Summary:

- Strategic vision without operational excellence does not transform into results.

- Cisco appears to be executing the vision as early numbers are showing.

- Stock appears reasonably valued here, backed by strong technicals.

- Solid dividend adds luster while we wait for the market to reward the stock with a higher multiple.

Sundry Photography

Cisco Systems, Inc. (NASDAQ:CSCO) is in the midst of a transformation from being “that dot com era network company” to a nimble, product and subscription based organization. Not many companies can be successful in such transformations but I believe Cisco is set up for success given the strength of its core business. I present five reasons in this article as to why the stock appears enticing here. Let us get into the details.

Transformation Vision Execution

I wrote about Cisco’s ongoing shift from being a service oriented business to product and subscription based. Strategic vision is one thing but executing the same through effective operations is another. It appears like Cisco is definitely the two as the number of SaaS related job openings on Cisco’s website indicates. Some job openings I’ve glanced over, like this one, clearly telegraph the company’s goals to continue the transformation into recurring SaaS revenue, which as I’ve explained in my past articles, is lucrative due to higher-margin and customer stickiness.

“With this role, you will be spearheading one of our key initiatives with the potential to unlock significant SaaS revenues over the coming years as well the potential to unlock broader opportunities with our Private 5G portfolio and further strengthen our position in the overall 5G value chain (from cloud software to end devices).“

This execution is clearly showing in the recent numbers reported by Cisco.

- Product Annual Recurring Revenue (“ARR”) went up 11% YoY

- Software revenue went up 10% YoY

- Subscription based Software revenue went up 15% YoY

- Lastly, to put those numbers into context when it comes to Cisco’s present and future, services were flat and up 2% in the last two quarters YoY.

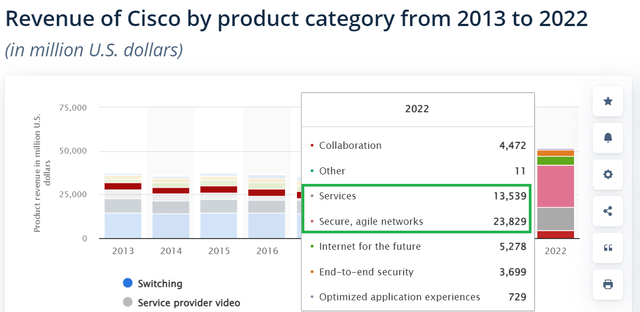

Bread and Butter Strength

As I wrote in my recent article on Meta Platforms, Inc. (META) companies tend to rely on their existing revenue streams while they attempt to diversify. With Meta, it is their reliance of ads while they attempt to diversify into Metaverse and AI. In case of Cisco, it is their services and networks (some of which is part of the product transformation) that bring in the bulk of their revenue while the company attempts to diversify itself. Despite slowing or no growth, Cisco’s position in these categories are not threatened as explained below:

- In the recently reported Q2, service gross margin was an impressive 67%, even higher than the product margin at 60%. I attribute product’s lower margin to the higher and one-time costs products tend to incur before the SaaS model kicks in to higher gear. Nonetheless, a 67% margin on services is impressive.

- Cisco’s position in enterprise network is enviable with a 45% market share that seems unlikely to be threatened anytime soon.

In short, Cisco’s fundamental business is strong enough for it to continue its transformation efforts without existential threats.

CISCO Rev by Segment (statista,com)

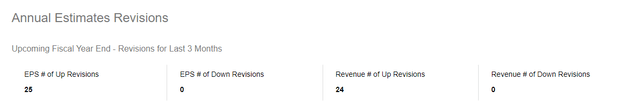

Estimates

It appears like the market has certainly noticed Cisco’s strength as an ongoing business as well as its transformation potential as estimates have gone by all across the board.

CSCO Estimates (Yahoo Finance)

I was surprised by the data above and wanted to be double-check this on Seeking Alpha’s earnings revisions page, which confirmed the same. There is not a single downward EPS or revenue revision for Cisco in the last 3 months.

CSCO Revisions (Seekingalpha.com)

Valuation and Price Target

Trading at 13 times forward earnings, Cisco’s stock appears undervalued to fairly valued here. With an expected growth rate of 7%/yr over the next five years, Cisco’s Price-Earnings/Growth (“PEG”) of 1.70 looks alright as well even though it is above the textbook recommendation of <1. It is almost impossible to find such undervalued names (with PEG <1) even in the present bearish market conditions. Median price target of $56 presents a 12% upside, not including dividends. In addition, the current yield of 3.10% is well above the five year average of 2.83% and the dividend appears extremely safe as I covered here.

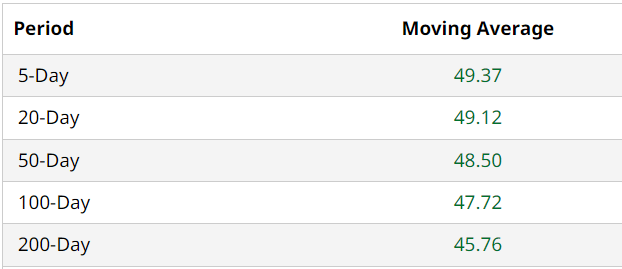

Technicals

Cisco’s stock has broken above all the commonly used moving averages as shown below. Most encouraging is that the current price is a good 10% higher than the 200-Day moving average, suggesting a higher base is being established. A Relative Strength Index (“RSI”) of 67 suggests there is still room to the upside before the stock becomes technically overbought.

CSCO Moving Avgs (Barchart.com)

Conclusion

I continue to like Cisco’s ongoing transformation efforts and believe the market is likely to reward the stock with a higher multiple than the current one in early teens should the product and subscription portion of revenue continue the current trajectory. The fact that the stock pays a decent 3% yield with growing dividends each year adds luster.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.