

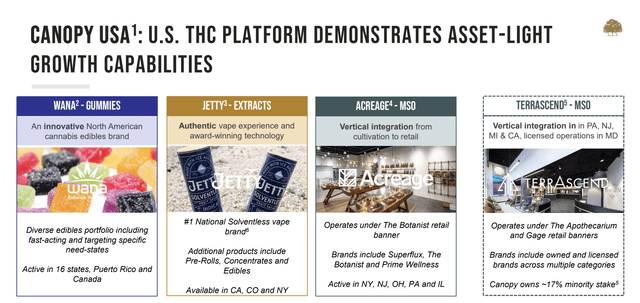

The complexity of the new non-voting share structure for the ownership of the Canopy USA shares isn’t likely helpful for the stock. Canopy USA has the following positions in the U.S.

Source: Canopy Growth FQ3’24 presentation

Canopy USA will own 100% of the outstanding equity interests in Wana and approximately 75% of the outstanding shares of Jetty. The more interesting stories are the investments in the MSOs, Acreage Holdings, Inc. (OTCQX:ACRHF, OTCQX:ACRDF) and TerrAscend Corp. (OTCQX:TSNDF).

Considering the weak results in Canada, one has to really wonder how Canopy Growth is going to juggle these additional businesses in the U.S. under a complex ownership structure.

On the FQ4 ’24 earnings call, CEO David Klein acknowledged the state of their longest U.S. investment isn’t ideal (emphasis added):

Shifting to Acreage, I’d like to take the opportunity to acknowledge that the company has recently been operating as a distressed asset. However, we believe that Acreage continues to have tremendous upside. Recently, acreage entered the New York market and continues to hone its presence in other key states, including Ohio, the seventh largest state in the US, which is turning adult use in the month of June and where its operations are well positioned with botanist dispensaries in Cleveland, Canton, Akron, Columbus and Wickliffe.

Canopy Growth ended the quarter with a cash balance of C$200 million, while the company has a debt balance of C$600 million. The stock has a market cap of $800 million and an enterprise value topping $1 billion.

The company is only forecast to report a revenue base of $220 million for FY25. Even with the Acreage business at $200+ million in annual sales, Canopy Growth has a collection of money losing assets outside the U.S. or primarily a distressed business in the U.S. offering shareholders limited reason to own the stock here at $8.

Takeaway

The key investor takeaway is that Canopy Growth rallied recently on excitement over the U.S. operations and the possibility for rescheduling cannabis to Schedule 3. Investors should dump the stock due to the weak operations and the complex U.S. structure not helping the overall business, as evidenced by Acreage turning into a distressed asset.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start June, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.