GameStop Slows The Bleeding, But Recovery Remains Unlikely

Summary:

- GameStop’s stock has lost 23% of its value since last May, but it remains popular among speculative traders and short-sellers.

- The company has improved its balance sheet positively, potentially allowing it to transition to more effective business models.

- GME’s outdated business model and declining sales challenge its long-term profitability and valuation.

- As long as its working capital is stable, bankruptcy is very unlikely, but without a clear business model transition, a rebound appears even less likely.

JIM WATSON/AFP via Getty Images

Last May, I published “GameStop: 2-Year Life Expectancy, Without A Huge Business Turnaround,” which detailed my bearish view of the company GameStop (NYSE:GME). Since then, GME has lost an additional 23% of its value. It fell to about $12 per share before bouncing in its December short squeeze. The stock continues to be famous for speculative traders, hoping it will rebound to its past heights. However, it is also a significant target for short-sellers, particularly hedge funds, which look to the company’s inability to adapt to a changing gaming market.

Much has changed for GameStop since I covered it last. The company has dramatically slowed its cash burn rate through aggressive cost cuts, improving its life expectancy. At the same time, many see that as a bullish factor, it does little to improve its long-term profit potential. In my view, the company has no clear path to sufficient profitability to justify its current valuation. That said, GameStop has made material positive improvements since I covered it last, potentially making it a dangerous short-squeeze bet.

GameStop’s Balance Sheet Has Value

There are two aspects we must consider with GameStop. One is its outdated business model, which will likely continue to face falling revenue without dramatic improvement. In my view, this front is still lacking, indicating low potential for high future incomes. The second aspect is its balance sheet, which could be leveraged through investments to prolong its life or give it some enduring income from alternative investments. Its healthy balance sheet could potentially allow it to transition toward other, more effective business models.

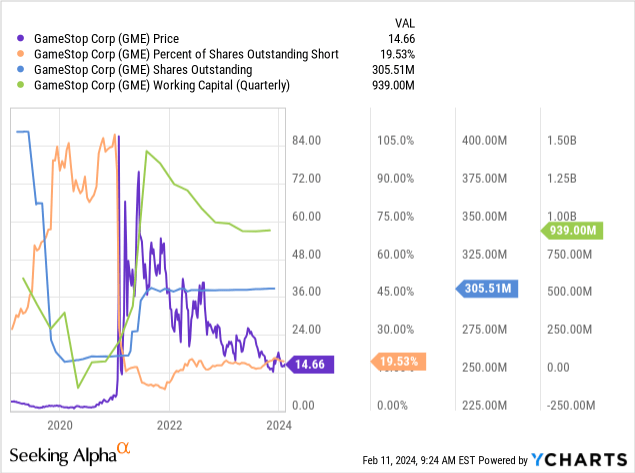

Ironically, GameStop’s survival today primarily results from the immense short interest in the stock in 2020. It was a significant target by short-sellers, given its lack of working capital and negative cash flows at the time. However, as retail speculators bought the stock, they squeezed short positions out, causing an immense buying spree that caused GameStop to be worth far more than it ever had been despite its terrible fundamentals. The firm then sold immense equity to raise cash at a high valuation, dramatically improving its working capital. See below:

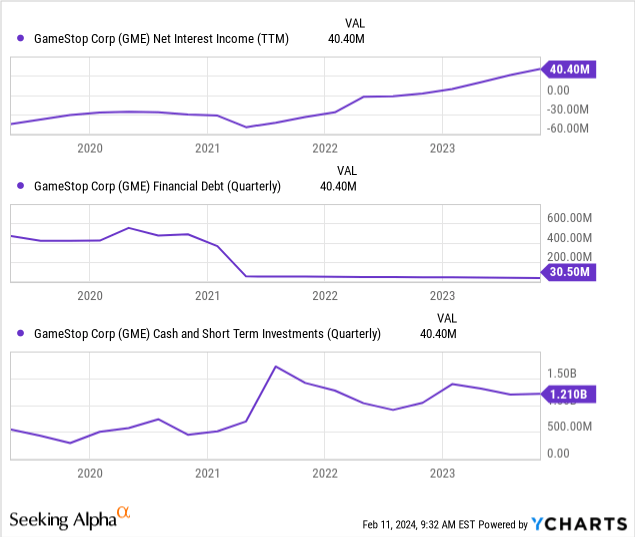

When I covered GME last, it seemed unlikely the firm would manage to slow its working capital losses. This is the net of its current assets and current liabilities. When the figure crosses below zero, GameStop’s bankruptcy chance will be much higher; however, not before then. This considerable capital infusion also reduced its debt and increased short-term investments. Now that interest rates are higher, the company is making a decent income from interest in its cash. See below:

While GameStop’s income and valuation are problematic, it has one of the cleanest balance sheets I’ve seen. Its debt is negligible, its liquidity remains ample, and it benefits from high interest rates by earning a decent income from its liquidity. Theoretically, GameStop could seize all operations and act as an investment vehicle. Still, in that case, GME should be worth little more than its current tangible book value per share of ~$4.1.

GameStop in An Operational Hole

Since I last covered GameStop, the firm has done little to change its operational focus besides moving back out of the angles it tried to take, such as NFTs. The company also offers relatively little guidance on this topic, having very short investor calls and no presentations. However, as discussed in its last brief call, GameStop’s CEO focuses primarily on aggressive cost-cutting to make its existing business model more robust.

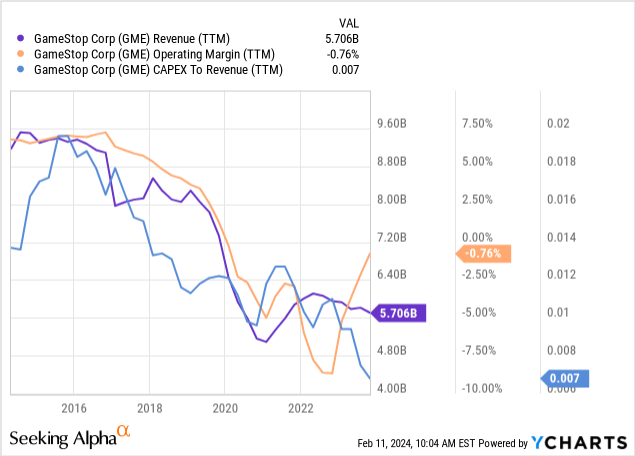

This approach works out somewhat, as its substantial operating losses are much lower. Still, its sales trend is negative, mainly if we account for the inflationary backdrop since 2020. See below:

Since last year, GameStop has dramatically reduced its operating margin losses by reducing its SG&A expenses and COGS. On a TTM basis, it is nearly earning an operating profit. However, if its sales continue to decline, it will be hard for the firm to continue to cut salaries and marketing costs proportionally, potentially making this a short-term benefit. The company has also dramatically cut CapEx spending, improving its cash stability, but again showing its lack of transition potential.

The gaming industry is dominated by online sales, particularly with the rise of Microsoft’s (MSFT) cloud gaming platform. The company used to earn a good profit off of selling new and used gaming discs, but that has quickly become a relic of ages past as new platforms will have no disc drives. GameStop is earning some with digital sales, but that is difficult due to immense competition from other third parties and Microsoft and Sony (SONY). As this transition is completed, GameStop’s revenue should continue to decline unless made up for in other categories.

The company’s hardware sales are also still notable. Still, they are not as profitable, considering Walmart (WMT), Best Buy (BBY), and Amazon (AMZN) naturally have better supply chains or superior store sizes that make this endeavor more suitable. Since GameStop is not dominant in online hardware sales and its stores are smaller, it has a material disadvantage in the hardware market. This segment may have some enduring value, but as hardware prices rise or consumer demand slows, it should lose any edge because of its lack of economic scale compared to competitors.

Collectibles are its smallest sales category, accounting for 16% of 2022 sales, but may have the best enduring value. This was an area where the firm saw solid growth and is likely a higher margin segment where its business model should have a natural competitive advantage. That said, it only earned around $177M in sales from this category as of Q3 23, and that figure slid around 15% YoY through the quarter.

Overall, hardware appears to be its primary focus for potential profits and revenues today, but that segment has the most significant cyclical and competitive risks. The collectible’s focus is interesting and could have some long-term value, but likely not enough to justify its current valuation.

The Bottom Line

I remain bearish on GME but revise my previous view to state that I do not believe GameStop will necessarily go bankrupt. Without a severe economic crash, it should avoid bankruptcy for long as long as it can manage its current cost cuts. Of course, while its cost cuts have impressively benefited its margins, they will not last if its sales continue to slide since its overall marketing costs will likely not slide proportionately.

I believe pre-owned hardware and collectibles may be an area where the company could maintain a long-term edge. However, new hardware and digital games are challenging markets due to competition from companies better suited to earning good margins in those segments. I do not believe its pre-owned hardware and collectibles sales are sufficient to offset the high overhead cost of its physical stores, and certainly not enough to justify its valuation.

If the company can keep its liquidity steady, it is worth around $5 per share, a nearly 20% premium to its tangible book value. That small premium represents the probability that its smaller segments could become long-term profit areas, which I doubt due to the scale issues. Given stability in its tangible book value, which is not guaranteed, GME could be discounted if it trades below $4 per share, given that most of that position is cash, earning a good yield.

I am very bearish on GME, but that is a long-term view. I would not short-sell it today because it is near its support level and is showing some signs of bouncing higher. Short squeeze risk remains high with its 22% short interest, though nothing compared to its squeeze risk in 2020. For the immediate horizon, enough speculators and investors should be attracted to its stabilization and may have unrealistic hopes for its recovery, potentially justifying a bullish view. Of course, GME’s market cap today is still higher than during its peak era of ~2005 to ~2015, making its current valuation extremely hard to justify rationally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.