Summary:

- Crude oil prices have continued to decline in the last six months.

- Chevron’s high profitability will not stand in a market of lower crude oil prices.

- Management is making a big mistake repurchasing stock at top dollar prices.

Justin Sullivan

As it turns out, Russia’s incursion into Ukraine has resulted in a big payday for Big Oil, including upstream firms like Chevron Corporation (NYSE:CVX).

The energy company’s profits were robust in the fourth quarter, but 4Q-22 earnings fell sharply QoQ due to lower realized crude oil market prices.

Chevron has also pledged $75 billion for stock buybacks, which will almost certainly be carried out at exorbitant prices, which I oppose. Having said that, I believe Chevron will be forced to deal with lower crude oil prices sooner or later, lowering the company’s earnings and cash flow prospects.

Decreasing Earnings Growth In The Fourth Quarter Is A Concern

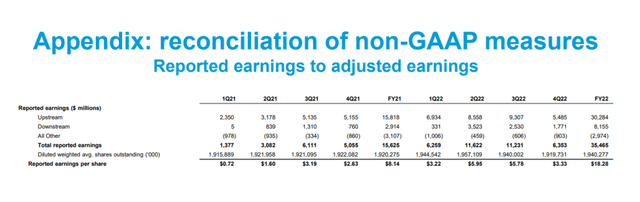

Chevron ended 2022 with $35.47 billion in profits, a 127% increase YoY. Chevron earned $18.28 per share, or 125% more than the company did a year ago.

Despite the fact that the results looked good on a YoY basis, Chevron’s earnings growth is slowing. The upstream company earned $5.49 billion in 4Q-22, compared to $9.31 billion in 3Q-22, a 41% decrease QoQ.

Reported Earnings To Adjusted Earnings (Chevron Corporation)

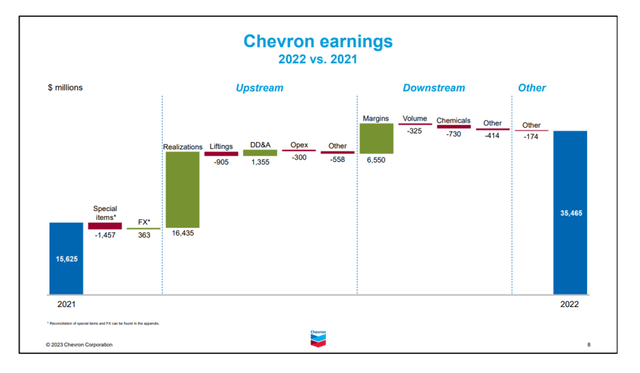

Chevron’s earnings were almost entirely driven by favorable price realizations throughout 2022, owing to the conflict between Russia and Ukraine.

Price realizations accounted for 83% of Chevron’s earnings growth in 2022, with rising downstream margins accounting for the majority of the remaining difference.

Earnings 2022 vs 2021 (Chevron Corporation)

Crude Oil Prices Are Set For Mean Reversion

Chevron’s earnings, in my opinion, will continue to decline. This conclusion is based on the fact that crude oil prices have historically not remained stable around 10-year highs for long periods of time.

Crude oil price spikes have occurred on a regular basis, often in response to geopolitical events such as terrorism, the outbreak of a war, or violent, local conflicts near production hotspots, but they have typically declined as quickly as they have risen.

A U.S. recession in 2023 could spark a new crude oil bear market, posing a significant challenge to Chevron’s earnings and cash flow growth.

Crude Oil Prices (Yahoo Finance)

Return Of Surplus Cash

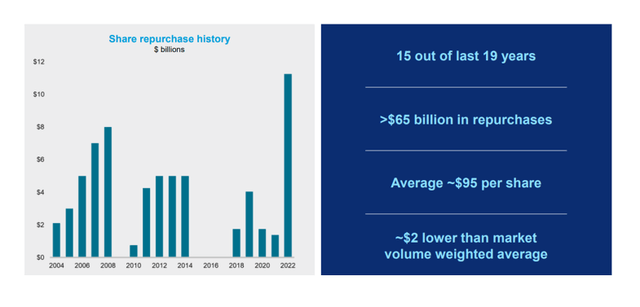

Chevron returned $11.3 billion in stock repurchases in 2022 ($3.8 billion in the fourth quarter), and the company repurchased $1.4 billion in stock in 2021.

The increase in repurchases is obviously the result of Chevron’s record cash flow, but I believe that this rather significant increase in repurchases that has materialized over the last year has occurred at a time when Chevron’s profits are on the verge of contracting. Simply put, Chevron is reinvesting $75 billion of its cash at a time when profits have already peaked.

This implies that Chevron, in my opinion, overpays for its own stock. Chevron could do better for shareholders if it decided to repay debt or invest in new production capacity, which would result in future earnings growth.

Share Repurchase History (Chevron Corporation)

Chevron Is Not A Bargain

Chevron’s stock jumped after the $75 billion stock repurchase commitment was announced, but the stock isn’t a compelling buy with or without the repurchase.

Chevron’s fourth-quarter earnings strongly suggest that profits have already peaked, and with investors likely facing a recession in 2023, I believe the risk/reward relationship for Chevron is unappealing.

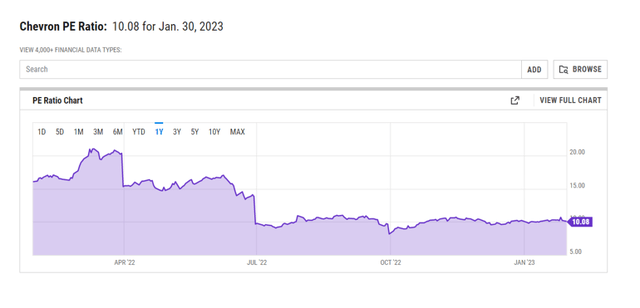

The energy company is currently trading at a 10X earnings multiple, but the P/E ratio is so low because of a period of exceptionally high profits. If Chevron’s earnings continue to fall in 2023, as I expect, the company’s P/E ratio will rise.

Why Chevron Could See A Lower/Higher Valuation

Chevron’s fortunes are inextricably linked to crude oil prices. A high crude oil price is fundamentally positive for Chevron’s profit prospects, whereas a low crude oil price is negative for the company’s profit and cash flow picture.

Moving forward, I anticipate lower crude oil market prices, but I could be wrong. For example, a geopolitical event (such as Russia’s expansion of its war in Ukraine) could occur, causing crude oil prices to rise again.

Risks To My Bearish Thesis

The obvious risk is that the market moves in the opposite direction of what I have written in this article. A significant increase in crude oil prices would negate my argument for why Chevron may see lower profits in the future.

However, my main point remains: in the long run, crude oil is more likely to trade at $30-40 per barrel rather than $100-120 per barrel.

My Conclusion

I believe it would be foolish to pay top dollar for Chevron now that the company’s profits have peaked.

As the economy transitions from peak productivity, high inflation, and labor shortages to a recession-like environment with softer economic activity, lower employment numbers, and potentially evaporating demand for crude oil and other energy sources, the market must expect an ongoing decline in profitability.

What troubles me is that Chevron is repurchasing a large amount of stock at a time when the company’s stock is at multi-year highs.

Given Chevron’s earnings decline in the fourth quarter, I would advise against purchasing Chevron stock, whether a large repurchase program was authorized or not.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.