Summary:

- Caterpillar’s revenue has grown mildly (+2%) but is contextualized by a portfolio pivot to higher margin offerings and its considerable scale.

- The company is a market leader globally, both commercially and financially. We do not believe there is any challenge to the company’s competitive position.

- We expect margin improvement to slow but growth should remain healthy, owing to industry tailwinds as infrastructure investment must increase.

- Whilst this is bullish for Caterpillar, the company’s valuation prices much of this in. Investors have rewarded its impressive decade, leaving limited scope for upside currently.

eakyaldiz/E+ via Getty Images

Introduction and thesis

Caterpillar Inc. (NYSE:CAT) is a multinational corporation that designs, manufactures, markets, and sells machinery, engines, and financial products and services. Founded in 1925 and headquartered in Deerfield, Illinois, Caterpillar operates through various segments, including Construction Industries, Resource Industries, Energy & Transportation, and Financial Products.

Caterpillar is a fantastic business. The company is the undisputed leader across a number of industry segments, owing to brand development and innovation. Given this size, the company can deliver market-leading margins and distributions to shareholders, while impressively still broadly matching its peers in growth.

We see very little wrong with this business and almost nothing can challenge it in the short-to-medium term. With industry tailwinds ahead, driven by investment in infrastructure, we expect Caterpillar to do well, potentially pushing toward MSD growth.

This said, following an impressive decade of margin development in particular, we struggle to see the same being replicated again. With the business trading at a justifiable premium, we do not see upside at its current valuation, thus rate Caterpillar a hold.

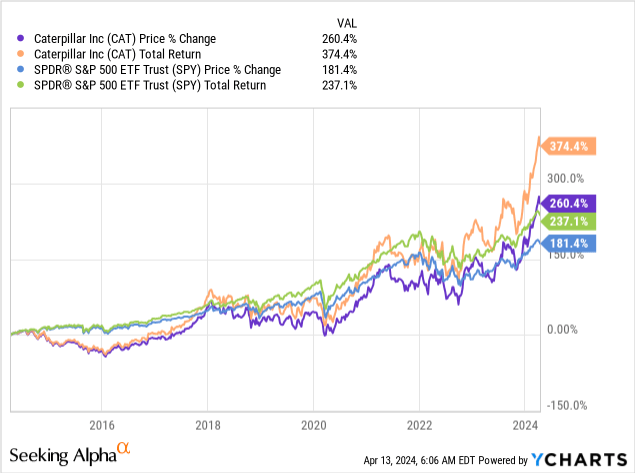

Share price

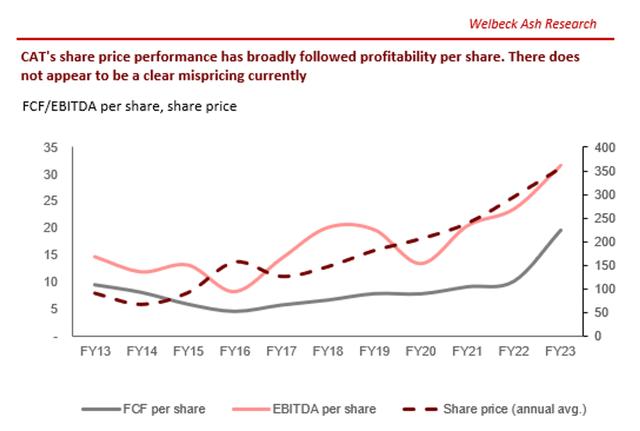

Caterpillar’s share price performance has been impressive, particularly when layering in distributions, comfortably outperforming the S&P500. This is a reflection of its positive financial development and the pivoting of its services during this period.

Commercial analysis

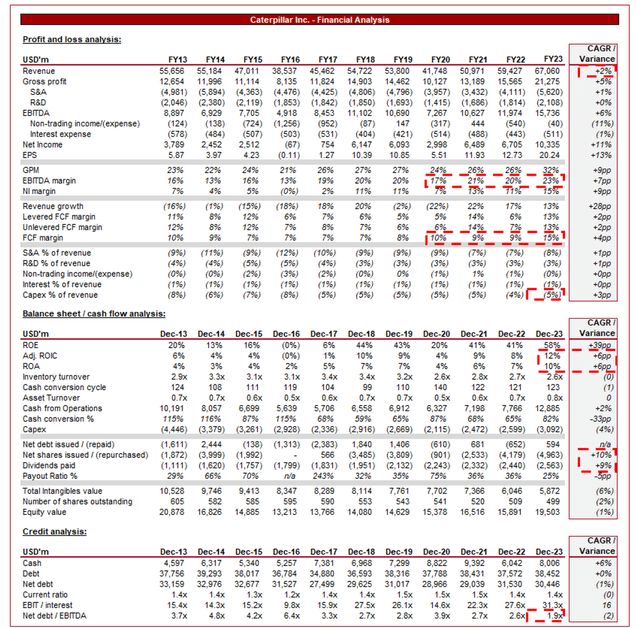

Presented above are Caterpillar’s financial results.

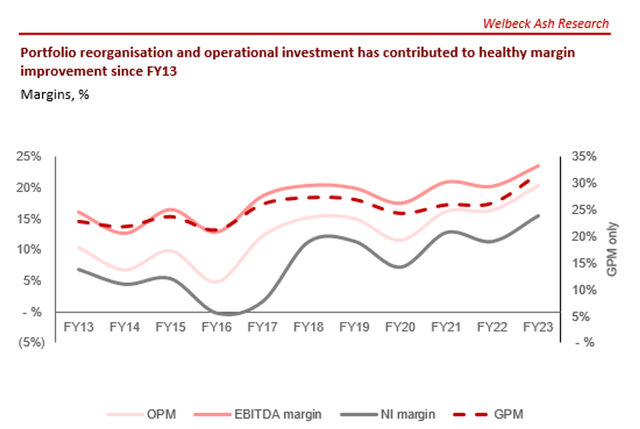

Caterpillar’s revenue has grown moderately during the last decade, with a CAGR of +2%. This is slightly deceiving as Caterpillar has restructured its portfolio during this period, focusing on its higher margin business lines and disposing of low profitability businesses. During this period, Caterpillar has posted over $600m in gains on disposals and ~$1.5bn in impairments to goodwill.

Illustrating its development is better observed in its EBITDA growth rate, with an impressive +6%.

Business Model

Caterpillar offers a wide range of products and services, including construction machinery (such as excavators, bulldozers, and loaders), mining equipment, diesel and natural gas engines, power generation systems, and aftermarket parts.

Through its long history (98 years), the company has progressively developed a diversified global portfolio that operates in all key geographies, through both acquisitions and innovation, enabling Caterpillar to serve various related industries and utilize its core competencies. This diversified portfolio allows the business to mitigate risks in specific industries and markets.

Historically, Caterpillar has invested heavily in R&D to drive innovation across its product lines. The company continuously develops new technologies and engineering solutions to enhance the performance, efficiency, and sustainability of its equipment and engines.

Its solutions are arguably the premier within the market when combined with its brand, allowing the company to incrementally improve products to stay ahead without transforming new product segments. Management has likely exploited this notoriety, as Caterpillar’s R&D spending has softened relative to revenue generation, with +0% growth and a decline as a % of revenue from FY13 to FY23 (-1ppt). We are not overly concerned by this, as the company has still shown the ability to develop new and innovative products, such as automation and electrification.

Alongside Caterpillar’s market-leading brand, as the premier global construction equipment manufacturer, and the quality of its products, we believe the following two factors are fundamentally important to its competitive position:

- Integrated Solutions – Caterpillar offers integrated solutions that combine equipment, technology, and services to address customers’ evolving needs. These solutions include telematics systems for equipment monitoring and management and fleet management software. Caterpillar’s scale facilitates cost-effective investment in the combination of technology and equipment.

- Operational Excellence – Caterpillar’s considerable size ($67bn of revenue!) allows for economies of scale to drive efficiency, reduction in costs, and enhance profitability. This allows the business to reinvest in R&D (which on an absolute basis trumps its peers) and its competitive position.

Manufacturing Equipment Industry

The manufacturing equipment industry appears in a healthy place in our view. The industry is forecast to grow at a CAGR of +7% into 2033, due to a number of tailwinds and a fundamental increased importance of the industry once again.

Globally, we are seeing increased infrastructure spending by governments and private sector entities. In the West, this is a result of historical infrastructure underspending during the last 2-3 decades, exacerbated by population growth. Leading this is the US with its IIJA legislation.

This infrastructure investment coincides with a once-in-a-lifetime need for complete modernization across most industries, owing to the decarbonization / electrification requirements. This will only accelerate into the 2030s and 2040s.

Further, we have seen considerable development in emerging markets, driving demand for Infrastructure projects such as road construction, urban development, and energy infrastructure. Whilst a fundamental slowdown in locations such as China is possible due to a transition away from construction-led growth, we believe India and much of East Asia can plug the gap.

Additionally, after a period of subdued demand, the mining sector appears primed to rebound as other nations slowly take up demand lost from China, leading to increased demand for mining equipment and services.

Finally, the aftermarket industry continues to be highly important to Caterpillar’s ability to generate ongoing revenue and soften the impact of cyclicality from equipment purchases. This includes spare parts, maintenance services, and remanufacturing solutions, which generates superior margins and supports reoccurring revenue generation. As the purchase of equipment grows, Caterpillar can enjoy the secondary benefits from this.

Overall, we believe Caterpillar is positioned well to capture growth in the coming years, with these tailwinds likely to continue into the long term. The company’s inherent size will limit its potential growth rate but we could see Caterpillar push toward MSD growth.

Caterpillar faces competition from various global and regional players, including Komatsu (OTCPK:KMTUY), Deere & Company (DE), Volvo (OTCPK:VLVLY), and Paccar (PCAR), Hitachi Construction Machinery (OTCPK:HTCMF).

Financials

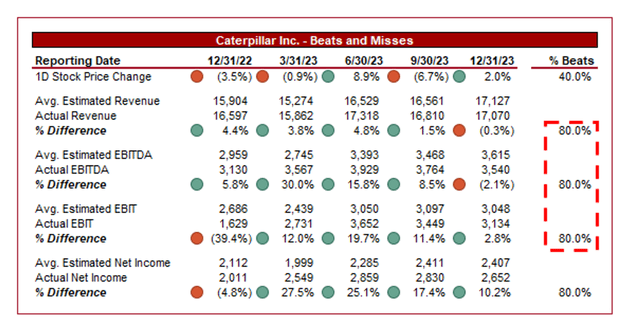

Caterpillar’s recent performance has been fantastic, with top-line growth of +16.7%, +21.6%, +12.1%, and +2.8% in its last four quarters. In conjunction with this, Caterpillar’s margins have continued to improve, reaching a record EBITDA-M of 23%.

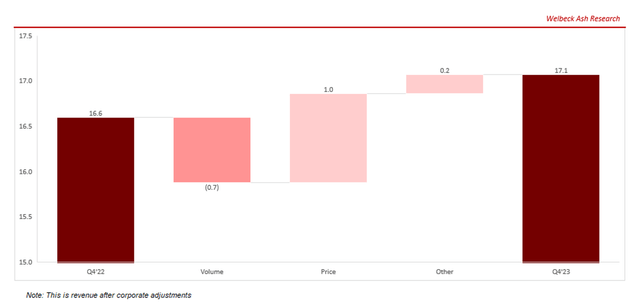

Caterpillar’s growth has been primarily driven by price realization, with the company successfully passing on inflationary pressures and gaining additional margin from clients, supported by strong demand. As the following illustrates, as of Q4’23, the company is still seeing price outstrip volume, reflecting its inelasticity over the last 24 months.

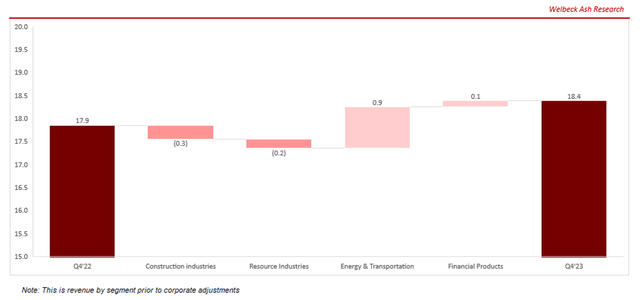

This said, we are seeing evidence to suggest growth is slowing. Two of the company’s segments have experienced a decline in growth, primarily due to volume. LatAm and APAC in particular are weighing on the business, while price realizations have been accretive in North America and EMEA.

Caterpillar’s E&T segment is benefiting heavily from the current macroeconomic environment. It is seeing strong demand from the O&G and Power Generation industries, as energy producers seek to increase supply in response to heightened prices. Alongside this, Transportation continues to perform well (mainly rail and marine, which are protected somewhat by Government spending), offset partially by softening Industrials which is likely reflective of weaker end-user capital spending due to funding conditions.

Due to the cost of its equipment, its clients are unable to forego funding costs. For this reason, the company has seen good revenue growth in its Financial Products segment and sticky demand.

Supporting the view that demand is softening can be seen in Dealer Inventories and Order Backlog, which have both declined. Further, as the below illustrates, Caterpillar missed against analyst estimates for the first time in several quarters. It is likely that the current funding environment, as well as softening private investment in the short-term is beginning to weigh on the company. We are not overly concerned due to the expectation for rates to decline in the coming year, albeit could mean 2-3 quarters of mild-to-flat growth.

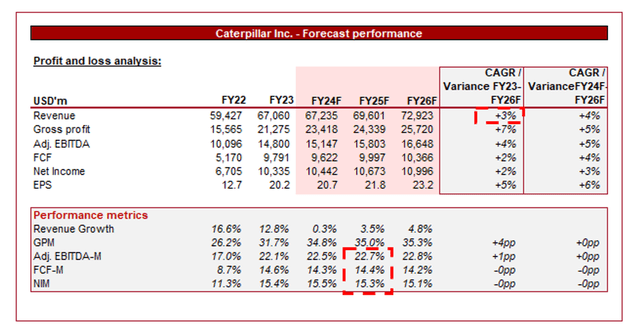

Looking ahead, analysts are forecasting growth of +3% into FY27F, alongside broadly flat margins. We concur with this assessment, albeit see scope for better margin improvement and growth. Importantly, we struggle to see much scope for downside based on the current industry outlook at Caterpillar’s business model. It is far too large and powerful to see any material volatility.

Balance sheet & Cash Flows

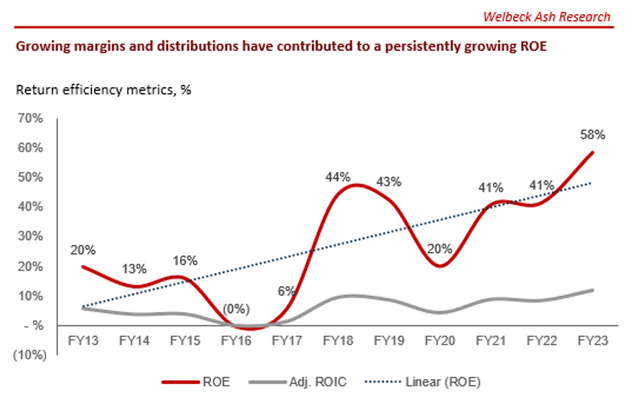

Caterpillar has utilized its impressive FCFs to distribute to shareholders, with healthy growth across dividends and buybacks. The company’s current share count has declined ~18%, which alongside margin growth has allowed for a soaring ROE.

With a war chest of ~$8bn, the company has the optionality to conduct M&A or increase distributions. At a payout ratio of ~25% and ~77% of FCFs used in distributions, Management still has significant room for maneuverability.

Industry analysis

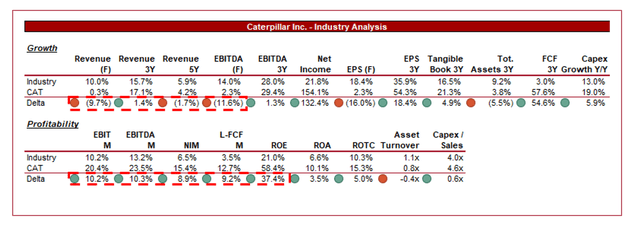

Presented above is a comparison of Caterpillar’s growth and profitability to the average of its industry, as defined by Seeking Alpha (28 companies).

Caterpillar performs well relative to its peers, with considerably better margins and surprisingly comparable growth. The company’s substantial scale and capabilities are wholly the reason for its margin delta, with limited threats to the continuation of this advantage.

Impressively, despite its size, the company has kept pace with its peers, reflecting impressive execution and an ability to capture large portions of industry growth and market share.

Valuation

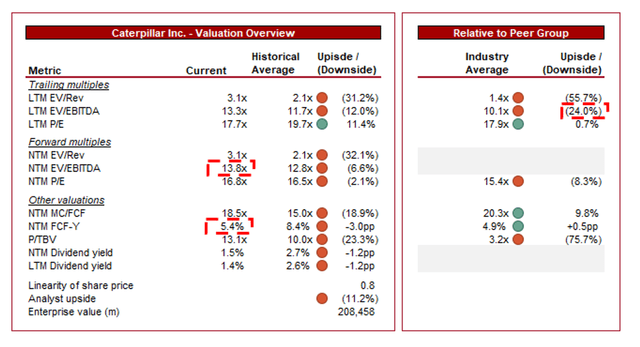

Caterpillar is currently trading at 13x LTM EBITDA and 14x NTM EBITDA. This is a premium to its historical average.

A premium to Caterpillar’s historical average is warranted in our view, as the company has delivered consistent margin improvement and positioned its portfolio well for growth. Its comparable industry growth shows the appetite for market share growth remains, justifying genuinely accretive gains. At an EBITDA premium of ~6-12%, we do not believe its valuation is too spicy, although the FCF yield premium of ~5% is far less attractive.

Further, Caterpillar is trading at a larger premium to its peers, albeit smaller on a NTM basis. This is clearly justified given its financial performance and commercial positioning within its industry. We believe Caterpillar’s FCF generation alone would justify a ~20% premium as Management is able to maintain distributions and opportunistic M&A.

Analysts appear overly hesitant would a price target implying downside we feel. This said, we struggle to see any upside at its current valuation. This is a high-quality business but its growth is just not attractive enough to justify a buy rating when the risk-free rate is ~5%.

Key risks with our thesis

The risks to our current thesis are:

- China – Infrastructure spending and mining activities have been materially driven by China in the last few decades. This appears primed to change in the coming years as China pivots. Whilst we believe others will pick up the demand shortfall to an extent, this remains a risk to the business.

- Economic conditions – Our expectation is for rates across the West to decline in mid-to-late 2024, followed by economic expansion in 2025. Whilst this appears reasonable, inflation and GDP developments have the potential to materially impact this timeline.

Final thoughts

Caterpillar is of the highest quality in our view. The company has a bulletproof business model and an (almost) undisputable competitive position. We see limited factors impacting its ability to maintain reasonable growth in perpetuity.

Industry tailwinds should allow it to outperform in the coming years, with good evidence to suggest the company can still capture a strong level of growth.

This said, we do not believe Caterpillar’s valuation is attractive, particularly given the level of margin improvement delivered during the historical period. For this reason, we rate the stock a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.