Summary:

- Chevron Corporation’s stock buyback was criticized due to potential overpayment and risk of an earnings recession.

- OPEC’s production cuts have supported higher crude oil prices, benefiting Chevron’s profitability.

- Consensus estimates for Chevron’s profits in 2024 suggest no earnings recession, making the stock classification a Hold.

JHVEPhoto

I criticized the stock buyback of Chevron Corporation (NYSE:CVX) last year as I saw a risk that the commodity company could overpay for its stock in the open market at a time when crude oil prices were still relatively high.

I was also deeply concerned about the potential for an earnings recession during a period of falling crude oil prices which led me to give Chevron Corporation a stock classification of Sell.

Chevron Corporation continued to profit from higher-than-average price realizations in its upstream business throughout 2023 and the baseline of profitability remained high in the third quarter. Thus, taking into account that Chevron Corporation has avoided an earnings recession so far and that prices remain fairly stable at $70/barrel, I think it is prudent to modify my stock classification to Hold.

OPEC Has Emerged As A Driving Force Of Crude Oil Supply Limitations

One reason why my thesis has not played out as expected (though I did not short Chevron Corporation) was that the cartel of oil producing countries has pushed for lower levels of production in order to prop up crude oil prices.

Crude oil output cuts have been supported by a large group of OPEC countries that recently came out in support of additional limits on production for 2024. These countries included Saudi Arabia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Russia, Oman and Algeria all of which have agreed to lower production by a total of 2.2 million barrels in an attempt to keep crude oil prices high. The price of WTI crude oil, at the time of writing, is about $70/barrel which continues to create profit tailwinds for Chevron Corporation.

Though crude oil prices did decline in 2023, relative to the 2022 period which saw record crude oil prices, the profit situation at Chevron Corporation is not that bad, actually, and much better than I anticipated.

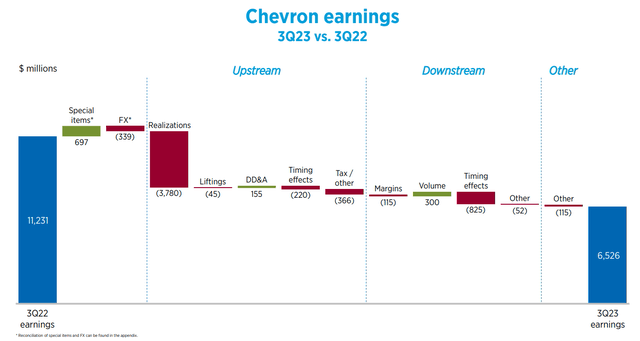

Chevron Corporation walked away with $6.5 billion in profits in the third quarter which reflected a YoY decline of 42%. Lower price realizations were mainly to blame for CVX’s YoY profit drop, but the company still produces a high baseline of profitability.

Chevron Earnings (Chevron Corp)

Chevron Corporation’s profits don’t just depend on higher prices to boost upstream profits, however. The commodity company also grows its production, particularly in the Permian, which is creating underlying organic and acquisition-driven growth that should, over time, also lead to a growing profit baseline.

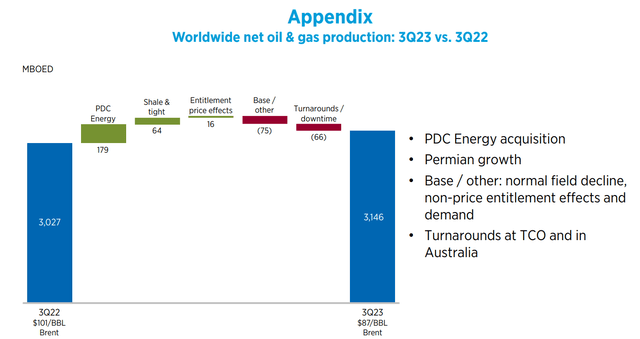

In 3Q-23, Chevron Corporation produced 3,146 MBOED compared to 3,027 MBOED in the year ago quarter. In part, this growth was made possible through the acquisition of PDC Energy, an independent exploration and production company with assets in Ohio and West Virginia. PDC Energy was swallowed up by Chevron Corporation in 2023 due to its complimentary assets in the Denver-Julesburg and Permian Basins.

Oil And Gas Production (Chevron Corp)

Will There Be An Earnings Recession In 2024?

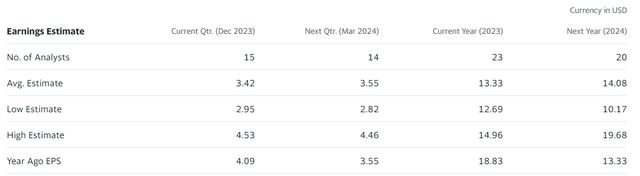

To figure this question out, a good start would be to look at the consensus estimates for Chevron Corporation’s estimated profits for 2024. Projected 2024 profits for the company, based on Yahoo Finance data, are $14.08 which implies a positive YoY profit growth rate of 6%. Note that the profit growth rate at this point can only be calculated based on the 2023 profit estimate since Chevron Corporation has not yet reported 2023 results.

Based on the present consensus estimate for CVX’s profits in 2024, investors pay a 10.6x P/E for Chevron Corporation. Exxon Mobil Corporation (XOM) is anticipated to produce $9.17 in profits in 2024, reflecting an estimated YoY drop of 0.4%, which thus reflects a P/E ratio of 10.9x.

The consensus numbers for both XOM and CVX therefore don’t imply an earnings recession and though the U.S. economy is anticipated to see slowing growth in 2024 (+1.5% in 2024 vs. +2.4% in 2023), the backdrop is generally positive for energy companies.

Both Exxon Mobil and Chevron Corporation, based on consensus estimates, are therefore selling for approximately the same earnings multiple and neither one of them is either expensive or particularly cheap. Both companies also don’t seem to be overpriced when taking into account that OPEC has come out in favor of crude oil price support in 2023 and in 2024.

Earnings Estimate (Yahoo Finance)

Lower-For-Longer Price Environment

Obviously, there are no guarantees that crude oil prices remain at or above the $70/barrel level. The turmoil in the Middle East is probably favorable for crude oil prices in general as is uncertainty surrounding key shipping lanes in the Red Sea which is where container ships have come under attack in recent months.

A U.S. economic recession, a decrease of geopolitical tensions and a crumbling OPEC front are key risks for Chevron Corporation.

My Conclusion

Chevron Corporation has not experienced an earnings recession so far and OPEC has played a vital role in ensuring that this didn’t happen.

New production cuts in 2024 are probable and even this year the energy company may avoid a large decline in crude oil prices, particularly if the economy keeps chugging along.

I misjudged OPEC’s determination to keep crude oil prices high and I think that the fact that WTI crude oil today still sells at a price above $70/barrel is a positive for the investment thesis.

Though I do see profit risks in a lower-price environment, I think that the resilience of Chevron Corporation’s earnings, which have been partially backed by production growth, is a reason for a change in the stock classification to Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CVX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.