Summary:

- Carnival Corporation reported better than expected results for its fourth quarter, with record revenues and a strong booking situation.

- The cruise line company beat estimates on both revenues and income.

- Carnival has made progress in reducing its debt burden.

- Shares are likely fairly valued, in my opinion.

Jonathan Knowles

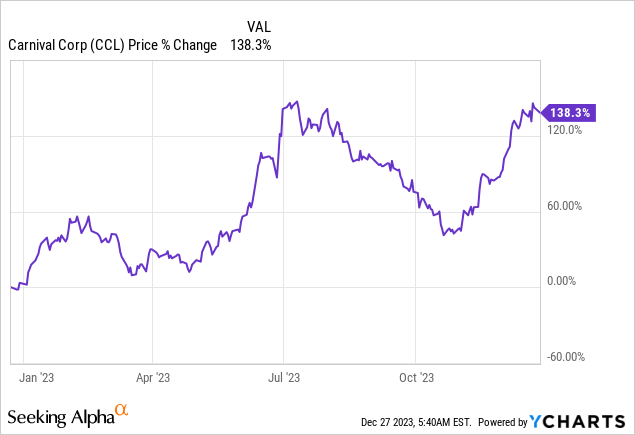

The cruise line sector has seen a robust recovery following the end of the COVID-19 pandemic and Carnival Corporation (NYSE:CCL) just reported better than expected results for its fourth quarter as well. The company also confirmed strong booking trends and made considerable progress in reducing its debt burden. However, since a major revaluation of the company’s shares has already occurred, I believe Carnival is not a buy despite reporting strong Q4’23 results. Carnival went through a major upside revaluation since October and I consider shares to be about fairly valued!

Previous coverage

I rated Carnival a hold in August, in part due to solid recovery trends and improving operating fundamentals in the cruise line industry. Carnival just reported results for its 2023 fiscal year and the company reported record fourth-quarter revenues as well as a full return to operating income. Given Carnival’s strong price revaluation since October, I believe the risk profile is not favorable.

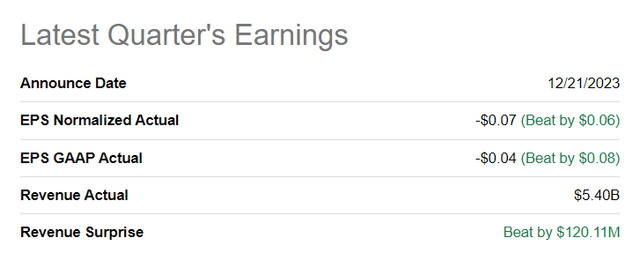

Carnival beats estimates

Carnival just reported results for its fourth-quarter and the cruise line company beat both on the top and bottom line. Carnival achieved an adjusted loss of $0.07 per-share which was $0.06 per-share better than expected. Carnival’s revenues beat by $120.1M.

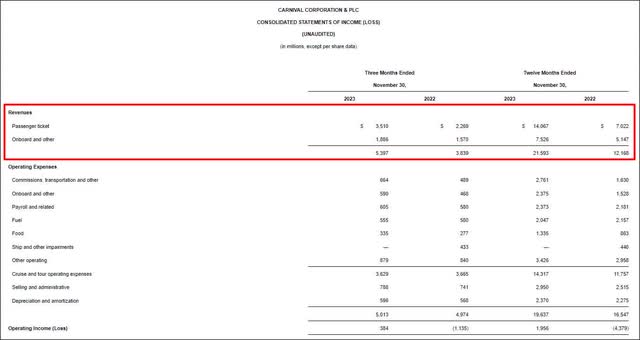

Carnival returned to record revenues and positive full-year operating income in FY 2023

The largest cruise company in the world last week reported strong results for its fourth-quarter as the recovery in the cruise line market continued. Carnival brought in $5.4B in revenues in the quarter ending November, 65% of which came in the form of passenger ticket sales. Quarterly revenues rose 41% relative to the fourth-quarter of FY 2022 while full-year revenues increased at a massive 77% rate year over year to $21.6B (an all-time high).

The fourth-quarter was also one that was highly profitable for Carnival: with operating profits of $384M the cruise line company has also fundamentally improved its earnings situation. In the same quarter in the year-earlier period, Carnival was still making losses. For the full-year, Carnival reported $2.0B in operating income compared against a loss of $4.4B in FY 2022.

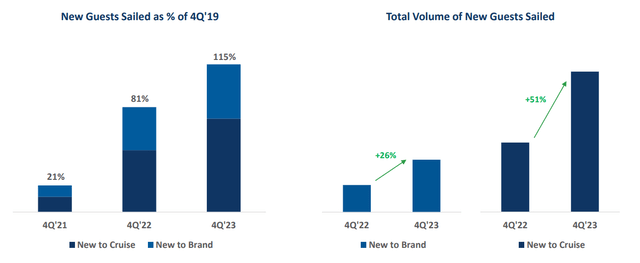

The rebound in revenues is driving chiefly by a broad recovery in the cruise line industry after the end of the COVID-19 pandemic, and, specifically, the return of passengers that are signing up at an accelerating rate for one of Carnival’s cruises. This trend has been linked to a phenomenon called “revenge travel” which says that travelers are spending lavishly on luxury cruises, as an example, to make up for lost holidays during the pandemic.

How strong the recovery has been can be seen in the chart below that displays the growth in cruise passenger numbers in the fourth-quarter relative to the fourth-quarter of 2019 (the quarter before the pandemic started to affect the cruise line industry): in Q4’23, new guests participating in cruises soared 115% relative to Q4’19 indicating that passenger demand for ocean-going cruises has never been better.

The return of passengers to Carnival’s cruises is also leading to record booking strength. The company’s CEO, Josh Weinstein, made the following comments when the cruise line company reported results for its fourth-quarter (Source):

We entered the year with the best booked position we have ever seen, and now have nearly two-thirds of our occupancy already on the books for 2024, at considerably higher prices (in constant currency). We continue to experience strong bookings momentum across the board, with our European brands showing remarkable strength during the quarter with booking volumes running up well into the double digits at considerably higher prices (in constant currency).

Booking volumes during the fourth quarter continued at significantly elevated levels, above both prior year and 2019 comparable periods, while recent booking volumes for the two weeks around Black Friday and Cyber Monday reached an all-time high for that period. Pricing on bookings during the fourth quarter was considerably higher than prior year pricing (in constant currency).

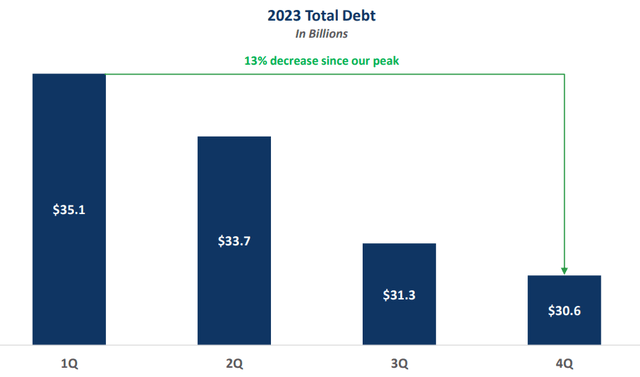

Positive development in terms of debt

One headwind the industry as a whole experienced after the pandemic was the massive amount of debt that has started to accumulate on the balance sheets of Carnival, Royal Caribbean Cruises (RCL) and Norwegian Cruise Line Holdings (NCLH). The recovery in the cruise line market and the restoration of the pre-pandemic revenue picture has allowed companies like Carnival to reduce their debt levels and return them to much lower baselines. Carnival has repaid $4.5B of its debt in FY 2023 which has been a major success for the cruise line company. However, the company still has $30.6B in total debt to deal with which is also the reason why I am not upgrading Carnival to buy.

A major revaluation has already taken place

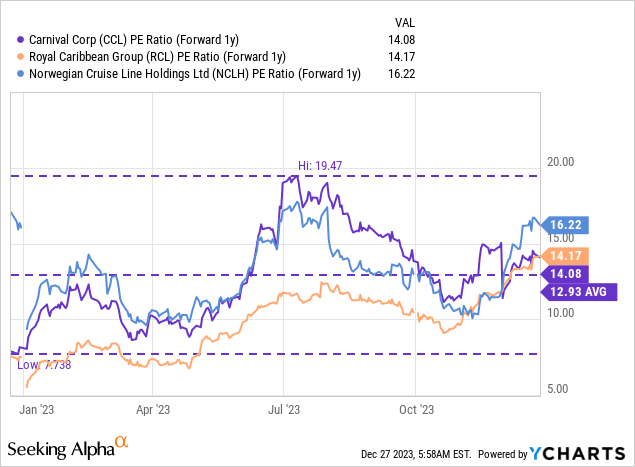

Carnival, together with the broader cruise line sector, has soared lately and shares are no longer as cheap as they were two months ago. Shares of Carnival are currently trading at a price-to-earnings ratio of 14.1X compared to a similar P/E ratio of 14.2X for Royal Caribbean Cruises and a higher P/E ratio of 16.2X for Norwegian Cruise Line Holdings. I recently down-graded NCLH — Deteriorating Risk Matrix — due to the company’s suspension of port calls to Israel (for its Middle Eastern tours). Carnival appears to me to be about fairly valued based off of its longer term valuation history as well: the cruise line company was valued at an average of about 13X forward earnings in the last year and now trades slightly above this average P/E ratio. Given that Carnival still has a considerable amount of debt to deal with, I believe a hold rating at this point is reasonable.

Carnival’s risk profile

Carnival is making clear progress with regards to paying down its debt, but the company still has a ton of debt to service. With total debt in excess of $30B, I believe future cash flow will have to be applied chiefly to the reduction of this debt burden. Record revenues and a return to operating income are great news, but if the U.S. economy were to slump, the cruise line industry would be set for a cyclical correction just at a time when it clawed its way back to profitability.

Final thoughts

Carnival just reported very solid results for its fourth-quarter and 2023 fiscal year. The cruise line company generated record fourth-quarter revenues and achieved an all-time high in terms of revenue volume for FY 2023. Carnival is also solidly profitable again in terms of operating income and the cruise line company made progress in repaying its debt. The booking situation, according to Carnival’s latest update, is robust as well. Since shares of Carnival have revalued strongly to the upside since October and the company will still have to pay back a ton of debt, I believe the upside potential is limited and I continue to rate shares of Carnival as a hold!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.