Summary:

- Disney+ has lost over 11 million subscribers globally, with a significant decline in India due to losing broadcasting rights for the Indian Premier League.

- Disney has incurred losses of nearly $2 billion from major film flops, impacting its box office revenues.

- A DCF valuation suggests that Disney’s intrinsic value is lower than its current stock price, leading to a sell recommendation.

Michael M. Santiago

Thesis

The Walt Disney Company (NYSE:DIS), is an American multinational mass media and entertainment conglomerate headquartered in Burbank, California. It is one of the largest producers of animated movies, accounting for 26% of box office revenues in the United States and Canada. The company has 46.5 million subscribers to its Disney+ Streaming service in the United States and Canada and 66.1 million international subscribers to Disney+. However, the company faces multiple challenges, such as decreasing visitors to its Domestic Disneyland parks, poor performance at the Box Office, a shift in advertising revenue away from traditional media, and the loss of one-third of its subscriber base in India. All this has resulted in slow revenue growth rates and shrinking profit margins.

Catalysts

Poor Performance at the Box Office

Disney has revealed that it spent $965 million on four of its most high-profile streaming and film flops this year. These four movies include popular films such as Antman and the Wasp ($193.2M), The Little Mermaid ($265.2M), Indiana Jones Dial of Destiny ($294.7M), and lastly, Secret Invasion ($211.6M). Forbes has gone on to describe these movies as flops as these have turned either loss-making or less profitable than expected.

However, Disney’s troubles at the box office didn’t start this year. It all started last year with Lightyear, and the studio has yet to turn a profit on any of these (as of August 2023). The list of flop films includes Lightyear (2022), Thor Love and Thunder (2022), Strange World (2022), Black Panther: Wakanda Forever (2022), Ant-Man and the Wasp: Quantumania (2023), Guardians Of The Galaxy Vol 3 (2023), The Little Mermaid (2023), Elemental (2023), Indiana Jones and the Dial of Destiny (2023), and the Haunted Mansion (2023).

It was estimated that a little more than $4 billion was spent on the production, marketing, and distribution of the ten films. Nevertheless, the films have grossed an estimated $2.31 billion in total, which equates to an approximate loss of $1.865 billion. For context, that is roughly all of Disney’s Net Income in FY 2021 and 80% of its Net Income in FY 2023. This poses a huge headwind to Disney’s profit growth rate (and thus profit margins).

This is also reflected in the company’s Media & Entertainment Distribution Results, specifically in the Content Sales and Licensing sub-division. For Q4 FY2023, Disney’s revenue has not grown from the same quarter last year, remaining at $1.9 billion. While net income has gone down from 0 to (-)0.14 billion.

Disney’s latest Marvel superhero movie, The Marvels earned a mere $47 million in its opening weekend, the worst showing for a Marvel movie in 15 years, and the worst-ever drop in the second week of 79% to a very poor performing $10.2 million in the past week. The movie’s net cost for Disney was ~$220 million after a $55 million subsidy meaning Disney will need to earn ~$440 million in order to break even as roughly half will go to the theatres, and the studios get the other half.

The movie has earned only $57 million in two weeks, and looking at how steep the downward trend is, crossing $80 million over the next 2-3 weeks seems to me like a big challenge at this point. This means Disney will make a revenue of roughly $40 million and a net loss of nearly $180 million after accounting for the production costs.

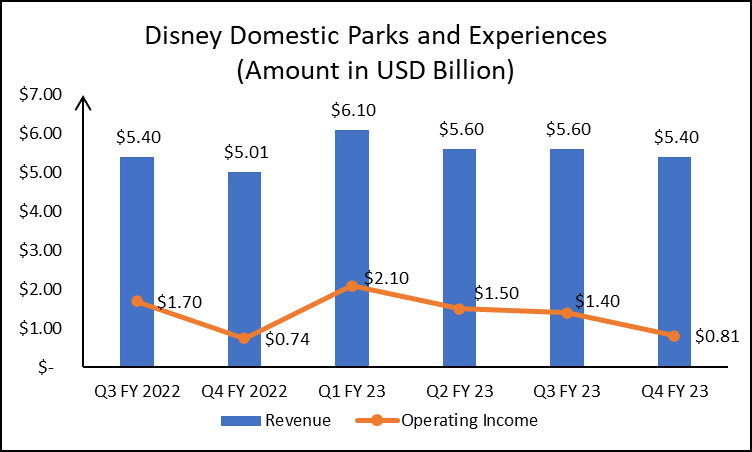

Weakness in Domestic Park Numbers – Decline in Overall Margins

Disney’s Domestic parks are a major contributor to its revenues, accounting for roughly 25% of the company’s revenue and 35% of its total gross operating profits in FY 2023. This shows that the margins in this segment are also disproportionately higher than other businesses that Disney operates.

With that in mind, one sign of worry is a decline in the revenues in Disney’s domestic parks, which have declined from $6.1 billion in Q1 FY 2023 to $5.4 billion in Q4 FY 2023. Alongside that, there has also been a decline in margins for the domestic parks business – from 34.4% in Q1 FY 23 to 15% in Q4 FY 23. Of this decline in Margins, some of it is due to accelerated depreciation on Star Wars: Galactic Cruiser, and the rest is due to higher costs due to inflation, and lower average daily hotel room rates at Walt Disney World Resort.

The company also warned in its Q3 FY 23 Earnings Call that it expects moderation in Domestic Parks revenue (especially compared to last year) for a variety of reasons but not limited to comparison versus the 50th-anniversary celebration last year, burn-off of pent-up demand and elevated travel costs hurting international tourism.

In early October 2023, Disney announced that it was halving children’s ticket prices for tickets between January 8th and March 10th next year. This is possibly being done to counter weak visitation at the domestic parks, as revenue declined even in the summer quarter (Q4 FY 23).

I believe the decline in domestic parks’ revenue also reflects, on a broader scale, the direction in which the economy is headed, and for that reason, I believe that revenue from domestic parks is headed lower over the coming few quarters.

SEC Filings

Poor Performance in the Linear Networks Segment

Within the Media and Distribution segment, Disney has the Linear Networks segment. Disney’s Linear Networks segment operates a long list of properties, including domestic and international cable networks such as Disney, ESPN, and National Geographic among others. Disney’s Linear Networks segment is a major contributor to its revenues, accounting for more than 25% of its revenue and 35% of its total gross operating profits in FY 2023. This shows that the margins in this segment are also disproportionately higher than other businesses that Disney operates.

The revenue for the segment has declined from $2.9 billion in Q4 FY 2022 to $2.6 billion in Q4 FY 2023. The company witnessed a decline in both domestic and international channels, and even within domestic, both broadcasting and cable channels suffered a decline. There were several reasons behind this, including lower cable results due to higher sports programming and production costs (NBA and new F1 Agreement). Lower broadcasting results were also due to a decline in advertising across ABC and Disney-owned television stations.

Also, as the lag effects of last year’s interest rate hikes start to take effect, I feel that advertising and related revenue will continue to be a weak link for the linear segments and the streaming segment for Disney.

Loss in Disney+ Hotstar Traction

The company’s streaming offering in India, Disney+Hotstar, has lost over a third of its subscribers, which declined from 61.3 million in Q4 FY 2022 subscribers to 37.6 million subscribers at the end of Q4 FY23. A major reason behind this is that Disney+Hotstar lost the broadcasting rights for India’s cricket league – the Indian Premier League (IPL) to rival JioCinema, which has also acquired the rights for all HBO content that used to be on Disney+Hotstar.

Assuming all these lost subscribers were on the basic ads plan ($11/year) on Disney+Hotstar, the loss of ~24 million subscribers is a loss of $250+ million in Annual Revenue.

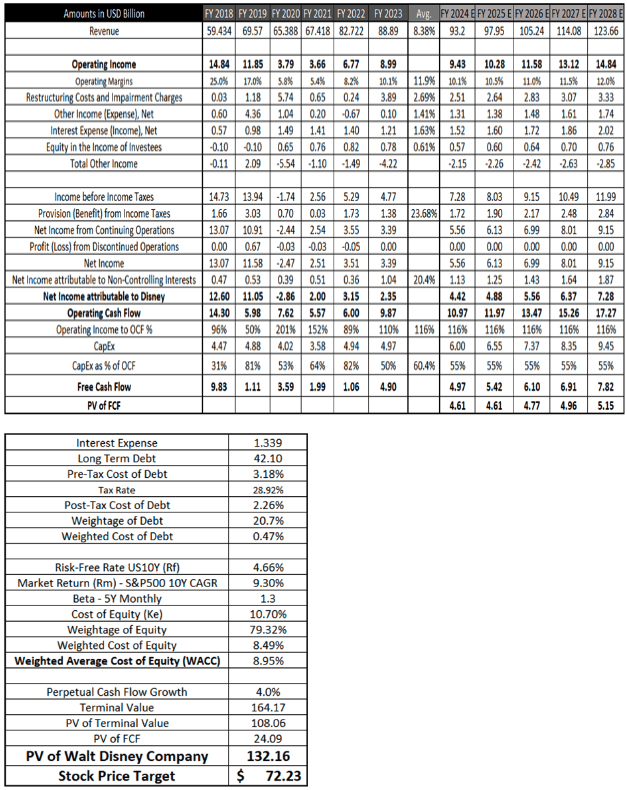

Valuation – DCF Valuation

I performed a DCF Analysis on Disney to calculate the intrinsic value of a Disney share.

Firstly, historical data was extracted from FY 2018 to FY 2023. Revenue for FY 2024 to FY 2026 was taken to be in line with the consensus estimates. For FY 2027 and FY 2028, I assumed revenue growth to return the longer-term average of ~8.4%.

My reason to agree with the consensus estimates is they account for the loss of subscriptions in India, as well as nearing saturation in its domestic markets (USA and Canada), combined with headwinds to domestic parks in the shorter term and, in my opinion, a more structural shift away from advertising and cable TV hurting the linear networks segments.

For Operating Margins, FY 2024 margins were assumed to be the same as in FY 2023 to accommodate the pressure on margins due to slowing ad revenue from Linear Networks as well as declining revenues and operating margins at Domestic parks. I expect these factors to offset the cost-cutting measures that are expected to occur in FY 24. For FY 2025 and beyond, I assumed a 50bps improvement in margins every year to account for the cost controls implemented under Bob Iger’s leadership.

Non-operating incomes and expenses were taken as averages from 2018 to 2023 on a common-size income statement basis and that percentage was assumed to be constant for the future. The tax rate was estimated as an average of the past six years, excluding FY 2021 and FY 2022. Net Income attributable to non-controlling interests was taken as an average of the past three years when expressed as a percentage of Consolidated Net Income from Continuing Operations.

Operating Cash Flow was estimated as the average of Operating Income to Operating Cash Flow conversion rate. Free Cash Flow for 2024 was taken as per guidance provided by the management, and the same ratio of operating cash flow spent on CapEx was assumed constant for all the years. Future Cash Flows discounted at the Weighted Average Cost of Capital calculated using the (CAPM) method gives me a fair value for The Walt Disney Company at $132.16 billion translating to an intrinsic value per share of $72.23.

Google Sheets

Risk

Bob Iger Inspires Turnaround

Robert Iger, popularly known as Bob Iger, is widely regarded as one of the greatest Disney CEOs, having facilitated the acquisition of Pixar (2006), Marvel Entertainment (2009), and Lucasfilm (2012).

He was brought back to the company with great expectations of leading a turnaround in Disney’s fortunes after a disappointing couple of years under Bob Chapek. He joined back in late 2022 and was expected to occupy the position for 2 years, but his tenure has now been extended to 2026. Iger has been determined to cut costs and has reiterated his focus on profitability (cash flow generation) rather than rapid growth.

For example, Disney+ and other subscription services such as Hulu and ESPN+ fall under the Direct-to-Consumer segment for Disney, which accounts for a little under 25% of the company’s revenues but has been a loss-making business for the company.

In the Q3 2023 earnings call, Bob Iger highlighted that the company was going to implement a crackdown on password sharing. Disney+ has also raised prices in 50+ countries to better reflect the value of their offerings. Additionally, 40% of new subscribers are opting for an ad-supported product, which has led to an improvement in Average Revenue per User (ARPU). Responding to a question in the earnings call, Iger says that as their streaming business matures, it expects to see an improvement in Operating margins in that segment.

Conclusion

As I conclude this report, I would like to reiterate my valuation of the business, which came in at ~$72/share, which is ~18% below the close price on 10th November 2023, and for that reason, I have a Sell Recommendation on the stock. The company faces several challenges in the short term, such as a decline in its Disney+ Hotstar subscriber base, poor performance at the box office, and pressure on operating margins because of underperformance in Linear Networks and Domestic Parks. Notably, these two account for more than all of Disney’s operating income, as other businesses had net operating losses throughout the year. In my opinion, these headwinds outweigh the turnaround opportunity Disney has with the return of Bob Iger.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.