Summary:

- Caterpillar is a resilient player in the industrial sector, demonstrating solid operational capabilities and financial robustness.

- The company has shown slow but steady revenue growth and impressive EPS growth over the past decade.

- CAT is poised to grow slowly in the medium term, and the current valuation doesn’t fully reflect it. Thus, the company is a Hold.

AleMasche72

Introduction

The industrial sector presents a unique landscape for investors, marked by its inherent cyclicality and sensitivity to the broader economic environment. This sector’s performance is closely tied to economic expansion and contraction trends, making it more resilient and adaptable. Companies that navigate these cycles effectively stand out within such a context, demonstrating solid operational capabilities, strategic planning, and financial robustness. These attributes make certain players within the industrial sector particularly noteworthy, as they weather the storms of downturns and often emerge stronger during economic recoveries.

Caterpillar (NYSE:CAT) is a leading example of such resilience within the industrial sector. As a top construction, mining, energy, and transportation equipment manufacturer, Caterpillar has established a solid presence on a global scale. The company’s ability to manage the cyclical nature of its business effectively, maintaining financial health and strategic growth initiatives through different economic cycles, makes it a compelling case for analysis. In this article, I will detail the reasons for my HOLD thesis, which mainly surrounds the lack of growth forecasts.

Seeking Alpha’s company overview shows that:

Caterpillar manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally. Its Construction Industries segment offers asphalt pavers, compactors, road reclaimers, forestry machines, cold planers, material handlers, tractors, excavators, telehandlers, motor graders, and more. The company’s Resource Industries segment provides electric rope and hydraulic shovels, draglines, rotary drills, hard rock vehicles, tractors, mining trucks, longwall miners, wheel loaders, off-highway and articulated trucks, wheel tractor scrapers and dozers, fleet management products, landfill and more. Its Energy & Transportation segment offers reciprocating engine-powered generator sets, reciprocating engines, drivetrains, integrated systems and solutions, turbines, centrifugal gas compressors, and more. The company’s Financial Products segment provides operating and finance leases, installment sale contracts, and repair/rebuild financing services. Its All Other operating segment offers filters, fluids, undercarriage, ground-engaging tools, fluid transfer products, precision seals, and more.

Fundamentals

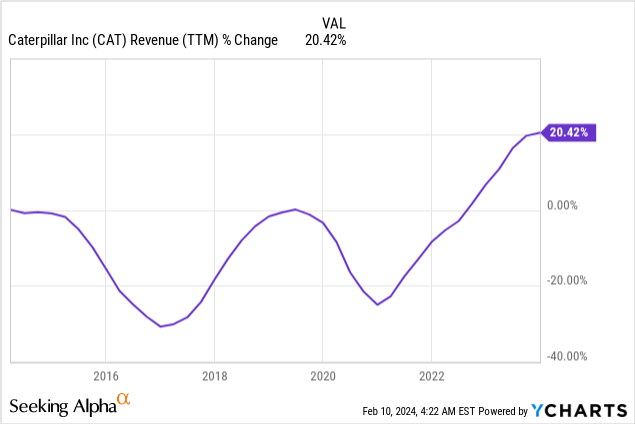

Over the last decade, Caterpillar’s revenues have slowly increased by 20%. The increase is mainly due to organic expansion, as the company only performed selective acquisitions to expand its product and service offerings. Notably, the acquisition of Weir Oil & Gas and the investment in Yard Club have been strategic moves to broaden its oil and gas segment and digital capabilities, respectively. Looking ahead, analysts’ consensus, as seen on Seeking Alpha, projects a steady yet slow sales growth rate of approximately 2% annually in the medium term.

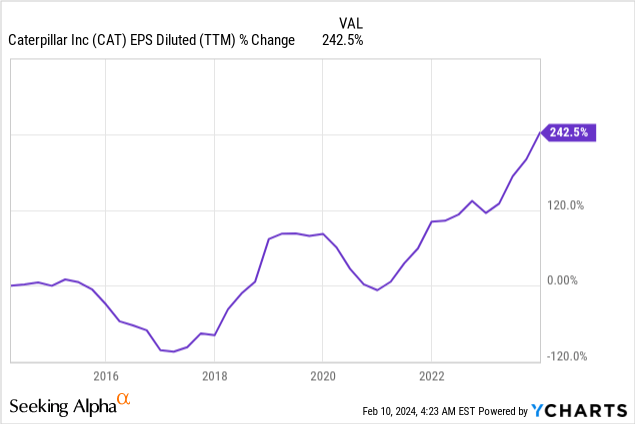

EPS (Earnings per Share) have surged by an impressive 242% during the same period, outpacing revenue growth and proving Caterpillar’s ability to enhance profitability through operational efficiencies, scale expansion, and cost management. The significant increase in EPS is also attributed to Caterpillar’s focus on high-margin service businesses and an aggressive share buyback program. As seen on Seeking Alpha, analysts’ consensus anticipates that Caterpillar will maintain an EPS growth rate of around 4% annually in the medium term, signaling continued financial health and shareholder value creation.

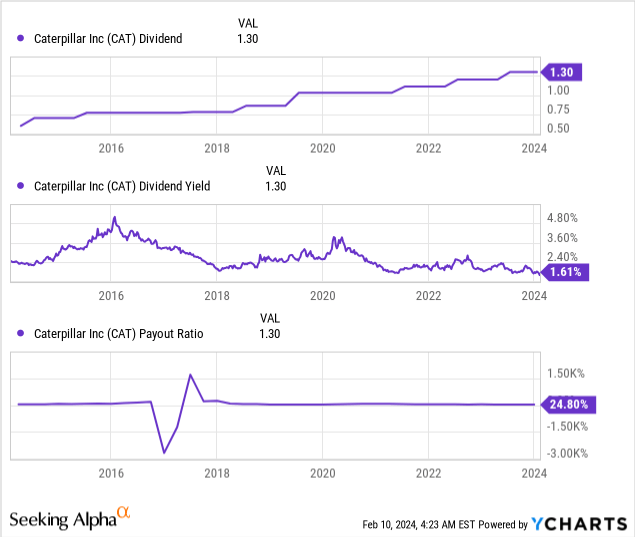

Caterpillar’s dividend policy highlights its financial strength and commitment to shareholder returns. Having increased its dividend for 30 consecutive years, Caterpillar has earned the title of a dividend aristocrat. The company announced an 8% dividend increase in June 2023, with a payout ratio of 25%, offering a low likelihood of a dividend cut. The yield is quiet at 1.6%, yet investors should expect future increases to align with EPS growth. We are unlikely to see an expansion of the payout ratio due to the cyclical nature of Caterpillar’s business.

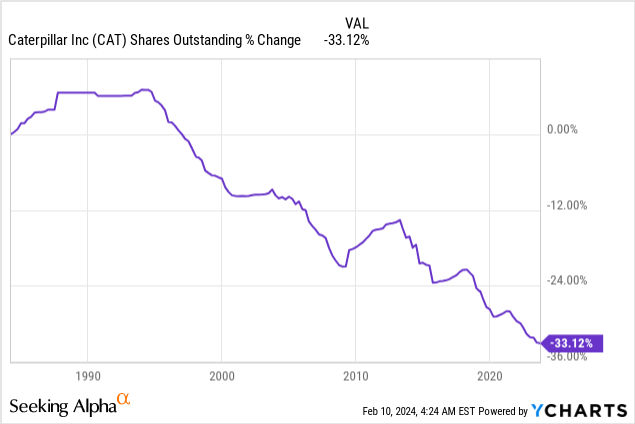

Complementing its dividend strategy, Caterpillar has effectively utilized share buybacks to fuel EPS growth, reducing its share count by 33% over the last decade. This strategic use of buybacks, particularly when undervalued shares, proves Caterpillar’s prudent capital allocation and commitment to enhancing shareholder value. Caterpillar will continue executing buybacks to take advantage of lower valuations. In 2023, it spent $5B on buybacks, almost twice the $2.6B used for dividends.

Valuation

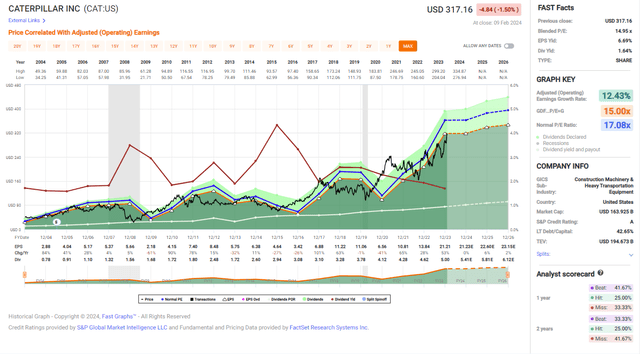

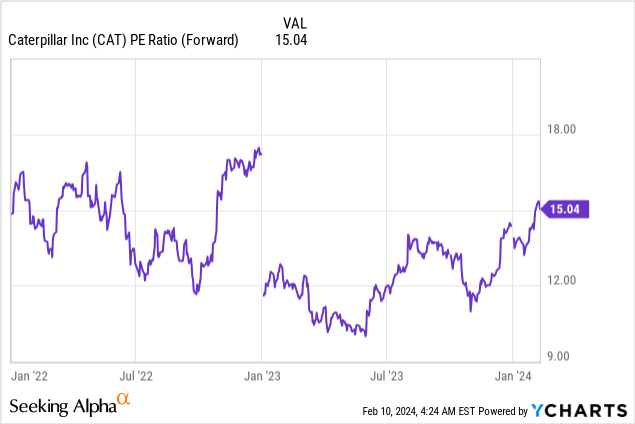

Caterpillar is currently trading at a P/E (Price to Earnings) ratio of 15 based on the 2024 EPS estimates. This valuation metric places it around the average P/E ratio observed over the last twelve months, reflecting a balanced market sentiment towards the company. Despite Caterpillar’s solid track record and strategic positioning within the industrial sector, the P/E ratio suggests that the stock is neither undervalued nor overpriced, given its growth prospects. The anticipated growth rate of approximately 4% is modest. Consequently, the valuation at 15 times earnings is reasonable, yet not a compelling bargain.

An analysis of Caterpillar’s valuation through the Fast Graphs chart below shows that the company is fairly valued at most. Historically, Caterpillar has traded at an average P/E ratio of 17 over the last twenty years, slightly above its current P/E of 15. This comparison indicates that the company is less expensive now than its long-term average. However, this comes against a lower expected growth rate of 4% compared to its historical average growth rate of 12%. A lower-than-average P/E ratio with a significantly reduced growth rate suggests that while Caterpillar may not be expensive, its valuation does not necessarily signal an attractive entry point.

Opportunities

The first growth opportunity for Caterpillar lies in its services expansion, targeting a significant increase in revenue. Caterpillar’s strategic focus on enhancing services through digital offerings and customer value agreements underscores its commitment to long-term growth. This initiative, bolstered by integrating advanced analytics and AI with over 1.5 million connected assets, is designed to improve operational efficiency and customer satisfaction. Caterpillar’s aim to achieve $28 billion in services revenue by 2026 represents a proactive approach to adapting to market needs and leveraging technology for sustainable business growth.

Services also increased by 5% to $23 billion, a record.”

(Jim Umpleby, Chairman and CEO, Q4 2023 Earnings Call)

Another opportunity is Caterpillar’s investment in sustainability and new technology, particularly in large engines and hydrogen fuel cells for its data centers. This investment responds to the growing demand for environmentally friendly and sustainable solutions across industries. Caterpillar’s commitment to innovation in this area aligns with global sustainability goals and positions the company to capitalize on the expanding market for green technologies. This strategy aims to ensure Caterpillar’s leadership in the transition to a more sustainable future.

Through internal testing in a typical mix of applications, it consumed up to 10% less fuel and produced up to 10% less tail pipe emissions than the previous model.”

(Jim Umpleby, Chairman and CEO, Q4 2023 Earnings Call)

The third opportunity stems from Caterpillar’s robust performance in the Energy & Transportation sector, fueled by strong demand for oil and gas and power generation applications. The company’s ability to meet this demand through its comprehensive product offerings and services contributes significantly to its revenue growth. This sector’s success is pivotal for Caterpillar, as it enhances profitability and diversifies the company’s revenue streams, mitigating risks associated with market fluctuations in other segments. This segment will also enjoy the energy transition trend.

Energy & Transportation sales increased by 12% in the fourth quarter to $7.7 billion. The increase was primarily due to higher sales volume and favorable price realization.”

(Jim Umpleby, Chairman and CEO, Q4 2023 Earnings Call)

Risks

One significant risk is the impact of economic uncertainties on customer demand, particularly in the Construction Industries and Resource Industries segments. Fluctuating economic conditions, including interest rate changes and geopolitical tensions, can lead to variability in equipment demand. Caterpillar’s ability to navigate these uncertainties, adjust production rates, and manage inventory levels will be crucial in maintaining financial stability and market position.

In EAME, we anticipate the region will be slightly down due to economic uncertainty in Europe, somewhat offset by continuing strong construction demand in the Middle East.”

(Jim Umpleby, Chairman and CEO, Q4 2023 Earnings Call)

Another risk involves supply chain disruptions, affecting Caterpillar’s production efficiency and delivery timelines. Despite improvements, specific constraints, especially in large engines, continue to impact operations. The company’s efforts to enhance its supply chain resilience and optimize inventory management are vital to mitigating this risk and ensuring the timely fulfillment of customer orders.

Because of the supply chain constraints we’ve had, our internal manufacturing operations are not running as efficiently as I would like.”

(Jim Umpleby, Chairman and CEO, Q4 2023 Earnings Call)

The third risk is related to dealer inventory adjustments, which can influence sales volumes and revenue recognition timing. Significant decreases in dealer inventory, as observed in the Construction Industries segment, highlight the need for strategic inventory management. Caterpillar’s ability to effectively balance inventory levels with market demand is critical to minimizing the impact of these adjustments on its financial performance.

Dealer inventory decreased by $900 million versus the third quarter. Machines declined by $1.4 billion, slightly more than we expected. We saw the largest decline in Construction Industries as dealer inventory decreased across all regions. The largest decline was in excavators.”

(Jim Umpleby, Chairman and CEO, Q4 2023 Earnings Call)

Conclusions

Caterpillar stands out as a leading company within the industrial sector, marked by a decade of growth in sales and EPS. The company’s dedication to expanding its high-margin services business has been critical to its success. Caterpillar has consistently delivered value to its shareholders through dividends and buybacks, maintaining its status as a dividend aristocrat with a 30-year history of dividend increases. The company’s ability to navigate the cyclical nature of the industrial sector, coupled with its focus on operational efficiency and growth opportunities in segments like oil and gas and rental platforms, shows its resilience and strategic foresight.

However, the investment case for Caterpillar has several risks, including the inherent cyclical challenges of the industrial sector, which can impact demand and profitability. Additionally, based on a P/E ratio of 15 times 2024 EPS estimates, the valuation suggests that the stock is fairly valued, given its modest growth rate of approximately 4%. This valuation, when considered alongside the company’s slower growth trajectory compared to historical averages, suggests that while Caterpillar is a solid company, the current price does not offer a compelling entry point for investors. Therefore, considering the balanced fundamentals, growth opportunities, existing risks, and current valuation, the verdict on Caterpillar is a HOLD until it trades for 11-13 times forward earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.