Summary:

- Chevron’s recent quarterly earnings have only confirmed that the current strategy is working with long-term shareholders in mind.

- At the same time, the drop in share price over the past year has reduced risk for shareholders and improved future returns.

- Chevron is now back in growth mode, and 2024 could be another good year to increase existing positions in the stock.

Richard Hamilton Smith/Corbis Documentary via Getty Images

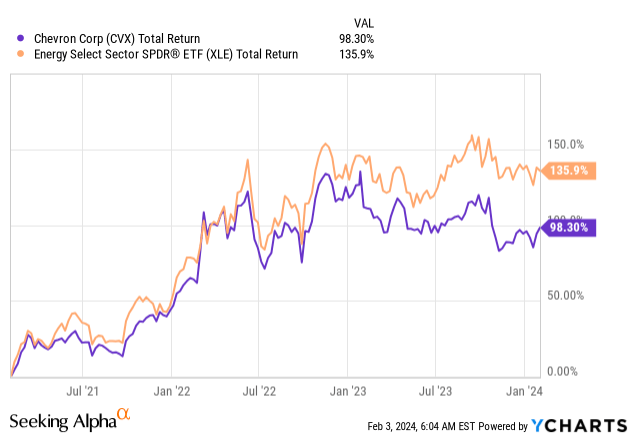

After a challenging 2023 for the Oil & Gas sector stocks overall, Chevron’s (NYSE:CVX) better than expected fourth quarter results last week came as a surprise to most market participants. It now appears that the stock could be on track to close the performance gap with the sector ETF – Energy Select Sector SPDR Fund ETF (XLE).

To be fair, the 3% share price jump on the day of the report was not substantial but in my view CVX is once again becoming less appreciated by the market than it should be. Just as it was in 2021.

At the same time, the lacklustre performance of Chevron in 2023 was largely expected and is now giving long-term shareholders (like myself), an opportunity to buy at prices that are more in-line with fundamentals.

After a year of exceptionally high returns, Chevron could face near-term volatility, but there are strong reasons why long-term investors should not fall victim to narratives and market speculations. (…) While returns in 2023 are unlikely to be as high as they were back in 2021 and 2022, I expect the company to continue to outperform the market.

Source: Seeking Alpha

Returning To Growth

The main reason why I remain on Chevron’s long-term potential is the management’s focus on profitable growth. Lack of investments in the Oil & Gas sector in recent years, as well as struggling competitors, has created an opportunity for the management team to pursue only the best and most profitable projects out there.

I covered all that in further detail back in late 2022, when I highlighted some key areas for long-term investors to focus on.

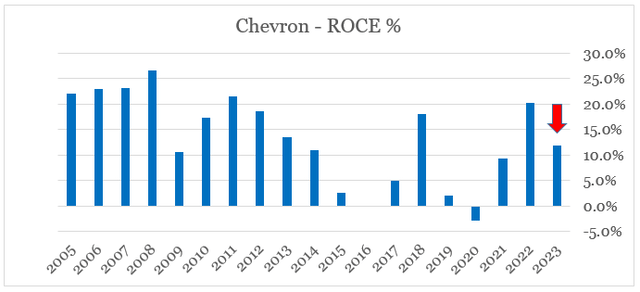

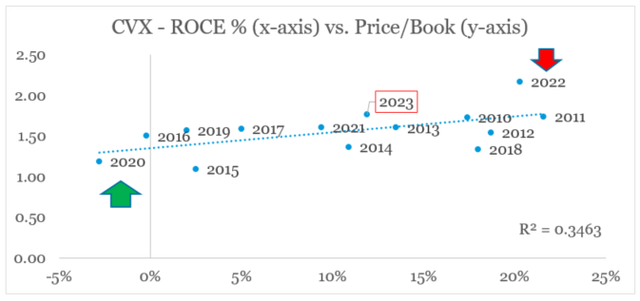

For those focused on the more immediate future and investors with short-term investment horizons, the sharp drop of Chevron’s Return on Capital Employed in FY 2023 is worrisome.

prepared by the author, using data from SEC Filings

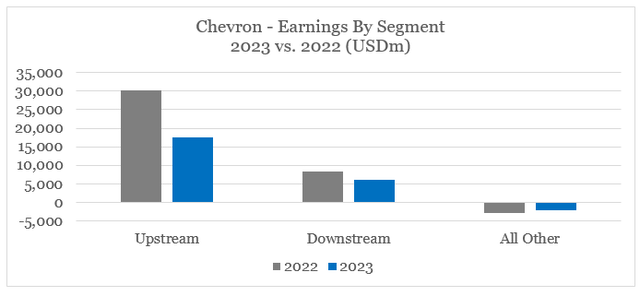

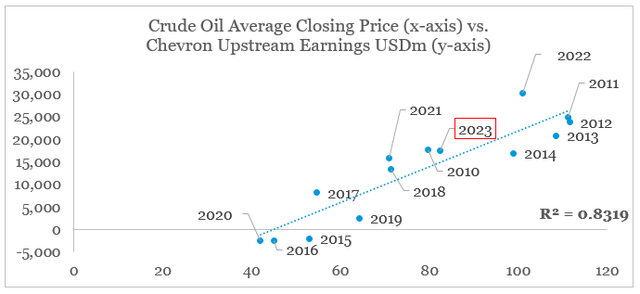

Due to the cyclical nature of the industry, such deviations are to be expected due to the impact of commodity prices on Chevron’s upstream results (see below).

prepared by the author, using data from SEC Filings

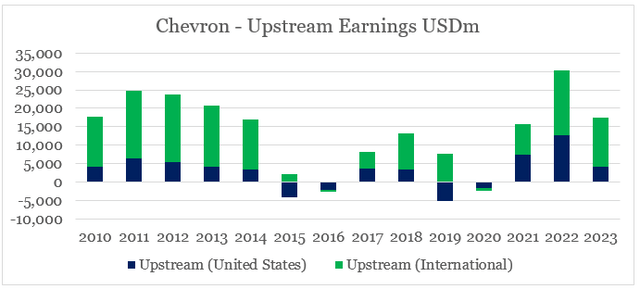

Given Chevron’s unique positioning, however, it was largely the U.S. Upstream segment that suffered in 2023 and International upstream earnings remained resilient in 2023.

prepared by the author, using data from SEC Filings

This does not mean that the strong relationship between oil prices and the upstream earning of Chevron has gone away (see below), but it highlights an unique competitive advantage of being a global-integrated Oil & Gas Major – the ability to generate significant economies of scale and thus continue to invest even during significant market downturns.

prepared by the author, using data from SEC Filings and FRED

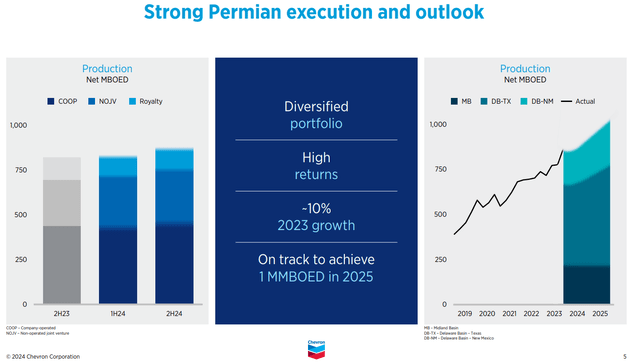

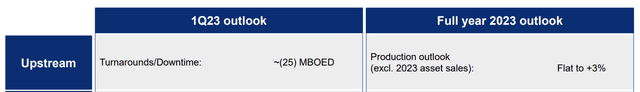

Now that the worst for the Oil & Gas sector appears to be behind us, Chevron’s investments through the bottom of the cycle start to pay off and with that production growth picks up. From a flat to +3% expected at the end of FY 2022, to +4% to +7% during the latest earnings release.

Chevron Investor Presentation Chevron Investor Presentation

Capital expenditures are also gradually increasing with organic Capex expected to increase to $15.5bn – $16.5bn, up from $14bn expected as of last year. As we will see down below, this will have negative implications for Chevron’s extremely high free cash flow yield at the moment.

Nonetheless, over the past year the stock has become more attractively priced relative to the company’s business fundamentals.

How Is Chevron Priced?

In spite of the annual fluctuations of Chevron’s ROCE that we saw above, the relationship with the stock’s Price/Book multiple is worth monitoring. The R-squared between the two variables is not particularly high on an annual basis for the period 2010-2023, but the relationship gives a very good indication of where CVX stock price is relative to actual business fundamentals (see the graph below).

For example, in FY 2020 the stock was priced as if the negative ROCE will persist indefinitely – a case that was highly unlikely not only for CVX, but for Exxon Mobil (XOM) as well. We saw the opposite dynamic play out in FY 2022 and the first half of 2023 which is why I have become more cautious on the stock’s short-term potential.

prepared by the author, using data from SEC Filings and Seeing Alpha

At present, CVX is priced in the middle of these two extreme scenarios based on its current ROCE and this is making me more optimistic on the stock. Not because I try to anticipate short-term movements in oil & gas prices, but rather because of the strong competitive positioning of the company over the long-run.

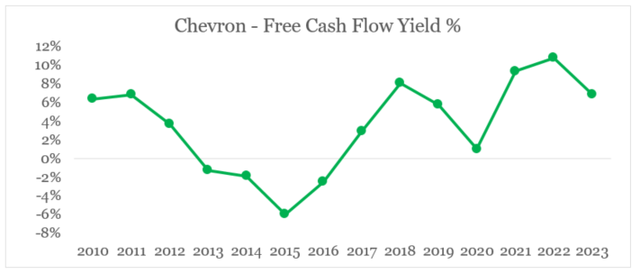

On a free cash flow yield basis, CVX now appears less attractive than it was a year ago, but due to the cyclical nature of the business this metric could be misleading.

prepared by the author, using data from SEC Filings

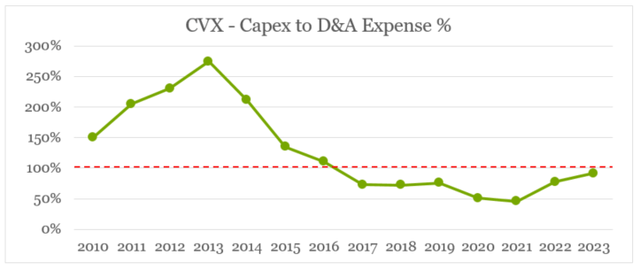

The lower free cash flow yield does not mean that CVX is less attractive now than it was in FY 2022, once we consider the record cut in capital expenditures in 2020-21 period. Instead of looking at Capex in total amounts, it is worth comparing the amount reinvested back into the business to the annual depreciation & amortization expense (D&A) in order to get an idea of whether the business is expanding or contracting.

prepared by the author, using data from SEC Filings

As of the end of FY 2023, Chevron is about the break the 100% barrier and with that it will be back to growth mode in 2024 – something that we haven’t witnessed in 7 years.

Even though it took a couple of years for Chevron’s Capex to return to normal, the company’s recent acquisitions have also positioned it well within the Permian, where it could extract significant returns on invested capital while significantly expanding production in the coming years.

(…) we expect production in the first half of the year to be down from the fourth quarter by about 2% to 4% before climbing toward a 2024 exit rate around 900,000 barrels per day. Chevron is a clear leader in Permian financial returns with our unique royalty advantage and strong execution across a diverse portfolio. We have strong momentum and expect to achieve 1 million barrels of oil equivalent per day in 2025.

Source: Chevron Q4 2023 Earnings Transcript

Conclusion

As Energy sectors is slowly falling out of favour once again, share prices of high quality companies, such as Chevron, become more closely aligned with their current business fundamentals. Chevron in particular is among the best-positioned Oil & Gas Majors to deliver superior long-term shareholder returns. The most recent quarter has only confirmed that the company is on the right track to grow production, improve existing competitive advantages and reward patient long-term shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.