Summary:

- Peak occupancy, higher pricing and increasing onboard spend is leading to upgrades in the earnings outlook.

- There are indications of greater fuel consumption efficiency. Investments in new ships over the next 10 years can drive long-term gross margin improvement via energy efficiency.

- Valuations are at an attractive 11.5% discount vs comps.

- Technicals vs the S&P500 point toward an early bullish reversal sign in-the-making.

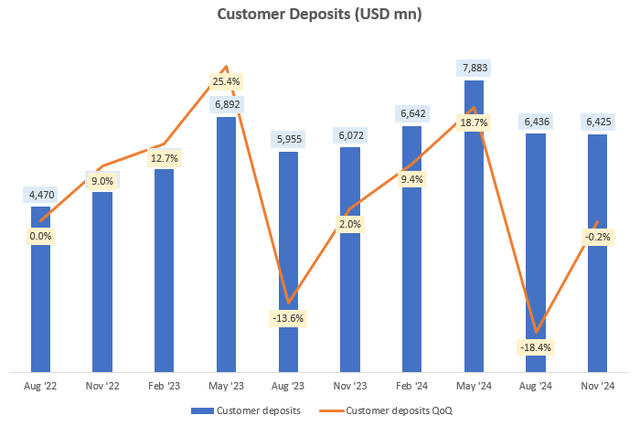

- Customer deposit levels are a key monitorable as it is a leading indicator of revenues and a mostly coincident indicator of bookings.

Constantinis/E+ via Getty Images

Thesis

I am bullish on Carnival Corporation (NYSE:CCL) after Q3 FY24 earnings release yesterday on Dec 20 2024:

- Peak occupancy, higher pricing and increased onboard spend is leading to upgrades in the earnings outlook

- New ships can drive long term margin improvement via greater fuel efficiency

- Valuations are at an attractive discount vs comps

- Relative technicals point toward an early-reversal sign in-the-making

- Customer deposits are a key monitorable as they are a leading indicator of revenues

Peak occupancy, higher pricing and increased onboard spend is leading to upgrades in the earnings outlook

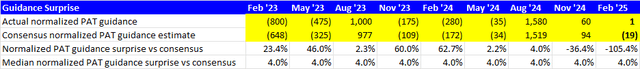

Carnival delivered a strong beat on Q1 FY25 normalized PAT guidance vs consensus estimates (a profit of $1 million vs a loss of $19 million consensus expectations):

Normalized PAT Guidance Surprise vs Consensus (Capital IQ, Author’s Analysis)

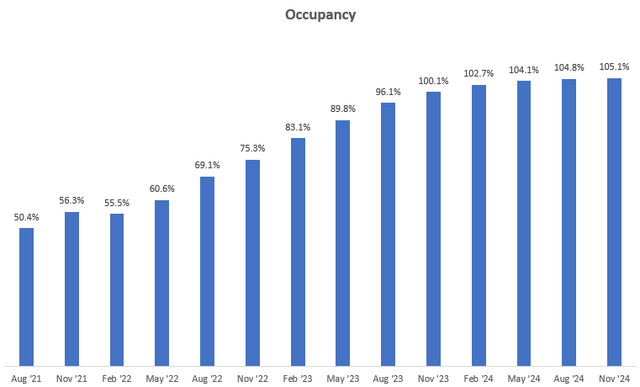

This bullish outlook is setting the tone for 2025 expectations, driven by peak occupancy rates:

Occupancy Rates (Company Filings, Author’s Analysis)

And increased prices and spending per passenger as well:

The strong improvement in 2025 yield is a result of an increase in higher ticket prices; higher onboard spending; and to a lesser degree, higher occupancy with all 3 components improving on both sides of the Atlantic.

– CFO David Bernstein in the Q4 FY24 earnings call

Indeed, according to some industry forecasts, the 2025 wave season (Jan – Mar period) is expected to see a 20% increase in cruise line passengers. As a market leader with ~37% of the world’s fleet, Carnival is well-set to benefit from these growth trends.

New ships can drive long-term margin improvement via greater fuel efficiency

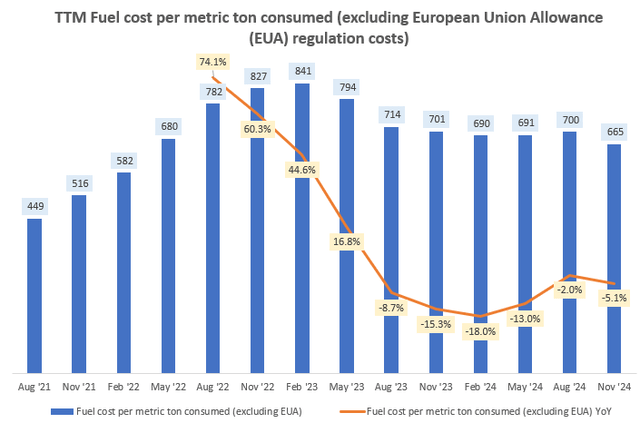

Carnival’s TTM fuel cost per metric ton [of fuel] consumed has been falling in recent quarters:

TTM Fuel Cost per metric ton consumed (excluding European Union Allowance (EUA) regulation costs) (Company Filings, Author’s Analysis)

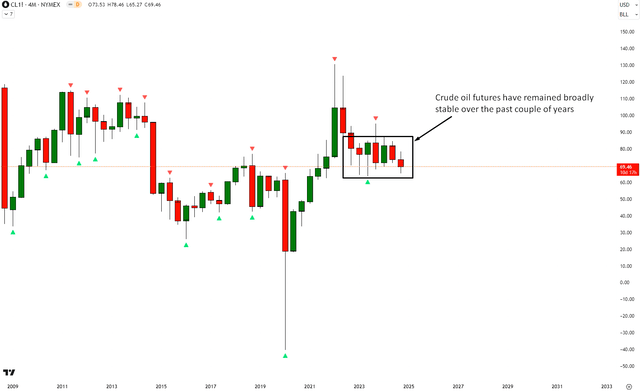

I don’t believe this is due to any material reduction in fuel pricing, since crude oil futures have been more or less steady over the past couple of years:

Flattish Crude Oil Prices (TradingView, Author’s Analysis)

Every candle represents a 4-month period in the chart above

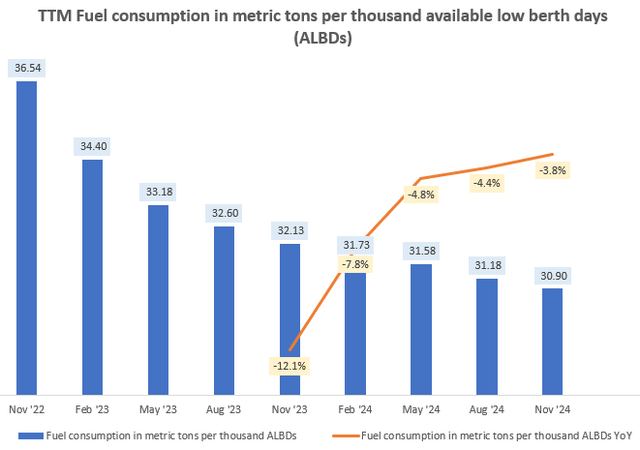

Instead, the bulk of the overall fuel cost reduction seems to be driven by a fall in the TTM fuel consumption per thousand available low berth days (ALBDs – which is a measure of total time-weighted passengers capacity):

TTM Fuel Consumption in Metric Tons per thousand Available Low Berth Days (ALBDs) (Company Filings, Author’s Analysis)

I think this could signal greater fuel efficiency. In my view, it is likely that Carnival’s fleet would become more fuel efficient both over the short-term horizon due to the introduction of new ships (newer, more modern ships tend to be more fuel efficient):

we welcomed three amazing new ships in 2024 [Carnival Jubilee, Sun Princess, Queen Anne]

– CEO Josh Weinstein in the Q4 FY24 earnings call

Noteworthily, Carnival Corporation has explicit targets for achieving greater fuel efficiency and reducing greenhouse gas (GHG) emissions; it targeted an 18% reduction in 2024.

Taking a bit of a longer-term view, over the next 10 years, Carnival has given a contract to shipbuilding company Fincantieri for 3 new landmark cruise ships scheduled for delivery in 2029, 2031 and 2033. These ships are powered by liquified natural gas (LNG) and its technology is expected to yield meaningful efficiency improvements to Carnival’s overall portfolio:

Once delivered in 2033, Carnival Corporation will have a total of 16 LNG-powered ships – including eight Carnival Cruise Line ships – making up almost 30% of Carnival Corporation’s global capacity and delivering immediate greenhouse gas emission reductions. The new ships will also feature advanced energy efficiency, waste management, and emission reduction technologies to further reduce the company’s environmental footprint.

– Carnival Corporation Press Release

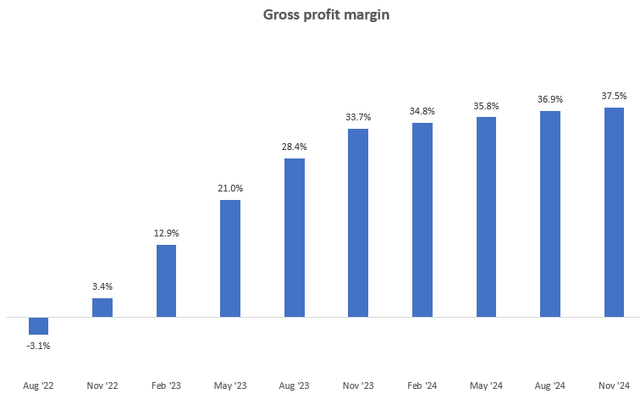

Currently, fuel costs make up 12% of overall cruise and other touring expenses as of Q4 FY24. I anticipate these new ship investments to bring that ratio down and lead to a lift in the longer-term gross margin profile of the company:

Gross profit margin (Company Filings, Author’s Analysis)

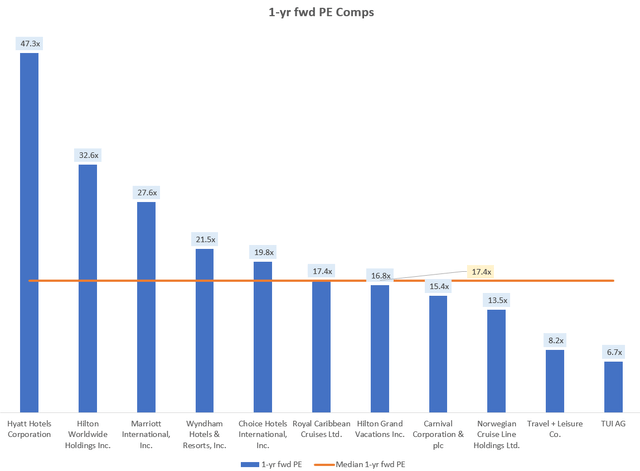

Valuations are at an attractive discount vs comps

1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

CCL stock is trading at a 1-yr fwd PE of 15.4x, which corresponds to an 11.5% discount vs the median comps level of 17.4x. Given the bullish demand and longer-term margin tailwinds ahead, I interpret this as an attractive discount for buys.

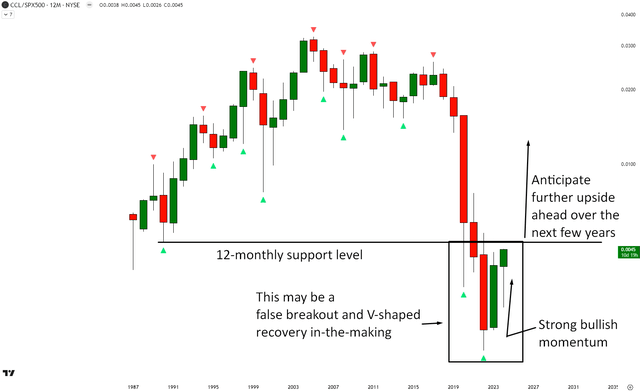

Relative technicals point toward an early-reversal sign in-the-making

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of CCL vs SPX500

CCL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P500 (SPY) (SPX) (IVV) (VOO), the 12-monthly charts (each candle represents a year) shows an early sign of a potential false breakout below 12-monthly support and sharp V-shaped recovery in-the-making. The momentum of the buyers looks prominent, which is why I anticipate further upside over the next few years.

Customer deposits are a key monitorable they are a leading indicator of revenues

Customer deposits may be a correlating indicator of bookings, which itself leads to revenues. Hence, I view this as a key risk to track:

Customer Deposits (USD mn) (Company Filings, Author’s Analysis)

So far, I am a bit surprised to see that customer deposits in Q4 FY24 have not shown a material increase vs 2023 levels. It seems a bit disconnected from the bullish commentary about strong booking volumes:

2025 booking volumes over the quarter were actually higher year-on-year at higher prices for each quarter, including the period leading up to the election… Booking volumes for 2026 also continue to break records, reflecting sustained demand even for further out sailings.

– CEO Josh Weinstein in the Q4 FY24 earnings call

Perhaps there are more nuances, such as a timing lag between deposit payment and booking confirmation, which explain the discrepancy between the numbers and the narratives here. In any case, it is a key metric to watch.

Takeaway & Positioning

I am bullish on Carnival Corporation as the demand outlook looks promising with near-peak occupancy levels, higher pricing and increased onboard spend trends. Cost trends also show that fuel consumption may be getting more efficient. And I think the company’s investments in 3 new ships will help lift gross margins over the next decade. Valuations are also attractive, as CCL trades at an 11.5% discount to its comps. Technically, relative to the S&P500, there is a long term (multi-year) bullish reversal setup being formed.

For these reasons, I am rating CCL a ‘Buy’. A key metric I will be monitoring to evaluate future revenue prospects is the company’s customer deposit levels, which logically correlates with bookings activity.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.