Overblown Consumer Credit Fears Make Capital One A Conviction Buy

Summary:

- Capital One shares have been hard hit by fears a recession will greatly weaken consumer credit quality.

- While delinquencies are rising, they are doing so from temporarily low levels and remain at a healthy absolute level.

- Capital One has sufficiently reserved for higher delinquencies, never assuming 2021 results would persist.

- At the same time, higher rates will boost interest margins.

- With over $15 in sustainable EPS, shares are far too cheap below $100.

JHVEPhoto

With increased concerns that the Federal Reserve could put the US economy into a recession as it aggressively raises interest rates to bring down inflation, many companies exposed to the economic cycle have underperformed with Capital One (NYSE:COF) a particularly bad performer, down 44% over the past year. While the company’s earnings will decline from unsustainably high levels, shares are discounting a far worse scenario than I believe likely, making them extremely attractive.

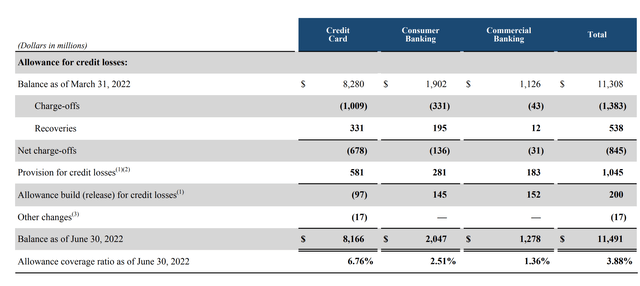

Capital One is one of the nation’s leading credit card lenders, and because credit card debt is unsecured, losses can be greater than on auto or home loans, which is also why interest rates on credit cards are so much higher. This has created the concern that its financial performance could deteriorate significantly if the economy slows down further. Those alarm bells rang even more loudly after the company’s second quarter results when it provisioned a gross $1.1 billion for credit losses. Given charge-offs of $850 million, this was a net build of over $200 million in allowance for credit losses. It also represented a $408 million increase in provisions. As you can see below, the build was focused in the consumer and commercial banking units.

Amidst the concerns about credit losses, it was seemingly lost that despite this build Capital One earned $4.96 a share or about $2 billion. Increased losses are reducing profitability, but they are not causing company-wide financial losses. Now, a bear might argue that just as we saw a sequential increase in credit allowances in Q2, we may see further increases in coming quarters until profitability is more dramatically eroded. This argument may sound even more persuasive given that in August, the delinquency rate on Capital One’s credit card portfolio was 2.76%, up from 1.79% a year ago. I think more context is needed.

There is no doubt that credit losses and delinquencies are increasing, in part because 2021 delinquencies were extremely low. During 2020 and 2021, we passed multiple economic stimulus programs like the CARES Act and American Rescue Plan, which sent many Americans several thousand dollars in checks. With so much cash coming in from the government, consumers were easily able to pay their bills – as we will see further below, many even paid off debt. With these checks not recurring, it is natural for delinquencies to rise.

That is why I like to look at results from the end of 2019, before COVID-related distortions. Back then, we felt the economy was performing well with unemployment at 3.5%. At that time, credit card delinquencies were 3.93%. So while delinquencies have risen over the past year to 2.76%, they remain well below 2019 levels. I think it is better to describe credit card delinquencies as normalizing from unsustainably low levels rather than truly deteriorating.

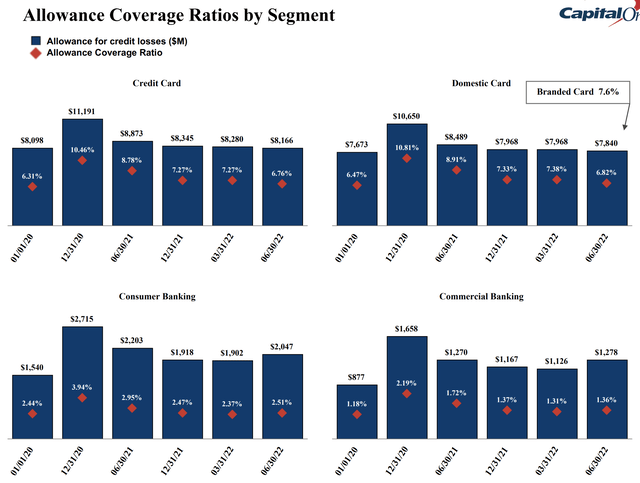

Importantly, Capital One always assumed that delinquencies would rise again. For perspective of credit loss adequacy, I think it is useful to see how its allowances have transpired over time, which I believe will provide a degree of comfort to investors. As of now, delinquencies are running better than Q4 2019, yet, when you look at allowance for credit losses as a share of total loans, Capital One is reserving more today than back then, by 0.45% in credit cards, 0.07% in consumer banking, and 0.18% in commercial banking. This means credit quality can continue to erode before Capital One will need to significantly increase credit loss reserves. As such, I would expect reserves in Q3 and Q4 to be similar or modestly higher than Q2 but not to spiral ever higher. COF has been conservative and prudent in its allowance policy, never assuming the ideal 2021 conditions would persist forever.

It is also important to note that while there is a focus on credit losses being a negative, there are also positives that will help earnings power. Despite high inflation, Capital One is showing tremendous cost control with non-interest expenses up just 1%, entirely driven by a 9% jump in marketing spend. All other expenses actually fell by 1%. The company is also growing its loan book, which should increase interest revenue. Credit card loan growth was 20% year over year to $121 billion. This outpaced the 9% growth in consumer banking loan growth as auto loan originations declined by 20%.

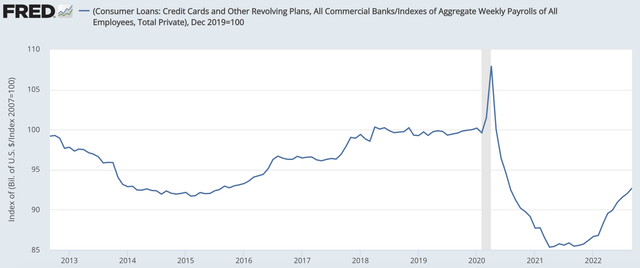

Now some may argue that such fast credit card loan growth is actually a warning sign that consumers are hopelessly stretched by elevated inflation, which is forcing them to borrow, and pointing to a coming default wave. Yes, credit card debt is rising, but when you look at credit card debt relative to income, the picture is far less concerning.

Right as COVID hit and unemployment plunged, credit card debt to income did spike, but then as stimulus checks were sent out and people got re-employed, it started to plunge, falling 15% from December 2019 levels. While it has risen, we are still 8% below the pre-COVID norm. This means consumers could borrow about another $70 billion on credit cards just to go back to where we were in Q4 2019, a time when we were happy with the economy and consumer credit. As with delinquencies, credit card balances are normalizing back to their pre-COVID levels rather than deteriorating in a concerning fashion.

While there has been such concern about consumer credit losses, it is notable that we are seeing improvement from the commercial bank where loans rose 9% to $94 billion. “Criticized loans” fell by 0.5% quarter over quarter and by 2.60% year over year to 5.99%. These are loans regulators have expressed concern over, generally due to excessive leverage ratios. The fact these are coming down actually points to fewer loans being at risk of loss.

Due to a larger loan book and higher interest rates, Capital One’s net interest margin increased to $6.4 billion from $5.7 billion a year ago. COF has liquid reserves of $93 billion including over $21 billion in cash and equivalents. Since the end of the second quarter, the Federal Reserve has twice raised interest rates by 0.75%, and its “dot plot” points to another 1.25% of hikes in Q4. These hikes will directly increase the income COF is able to generate on its liquid assets. At the same time, COF held deposits quarter over quarter flat at $254 billion even as it only increased its average interest rate by 9bp to 0.38%.

As rate hikes continue, COF will increase what it pays on deposits to retain them, but it is only having to increase them a fraction as much. Relative to Q2’s run rate, higher front end interest rates could generate an additional $1.25-1.75 billion of pre-tax earnings power in 2023 based on the Fed’s 4.6% projection.

First half earnings have been $10.61, which is down substantially from $14.65 when it was over-earning its true earnings power because fiscal stimulus measures artificially suppressed credit losses. The question is where do earnings land going forward. At Q2’s pace, COF has about $19.75 in earnings power. The increased net interest margin is worth about $2.85 of incremental earnings power. Even if COF reserved a net 1% of its loan book, a 25% increase in allowances, that would reduce EPS by $5.61. On net, that still provides Capital One with about $16.50-$17 in 2023 earnings, giving the stock a less than 6x multiple.

Plus, Capital One has been aggressively repurchasing stock, having bought back $2 billion in stock in Q2 and $4.4 billion year to date. Over the past twelve months, the company has reduced its share count by 13% to 392.6 million. Last August, the company also increased its dividend by 50% to $0.60. Due to its large share repurchases and loan growth, the company’s tier 1 capital ratio has declined from 14.4% to 12.1%. Over the long-term, management is targeting an 11% capital ratio.

As a consequence, I expect COF to continue to repurchase stock but at a slower rate, particularly as it may choose to keep its capital ratio a bit above target given economic uncertainty. I also expect buybacks to be a focus over dividend growth and view a hike prior to mid-2023 as unlikely. Still, even if COF chose to return just half of its earnings to shareholders, there would be scope to buy back about $2.3 billion in stock or a further 6% of shares outstanding, and this is likely at the low end of what management will do.

Shares are now trading just 1.1x tangible book value of $87.84. Book value including goodwill stands at $125. With the company comfortably having in excess of $15 in earnings power and the outlook for consumer credit better than many fear, shares are a bargain below $100. As the durability of its earnings power is better appreciated in coming quarters, I believe shares would merit a 10x earnings multiple, recognizing the cyclicality of credit card lending will structurally keep Capital One’s lower than for less cyclical companies. That still points to a $150 share price, or 50% upside. Even at 8x earnings, it would only trade to book value in the low $120s, up over 25% from here. COF is among the most compelling opportunities I see in the market today.

Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.