Summary:

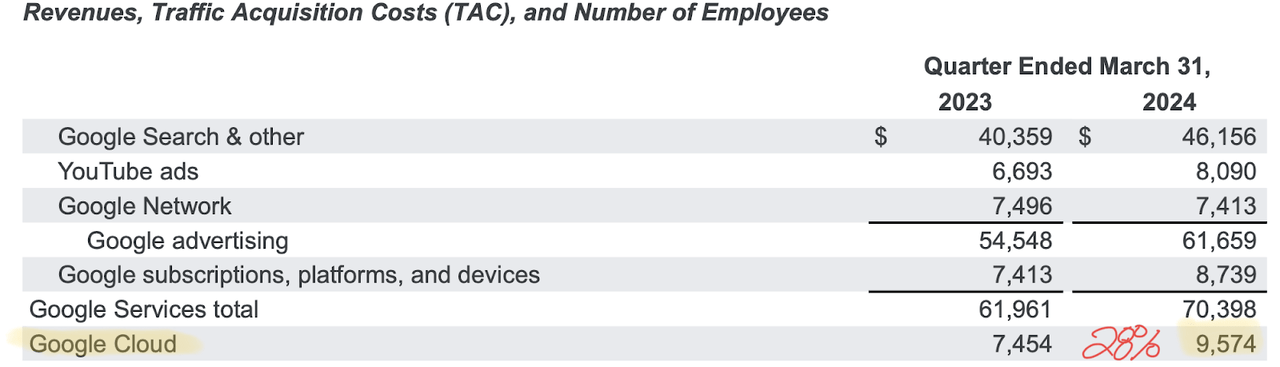

- Its Q1 earnings in 2024 saw a significant 15% year-over-year increase, with Google Cloud revenues up by 28%.

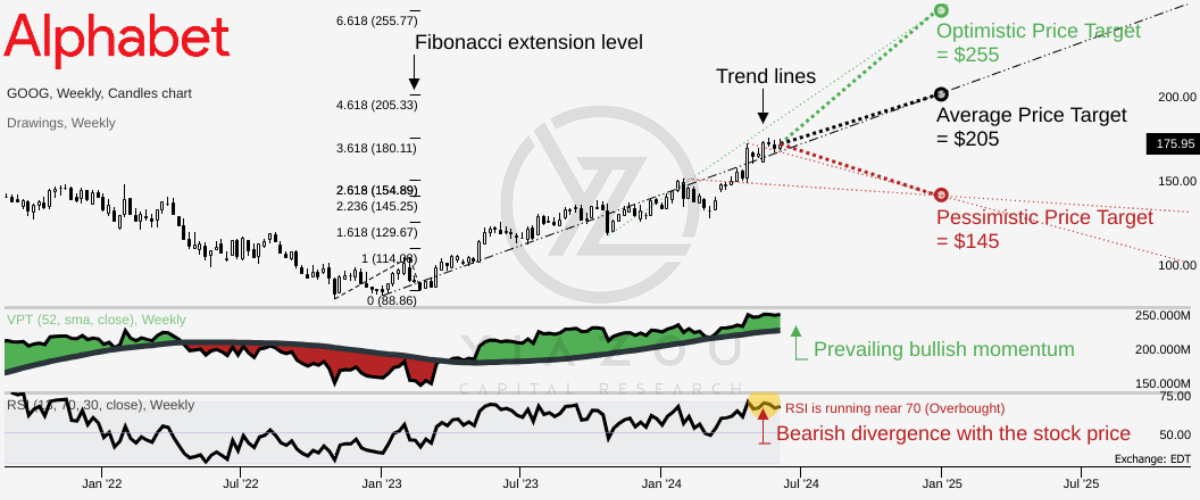

- On average, GOOG may reach $205 by the end of 2024, with an optimistic target of $255.

- Alphabet’s strong growth across segments, including Google Services, Google Cloud, and YouTube, drives robust revenue and operating income.

- The deployment of its advanced AI model, Gemini, and other AI-driven enhancements are pivotal in maintaining its market leadership and addressing competitive threats.

da-kuk

Investment Thesis

Since our previous bullish coverage on Alphabet (NASDAQ:GOOG)(NEOE:GOOG:CA) (NASDAQ:GOOGL), the stock has increased by 11%, reflecting robust investor confidence bolstered by solid earnings performances. Alphabet continues to dominate in search and advertising, with AI innovations like Gemini enhancing its products and market position. Despite competitive pressures, Alphabet’s sustained investments in AI and data centers highlight its strategic focus.

The stock, trading at a discount relative to its growth potential, presents a compelling buy opportunity. Alphabet’s performance, supported by solid earnings, robust advertising revenue, and strategic AI integrations, reaffirms our bullish outlook on Alphabet.

Alphabet’s Stock Price Eyes $255 Peak with $205 Average in 2024

The stock price of Alphabet, a.k.a. Google, may hit $205 by the end of 2024 on an average basis. Optimistically, the price may reach $255 by the end of the year. Whereas, the stock price may hit $145 by the end of the year on a pessimistic basis. The average price target is based on the mid-term trend of the change in polarity. Whereas optimistic and pessimistic price targets are based on current upward and downward price swings (projected over Fibonacci extensions).

The relative strength index (RSI) is hovering near 70, which suggests an overbought state of the stock price with a minor bearish divergence. This signifies the potential for a near-term price correction. On the other hand, the volume price trend (VPT) is running above the annual average in the weekly time frame, suggesting prevailing bullish momentum in the stock price. This also points to the prevailing upside potential for the stock.

GOOGL’s 25%+ year-to-date gain comes on strengthened investor confidence about the tech giant’s growth metrics and long-term prospects. The company’s earnings reports surpassing estimates and expectations have reiterated that growth metrics remain intact. Additionally, the company is capitalizing on solid advertising spending amid the booming global economy.

Lastly, AI integrations into the tech giant’s core products and solutions have also helped propel Alphabet to $2+ trillion in market value. Despite the stock climbing by over 25% in 2024, adding to the 224% gain over the past five years, it is trading at a discount due to the underlying growth of its core business.

Author (trendspider.com)

Strong Growth Across Segments Amid Intense AI Competition and Cost Restructuring

A solid first-quarter report underlines that the company is growing at an impressive rate, even as it faces stiff competition from Microsoft (MSFT) in search of information with the emergence of AI. Additionally, the company has had to fend off competition from Meta Platforms (META) in advertising its core products, such as YouTube and Search.

Moreover, revenue in the first quarter jumped 15% year-over-year (YoY) to $80.5 billion, reflecting strength across the company even as it re-engineered its cost structure. The 15% revenue growth was five times more than the growth of 3% in the same quarter last year, which was $69.79 billion. According to the CEO Sundar Pichai, the increase in Q1 2024 was driven by the strength of search, YouTube, and Google Cloud, which has also boosted operating margins significantly.

Robust revenue growth across Alphabet segments was the catalyst behind operating income, increasing 46% yearly to $25.47 billion, as the operating margin improved to 32% from 25% a year ago. Consequently, the search behemoth delivered a net income of $23.7 billion, or $1.89 a share.

abc.xyz

While Google is a broad collection of businesses, it is broadly split into segments, such as Google Services and Google Cloud. Google services account for the most significant share of the company’s total revenues at 87%, including all the advertising on the search engine and YouTube, with Google services growing by 14%.

Breaking down the Google services segment, advertising on search remains a key driver of the company’s bottom line. It increased 14% YoY to $46.2 billion, and the total advertising segment (excluding subscriptions) accounts for about 76% of total revenue. The YouTube network brought in $8.1 billion in revenue, representing a 17% year-over-year increase.

The Google Cloud unit, which includes the company’s cloud infrastructure, is also seen growing at an impressive rate, attributed to Alphabet integrating more AI solutions. While competing against Amazon Web Services (AMZN) and Microsoft Azure, the unit brought in $9.6 billion in revenue in Q1, a 28% year-over-year growth.

Moreover, the company has announced plans to lay off at least 200 employees from its core organization to reduce operating costs. The cuts will primarily affect cloud staff members in sales consulting and engineering as the company continues to evolve the business to meet customers’ needs.

Since the beginning of last year, Alphabet has been reducing its staff, announcing plans to cut approximately 12,000 positions or about 6% of its workforce. The cuts come amid concern about a decline in the online advertising sector. Despite a recent recovery in digital advertising, Alphabet has continued its downsizing efforts, implementing layoffs in various departments throughout the year.

Alphabet’s AI Bet Pays Off: Google Cloud’s Revenue Skyrockets

Like Amazon, Alphabet’s cloud division is already reaping the rewards of its AI investments. Google Cloud provides clients with various AI services, including access to its most advanced AI model, Gemini 1.5 Pro. Although Alphabet has not disclosed the exact contribution of AI to its revenue, the company highlighted in its earnings report that it has “clear paths” for generating income from AI, including through advertising, cloud services, and subscription models.

Another clear indication that investments in AI are already paying off is that cloud revenue jumped by 28% in the first quarter due to strong growth in Google Workspace. In the Workspace section, the tech giant offers an array of AI features powered by its large language model, Gemini.

Additionally, Alphabet has already announced plans to invest $3 billion in building data centers in Indiana and Virginia to strengthen its Google Cloud. Therefore, the investment comes as a boom in AI continues to fuel demand for cloud computing, prompting companies to enhance their data center capacities.

abc.xyz

Unrivaled Reach with YouTube, Android, and Google Search Fuels Advertising Growth

Alphabet has come to the fore with its many diverse products and solutions on the Web. Some brands behind it, including YouTube, Android, Chrome, and Google Search, are in people’s daily lives.

Android powers over 2.5 billion active devices, on which Google Play hosts over 3 million apps. The fact that Google controls information retrieval for 7% of the world’s population tells of one of the most giant internet behemoths, and with it comes a vast potential to monetize this data.

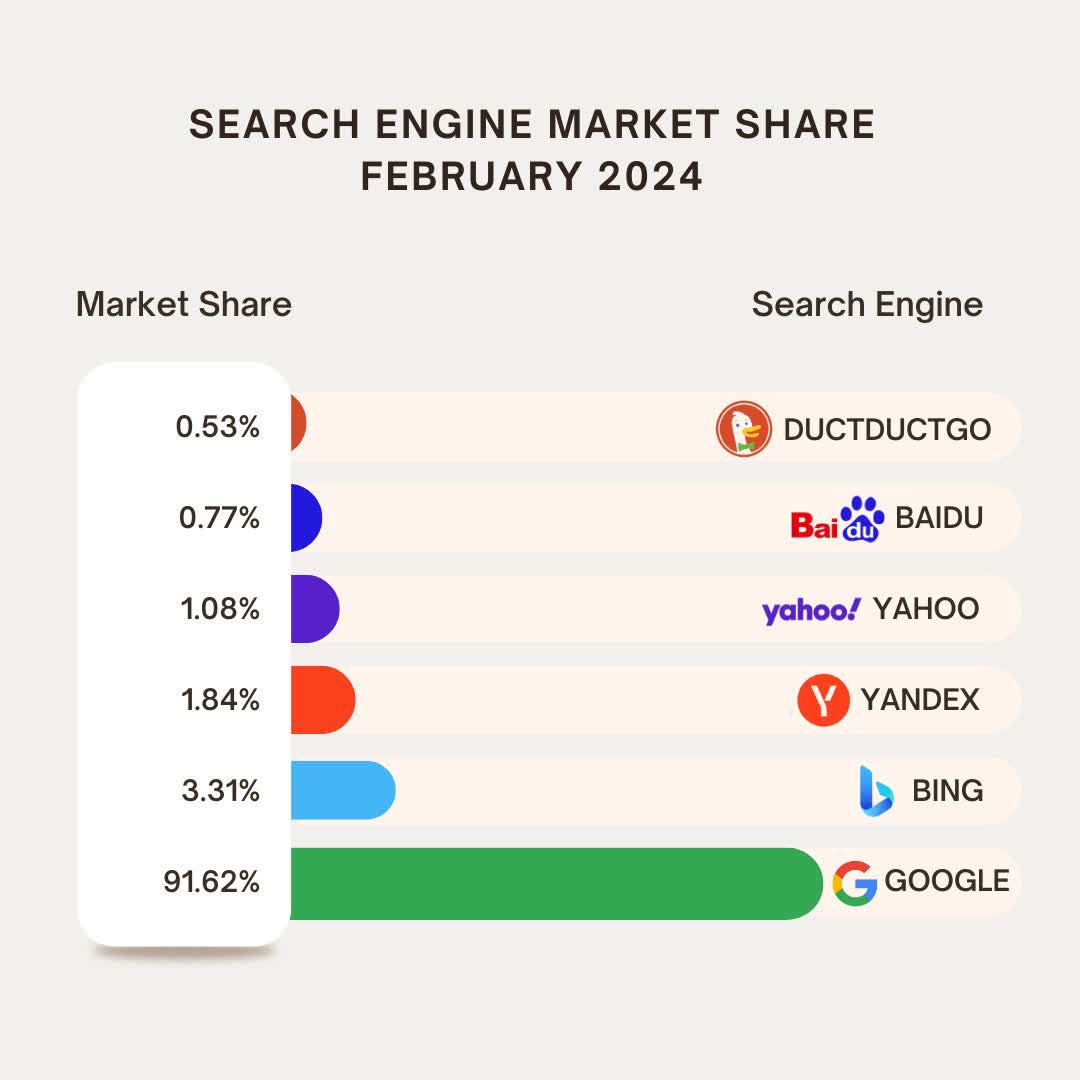

Additionally, the company continues to attract more advertising spending since it processes over 40,000 search queries on its search engine every second, making it a prime platform for advertising. While there have been concerns that Google is under pressure amid the proliferation of AI tools, its search engine remains the preferred tool for 92% of Internet years.

Given that over 3.5 billion searches are performed on Google search daily, it affirms why Alphabet is well poised to continue generating more advertising revenues as it integrates AI capabilities and solutions, protecting its massive 90%+ market share.

Google Market Share

Investing Billions to Lead in the Generative AI Era

For Alphabet enthusiasts, the primary concern that has risen recently is the potential impact of generative AI on Google’s leading search engine. Search accounts for most of the company’s income, and any threat to its dominance could undermine the core investment rationale.

Alphabet is increasingly investing in AI to safeguard its search, cloud, and advertising edge. Over the past year, Alphabet has steadily grown its AI cloud offerings, introducing its most advanced AI system, Gemini, in December 2023. The firm’s commitment to generative technology is starting to yield results, with companies increasingly relying on its solutions to incorporate AI into their daily operations.

The company’s focus on AI is enhancing its search capabilities, leading to quicker and more accurate search results that could solidify Google Search’s leadership position and encourage advertisers to continue investing there.

Recent experiments have shown that using AI tools has led to a rise in search activity and increased user satisfaction. Furthermore, Alphabet boasts six products with over two billion monthly active users, opening up opportunities for further expansion as the company introduces AI into these offerings.

Enhancing its AI features through Gemini and other models is set to strengthen various aspects of the company’s operations, including providing more effective advertising, developing a Search interface that rivals OpenAI’s ChatGPT, boosting its productivity offerings, and introducing generative updates for Android. Indeed, Alphabet introduced AI-driven ads the previous year, leveraging Gemini to improve its advertising solutions.

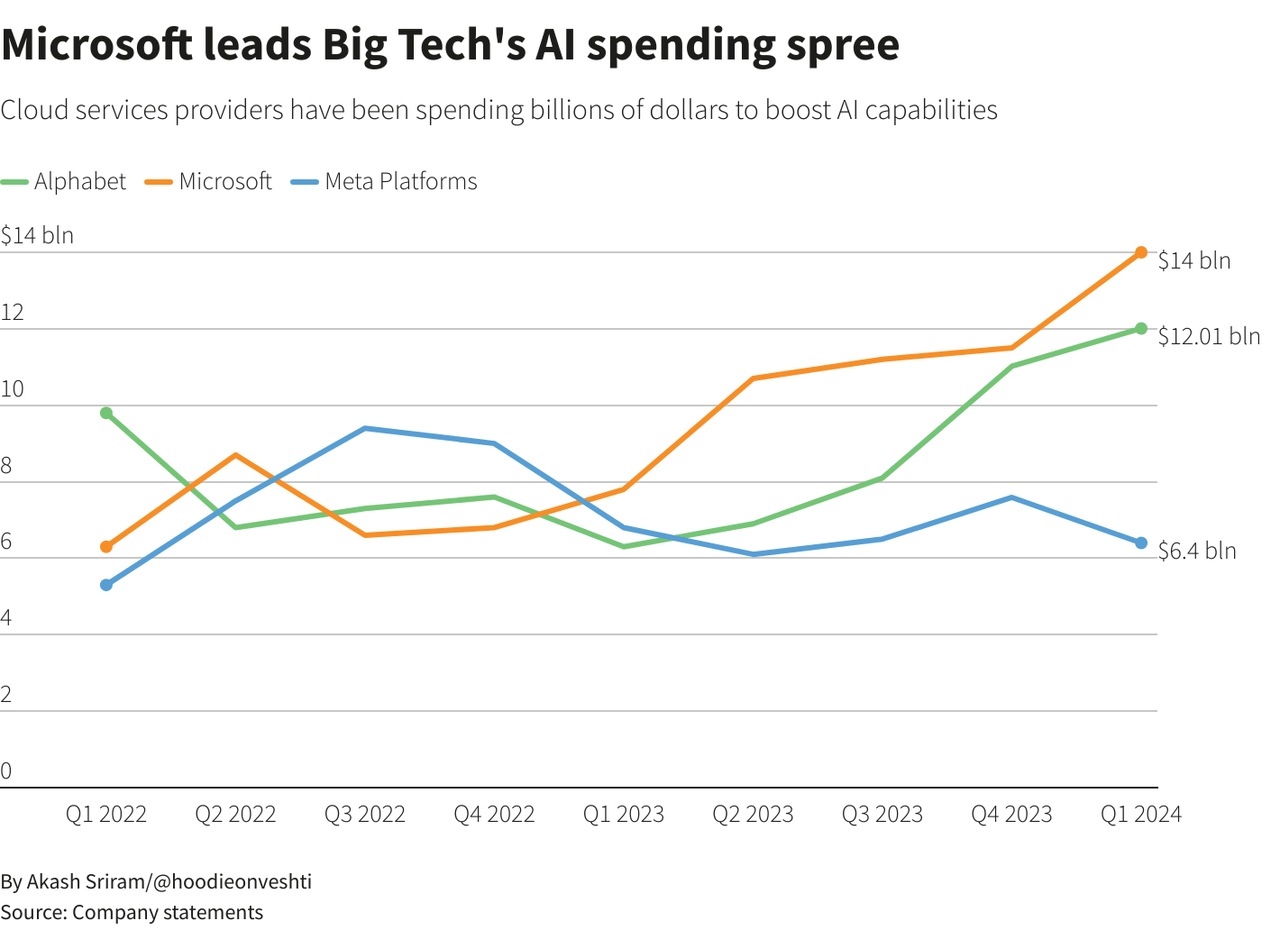

Additionally, Alphabet has already spent nearly $12 billion to boost the AI capabilities of some of its core products, including search. Therefore, the unveiling of Bard to counter the threat posed by ChatGPT that Microsoft integrated into its search tool Bing was a clear indicator of how focused Alphabet is on AI capabilities.

reuters.com

In addition to strengthening its search tool using AI, DeepMind, Waymo, and Nest are some of the units benefiting heavily from Alphabet’s growing AI investments. In DeepMind, the company is leveraging technology to solve engineering changes such as energy efficiency. For instance, by applying DeepMind ML in data centers, energy use for cooling has been reduced significantly.

Finally, Alphabet is also digitizing the healthcare sector by leveraging AI in DeepMind Health. Therefore, it is working with hospitals on AI-powered mobile tools to help patients get treated quickly and efficiently. In Waymo, the company also leverages AI to enhance self-driving car technology.

Takeaway

With a 2024 stock forecast reaching up to $255, despite potential near-term corrections indicated by an overbought RSI, Alphabet’s outlook remains bullish. Finally, strategic investments in AI, particularly in Google Cloud and data centers, drive significant revenue growth, ensuring Alphabet’s continued dominance across its extensive digital ecosystem, from YouTube to Google Search.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.