Summary:

- Caterpillar’s shares have continued to soar and appreciate, thanks to resilient and consistent results.

- Favorable macro-trends, such as increased construction equipment use, reshoring efforts, and the transition towards renewables, are benefiting the company.

- Caterpillar’s FY2023 results were record-breaking, but it is time to understand whether this trend is sustainable of if we should moderate our expectations.

AL-Travelpicture

Introduction

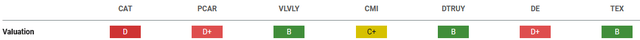

Caterpillar (NYSE:CAT) is the world’s leading construction, mining, and energy machinery and equipment manufacturer. Unlike many similar industrial companies, its shares continue to soar and appreciate, thanks to extremely resilient and consistent results. Therefore, the stock trades at a compelling valuation, higher even than that of industry leaders such as Paccar (PCAR) and Deere (DE).

Seeking Alpha

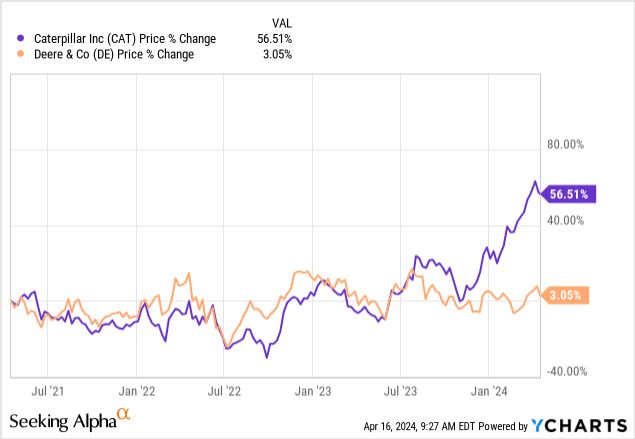

Just two years ago, when I first covered it, the stock was trading at $218. In hindsight, many would pay to have that average price on their shares because right now the same shares need to be paid $363 each. Why has Caterpillar been such a rewarding investment? What is driving up the stock while other machinery manufacturers, such as Deere, have returned much less?

As we get ready for Caterpillar’s upcoming Q1 earnings report due on April 25th, we can go over the company’s latest financials to share an educated guess about the company’s prospects and assess whether Caterpillar is still an actionable investment of if investors should just sit on the sidelines for now.

Favorable Macrotrends

One of the reasons I like industrials is that they belong to a cyclical industry where investments are massive. Why do I like these aspects? On one side, cyclicality, while it may sound like a bad word to investors, offers many chances to step in and invest in a stock. In addition, though to a lesser extent, it can be somewhat predictable or, at least understandable. In the case of a company such as Caterpillar, since its products require heavy capital investments from its customers, we also can crosscheck the industry dynamics with other publicly known dynamics such as government incentives, public spending, and easy access to credit. In particular, in Caterpillar’s case, I like to highlight three macro-trends that are benefiting the company:

- The Infrastructure Investment and Jobs Act approved in late 2021 is boosting construction equipment use and demand.

- Revitalization of American Manufacturing has become a political priority for the U.S. to build a shorter supply chain and take control once again over industrial production.

- The role of critical minerals in the transition towards renewables will lead to increasing mining activity, strengthening the need for highly technological and competitive equipment.

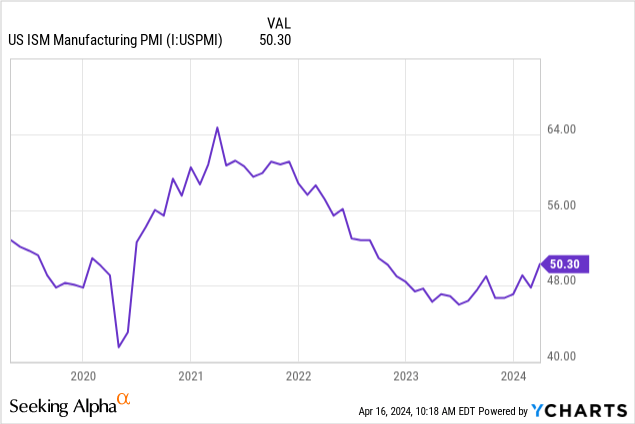

Since early 2021, however, we have seen a steady decline in U.S. manufacturing activity which has caused some concerns for the economy and for industrials. Recently, the US ISM Manufacturing index came in above 50, which is used to detect whether we are in a contraction or an expansion phase.

This means that manufacturing activity seems to have bottomed and it is probably picking up speed once again. Good news for Caterpillar and its peers.

If Caterpillar weathered these past two years reporting record-breaking results, what should we expect once everything aligns positively once again?

Caterpillar’s FY2023 Results

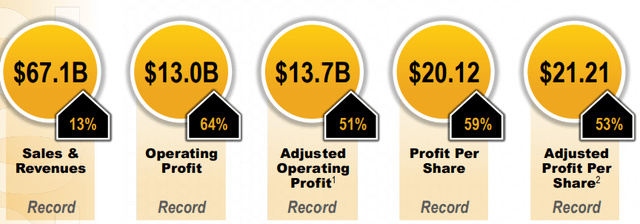

Let’s start with the main financials. What we will see is easily described: 2023 was a record year all across the board.

CAT Q4 2023 Results Presentation

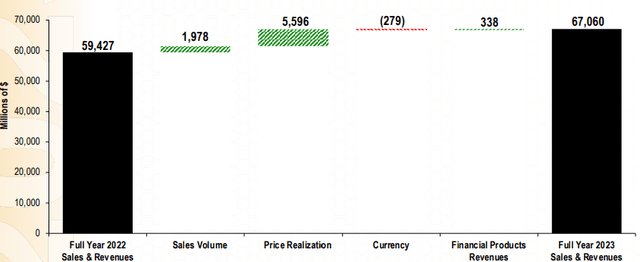

Sales and revenues were up 13% to the record amount of $67.1 billion. Operating earnings increased 64% to a mind-blowing $13 billion. EPS came in with a 59% increase to $20.12.

Industrial operations generated $10 billion in free cash flow, almost double the $5.8 billion of FCF reported for FY2022.

The big driver of these results was price realization (Caterpillar flexed its pricing power), with a bit of help from volume.

CAT Q4 2023 Results Presentation

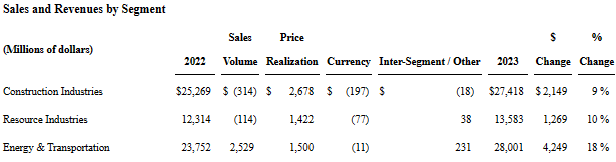

As far as each one of the three industrial segments goes, Caterpillar reported quarterly sales down for Construction Industries (from $6.8 billion to $6.5 billion), but a segment profit increase of 180 bps to 23.5%; a decrease for Resource Industries (from $3.4 billion to $3.23 billion) with a profitability increase of 90 bps to 18.5%; a sales increase in Energy & Transportation (from $6.8 billion to $7.7 billion), with a 130 bps spike in the segments’ profitability that reached 18.6%.

At the same time, the other three quarters of the fiscal year were so strong that Caterpillar ended the fiscal year with a 9% increase in Construction, a 10% increase in Resources, and an 18% increase in Energy.

CAT 10-K

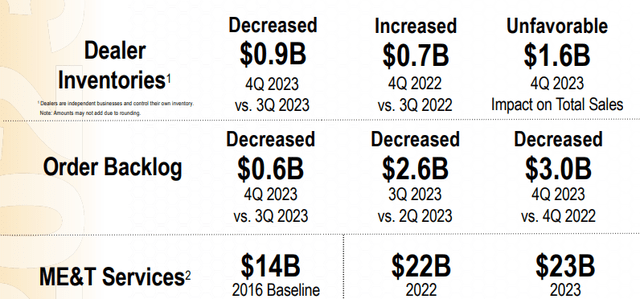

In the 2023 Annual Report, Caterpillar also disclosed some important data investors are sensible too. I am speaking of its backlog. As we can read there:

The dollar amount of backlog believed to be firm was approximately $27.5 billion on December 31, 2023, and $30.4 billion on December 31, 2022. Compared with year-end 2022, the order backlog decreased across the three primary segments. Of the total backlog on December 31, 2023, approximately $5.8 billion was not expected to be filled in 2024.

CAT Q4 2023 Results Presentation

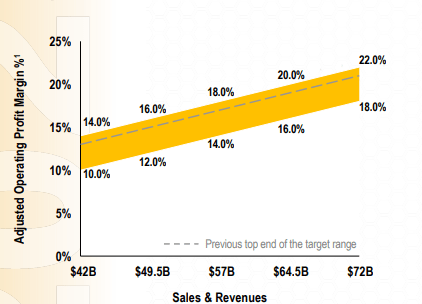

Even though the backlog decreased by $3 billion YoY, it is still so huge that 21% will go directly to 2025. Given this important number, Caterpillar also updated one of the graphs I like most in its presentations: the operating profit margin as a function of sales.

CAT Q4 2023 Results Presentation

We see that Caterpillar now considers the outcome of reporting more than $70 billion in sales, which would lead to an operating profit range between 18% and 22%. While these numbers may not be due in 2024, it is just a matter of time before Caterpillar will come close to this range.

Before we move on, allow me to point out one number that I feel is often overlooked by new investors who are looking at Caterpillar for the first time: services revenue. In 2023, Caterpillar reported $23 billion. Yes, you read that right: $23 billion out of the $67 billion in sales Caterpillar reported don’t come from equipment sales but from aftermarket parts and service-related revenues, which do not include financial products revenues. Simply impressive. It means 34% of Caterpillar’s revenues is of a much higher quality compared to the revenue coming from machine sales. In fact, services can be rightly considered a stream of recurring revenue that is constantly increasing and, most importantly, offers higher margins. Caterpillar doesn’t disclose the segment’s profitability, but we can look at an important example in a similar industry: Paccar. The truck manufacturer reports a 32% gross profit margin for its spare parts business.

This is why each of the three industrial segments of Caterpillar have their operating margins close, if not, above 20%: it is thanks to the contribution of services

Caterpillar Q1 2024 Earnings Forecast

Caterpillar’s management gave investors some guidelines to assess the upcoming earnings report. Sales are expected to be similar to Q1 2023 when the company reported $15 billion.

We can also expect a lower dealer inventory build with some extra favorable price realization due to smoother and leaner supply chains. As a result, the operating profit margin should increase a bit. Last year it was 21.8%, this year it could be above 22%.

However, Caterpillar is on track to double its services revenues by 2026 vs. 2016. The target is thus $28 billion a year, which translates into $7 billion per quarter. We can expect this revenue stream to keep increasing. Therefore, I would not be surprised to see Caterpillar report a quarterly revenue of $15.3 billion.

This is already a somewhat bullish forecast, given that current consensus revenue estimates forecast a flattish year for Caterpillar, with a YoY growth of just 0.40%. EPS are expected to post an even worse result with a modest decline of 0.03%, which gives us a fwd PE of 17.2 based on the current share price hovering around $360.

Now, to understand why Caterpillar has a higher PE compared to its peers, we have to go back to what we have said about its Services.

If we use the sum-of-the-parts valuation method, we can split Caterpillar’s revenues and earnings into two segments: production and services.

In 2023, Caterpillar reported $63.87 billion in industrial sales and $3.78 billion in financial products services. We therefore need to use the first number. We know that $23 billion comes from spare parts services. Thus, production accounts for the remaining $40.87 billion.

Now, Caterpillar’s operating profit for the year was $13 billion. But how much of this comes from production?

If we assume Caterpillar’s services to have a 32% gross margin just like Paccar does, we can expect an operating profit margin for this business line around 28% since SG&A and opex should not be extremely impactful here.

This means we can assume Caterpillar’s services generate $6.44 billion in operating profit, which is almost 50% of the overall operating profit.

A business with $23 billion set to become $28 in three years and an operating profit margin of 28+% can be valued with an earnings multiple in the low 20s. Let’s take a 22.5 multiple and let’s assume the net income margins is here around 24%. We have a business whose value should be around $70 billion, which is around 39% of the current market cap.

The other part of the business – production – should be valued with a lower multiple. We know production generates around $6.56 billion in operating profits. This is a 16% operating profit margin. So, we could assume that this business line’s net income margin could be around 8%, which translates into a net income of $3.27 billion. We could use a low double-digit multiple; let’s use 12.5. The result is that Caterpillar’s production business is worth around $41 billion.

The sum of the two gives us around $111 billion as the fair value of today’s operations. This puts Caterpillar’s current market cap of $181 billion a bit under the radar.

Capital expenditures are expected to be in the range of $2 billion to $2.5 billion for the whole year, which means we should see lower capex YoY (it was $3.1 billion in 2022). This poses an opportunity to increase free cash flow. If the company reports $15.3 billion in sales, with an operating profit margin of 22%, we can expect $3.36 billion in operating cash. If we subtract $625 million of capex, we have $2.74 billion in FCF. Considering Caterpillar has 500 million common shares outstanding, we have a quarterly FCF/share of $5.49.

As a result, we can expect Caterpillar to report almost $11 billion in FCF for the year. This means Caterpillar’s fwd P/FCF is around 16.5. While this may seem expensive, if we look at Caterpillar’s expected FCF and its market cap, we have a very interesting FCF yield of 6%.

Since free cash flow generation and its yield are highly depended on the company’s profitability, we can look at Caterpillar’s profitability grade on Seeking Alpha: a sound A+. This can increase our confidence in Caterpillar’s future free cash flow generation, which is one of the reasons why a cyclical stock such as Caterpillar is, in any case, a Dividend Aristocrat with 30 years of dividend growth (not by chance, Caterpillar’s dividend growth grade is an A-).

Overall, I see a fantastic company, whose multiples are a bit high. True, many reasons have made investors bid Caterpillar up to a higher valuation compared to other similar businesses. But the current run-up offers me a little margin of safety in case of dips and volatility. Only a mind-blowing Q1 report could make me change my rating, which, for now, remains a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.