Summary:

- Cisco Systems, Inc. reported its Q2 2023 results on February 15 and managed to impress investors for the first time in a long time.

- Cisco has barely seen any revenue growth over the last 10 years, but is well positioned to see a period of renewed growth over the next several years.

- Exposure to several high growth industries like cybersecurity, cloud computing, and IoT should drive growth for Cisco.

- Management has been shifting the business model away from a focus on hardware sales to a subscription-based business model. This has resulted in 44% of revenue being subscription based today.

- I believe Cisco offers good value to investors due to its solid growth outlook, shift in business model, and decent capital returns to investors.

Sundry Photography

Introduction

I have only recently bought a small position in Cisco Systems, Inc. (NASDAQ:CSCO) for my personal portfolio, as I felt like this dot-com bubble darling is being significantly underestimated with the company quietly transforming the business in order to solidify its revenue stream. In addition to this, I believe Cisco might be entering a new period of growth driven by increased connectivity demand, 5G, and cloud computing growth.

The history of the company seems to be a heavy burden and a drag on the share price. Cisco once was the largest company in the world and one of the leading stocks during the dot-com bubble hype. It achieved a top share price of above $78 per share, which is a staggering 50% higher compared to the current share price, and no, there has been no stock split. This company really saw a 50% higher share price back in 2000 compared to today. This is the heavy burden I am talking about. Being the company that delivered negative returns over the last two decades does not particularly attract many investors, certainly not individual investors. Cisco Systems is no hyped growth stock today and does not tell a futuristic story. Does this, then, make it a bad investment today?

The only thing I have to say about this is that the profits of your investments today lie in the future performance of the company and not in the past. I am not saying this company is perfect outside of its share price performance, though. Cisco has known a number of bad years and growth has been pretty much dead for many years, explaining the mere 10% increase in share price over the last 5 years. The combination of circumstances has made investors skeptical about the communications giant.

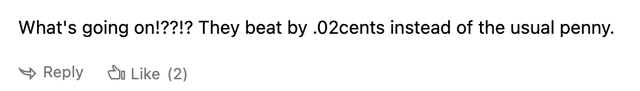

On that note, let’s start focusing on current performance and future growth opportunities and expectations. Cisco released its fiscal Q2 2023 quarterly results yesterday and managed to amaze investors, or at least amazed me. Comments made under the earnings release news article pretty much tell the story of this company’s performance over the last couple of years and the way investors see it.

Comment (Seeking Alpha) Comment (Seeking Alpha)

While the beat itself was not overly impressive, the double beat was still solid. Cisco managed to beat the EPS consensus by $0.02 and revenue consensus by $190 million. Solid, but no fireworks here. The real surprise and “fireworks” were in the company’s guidance for the next quarter (3Q23) and its FY23 updated expectations. Both came in significantly higher compared to the consensus prior to the earnings release and show impressive growth rates for Cisco to be expected.

The release of the quarterly results seemed like an excellent moment for me to start my coverage of Cisco Systems. Therefore, within this article, I will take you through the company fundamentals and offerings, quarterly financials, outlook, valuation, and risks.

So, without further ado, let’s get to it!

Cisco Systems

Cisco Systems, Inc. is a multinational technology company based in San Jose, California. The company designs, manufactures, and sells networking hardware, telecommunications equipment, and other high-tech products and services. Cisco’s product portfolio includes routers, switches, firewalls, wireless access points, cloud-based collaboration tools, and much more.

Cisco is known for its enterprise networking products, which provide the backbone for many corporate and government organizations around the world. The company has also expanded its product offerings in recent years to include cybersecurity solutions, cloud-based services, and software-defined networking solutions.

Founded in 1984, Cisco has grown to become one of the world’s largest technology companies, with operations in over 100 countries and a workforce of over 80,000 employees.

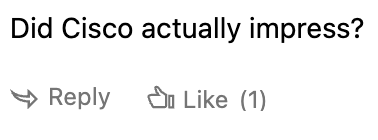

Cisco revenue growth (Statista)

The company has seen its revenues almost double over the last 17 years to a total of $51.6 billion for its fiscal FY22. Despite this significant increase in revenue over the last 17 years, the picture over the last 10 years is not so positive, as Cisco has grown its revenue by a very disappointing 6% since 2013 when revenue was $48.61 billion. This underperformance was driven by a number of factors like the loss of market share, market saturation, and a number of failed large acquisitions. In addition to this, Cisco has been shifting its focus from hardware-based solutions to software and services. While this has been a necessary move to adapt to changing customer needs and market conditions, it has also led to a transition from one-time hardware sales to subscription-based software and service offerings.

While the transition to a subscription-based business model has not helped the company to grow revenue meaningfully over the last several years, I do think this to be an excellent move by the company to solidify its revenue stream and increase customer loyalty. A customer is less likely to switch its hardware to another provider when the company has a contract and long-time relationship with Cisco. A subscription-based model can also provide more flexibility in the pricing and packaging of products and services. This can help Cisco tailor its offerings to specific customer needs and potentially increase sales by making its products and services more affordable.

So, overall, I am enthusiastic about this transition Cisco Systems, Inc. is making. Still, this alone is not going to meaningfully drive revenue and EPS growth over the next decade. So, what is?

There are several fast-growing and promising industries/markets the company is exposed to, which could drive revenue growth for Cisco. The first one of these secular growth industries is cybersecurity. Cybersecurity is an important concern for businesses all around the world, and the threat landscape is constantly evolving. Cisco’s focus on cybersecurity can help the company capture new opportunities in this growing market. The global cybersecurity industry was valued at $203 billion in 2022 and is expected to grow at a 12.3% CAGR until 2030. By offering a comprehensive range of cybersecurity solutions, including software-defined security, threat detection and response, and identity and access management, Cisco can help customers protect their networks, data, and applications. Through decades of expertise in communication networks, Cisco is well-positioned to benefit from the demand for network security and is among the leading security providers.

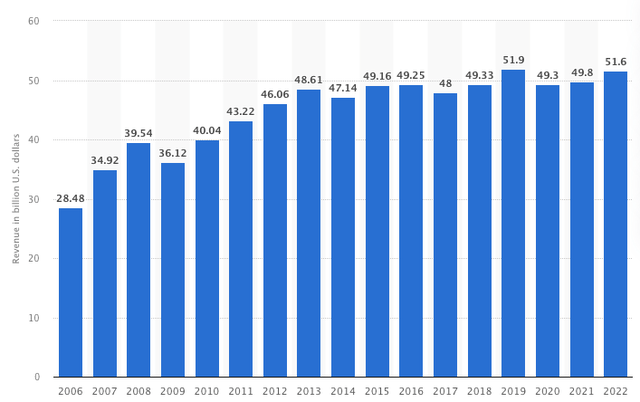

Cisco held a 9.1% market share in the cybersecurity industry back in 2020, according to the graph shown below. This had grown from 8.7% in 2017 but was down from 10% in 2019. According to Canalys, Cisco held a 6.9% market share in the cybersecurity market, making it the second largest, only behind Palo Alto Networks (PANW). The industry is highly competitive and still fragmented, but the strong current position of Cisco should make it a beneficiary of overall industry growth.

Cybersecurity market split (Statista)

The second growth driver I see for Cisco is the continued transition to the cloud. The shift to cloud computing has been a major trend in the technology industry over the last decade, and Cisco has been expanding its presence in this market. By partnering with major cloud providers like AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOGL), Cisco can offer customers more options for connecting their on-premises data centers to the cloud.

Again, Cisco’s expertise in connectivity positions it well, but it has been rapidly losing market share to competitors like Juniper Networks (JNPR) and Arista Networks (ANET). While Cisco is said to still dominate the overall data center connectivity market, its market share has been declining. In 2020, the company still held a market share of 40.6%, but by the end of 2021, this had already dropped to 38.1%.

Still, Cisco holds a significant position and with the transition to the cloud expected to remain strong over the next decade, I expect Cisco to benefit.

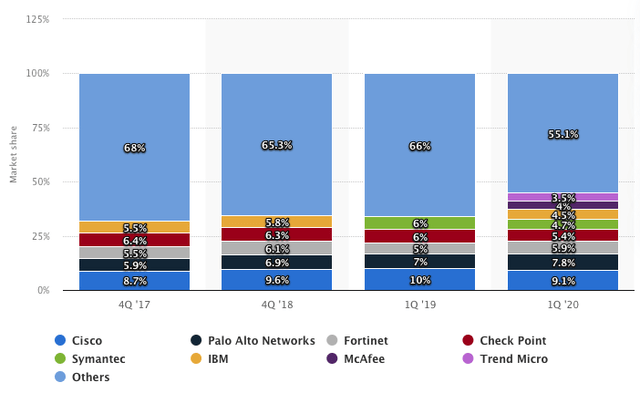

The third and final growth driver that I would like to discuss in this article is the growth of the IoT (Internet of Things) industry. IoT is a rapidly growing industry and offers great growth potential for Cisco as well. Cisco’s IoT portfolio includes solutions for connecting, managing, and securing IoT devices and data, as well as analytics tools for gaining insights from IoT data. As the number of connected devices continues to grow and the demand for IoT solutions increases, Cisco is well-positioned to benefit from this trend. According to Fortune Business Insights, the IoT market should grow at a CAGR of 26.4% until 2029 and will reach a market size of $2.4 trillion.

Edge networking, a crucial part of both datacenters and IoT, will see even higher growth rates according to Vantage Market Research. This particular market is expected to grow at a 38.2% CAGR until 2028 to reach a market size of $49.8 billion. Cisco is still the clear leader on this front, but is seeing increased competition and so will have to stay on its toes.

Cisco

While Cisco has exposure to many more markets than discussed above, I believe these three offer the best growth prospects. Of course, these industries exist of many services and components not made or offered by Cisco, so these should not be interpreted as a total addressable market, or TAM, for the company. I am simply trying to illustrate the growth potential and exposure of Cisco that is often overlooked. Management has a decent company in hand but will need to stay sharp and on its toes to stay ahead of the competition or regain technological leadership where it has lost it.

On that note, let’s see how the company did over the latest quarter.

Quarterly review

Cisco delivered a very decent quarter which beat both its own estimates and those of Wall Street analysts. The primary reason for the outperformance was the improved availability of the supply chain which is improving faster than anticipated. As a result, the company reported revenue of $13.6 billion, which was an increase of 7% YoY. If we zoom in a bit more on the reported revenue numbers, we can see that total product revenue was $10.2 billion and was up 9% YoY. It was service revenue that saw slower growth rates of just 2% while reporting total revenue of $3.4 billion.

Cisco is seeing solid revenue growth as a result of continued demand by its customers. The digital transformation across industries is still very much ongoing, and new groundbreaking technologies like AI, ML, and IoT are driving growth for Cisco, as illustrated below by the CEO:

We are also seeing many customers moving ahead with their hybrid work, AI and ML investments while building the modern infrastructure they need to deliver on their objectives. IoT has also been accelerating. We saw record revenue growth in Q2 as customers look to connect their industrial systems in order to optimize power consumption, automation and efficiency.

Cybersecurity and cloud continue to be focus areas for the company, and Cisco is increasing its investments in this area, as discussed during the Q2 earnings call:

We are increasing our investments in our cloud management platforms that deliver the simplicity our customers need. You will see us continue to bring AI and ML into those platforms to further simplify how networks are managed. For example, in Q2, we announced several new innovations across our cloud managed networking and security portfolios that offer greater visibility with AI-driven insights, enable secure connectivity, and give our customers the ability to simplify their IT operations.

We also introduced new flexible, more powerful and energy-efficient servers, which not only help lower cost, but also help our customers meet their sustainability goals, an increasingly critical area for most of our customers.

Breaking down revenues even further, we can see that product revenue growth was driven by the Secure, Agile Networks segment which grew by 14% YoY while accounting for the largest part of product revenue by a far margin. Revenue for this segment came in at $6.75 billion. Growth for the segment was driven by strong Switching revenue but was partially offset by datacenter switching which declined slightly. Enterprise routing did grow by double digits.

The Internet of the Future segment, the second largest product segment, saw revenue decrease by 1% which was driven by both optical and edge product sales. The Collaboration product segment saw a decrease of 10% YoY due to falling demand for meeting and collaboration devices. End-to-End security was up by 7% YoY driven by high demand for zero trust and threat management solutions.

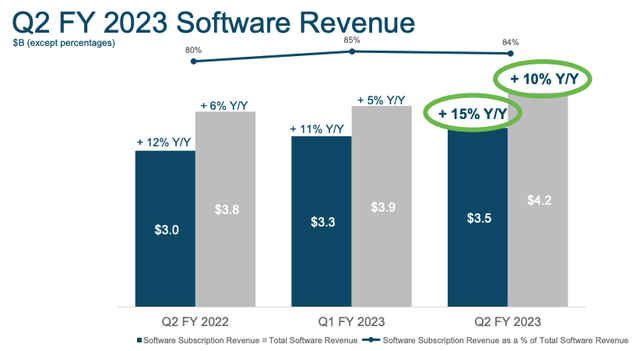

The company saw strong performance in ARR (Annual Recurring Revenue) growth as this now totaled $23.3 billion and grew by 6% YoY, with 11% growth for its product ARR. Software revenue increased by 10% while software subscription revenue grew by a faster 15%. The transition of the business model seems to be developing well.

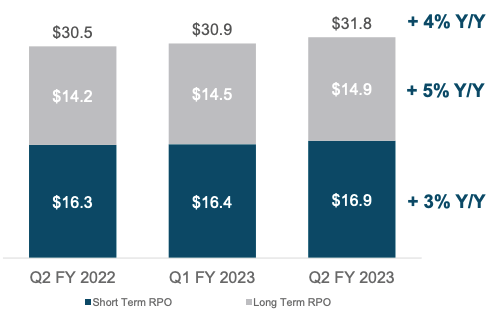

Total subscription revenue reached $6 billion, an increase of 9%, and now represented 44% of revenue. RPO was $31.8 billion and increased by 4% which was driven by a 7% increase in product RPO.

RPO (Cisco)

The gross margin for the quarter also came in higher than anticipated as this was 63.9%, up 90 basis points sequentially.

While the financial performance of the company was very strong, this was not the case for orders. Total product orders were down 22% YoY, although this did compare to its strongest ever order intake in the year before when it increased by 34%. Still, this year the company saw a decline in orders across all geographies. One positive point is that sequential growth was in line with historical averages and cancellations rates remain below pre-covid levels. Strong margins for Cisco resulted in a net income of a record $3.6 billion which resulted in a record EPS of $0.88. Profitability is no problem for Cisco at all.

The backlog for Cisco was up YoY, but down 6% sequentially which is not ideal. With supply issues fading, the company could be picking up its growth path over the next couple of quarters but will most likely burn through its backlog at a rapid pace. Also, several Wall Street analysts point to the backlog as something to worry about over the next several quarters. Cisco did not mention an exact number, so it is all about guessing just how big the backlog really is. Jefferies analyst George Notter estimated that Cisco currently holds a backlog of roughly $14 billion.

Raymond James analyst Simon Leopold said the following after the earnings release:

Order declines and reductions in backlog are part of normalization and should be expected, but feed some bearish arguments,” Leopold wrote. “We see the software shift and margin improvement favorably, and the upward revisions justify stock appreciation.

Balance sheet & Dividend

Cisco ended the second quarter of its fiscal year, ending December 31, with a total cash position of $22.1 billion as it saw a record operating cash flow of $4.7 billion, up 93% YoY. Cisco holds a very solid net cash position which gives them a lot of freedom to invest in the business or look for M&A opportunities.

Another option to make good use of the cash is to return a part of it to shareholders in the form of dividends and share buybacks. During the latest quarter, the company returned $2.8 billion to shareholders. This consisted of $1.6 billion in dividend payments and $1.3 billion in share buybacks. Management still had $13.4 billion remaining to repurchase additional shares over the next years.

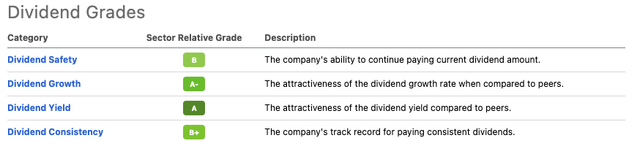

Cisco also increased its dividend by $0.01 (3% increase) to $0.39 per share and this marks the 13th consecutive increase of the dividend. Management remains committed to returning 50% of free cash flow to shareholders annually. Cisco now has a forward dividend yield of 3.22% which I think is very decent for a technology company. Also, with a payout ratio of below 45%, the dividend looks relatively safe, and combined with growth prospects over the next several years, we should see the dividend grow between 4-8% annually. The current 5-year growth rate is 5.55%.

The solid dividend yield in combination with a low payout and consistent increases results in a very strong dividend rating from Seeking Alpha as shown below. The company might not be the dream for either dividend income investors or dividend growth investors, but I think that overall, the dividend is a very nice extra when owning this communications giant.

Outlook & Valuation

While the financial results were very decent, these in themselves were no reason for Cisco Systems, Inc. stock to climb close to 6% at the time of writing (the next trading day). It was the very impressive outlook given off by management that caused enthusiasm among investors. Management expects revenue to grow between 11% and 13% YoY for 3Q23, compared to the consensus of below 6% growth. The gross margin is expected to be between 63.5% and 64.5% with EPS expected to be in the range of $0.96 to $0.98. This compares favorably to a consensus prior to the earnings release of $0.89 in EPS.

And the fun did not even end here as management also meaningfully increased its FY23 outlook. It now expects revenue growth of between 9% and 10.5% (prior guidance of 4.5%-6.5% vs. 5.72% consensus) with EPS of $3.73 to $3.78 (from prior guidance of $3.51-$3.58 vs $3.55 consensus). This means that Cisco expects both top and bottom-line growth to come in significantly higher than previously expected. The primary reason for this outperformance seems to be the faster recovery of the supply chain which increases the output from Cisco and allows the company to benefit from its strong RPO and backlog. The new guidance will require analysts to also significantly increase their estimates which then will bring down the valuation of the company. This explains the 6% jump in share price, and it looks completely justified.

Management confirmed that they keep a close eye on the macroeconomic conditions as these remain treacherous, but they also see that overall demand remains steady and on par with the first quarter. Management added the following:

Looking at the broader landscape, digital transformation and hybrid cloud remain top areas of spend, which is fueling growth across our portfolio. Many customers have told me that while their spend levels may be slowing in some areas, technology remains essential as it is vital to their overall business resilience, competitive differentiation and success.

So, what does the current analyst guidance look like now? Analysts now guide for 3Q23 EPS of $0.97 and in line with the midpoint of guidance from Cisco itself. Revenue is expected to come in at $14.40 billion and shows a growth rate of 12.2%.

The upbeat guidance from Cisco has also impacted FY23 guidance by analysts as they now point to an 11.7% growth in EPS and revenue growth of close to 10%. For the years that follow, analysts believe growth will revert back to 5% on average for EPS and revenue growth of around 3%.

Honestly, I believe that the current consensus for the next couple of years is somewhat too low as I expect the company to report closer to 5% revenue growth and 7% EPS growth for the years until 2026. I believe the company will see strong demand for its products once demand reaccelerates in the period 2024-2026. Cybersecurity and IoT growth will be significant, and I think Cisco will be a beneficiary if it is able to take a step up against the competition.

As a result of my expectations, I am willing to award this communications giant a P/E of 15x. If we assume the company to, indeed, report EPS of 3.75 for FY23, and grow EPS by 7% in FY24, this results in FY24 non-GAAP EPS of $4.01. Based on a 15x P/E ratio we end up with a price target of $60.15 per share or 16% upside potential.

As for comparison, Wall Street analysts currently hold a buy rating on the company with a target price of $55.82 per share, leaving investors with an 8% upside potential from its current share price.

Risks

An investment in Cisco Systems, Inc. is, like any other investment, not without risks. While the company looks to be relatively stable and the new business model increases cash flow predictability, there are still some risks to be aware of when you are considering investing in Cisco.

One of these risks is the threat of a more serious economic slowdown. While inflation is coming down quite steadily and economic data remains resilient, we could still end up in a mild recession by the second half of 2023. Wall Street analysts remain divided on this subject as some believe we will see a recession in the U.S., while others believe a soft landing is now the most likely scenario. I believe we will indeed see a soft landing and avoid a recession in both the U.S. and Europe. While economic data might deteriorate a bit further over the next 6 months, I expect this to improve by the second half of the year.

If against my expectations we would end up in a recession, this will most likely impact demand for Cisco’s products resulting in cancellations in the backlog together with Cisco burning through its backlog even faster, which will primarily impact the revenue growth outlook for the following years.

Another risk that is crucial to consider is the risk of Cisco losing further market share to competitors. Cisco has been losing market share over the last couple of years to competitors such as Arista Networks, Juniper Networks, and a whole load of start-up cybersecurity companies. To achieve the growth rates discussed above, it will be crucial for Cisco to hold onto its current market share in critical growth markets like cloud, IoT, and cybersecurity. The competition looks tough, but Cisco definitely has the financial resources to fight off these competitors and even acquire some of them to expand its portfolio and technical knowledge.

Conclusion

Cisco Systems, Inc. delivered solid results for its 2Q23 and impressed with its outlook for 3Q23 and FY23, which were significantly above the consensus estimates. Management continues to shift the business to a subscription-based business model which should result in more predictable cash flows, a better understanding of customer needs, and increased customer loyalty. I believe this is a great move by management and I think this will pay off over the next decade.

In addition to this, the company is exposed to several growth drivers that should cause healthy growth over the next several years of between 3% to 6%. Based on my estimates for FY24 EPS and a P/E of 15x, I calculate a target price of $60.15 which leaves us with a 16% upside potential from the current share price.

The combination of solid and predictable revenue growth and decent capital returns in the form of both dividend and share buybacks brings me to the conclusion that Cisco is a buy below a share price of $53.

I, therefore, rate Cisco Systems, Inc. a buy at a current share price of $51.65.

Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.