Summary:

- Intel’s Q4 horror show was yet another speed bump on the semiconductor giant’s ride to glory, and the threat of a dividend cut now looms large.

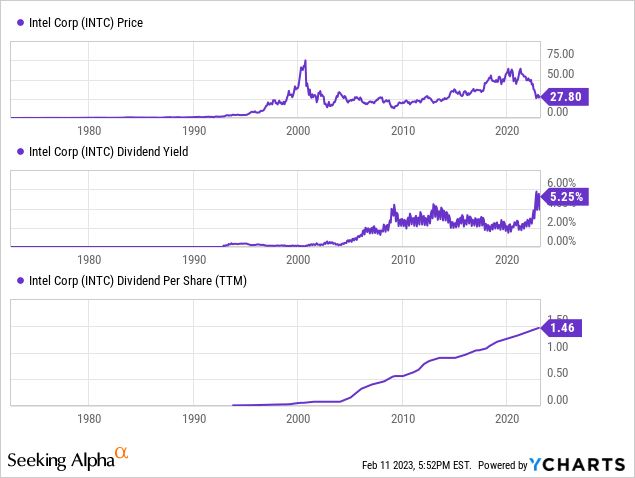

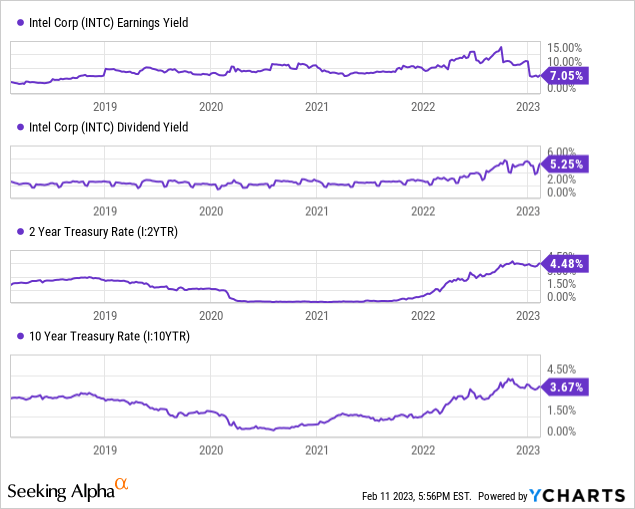

- In this article, I share my analysis of Intel’s elevated dividend yield of 5.25%, which is ~10x that of its sector’s dividend yield.

- In my view, deteriorating financial performance, poor business outlook, growing balance sheet leverage, and an uncertain macro picture render a dividend cut at Intel highly likely.

- Despite the rising threat of a dividend cut, I continue to rate Intel a modest long-term “Buy” at $28.

David McNew/Hulton Archive via Getty Images

Introduction

In my latest research note, we briefly discussed Intel’s (NASDAQ:INTC) elevated dividend yield, and based on reader feedback, I have realized that a deeper look into this subject is warranted.

Amid a poor macroeconomic backdrop, Intel’s business has come under significant pressure over the last year or so. However, despite a noticeable deterioration in financial performance, Intel’s management has (so far) maintained its annual dividend payouts of ~$6B. A sharp price decline in 2022 has left the stock reeling at multi-year lows. Consequently, Intel’s dividend yield has spiked up to 5.25%.

In this note, we will compare Intel’s dividend yield to its peers, review its dividend grades and history, and examine the safety of this dividend.

If you have followed my work on Intel, you know that I have a bullish rating on the semiconductor giant. Here’s my research coverage (investment thesis) for your perusal:

- Intel’s Bumpy Ride To Glory Just Got Bumpier [Jan 31st, 2023]

- Intel Stock: Mobileye IPO Could Be A Masterstroke [Dec 14th, 2021]

- Intel: Gearing Up For A Bumpy Ride To Glory [Oct 25th, 2021]

- Intel Stock Has 3 Big Advantages Over Nvidia & AMD [Aug 23rd, 2021]

Alright, let’s dissect Intel’s anomalous dividend yield!

How Does Intel’s Dividend Compare To Its Peers?

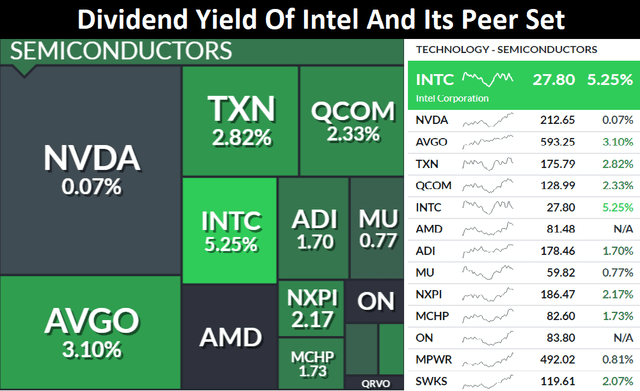

While Intel’s dividend yield of 5.25% seems enticing, such a sharp rise in dividend yield generally represents the increased risk of a dividend cut.

Compared to peers, Intel’s dividend yield seems like an outlier. The VanEck Semiconductor ETF (SMH) currently offers a dividend yield of 0.50%, which means Intel’s dividend yield is ~10x that of its sector.

Intel’s Dividend Yield Relative To Peers (Author and SeekingAlpha)

According to Seeking Alpha’s rating system, Intel’s dividend yield gets an “A+” rating, which is clearly warranted based on the data in the image above. We shall review Intel’s dividend history in a bit; however, Intel’s Dividend Consistency grade of “A” is noteworthy. Lastly, Intel gets a “B-” rating for Dividend Growth and Dividend Safety, which is not great, but it’s certainly a decent rating.

Intel’s Dividend Grades (SeekingAlpha)

Overall, Intel’s Dividend Grades are pretty strong, and they make INTC look like a good dividend stock to own at current levels. However, before reaching any conclusions, let’s dig a bit deeper.

What’s Intel’s Dividend History?

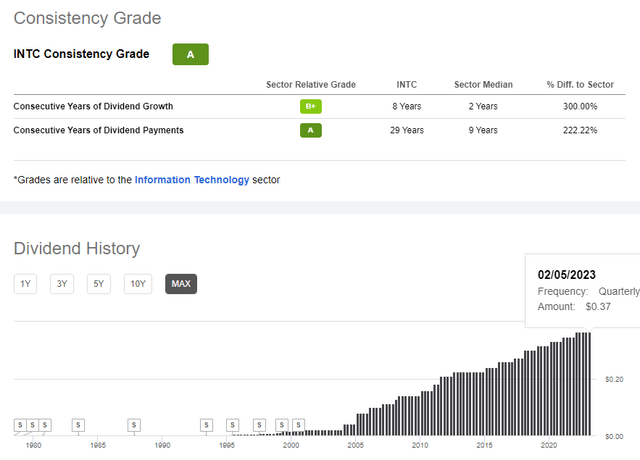

In terms of consistency, Intel’s 29-year track record for paying dividends is flawless! Ever since Intel started paying dividends in 1992, the semiconductor giant has paid out a quarterly dividend to shareholders.

Intel’s Dividend History (SeekingAlpha)

Despite having never cut its dividend throughout history, Intel is not a “Dividend Aristocrat” stock. Back in 2014, Intel froze its dividend, putting an end to a 22-year streak of growing dividends (falling three years short of achieving the dividend aristocrat status). Then in 2016, Intel started raising dividends again, and you can see the ongoing eight-year streak of growing dividends on the chart above.

During tumultuous economic times in the past, Intel has maintained or grown its dividend. Hence, from a historical standpoint, Intel’s dividend looks safe.

INTC Stock’s Dividend Projections

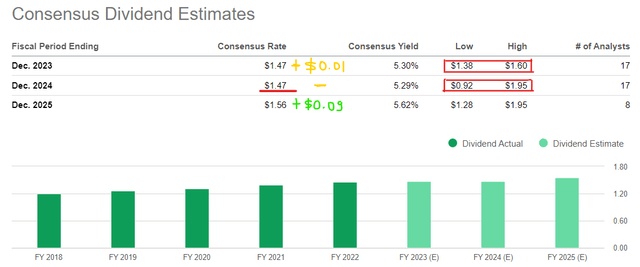

In 2022, Intel paid total dividends of $6B ($1.46 per share), and consensus analyst estimates suggest that Intel’s annual dividend will rise marginally to $1.47 in 2023, stay flat at $1.47 in 2024, and then grow to $1.56 in 2025. While the range of estimates shows that some analysts are expecting a dividend cut at Intel in 2023 and 2024, the consensus outlook for Intel’s dividend remains favorable.

Intel’s Dividend Estimates (SeekingAlpha)

Past data and future projections (from Wall Street analysts) suggest that Intel’s dividend is safe. However, I think you would agree that Intel’s current dividend yield of 5.25% is still anomalous. After all, the dividend yield on INTC stock never reached such heights, even during the pre-GFC asset bubble.

In my view, Mr. Market has priced in (or is trying to price in) the elevated risk of a dividend cut from Intel. And if you remember, I remarked in my previous note that Intel’s dividend is not under threat for now, but things could change quickly:

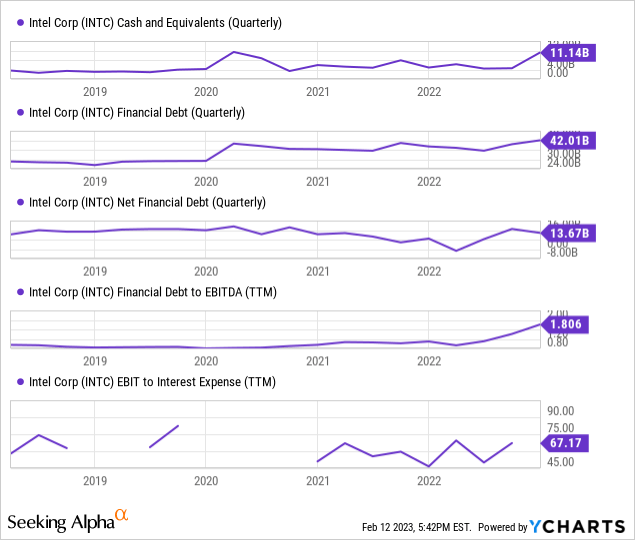

Intel’s financial debt is rising and its cash position is dwindling, causing the net financial debt to shoot higher. Given the uncertain macroeconomic environment and Intel’s ongoing investment cycle, the management may be forced to cut dividends in the second half of 2023 (especially if we end up in a recession).

Source: Intel’s Bumpy Ride To Glory Just Got Bumpier (NASDAQ:INTC)

In order to formulate an informed investment decision here, we must find an answer to this question:

Is Intel’s Dividend Safe?

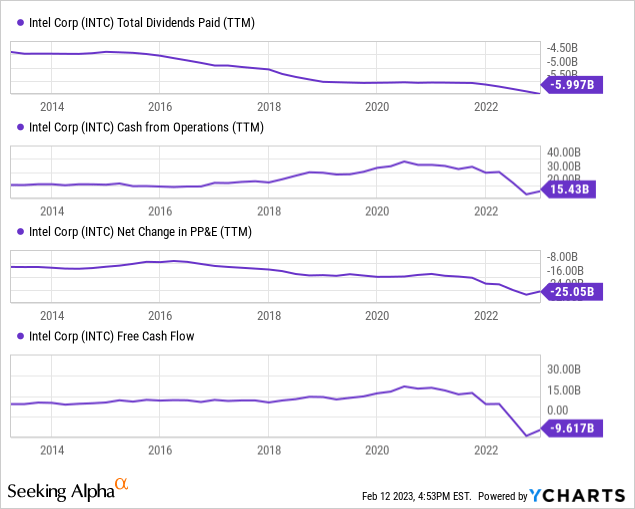

As we know, Intel is going through a heavy capex spending cycle (IDM 2.0 investment phase: 2022 to 2024), with ~$25B spent on PP&E in the last 12 months. During this transitory period, a sharp drop in revenues, margins, and operating cash flows has resulted in a complicated cash-burn situation at Intel.

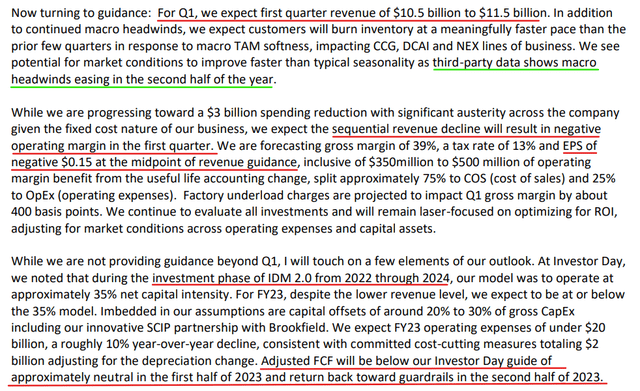

While Intel generated a positive FCF of $3.1B and paid dividends of $1.5B in the quarter gone by (cash dividend payout ratio < 50%), Intel reported negative free cash flows of -$9.62B for 2022, and management’s latest commentary suggests that Intel is set to report negative free cash flows for the first half of 2023 too.

Intel’s Q4 2022 Earnings Transcript (SeekingAlpha)

As highlighted in management’s commentary, the investment phase of IDM 2.0 is set to last through 2024, i.e., heavy capex spending will continue for the next couple of years too. With rivals wrestling market share away from Intel during a weak macroeconomic (demand) environment, Intel’s revenues are shrinking, and margins are collapsing!

In the aftermath of a horrendous earnings report in Q3 2022, Intel’s management vowed to make structural cost improvements of $3B in the short term and $8-10B in the long run. And despite making some progress on these cost-cutting objectives, Intel finds itself in a tricky financial situation.

With operating cash flows falling short of capex (i.e., negative free cash flows), Intel is taking on new debt to finance its dividends ($6B per year). And I think you’ll agree that this practice is not healthy!

Now, an argument can be made that Intel’s capex investments are being made through this new debt, and the dividend is coming out of operating cash flow, which stood at +$15.4B in 2022. Even if we accept this argument, Intel’s debt is exploding higher, and we haven’t seen much success on Gelsinger’s promise of five nodes in four years! If Intel fails to regain process leadership, the “IDM 2.0” strategy could prove to be an absolute disaster that leaves Intel stuck in a debt spiral.

For now, Intel’s net debt of ~$13.7B is very manageable, with EBIT covering ~67x of current Interest Expense [TTM]. And Intel has ample liquidity to maintain its dividend for the next couple of quarters. However, if the macroeconomic environment deteriorates and Intel fails to return to positive FCF generation in H2 2023, then a dividend cut would be financially prudent.

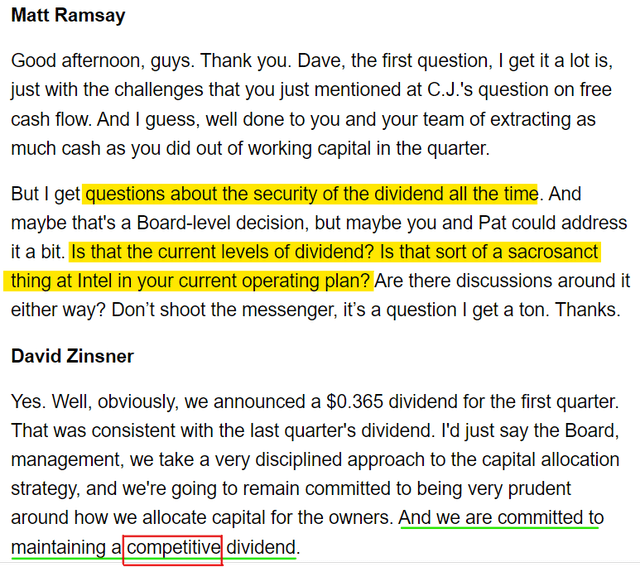

Here’s some interesting commentary from Intel’s Q4 2022 conference call:

Intel’s Q4 2022 Earnings Transcript (SeekingAlpha)

As of now, Intel’s CFO, David Zinsner remains committed to maintaining Intel’s dividend, but his choice of words around capital allocation was very interesting. Personally, I think a 5.2% dividend yield from a blue-chip tech company is a rarity. Intel’s current dividend yield is not just competitive, it’s an outlier in the technology sector. As I see it, Intel’s management could cut the dividend in half, and the dividend would still be competitive.

Is a dividend cut inevitable at Intel? Yes, I think so. Nothing is guaranteed in investing, but deteriorating financial performance, poor business outlook, growing balance sheet leverage (+ rising cost of capital), and uncertain macroeconomic environment lead me to believe that Intel’s management will be forced into cutting the $6B dividend in H2 2023.

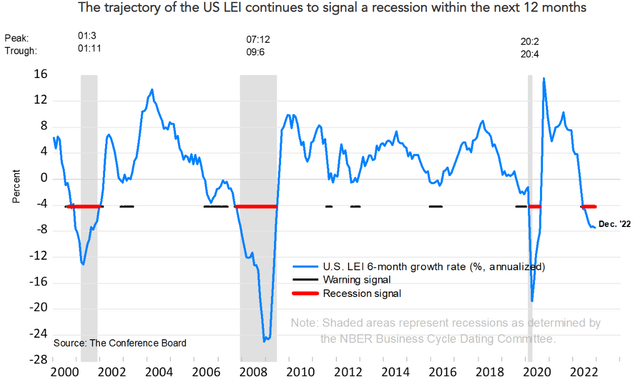

Conference Board

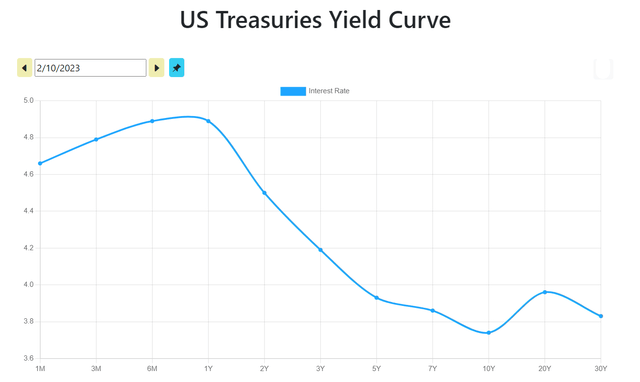

ustreasuryyieldcurve

With the Fed pulling liquidity out of the economy despite the yield curve being deeply inverted and leading economic indicators pointing to an imminent recession, a demand recovery for the highly macro-sensitive semiconductor industry by H2 2023 is too hard for me to digest.

Concluding Thoughts: Is Intel A Good Dividend Stock To Own?

With its earnings (7.05%) and dividend yield (5.25%) being greater than short-term (2-yr: 4.48%) and long-term (10-yr: 3.76%) treasury rates, Intel is certainly an enticing investment. However, as we saw in this note, Intel’s elevated dividend yield is anomalous and quite likely to get cut in 2023.

In my view, Intel is not a buy for someone looking to invest in this counter solely for the dividend. However, I still think Intel is a good stock to buy (and own) at current levels.

As I said in Intel’s Bumpy Ride To Glory Just Got Bumpier:

Despite an obvious deterioration in financial performance, Intel remains a company of national importance as the only scaled semiconductor manufacturer in the Western hemisphere. Given the uncertain macroeconomic environment, Intel’s financial performance is likely to remain in flux during 2023. However, Intel looks like a decent buy at current levels based on forward-looking valuations.

Intel’s stock is forming a base in the $24-32 range, and while I would prefer buying towards the bottom of this range, getting in here at ~$28 is fine too. Based on a mix of fundamental, quantitative, and technical analysis, I think Intel is a modest long-term buy at current levels. And I strongly prefer slow, staggered accumulation in this counter. If you’re looking at Intel as a short-term buy or as a way to earn dividends in the near to medium term, I would urge you to look elsewhere.

Key Takeaway: I rate Intel a modest long-term “Buy” at $28. That said, Intel’s 5.25% dividend yield is not bulletproof. If you are contemplating an investment in Intel solely for its dividend, you will be better off looking elsewhere.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to shield your portfolio against a potential market crash in 2023?

At TQI, we pursue bold, active investing with proactive risk management. If you would like to read our detailed market outlook and access our positioning for this challenging market environment, join our community today.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). For a limited period only, we are also offering a free trial.