Amazon: 2022 Was A Disaster, And Leadership Must Take Action

Summary:

- I am not thrilled with the 2022 results, as AMZN generated over $500 billion in revenue and couldn’t turn a profit.

- After going through the numbers, AMZN’s valuation is looking dicey, and if they don’t get back to profitability, I am afraid the Street will lose confidence.

- If management can create operational efficiencies, there is no reason why AMZN can’t get back to generating tens of billions in profit.

HJBC

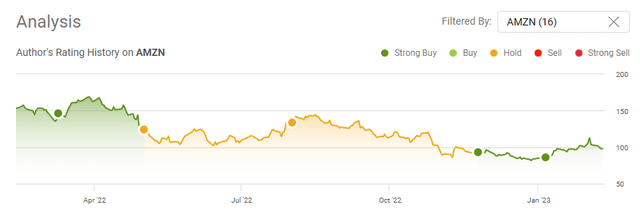

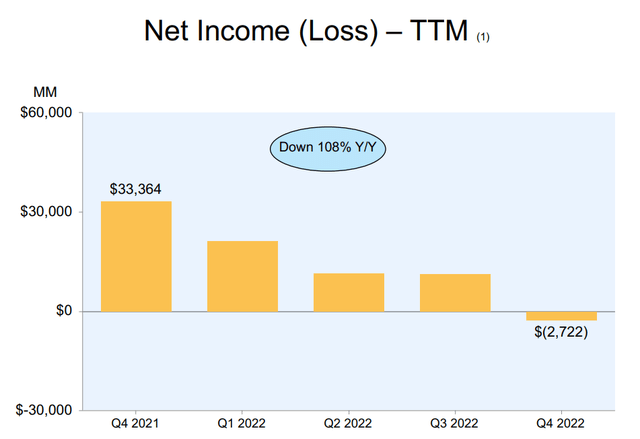

To say I was disappointed with Amazon (NASDAQ:AMZN) after they reported its 2022 results is an understatement. AMZN is one of my favorite companies, but in May of 2022, I changed my position from very bullish just 2 months prior to neutral because of its financials. In November of 2022, I got back on the bullish train when inflation started rolling over, and AMZN was trending below $100. I was hoping that the combination of inflation and commodity pricing declining would lead to lower expenses and bring AMZN back into profitability or at least break even in their U.S. and International businesses in Q4 and that AMZN would post an overall profit for 2022. This wasn’t the case, and after reviewing the numbers, I am absolutely perplexed. AMZN stock has a market cap of $1 trillion and generated $513.98 billion of revenue in 2022, yet it lost money. If you have read my articles on Seeking Alpha, you would know that I think Tesla (TSLA) is a remarkable company, but the valuation is too high. AMZN is making TSLA look good, and leadership needs to make some tough choices. AMZN went from generating $33.36 billion of net income in 2021 to losing -$2.72 billion in 2022, and 100% of the operating income generated came from AWS. International has been a disaster, and over the past two years, it generated $245.79 billion in revenue and cost the company -$8.67 billion. The justification for being a $1 trillion market cap company is getting harder and harder to make, and unless something changes, I will have to reconsider staying a shareholder.

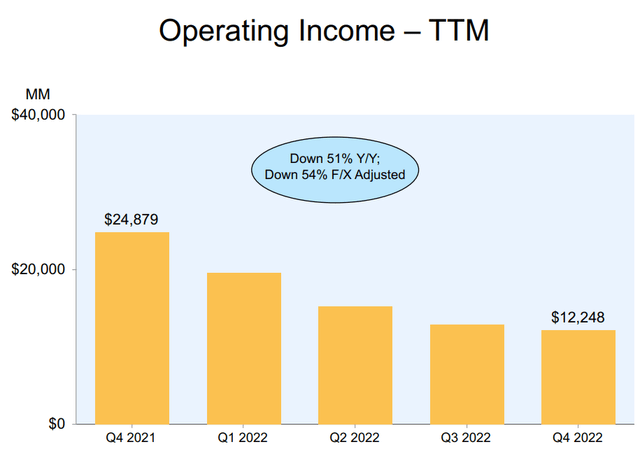

Amazon isn’t a start-up and profits matter

AMZN has a profitability problem. On a trailing twelve-month (TTM) basis, AMZN has watched its operating income sequentially decline quarter over quarter (QOQ). In fact, AMZN’s operating income has declined by -50.77% year over year (YoY). In 2021 AMZN generated $24.88 billion in operating income; in 2022, AMZN’s operating income came in at $12.25 billion, a decline of $12.63 billion. This has led to the overall profitability of AMZN suffering as AMZN’s net income has declined by -$36.09 billion YoY.

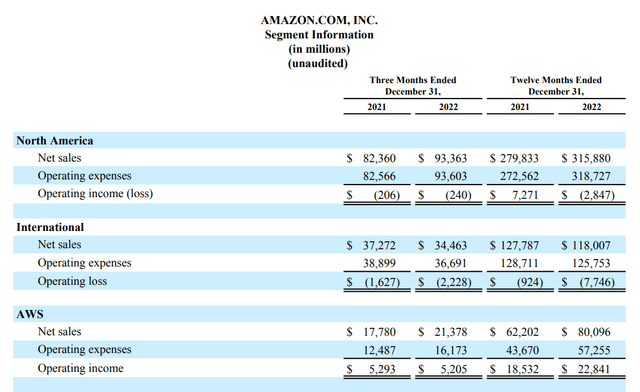

All businesses aren’t created equal, and AMZN’s traditional business, which comprises North America and International, generated 84.42% of AMZN’s 2022 revenue and lost -$10.59 billion. In 2022, North America grew sales by 12.88% ($36.05 billion) YoY and generated -$2.85 billion in profits. While one could argue that the non-existent income was an anomaly, as North America generated $7.27 billion in net income in 2021, the International business segment is a disaster. The International side of AMZN’s business represented 22.3% of its 2022 revenue mix and watched the overall revenue it generated decreased by -7.65% YoY. In addition to the declining revenue, its operating loss increased to -$7.75 billion from just -$924 million one year prior.

AWS has been AMZN’s saving grace as it generated $22.84 billion in operating income and generated 100% of AMZN’s overall operating income in 2022. In 2021, when the combination of North America and International generated $6.35 billion in operating income, this was only a margin of 1.56% as their total revenue amounted to $407.62 billion. AWS is a much higher-margin business, as its operating margin was 29.79% in 2021 and 28.52% in 2022.

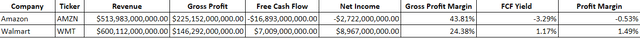

If AMZN’s market cap wasn’t anywhere near $1 trillion, its 2022 financials wouldn’t be as detrimental, but this valuation is questionable due to its minimal profits. Think about this, AMZN generated $513.98 billion in revenue, $225.15 billion in gross profit, and lost -$2.72 billion. They operated at a 43.81% gross profit margin, and its actual profit margin was -0.53%. AMZN had a non-existent free cash flow (FCF) yield as their FCF was -$16.89 billion. One of the main justifications has been that AMZN is still growing, and its revenue is now exceeding $500 billion. AMZN has a competitor that finished 2022, generating $600.11 billion in revenue, $146.29 billion in gross profit, $7.01 billion in FCF, and $8.97 billion in net income. Its gross profit margin was 24.38%, FCF yield was 1.17%, and profit margin was 1.49%. This competitor is Walmart (WMT), and its market cap is 38.75%, as large as AMZN’s at $387.58 billion. The main difference between the two is that WMT doesn’t have an AWS in its portfolio, but overall it’s a larger company by revenue, and in 2022, which was a difficult year across the board, it turned a profit regardless of the margins being dismal.

Steven Fiorillo, Seeking Alpha

Profits matter because AMZN burned through $26.02 billion in cash throughout 2022, and its cash position declined by -27.09%. AMZN spent $63.65 billion on CapEx in 2022 and $61.05 billion in 2021. AMZN’s total debt increased by 21.30% to $169.94 billion, while its long-term debt increased by 34.41% to $73.85 billion. Management needs to implement strict guidelines and figure out a way to deliver efficiencies without sacrificing revenue. AMZN spent $288.83 billion on its cost of revenue, $212.90 billion in operating expenses, and $63.65 billion in Capex throughout 2022. Other companies are finding ways to do more with less, and AMZN needs to become operationally more efficient. AMZN generated $33.36 billion in net income in 2021, and between its continued growth and implementing operational efficiencies, there is no reason why it can’t add tens of billions to its bottom line.

For a trillion-dollar company, Amazon’s current valuation looks crazy based on how I am now looking at companies

There isn’t an end-all-be-all to valuing companies, as different investors use different methodologies to determine if a company is undervalued. Some stick with P/E, build out a discounted cash flow model, find the intrinsic value, or evaluate a discounted residual income model.

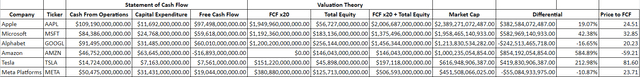

For established companies, I have built my own model, which is clean, and simple and tells me what I want to see in a high-level overview. This is to establish a baseline before I look at the growth trends in revenue and profits, then the entire balance sheet and cash flow statement. I combine the total equity found on the balance sheet and a multiple of 20x a company’s FCF to come up with a theoretical market cap. Then I look at if the company trades at a discount or premium to this number. The total equity on the balance sheet is what is left over after all of the assets cover the liabilities, so this is my foundational value. Then I look at FCF because FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This also is the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions. I assign a multiple of 20 to FCF, then add the total equity and 20xFCF to establish a target market cap. This allows me to see quickly how much of a discount or premium the actual company is trading at compared to my model.

Steven Fiorillo, Seeking Alpha

I compared AMZN to Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), and Tesla. The results were far from what I wanted to see. Since AMZN generated negative FCF, I assigned a multiple of 0, so the baseline market cap in my model is only the equivalent of its equity which is $146.04 billion.

- Total Equity = $56,727,000,000.00

- FCF = $97,498,000,000.00

- FCF x 20 = $1,949,960,000,000.00

- FCFx20 + Total Equity = $2,006,687,000,000.00

- Market Cap = $2,389,271,072,487.00

- Discount/Premium to market cap = 19.07% Premium

- Total Equity = $183,136,000,000.00

- FCF = $59,618,000,000.00

- FCF x 20 = $1,192,360,000,000.00

- FCFx20 + Total Equity = $1,375,496,000,000.00

- Market Cap = $1,958,465,140,933.00

- Discount/Premium to market cap = 42.38% Premium

- Total Equity = $256,144,000,000.00

- FCF = $60,010,000,000.00

- FCF x 20 = $1,200,200,000,000.00

- FCFx20 + Total Equity = $1,456,344,000,000.00

- Market Cap = $1,213,830,534,282.00

- Discount/Premium to market cap = -16.65% discount

- Total Equity = $146,043,000,000.00

- FCF = -$16,893,000,000.00

- FCF x 20 = $0

- FCFx20 + Total Equity = $146,043,000,000.00

- Market Cap = $1,000,235,054,854.00

- Discount/Premium to market cap = 584.89% Premium

- Total Equity = $45,898,000,000.00

- FCF = $7,561,000,000.00

- FCF x 20 = $151,220,000,000.00

- FCFx20 + Total Equity = $197,118,000,000.00

- Market Cap = $616,948,906,387.00

- Discount/Premium to market cap = 212.98% Premium

- Total Equity = $125,713,000,000.00

- FCF = $19,044,000,000.00

- FCF x 20 = $380,880,000,000.00

- FCFx20 + Total Equity = $506,593,000,000.00

- Market Cap = $451,508,066,025.00

- Discount/Premium to market cap = -10.87% discount

It’s difficult to justify AMZN having a $1 trillion market cap when its profits are non-existent. If AMZN had generated $30 billion in FCF, which is half of GOOGL, 20xFCF + total equity would be $746.04 billion, which is still a 34.07% premium to its current market cap. By this high-level overview I created, AAPL trades at a 19.07% premium, and they produced $97.49 billion in FCF. GOOGL trades at a -16.65% discount, and they generated $60.01 billion in FCF. META has a market cap of $451.51 billion, has $125.71 billion of equity on the books, and generated $19.04 billion in FCF. GOOGL has a market cap of $1.21 billion with$256.14 billion in total equity on the books and generated $60.01 billion in FCF. It’s increasingly difficult to make a case for AMZN being a trillion-dollar company when looking at how it stacks up to its peers.

Conclusion

2022 wasn’t the year I hoped for, and shares are still down -42.86% from their 52-week high of $170.83. If AMZN is to have any chance of reclaiming its previous valuations, leadership needs to make the tough decisions and implement efficiency measures across the board. My fear is that AMZN will have another tough year operationally, and the street will lose faith in its ability to generate profits. AWS will matter less and less if AMZN is unable to generate stable returns from North America and the International segments because it will be viewed as a crutch rather than a profit center that separates it from WMT. I am back to being neutral on AMZN and believe we could see more downside until AMZN gets back to generating tens of billions in profits. Eventually, I believe management will come out victorious, and that’s why I am still a shareholder, but if things don’t change, I am going to need to rethink this investment.

Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, GOOGL, META, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.