Summary:

- Carnival’s fiscal year results paint another bleak picture.

- The cycle of issuing and refinancing junk bonds continues as free cash flow cannot even pay the interest.

- The stock isn’t as cheap as it looks; exercise extreme caution.

- Let’s take a closer look.

KanawatTH

Sometimes companies are faced with severe disasters that, through no fault of their own, make the future incredibly grim for shareholders. Past investors in General Motors (GM) know this well. The company was forced into Chapter 11 reorganization when the Great Recession decimated the economy and auto industry. Common shareholders were basically wiped out.

Other times, companies facing bleak futures manage to rise from the ashes; however, investors should know the complete picture before buying an expensive lottery ticket.

Let’s take a closer look at the Carnival Corporation (NYSE:CCL) situation.

Carnival’s 2022 results show deterioration across the board

“Buy not on optimism, but on arithmetic.” – Benjamin Graham

We all know the devastating effects that COVID-19 had on the cruise industry, so there’s no reason to rehash it. Carnival’s share price is down 80% since the beginning of 2020, although new buyers aren’t getting a massive discount on the stock (more on this below).

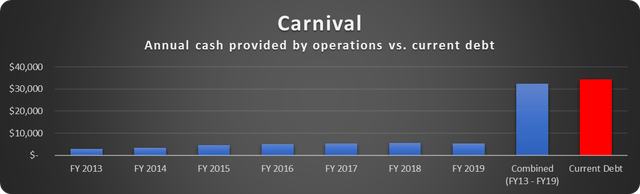

Carnival was forced to issue debt exceeding all the cash provided by operating activities in the seven years before COVID-19, as shown below.

Data source: Seeking Alpha and Carnival Corp. Chart by author.

The picture is actually worse since this doesn’t account for capital expenditures (CAPEX). This debt will probably take decades to pay down to a reasonable level.

But the interest, the horrible interest! – Luanne Platter, King of the Hill

The interest rates on these junk bonds are astronomical (in many cases, more than 10%). Carnival spent $1.6 billion on interest in fiscal 2022 alone, or 13% of top-line revenue, and these payments will continue to hurt shareholders for years.

Here are some other concerning figures from the fiscal 2022 financial report.

-Total long-term debt: Up 13% year over year (YoY) to $34.3 billion.

-The current portion of long-term debt is up 24% to $2.4 billion.

-Current assets: Down 26% to $7.5 billion.

-$1.2 billion in common stock issued.

I’ve heard the argument that Carnival will see increased ridership because of the pent-up demand from COVID-19, which will solve its ills. First, this seems a dated idea. Most people lived normally last quarter, yet occupancy was 19% below 2019.

Further, costs are rising faster than sales. Last quarter, Carnival reported a 3.8% rise in revenue per passenger cruise day over the same quarter in 2019 but an 11% rise in adjusted cruise costs (both figures in constant currency). Please explain again how pent-up demand will solve the cash flow problem.

The stock is not a bargain

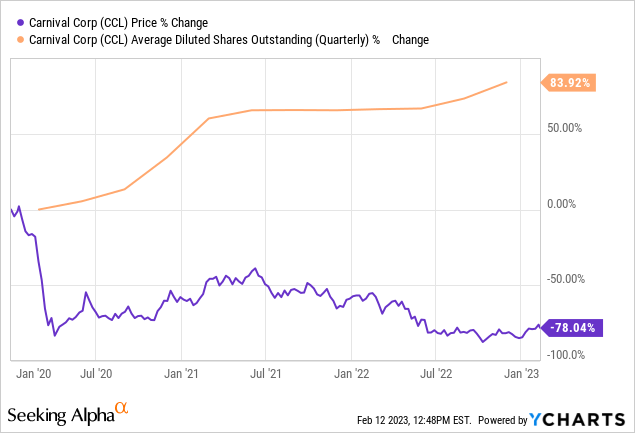

Carnival’s share price is down 78% since January 1st, 2020; however, the number of shares outstanding is up 84%, as shown below.

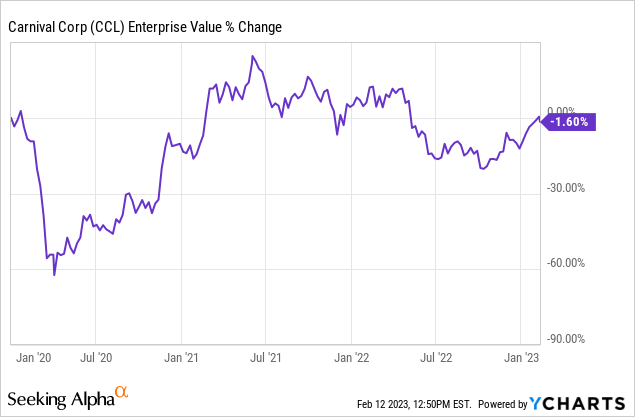

The enterprise value considers the rising share count and ballooning debt and shows that new investors only get a 1.6% discount on the stock. That’s right! As shown below, when factoring in the debt and dilution, shares are basically the same price as before the pandemic.

Would we buy a business with these problems without a substantial discount? I would not.

What’s the bottom line?

Carnival has become a company that is earning money to pay its debts. The bondholders receive the cash, and the stockholders are in for a long slog.

The common stock is, at best, a lottery ticket and, at worst, a ghost ship luring in unsuspecting investors.

Traders understandably enjoy the stock since it is subject to large swings on news; they have no interest in the company’s long-term success. But long-term investors beware: this stock could pop in the short term, but it will likely underperform the market significantly in the long run.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.