Summary:

- Canopy Growth stock has fallen recently due to a dilutive secondary offering and ongoing financial troubles.

- With $411 million in net debt, I expect more dilution to come moving forward.

- Investors may be betting on a federal rescheduling of cannabis, but that is unlikely to benefit the company.

- I reiterate my strong sell rating for CGC stock due to the myriad of negative fundamental factors.

Yarygin

Canopy Growth Corporation (NASDAQ:CGC) has seen its stock plunge amidst a dilutive secondary offering as well as ongoing financial troubles. But with prospects of a federal rescheduling on the horizon, has the stock finally fallen too far? I am not convinced, as the company continues to hemorrhage cash while managing a highly leveraged balance sheet. Management expects to reach positive adjusted EBITDA generation within two quarters, but such an achievement may not be enough given the $411 million in net debt. I expect the company to require additionally highly dilutive capital offerings in order to address the debt position. The valuation is far from compelling as it is difficult to frame a bullish thesis given the low quality revenue base. I reiterate my strong sell rating as the downward momentum may be too hard to overcome.

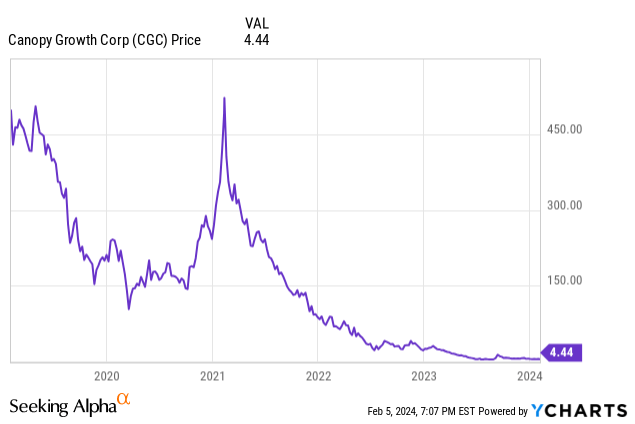

Canopy Growth Stock Price

While there have been occasional short-lived rallies, the long-term trend of CGC stock has been sharply lower ever since 2021.

I last covered the stock in September where I rated the stock a strong sell given the poor fundamental outlook. The company’s private placement adds more fuel to the fire as it came with expensive “sweeteners” which I’ll discuss later. The company reports earnings on February 9th before the bell, but I caution against pre-earnings speculation.

CGC Stock Key Metrics

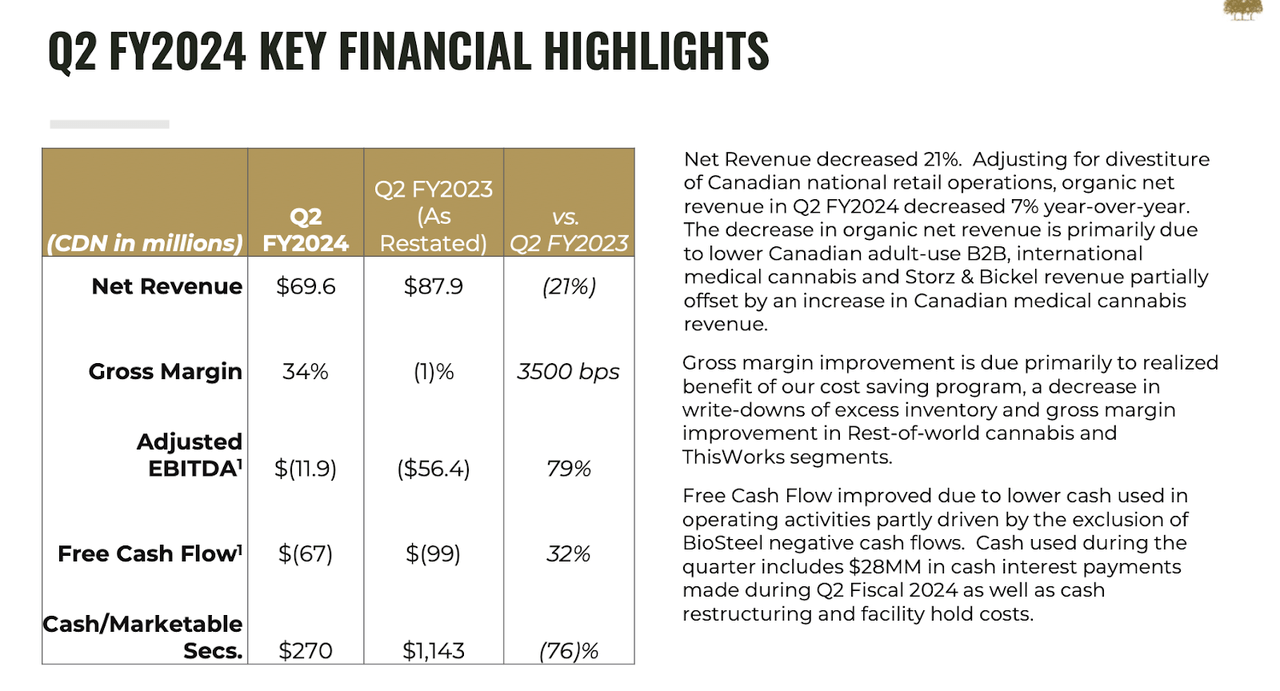

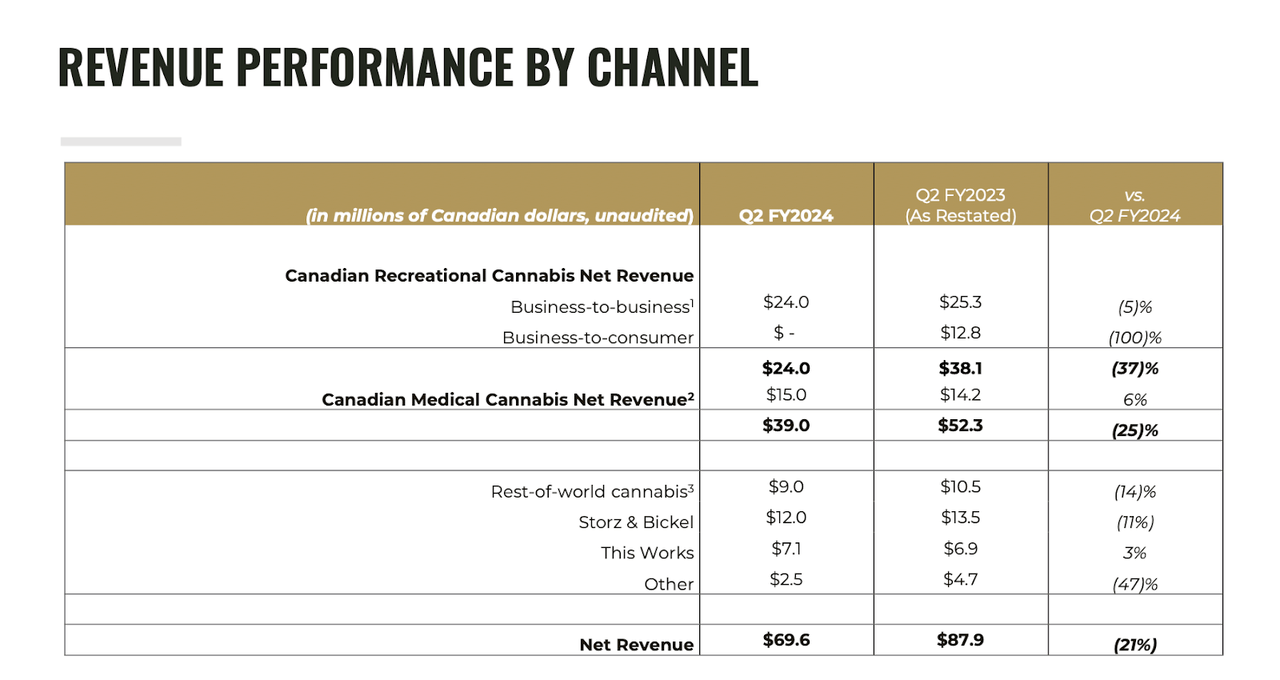

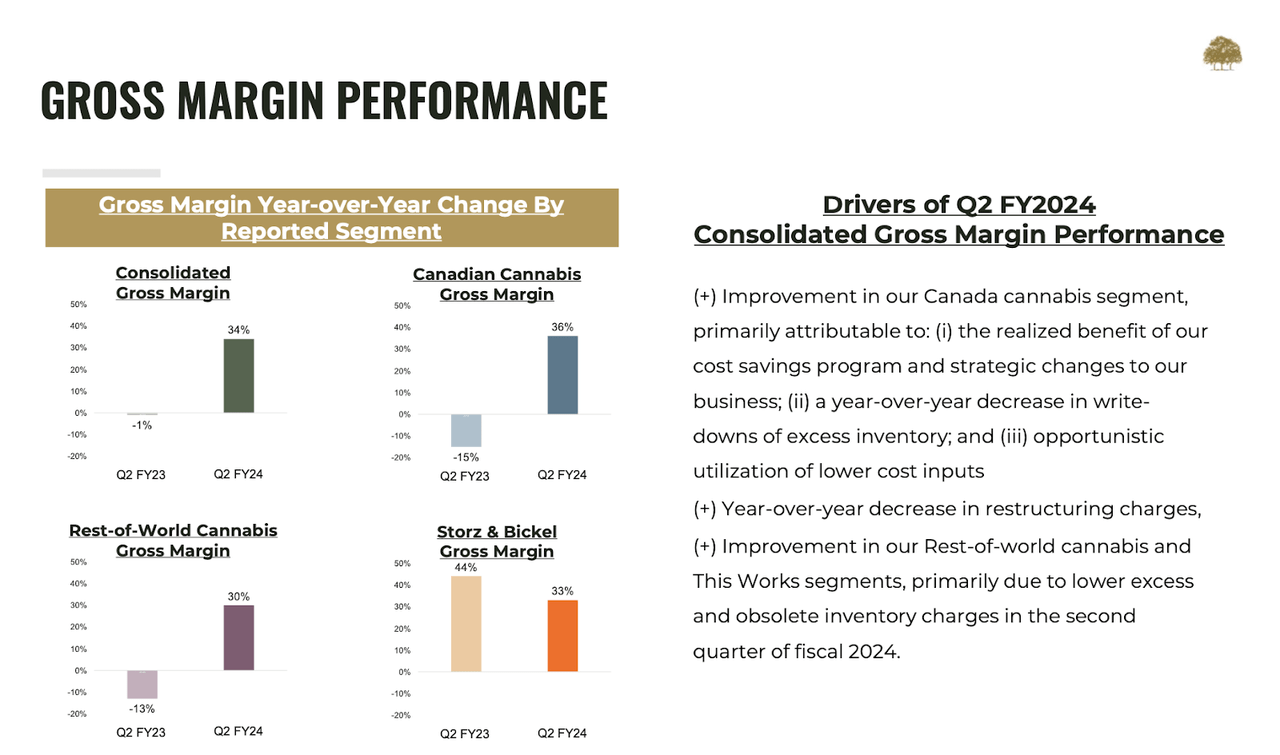

In its most recent quarter, CGC saw net revenues decline 21% YoY though gross margins improved dramatically 3500 bps to 34%. The company narrowed its adjusted EBITDA loss to $11.9 million but still burned through $67 million in free cash flow in the quarter. The company has seen its cash balance plunge $873 million YoY.

The company saw great pressures to its cannabis business, which continues to be limited by the constrained demand of the Canadian market.

If you haven’t looked at the name in a while, you might be wondering why the beverage line BioSteel is no longer showing in the segmented results. CGC completed the sale of BioSteel in December, netting $30.4 million in gross proceeds. That may come as a negative surprise to many investors given that the company had been investing heavily in the unit as one of their more promising growth vectors. Management notes that BioSteel accounted for 60% of their FY24 Q1 adjusted EBITDA loss, which was $57.8 million.

BioSteel had been a major detractor to gross margins, though CGC also saw cannabis margins rise dramatically.

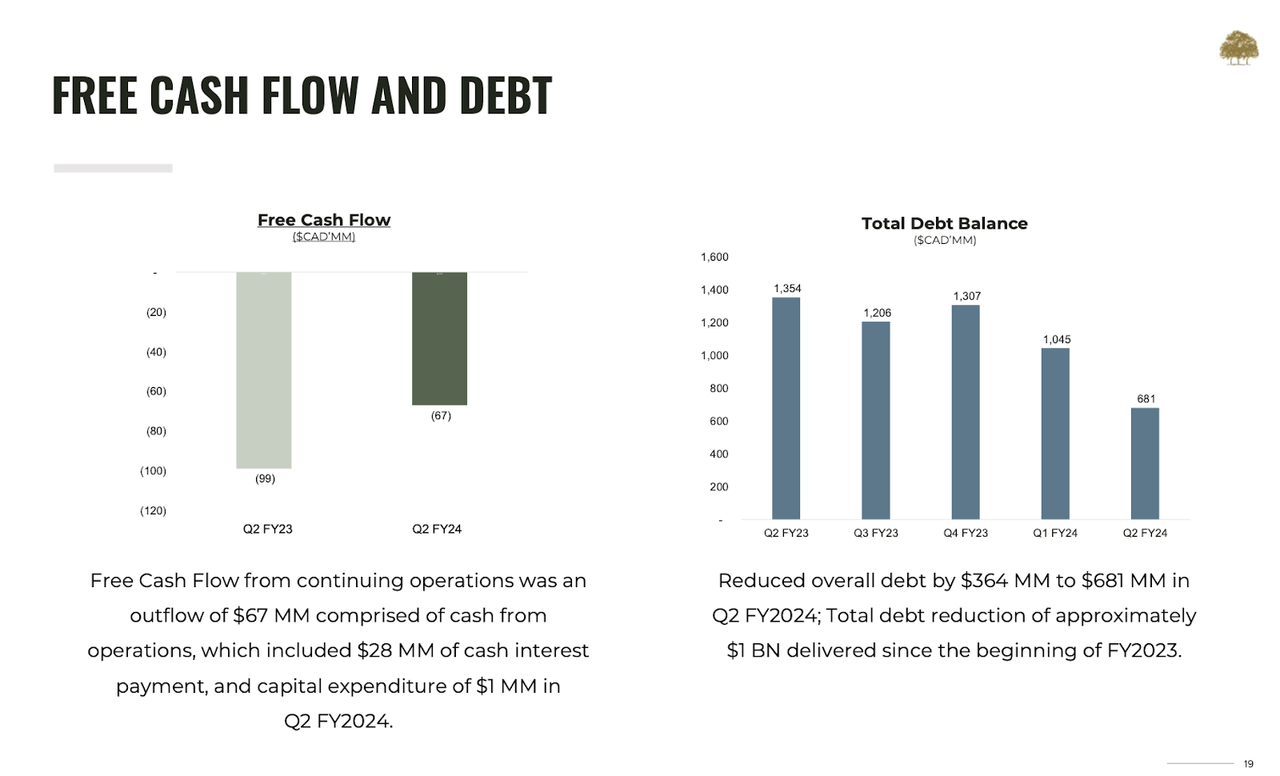

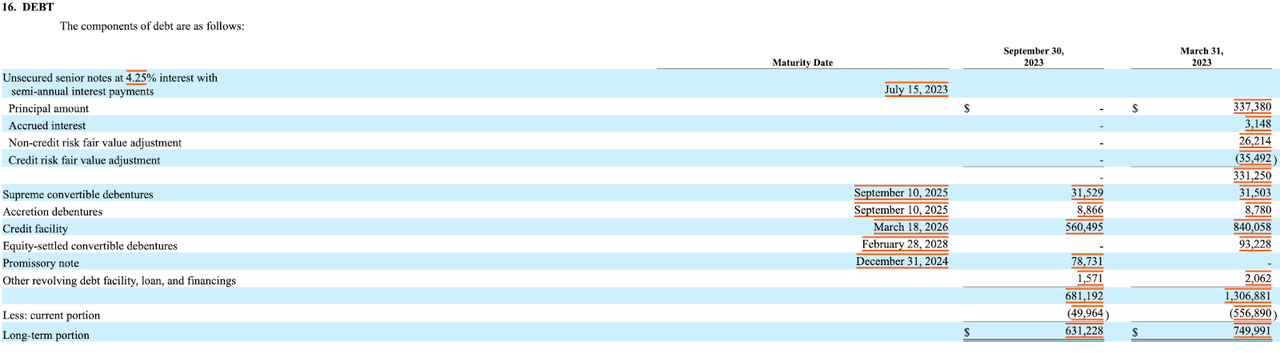

CGC saw its debt position decline to $681 million, though net debt remained elevated at $411 million.

Management appears to be taking aggressive actions to address the debt position. The company announced a private placement, raising $35 million from the sale of 8.158 million units at a price of $4.29 per unit. This offering was highly dilutive, as it came with “sweeteners” in the form of long-dated warrants. Each unit came with one warrant with a 5 year expiration date and strike price of $4.83. Given that the company has around 96 million fully diluted shares outstanding, this offering essentially increased that share base by 17% (inclusive of the warrants).

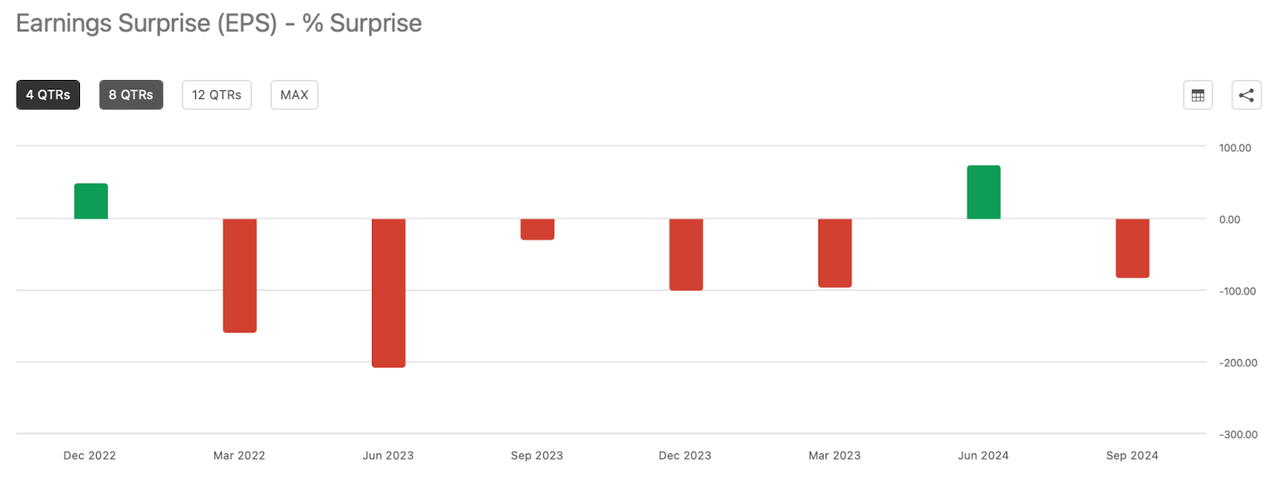

On the conference call, management reiterated expectations to achieve positive adjusted EBITDA exiting fiscal 2024. The company is slated to report earnings on Friday, February 9th pre-market. Consensus estimates call for the company to generate $54.86 million in revenue, representing a 27% YoY decline, and lose $0.37 in GAAP EPS. I wouldn’t be surprised if the loss comes in higher than that, given the company’s recent history of surprising to the downside.

Is CGC Stock A Buy, Sell, or Hold?

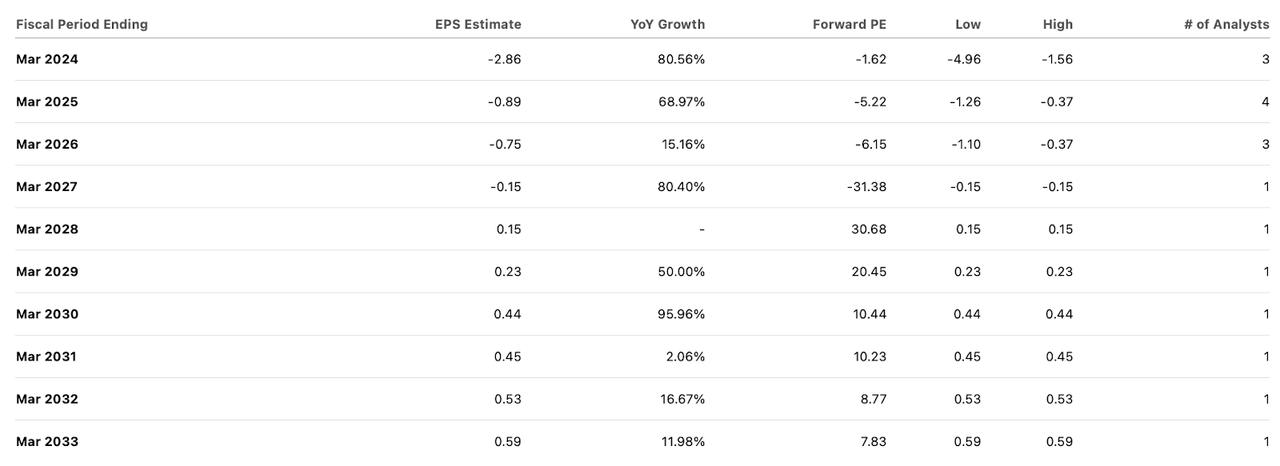

Consensus estimates call for the company to achieve profitability by 2028, but I caution that consensus estimates have been wrong for a long time, as any push for meaningful profitability can only come after cannabis is legalized federally in the United States.

The issue is that full legalization does not appear to be on the agenda any time soon. Yes, there is growing optimism for the Drug Enforcement Administration to reschedule cannabis to Schedule III, but this falls short of the full legalization needed to allow CGC to export product into the country. Instead, the primary beneficiaries of a rescheduling are likely to be the multi-state operators (“MSOs”), which stand to see excessive corporate tax rates normalized with the removal of 280e taxes.

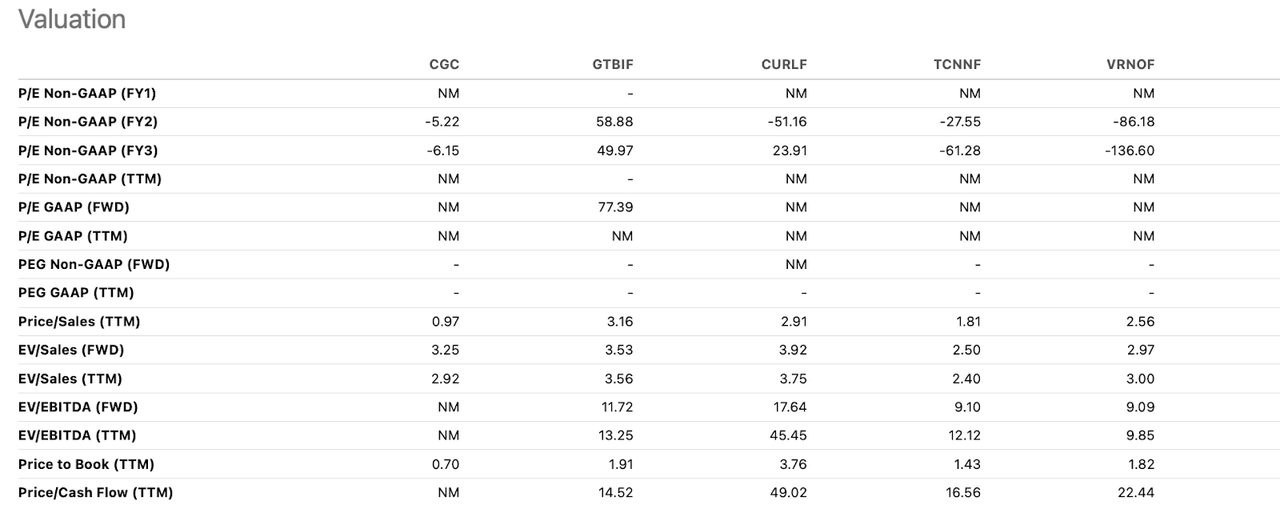

It is curious that, even after the brutal stock price action, CGC still trades at rich valuations relative to stocks like Green Thumb Industries (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF), and Verano (OTCQX:VRNOF). We can see below that CGC trades neck-to-neck on an EV/sales basis, but that makes little sense given that these MSOs in general have far higher gross margins and have been generating 20+% adjusted EBITDA margins.

I continue to see debt being an important near-term catalyst. The vast majority of the company’s debt does not mature until 2026, but that is only 2 years away.

As noted in the annual filing, this credit facility contains financial covenants including “requiring minimum liquidity of US$200 million at the end of each fiscal quarter.” The company’s cash balance stood at $270 million as of the most recent quarter, rather close to that covenant requirement. With the company still not yet profitable on an adjusted EBITDA basis and still burning through cash flow, I expect the company to have to continually diluting shareholders through private placements such as the one conducted in this past quarter, which may prove highly dilutive due to the attached warrants.

The company appears to be stuck in a downward spiral, as its cash flows are constrained due to a bloated cost structure and high interest expenses, while its cost of capital keeps climbing higher due to the plunging stock price. Perhaps the main hope for investors may be for the potential to participate in hype-driven rallies, but I find the stocks of the MSOs to be better suited given that they stand to directly benefit from any incremental legislative reform. I reiterate my strong sell rating, as Canopy Growth Corporation faces what appear to be insurmountable headwinds from poor unit economics and a looming debt maturity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VRNOF, GTBIF, TCNNF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!