Summary:

- Operating margins should improve in 2023 as competitive pressures ease.

- No one has a streaming ecosystem like Netflix.

- The journey to streaming is still very early in markets like Poland.

Brandon Bell

Introduction

Netflix (NASDAQ:NFLX) has always focused on engagement, revenue and profit as they never had the luxury of using legacy media profits to support streaming. Co-CEO Ted Sarandos talked about this at the December 2022 UBS TMT Conference:

The core KPIs in this business are very simple, engagement, revenue and profit. So for some reason, when we talk about this business, we get clouded with a bunch of other things like Rotten Tomatoes scores and raw subscriber numbers without any ARPU attached to it. And it’s not really a good way to measure the business. I would measure engagement, profit and revenue.

The streaming landscape was extremely competitive in 2022 with key competitors spending irrationally on subscriber growth and not worrying about profits. This is changing in 2023 and Netflix should be able to improve their operating margin from the level we saw in 2022.

Netflix has developed a substantial streaming ecosystem that is sure to boost operating income and revenue in the years ahead.

My thesis is that Netflix should have improved operating income in 2023 given the more rational competitive landscape and the potential of their ecosystem.

Rational Landscape

The days of breaking the bank in order to add streaming subscribers are coming to an end.

Warner Bros. Discovery (WBD) CEO David Zaslav signaled back in the 2Q22 call that they would no longer overspend in an effort to gain streaming subscribers:

We’re not in the business of trying to pick up every sub. We want to make sure we get paid. We get paid fairly.

During the December 2022 UBS Conference, Paramount Global (PARA) President Bob Bakish implied that 2024 would be the start of less intensive streaming investments:

’23 will be peak streaming investment. Therefore, losses.

In the 1Q23 call, Disney CEO Bob Iger said they are re-evaluating their aggression with respect to streaming:

And in our zeal to go after subscribers, I think we might have gotten a bit too aggressive in terms of our promotion…

It will be easier for Netflix to resume their operating margin expansion in 2023 and 2024 now that competitors are being more careful about protecting the value of their offerings.

Powerful Storytelling Ecosystem

During the 2023 Super Bowl, Disney (DIS) had a number of commercials showing us that they have a powerful ecosystem. One of their memorable ads reminded us that they have been in the storytelling business for 100 years now! The storytelling business can be especially lucrative for iconic companies like Disney and Netflix whose ecosystems are respected around the world. Disney is in Chris Mayer’s 100-Baggers book and it shows a total return of 3,276 from December 1962 to the time the book was copyrighted in 2015.

While Disney has a storytelling ecosystem that is powerful overall, Netflix has a storytelling ecosystem specifically focused on streaming. Size begets size with respect to streaming revenue. Companies like General Motors (GM) and Anheuser-Busch InBev (BUD) know Netflix has the best streaming audience as they bring in prodigious amounts of revenue. As such, it makes more sense for them to do partnerships with Netflix than it does with other streamers who are less appealing with respect to audiences. GM and Budweiser know the average revenue per user (“ARPU”) for streaming on Netflix is nearly double what it is for Disney (DIS). In some ways it is similar to the way in which Apple has a small percentage of the smartphone market share but a large percentage of the smartphone profits as they have some of the best customers. Netflix had a joint Super Bowl commercial with GM where Will Ferrell explained that GM is going electric and showing their EVs in upcoming shows and movies on Netflix. The Squid Game parts of the ad were especially cool! Another joint commercial featured Budweiser’s Michelob Ultra and the Netflix Full Swing golf series.

GM said they’re not paying Netflix for the EV partnership but sooner or later we’ll see Netflix being compensated by others who want to take part in the ecosystem. This will boost Netflix’s operating income and revenue.

Valuation

The 4Q22 letter shows that we have gone from nearly 222 million global subs in 4Q21 up to nearly 231 million in 4Q22. It is important to remember that this was during a year when competitors were overzealous.

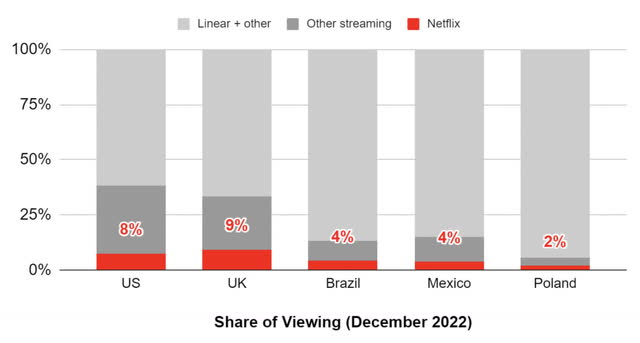

We believe ultimately the vast majority of time spent on TV will happen via streaming, which should provide a long runway for growth as we continue to improve our service.

The 4Q22 letter goes on to show that even in mature markets, streaming is still less than half of TV time:

Share of viewing (4Q22 letter)

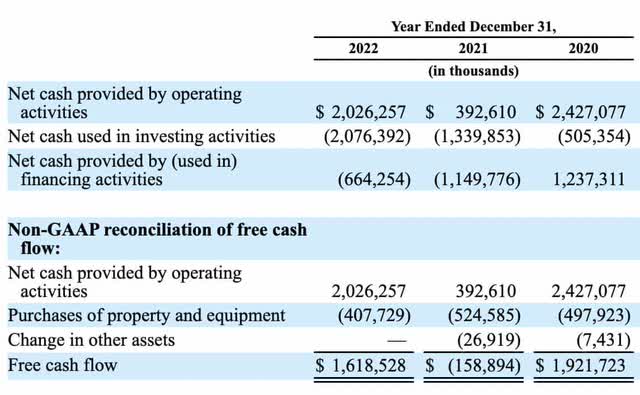

The 2022 10-K shows FCF of $1.6 billion and the 4Q22 letter says it is expected to be at least $3 billion in 2023:

FCF (2022 10-K)

I think of stock-based compensation expense as a cash expense and it was $415 million, $403 million and $575 million for 2020, 2021 and 2022, respectively.

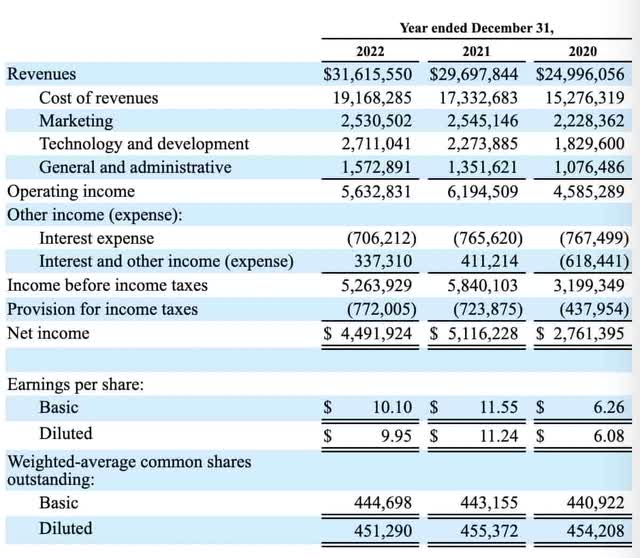

Operating income declined from $6.2 billion in 2021 down to $5.6 billion in 2022:

Income statement (2022 10-K)

The 4Q22 letter said the following:

Our long term financial objectives remain unchanged – sustain double digit revenue growth, expand operating margin and deliver growing positive free cash flow.

If management can get back on track with double digit revenue growth of 10% in 2023 along with an increase in operating margin from the 18% level in 2022 back towards the 21% level we saw in 2021 then we can see 2023 operating income of $7.3 billion or 21% of $34.8 billion. I think Netflix is worth 23 to 25x this amount or $168 to $183 billion.

The 2022 10-K shows 445,346,776 shares outstanding as of December 31st. Multiplying this by the February 13th share price of $358.57 gives us a market cap of $159.7 billion. The enterprise value is $168 billion which is $8.3 billion higher than the market cap due to long-term debt of $14,353 million which is partially offset by cash and equivalents of $5,147 million along with short-term investments of $911 million. The stock is at the low end of my valuation range so I think it is a buy for investors who have a long-term outlook of at least 3 to 5 years.

Forward-looking investors should look at the upcoming 4Q23 results from Warner Bros. Discovery and Paramount to confirm that they are continuing with a more rational spending approach with streaming.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Disclosure: I/we have a beneficial long position in the shares of NFLX, AMZN, GOOG, GOOGL, PARA, WBD, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.